The New GST Return System will inaugurate in October 2020 as per the decision of the 39th GST Council Meeting held on March 14th, 2020.

The changing system also has impacted various components of the Existing System. The introduction of new forms will also change the reporting of various miscellaneous transactions.

Let us understand what changes are proposed by the New GST Return System for reporting Exports, SEZ, Zero-rated supplies & deemed exports.

Before we address the changes let us also enlighten you more about this class of supplies & how these are being handled currently.

And a final comparison analysis will help you better understand the changes.

Watch video to know about GST Refund Application

Content Table |

|---|

You may also interested in reading below posts:

Detailed explanation of Exports, Zero-rated Supplies & Deemed Exports under GST

Exports are the class of supplies that are given high priority in the GST Regime to build healthy relations with other countries & to emerge as a brand.

Exports, Zero-rated supplies & Deemed exports are no new terms in Indirect taxation due to their high eminence in the taxation regime. Yet, let us walk through the meanings of these classes of supplies.

1. Exports under GST:

Exports as per IGST Act means taking the goods out of the country as a part of a sale to the recipient who also operates outside the country.

Trading or supplying the goods outside the domestic territory to a foreign recipient is called the export of goods.

The payment for exports is either made in convertible foreign exchange or in Indian Rupees if permitted by the RBI.

Exports are free from the burden of taxation & hence no taxes are levied on Exports.

Although the exports are zero-rated supplies it comes under interstate supply or IGST under GST.

Any IGST, if levied on exports either as input tax or on finished goods can be claimed & refunded in their GST returns.

2. Zero rated supplies under GST:

Zero-rated supplies mean supplies that levy no GST neither as input tax nor on finished goods. Following supplies fall under the category of Zero-rated supplies-

- Exports of goods &/or services outside of the country

- Supply of goods & services to SEZ ( Special Economic Zones ) or SEZ Developers.

Zero-rated supplies simply mean that the recipient of such goods & services does not have to pay taxes to the suppliers of such goods & services & thus these suppliers need not pay taxes to the Government.

This has nothing to do with 0% rate of tax on goods & services.

Any Input Tax Credit payable that you might have paid can be claimed back.

3. Deemed Exports Under GST:

This is a tricky type of supply. Deemed exports are exports that are not supplied outside the country & yet considered to be and treated as exports under GST.

Meaning deemed exports are exports that are not required to be taken outside the national territory.

Such supply is needed to be notified by the Central Government as Deemed Exports under Section 147 of the CGST Act 2017.

You may also interested in reading below posts:

Following are the things that make Deemed Exports different from Exports-

- Deemed exports are only applicable to goods and not services.

- Deemed Exports cannot be made under Bonds or LUT (Letter of undertaking)

- Goods need not be taken outside the country

- Taxes on such supplies are required to be paid at the time of supply, however, the refund of the same can be claimed later.

- If a refund has been claimed by the supplier then the recipient cannot claim ITC for the same.

The following supplies have been notified as deemed exports in Notification No. 48/2017- Central Tax (Link) :

- Supply of goods by a registered person against Advance Authorization (AA)

- Supply of capital goods by a registered person against Export Promotion Capital Goods Authorization (EPCGA)

- Supply of goods by a registered person to Export Oriented Unit (EOU) or Electronic Hardware Technology Park Unit (EHTP) or Software Technology Park Unit (STP) or Bio-Technology Park Unit (BTP)

- Supply of gold by a bank or Public Sector Undertaking specified in the notification No. 50/2017-Customs, dated the 30th June 2017 (as amended) against Advance Authorization.

Here is an illustration to understand & link Exports & Deemed Exports-

Mr. Bharat sold a consignment to Mr. Ram who is an EOU.

Later Mr. Ram sells the consignment to Mr. Markus in California.

Here, the trade between Mr. Bharat & Mr. Ram is Deemed Export & between Mr. Ram & Mr. Markus will be treated as Export.

Introducing New GST Returns & the New Forms

New GST Return System is going to be an upgraded & more compliant version of the current system as is the intent of the revamp.

Forms under the New Returns have been simplified & the process has been made more systematic & automated, both for small & large enterprises.

The forms under the new system will replace the existing GSTR-1, GSTR-2A & GSTR-3B. Instead, there will be one mail return filing form for all taxpayers.

