Global business often involves dealing with different tax rules, invoice formats, and e-invoicing compliance standards. PEPPOL PINT (International Invoice) simplifies this process by standardizing Peppol e-invoicing for cross-border transactions.

PEPPOL PINT clears common hurdles, ensuring businesses can operate accurately, efficiently, and within compliance across international markets. Whether you're dealing with e-invoice Malaysia regulations or expanding to Europe and Singapore, PEPPOL PINT offers a global solution.

PEPPOL PINT provides a universal framework that makes exchanging invoices between countries as straightforward as local transactions. Automating compliance and reducing manual adjustments saves time and cuts errors.

Whether a small company entering global trade or a multinational managing thousands of invoices, PEPPOL PINT (Peppol International Invoicing Model) ensures invoicing is a hassle-free, streamlined process.

How Does PEPPOL PINT Simplify Global Invoicing?

PEPPOL International Invoice (PINT) simplifies the complexities of cross-border invoicing by providing a standardized format based on BIS Billing 3.0. It eliminates paperwork, formatting issues, and tax code variations. It transforms international invoicing into an efficient, transparent process, making it as smooth as local transactions.

With PINT's universal framework and seamless e-invoice integration, businesses can exchange invoices across borders effortlessly. The framework relies on predefined XML standards and API integration, ensuring data mapping aligns with country-specific regulations, currency formats, and tax codes, eliminating manual intervention and reducing data inconsistencies.

What Are the Basics of PEPPOL and Why Does It Matter?

PEPPOL for e-Invoicing is a surrounding for electronic procurement and invoicing that started in Europe but quickly gained popularity worldwide. PEPPOL (Pan-European Public Procurement Online) is managed by OpenPEPPOL, a non-profit group that's turned e-invoicing from a logistical headache into an organized, compliant, and surprisingly stress-free process.

By standardizing invoicing, PEPPOL enables smooth data exchange for businesses and governments, eliminating the "Lost in Translation" issues when invoices cross borders. PEPPOL e-invoicing is now the benchmark for electronic invoicing services globally.

What is PINT, and How Does the PEPPOL International Invoice Work?

PEPPOL International Invoice (PINT) simplifies cross-border invoicing by providing a standardized structure for invoice data exchange. Built on PEPPOL BIS Billing 3.0 and compliant with EN 16931, PINT ensures all invoices are formatted correctly and validated automatically. Removes the complexity of handling different tax regulations and invoice templates, making international invoicing as smooth as domestic transactions.

What Are the Fundamental Advantages of Using PINT in Your Business?

The PINT framework relies on BIS Billing 3.0 to ensure accuracy and compliance. Key features include:

Universal Compliance: PINT eliminates the need to tweak invoices for each country, saving your finance team a lot of time—and aspirin. Its built-in compliance structure keeps everything in order, from VAT fields to line items.

Efficiency Delivered: No more manual formatting, no more errors. PINT automates data entry and ensures each field is filled correctly.

Cost Savings: An efficient, automated invoicing system means fewer resources to resolve disputes, often due to simple formatting issues.

Secure and Transparent: PEPPOL's secure network protects invoice data, ensuring it's transmitted reliably. Transparency is critical in business relationships, and PINT has that covered.

How Does a PEPPOL International Invoice Work Under PINT?

PINT streamlines the invoicing process using standardized data fields, adaptable compliance options, and automated validation checks. Ensures invoices are accurate, compliant with tax laws, and ready for seamless cross-border transactions.

Standardized Data Fields (Because Every Invoice Needs Structure)

Tax Details: From VAT rates to the final total, PINT ensures all tax-related fields meet local laws.

Unique Identifiers: Each invoice has a unique ID, making it as trackable as your online orders.

Detailed Line Items: Every product or service has its section, minimizing confusion.

Adaptable Compliance Options

Country-Specific Fields: PINT can handle variations in tax laws like a pro, allowing for minor tweaks without needing a whole new system.

Automated Validation Checks

Error Detection: No more typos slipping through; PINT's validation ensures data accuracy and completeness.

Compliance Checks: Verifies that each invoice meets necessary standards for its destination country.