There are three types under the main return forms & businesses can pick one according to their turnovers, ITC claiming and types of supplies to be declared.

Additionally, there are two annexures, Annexure-1 (Sales), it is deemed that most of its data will be auto-populated from the e-Invoicing data. And Annexure-2 (Purchase) which be auto-generated from the details given in the suppliers' Annexure-1.

All of the taxpayers need to file these Annexures & one of the three main return forms namely- GST RET-1 Normal, GST RET-2 Sahaj and, GST RET-3 Sugam.

Under New, GST Returns you can declare your exports in Annexure-1 from where these will directly populate in GST RET-1.

Sahaj & Sugam being simple forms especially for small businesses having a turnover of less than Rs. 5 Crores do not support Exports. So you must opt for GST RET-1 and file monthly returns of you have Export supplies.

You can comply better with the New GST Returns with the help of GSPs, and GSTHero is one of the best & most relevant software solutions for all your GST Compliance needs.

You may also interested in reading below posts:

Declaration of Zero-rated Supplies & Deemed Exports in the present system

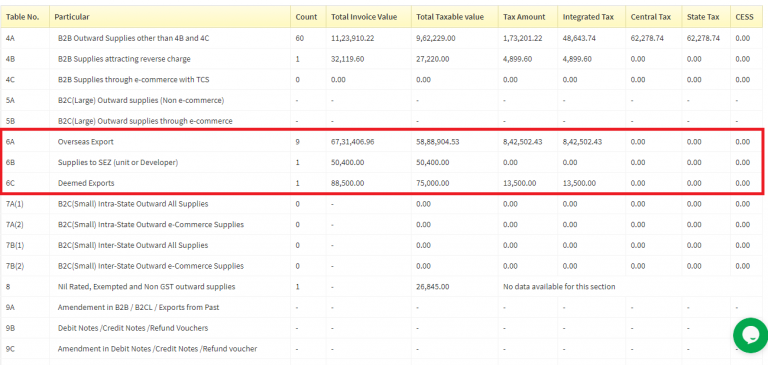

In the current system, Zero-rated supplies: Exports or SEZ supplies and Deemed exports are reported in Form GSTR-1 in the monthly filing.

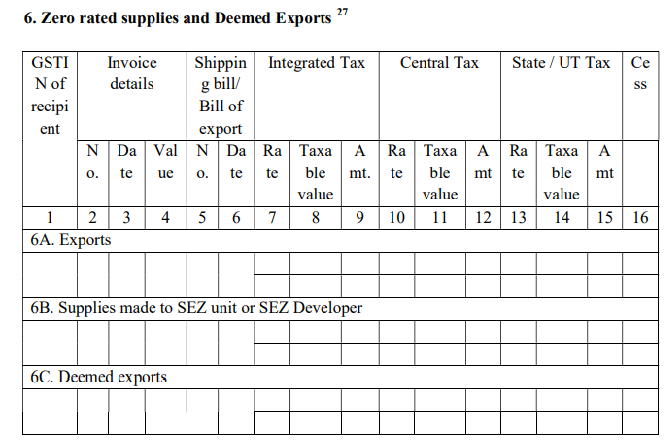

These supplies are currently reported in Table 6 of Form GSTR-1.

- Exports- Table No. 6A

- Supplies to SEZ Unit & SEZ Developers- Table No. 6B

- Deemed Exports- Table No. 6C

In the current system Composition Taxpayers are restricted from Exporting goods, as exports are treated as interstate supplies.