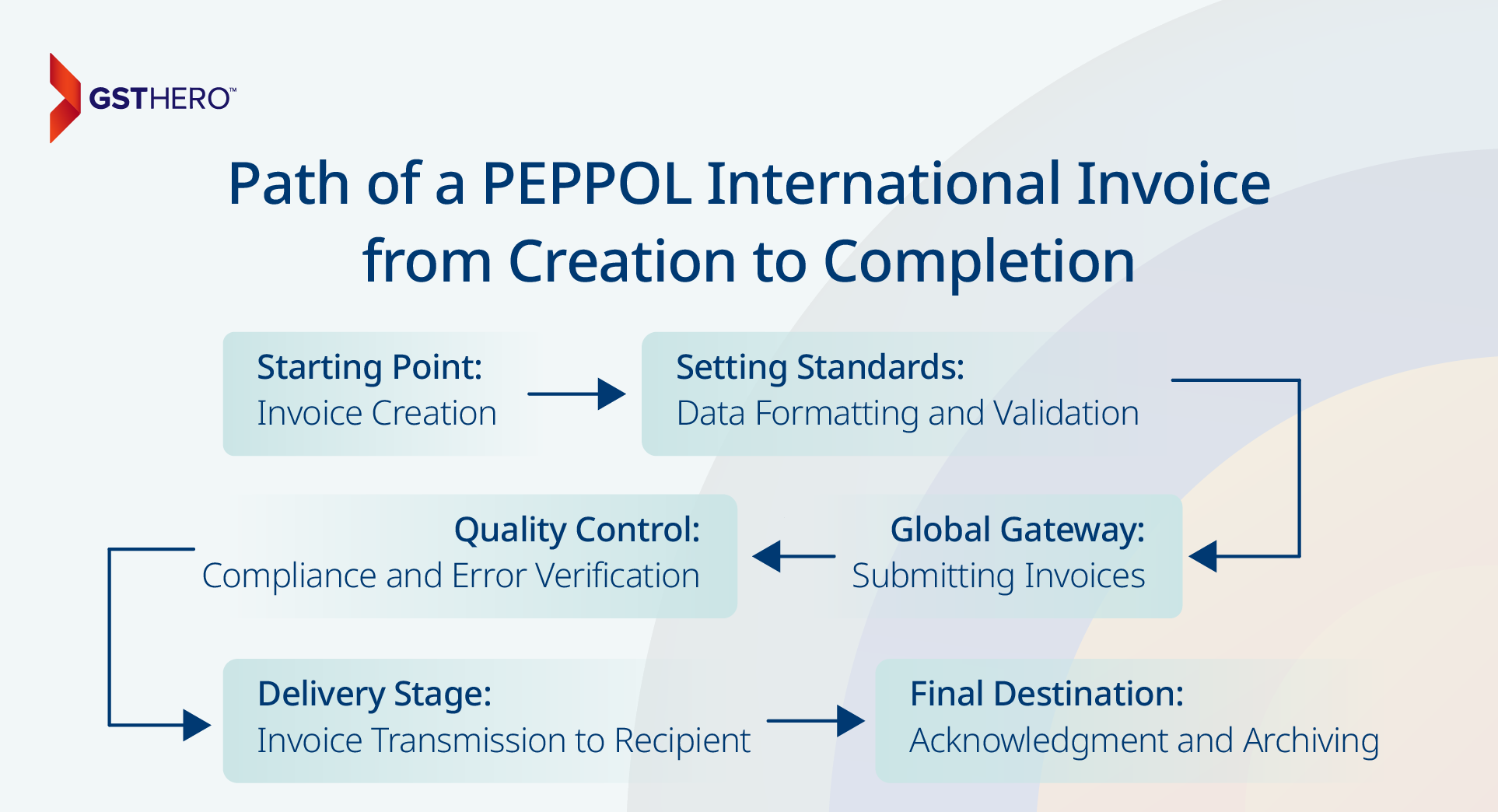

What Is the Path of a PEPPOL International Invoice from Creation to Completion?

The journey of a PEPPOL International Invoice involves a series of systematic steps, ensuring seamless and compliant cross-border transactions. Each stage, from creation to archiving, is designed to streamline invoicing and minimize errors.

Starting Point: Invoice Creation

Every journey begins somewhere, and for a PEPPOL International Invoice, it all starts with creation, where essential details are entered into your ERP system or E-Invoicing software, which sets up the invoice for its global voyage.

Setting Standards: Data Formatting and Validation

Like a passport check, PINT formatting Ensures the invoice complies with BIS Billing 3.0 & Peppol PINT Format standards for smooth travel. PINT's standards verify that all necessary fields are correctly completed and formatted so there are no delays along the way.

Global Gateway: Submitting Invoices via PEPPOL PINT Access Point

At the Access Point, the invoice undergoes automated formatting and validation to ensure compliance with international standards. This step secures the invoice's journey across the PEPPOL network to its intended destination.

Quality Control: Compliance and Error Verification

A quick stop for verification ensures the invoice meets all compliance standards and is error-free. Automated checks keep everything on track, minimizing potential disruptions.

Delivery Stage: Invoice Transmission to Recipient

Now on the move, the invoice travels securely through the PEPPOL network, making its way to the recipient's Access Point safe and sound.

Final Destination: Acknowledgment and Archiving

The journey ends here. Upon reaching its recipient, the invoice is acknowledged, and both sender and receiver securely archive it, ready for future reference.

How to Implement PINT in Your Business

Transitioning to PINT is like giving your invoicing system a software upgrade. Here's the step-by-step process:

Choose a PEPPOL Access Point Provider

Your PEPPOL provider connects you to the PEPPOL network. Integrate your ERP system to send and receive e-invoicing PEPPOL.

Set Up ERP Integration

Connect your ERP system to PEPPOL, making it PINT-compliant to save time on invoicing with BIS Billing 3.0 standards.

Compliance Training for Your Team

Training ensures that everyone on your team understands what goes where and why.

Testing and Validation

Test invoices to ensure everything's in order and there are no missing fields.

Go Live

Start sending PINT invoices with confidence. Monitor for any adjustments and refine as needed.

How Does PINT Work in Real-World Global Trade Applications?

- EU Adopters: The European Union was the first to embrace PINT, making cross-border invoicing smooth and compliant for businesses.

- Asia-Pacific Expansion: Countries like Singapore (Peppol PINT Singapore) and Australia leverage PEPPOL for e-Invoicing to meet their electronic invoicing needs efficiently and compliantly.

- Global Rollout: As PINT adoption grows, so do the opportunities for companies looking to streamline invoicing in various regions.

Use Case For better understanding

A Canadian enterprise needs to send an electronic invoice to a government agency in Australia. The transaction requires adherence to structured e-invoice formatting rules and delivery through a recognized network such as the PEPPOL network.

Problem

Cross-border invoicing comes with specific challenges:

Formatting the invoice to align with PEPPOL PINT (PEPPOL International Invoice) standards ensures that it meets global compliance requirements.

Including accurate identifiers, such as the recipient's PEPPOL ID or routing code, facilitates seamless routing and delivery of the invoice.

Ensuring compliance with tax regulations and business rules in both the sending and receiving countries minimizes the risk of rejection or legal issues.

Preventing errors and delays caused by manual entry or formatting inconsistencies is crucial for efficient cross-border invoicing.

Solution

PEPPOL-Certified Access Point Integration: Use an access point to securely connect to the PEPPOL network, enabling seamless invoice exchange.

Automated Invoice Generation Tools: Implement software that creates invoices in the correct UBL (Universal Business Language) format aligned with PEPPOL standards.

Integrated PEPPOL ID Directory: Utilize tools with a built-in directory for PEPPOL routing codes and identifiers, eliminating the need to obtain recipient details manually.

Automated Compliance and Validation: Use software that ensures invoices comply with the specific tax laws and business rules of both countries, reducing errors and rejections.

Secure and Efficient Delivery: Send the invoice through the PEPPOL network with automated tracking, ensuring it reaches the recipient in the required format.

The Future of PEPPOL International Invoice (PINT) with GSTHero

As PINT evolves into a global standard for e-invoicing, GSTHero ensures businesses stay ahead with BIS Billing 3.0 compliance, ERP integration, and real-time validation. With OpenPEPPOL introducing new fields and compliance options to meet complex tax laws, GSTHero's solutions simplify cross-border invoicing through real-time validation, ERP integration, and secure transactions. PINT and GSTHero are shaping the future of efficient and compliant international trade.

How GSTHero Supports PEPPOL International Invoice (PINT) Implementation

Transition to PEPPOL PINT effortlessly with GSTHero's advanced e-invoicing solutions in malaysia. From automated compliance checks to real-time ERP integration, GSTHero empowers businesses to streamline global invoicing while staying compliant with PEPPOL standards.