Declaration of Zero-rated Supplies & Deemed Exports under New GST Return

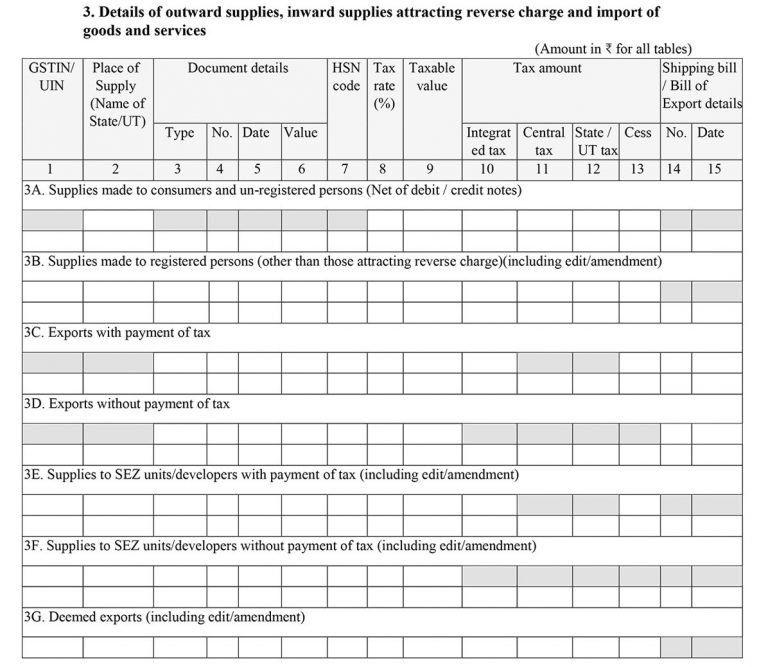

In the New GST Return System, you will have to report the Zero-rated supplies & Deemed Exports in the replacement of Form GSTR-1 that is Annexure-1.

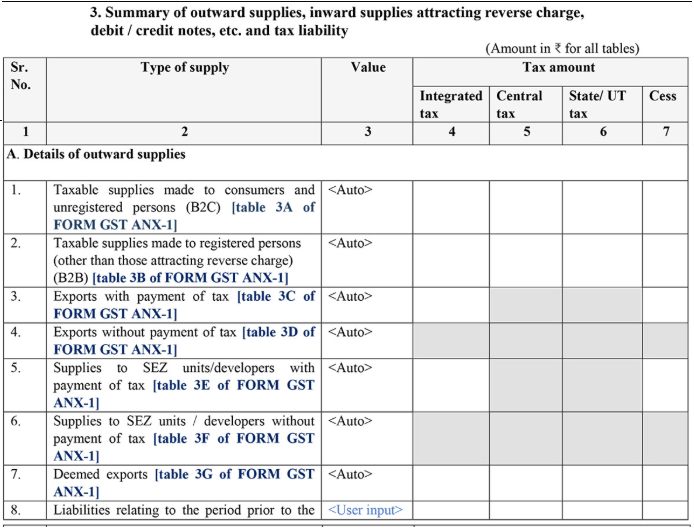

From Annexure-1 the data will auto-populate in their main return- GST RET-1 Table-3A.

Unlike in the current system, the new system has segregated the export supplies into two parts, with or without the payment of tax on such supplies.

Annexure-1

The declaration of Exports, supply to SEZ Unit/Developers, & Deemed Invoices are reported in Anx-1, from Table 3C to Table 3G.

GST RET-1

The data of Exports from Anx-1 is auto-populated in the Main form GST RET-1 under-

Section-3-A. : Summary of, outward supplies, inward supplies attracting reverse charge, debit/credit notes, etc & tax liability > Details of outward supplies.

You may also interested in reading below posts:

Comparative Breakdown of reporting Zero-rated Supplies & Deemed Exports in the Current & New GST Return System

We have listed down 5 most important miscellaneous differences in the reporting of exports in the current & the upcoming GST Return Filing System-

- No specification of reporting the exports under Bonds/LUT- The current system requires the reporting of exports under Bonds/LUT in Table 6A & 6B of Form GSTR-1. Although, nothing has been specified in this context in the New GST Return System.

- Payment-wise bisection of Export reporting- The reporting of the exports both with & without the payment of IGST is merged to one table under the New Return. The current has two separate tables for the same.

- Simplified Refund Claim- A new column has been enabled in Table 3E, 3F & 3G of Annexure-1 to simply the process of claiming refunds of the paid IGST. This column is named, "Would you claim refund", if you select 'No' in this column, it will automatically allow the SEZ Unit/Developer to claim the ITC refund after export.

- Merged Amendments Table- The New GST return System enables you to report the edits & amendments in the same where you reported the exports, supplies to SEZ, or the deemed exports. The current system, on the other hand, has a separate table to report the amendments (Table-9) in Form GSTR-1.

- Updating the Shipping Bill Details- The current system does not offer the facility to declare the Shipping Bill details. This will change in the New System, as a separate component will be given under Table-3 of Annexure-1 to report the Shipping Bill details.