With a focus on automation, compliance, and efficiency, GSTHero helps businesses overcome the complexities of international invoicing. Here's how GSTHero makes a difference:

PEPPOL Compliance Integration: GSTHero ensures that all invoices adhere to PEPPOL's PINT standards, enabling smooth cross-border transactions.

Automated Invoice Processing: Eliminates manual data entry with automated invoice generation and validation features.

Seamless ERP Integration: Easily connects with popular ERP systems like SAP, Oracle, and Netsuite to facilitate PINT-compliant invoicing.

Real-Time Validation: Reduces errors with built-in compliance checks and validation rules for various international tax laws.

Customizable Solutions: Offers tailored solutions for businesses of all sizes, accommodating unique invoicing requirements.

Secure and Reliable Network: Provides a secure transmission channel, ensuring data integrity and confidentiality. Designed to handle both B2B and B2G invoicing, GSTHero is ideal for enterprises engaging in international trade.

Expert Support: GSTHero's team provides ongoing advisory and support to help businesses seamlessly transition to PEPPOL-compliant systems.

Conclusion

As global trade becomes increasingly digital, PEPPOL PINT for e-Invoicing is emerging as the gold standard for cross-border transactions. By choosing the right e-invoicing solution in Malaysia, companies can ensure compliance and efficiency. Leading providers like GSTHero offer the tools and expertise needed to navigate international e-invoicing with ease, leveraging tools such as e invoicing software, e invoice system, and comprehensive electronic invoicing services.

FAQ on PEPPOL International Invoice (PINT)

PEPPOL PINT (Peppol International Invoicing Model) is a standardized e-invoicing framework designed for seamless cross-border invoicing. Built on BIS Billing 3.0, it simplifies invoice formatting, compliance, and data exchange between businesses and governments across countries.

PEPPOL is used for securely exchanging electronic business documents, like e-invoices, between businesses and governments in a standardized, compliant format.

PEPPOL e-Invoicing refers to the process of exchanging electronic invoices through the PEPPOL network. It ensures compliance with global standards, automates validation checks, and eliminates manual errors, making international invoicing as easy as domestic transactions.

PEPPOL PINT works by standardizing invoice data exchange through predefined XML formats. Invoice Creation: Details are formatted per BIS Billing 3.0 standards. Validation: Automated checks ensure compliance with tax laws and data accuracy. Transmission: The invoice is securely transferred via the PEPPOL network to the recipient. Acknowledgment: Both sender and receiver archive the invoice for reference.

PEPPOL PINT ensures compliance with tax laws, automates invoicing to reduce errors, lowers costs, provides secure and trackable exchanges, and scales to suit businesses of any size.

To implement PEPPOL PINT, follow these steps:

Select a PEPPOL Access Point Provider: Link your corporation to the PEPPOL network.

ERP System Integration: Align your system with BIS Billing 3.0 standards for PINT compliance.

Compliance Training: Train your team on PINT requirements and processes.

Testing and Validation: Conduct trial runs to ensure smooth operations.

Yes, PINT includes standardized fields that align with various national tax regulations. However, specific country adaptations may be necessary, managed through PEPPOL's flexible structure to support compliance.

A PEPPOL Access Point is a service provider that connects your business to the PEPPOL network, allowing you to send and receive PINT-compliant invoices securely. Access Points act as intermediaries, ensuring your documents are formatted and transmitted according to PEPPOL standards.

PINT accommodates various tax types, including VAT, GST, and other regulatory requirements. It includes fields for tax rates, codes, and details that comply with the tax standards of multiple countries.

PINT suits B2B (business-to-business) and B2G (business-to-government) transactions, making it a versatile option for businesses dealing with government contracts or other public entities.

PEPPOL is known for its secure network, using encrypted channels to protect data integrity and confidentiality. Assures that sensitive or liable data remains private and protected during the transmission of information.

PINT suits B2B (business-to-business) and B2G (business-to-government) transactions, making it a versatile option for businesses dealing with government contracts or other public entities.

An API connects software systems, while PEPPOL is a standardized network for securely exchanging electronic business documents like e-invoices. APIs are often used to access the PEPPOL network.