Is Your Business Ready for the Next Wave of AP Automation in Malaysia?

Malaysia is gearing up for full-scale adoption of e-invoicing, with the government advocating for LHDN-compliant systems. This shift aims to improve transparency and simplify tax audit compliance for businesses nationwide.

AP automation software is more than just a digitization tool—it's a strategic solution to streamline operations and enhance compliance. By leveraging AP automation software, businesses can automate processes, companies can reduce manual errors, and ensure efficiency in their workflows.

Integrating AP automation software with Malaysia's e-invoicing framework ensures seamless invoice validation and compliance. AP automation software eliminates time-consuming manual tasks, speeds up approvals, and minimizes the risk of non-compliance penalties.

This blog delves into how AP automation software simplifies tax audit processes while boosting operational efficiency. Learn why adopting AP automation software is essential for staying competitive in Malaysia's evolving business landscape and meeting the challenges of the e-invoicing era.

Why Is It Important to Understand AP Automation in Malaysia?

Malaysia’s move toward e-invoicing, led by Lembaga Hasil Dalam Negeri (LHDN), is designed to reduce fraud and enhance tax collection. This transition is more than just a compliance requirement; it allows businesses an opportunity to upgrade traditional accounts payable (AP) processes and adopt modern solutions like AP automation Malaysia, which provides tailored features for local businesses.

Manual systems often result in errors, delays, and increased risks of non-compliance. By automating the AP process—from invoice capture to payment approval—businesses can ensure greater accuracy, improve efficiency, and stay aligned with Malaysia's e-invoicing framework.

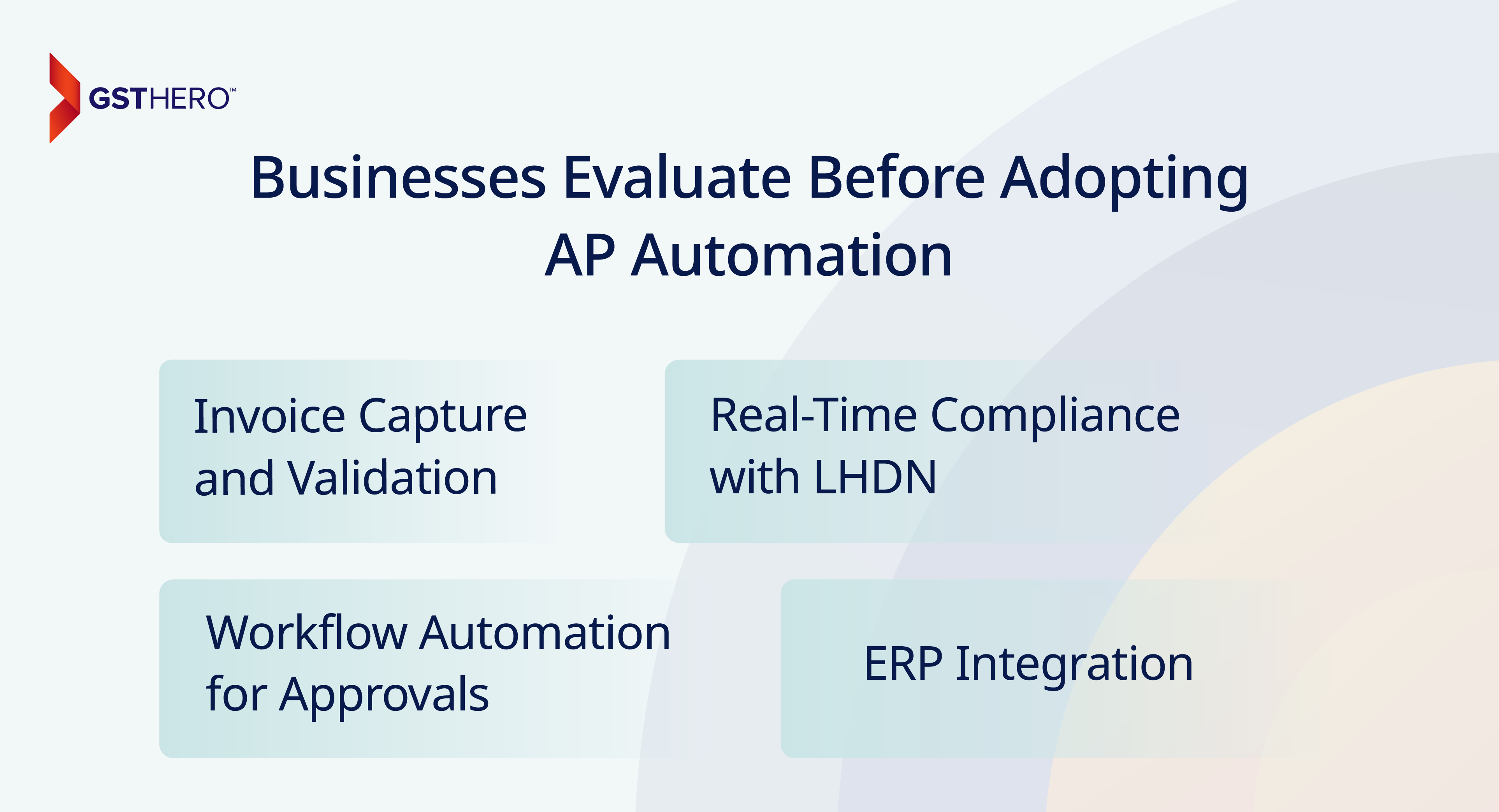

What Should Businesses Evaluate Before Adopting AP Automation?

Before adopting AP automation, many businesses in Malaysia face several challenges that hinder efficiency, accuracy, and compliance in their accounts payable process:

- Manual Data Entry: Manually handling invoices takes a lot of time and often leads to mistakes like typos, duplicate payments, or forgotten invoices. These errors can cause delays, extra work, and penalties, especially when dealing with large invoices.

- Approval Delays: Invoices waiting for approval can get stuck in emails or paperwork. It slows down payments, annoys suppliers, and makes businesses miss discounts for paying early, which helps with cash flow management.

- Limited Visibility: Tracking where invoices and payments stand is only possible with automation. It makes managing money and meeting LHDN rules difficult, especially when businesses can only see part of the picture.

- Compliance Problems: Manual systems make missing essential e-invoicing rules easier for LHDN sets. With proper records and quick submissions, businesses can avoid fines and other issues.

By automating these processes, businesses eliminate inefficiencies, ensure compliance with Malaysian tax laws, reduce errors, and improve financial reporting accuracy.

How Does AP Automation Integrate with E-Invoicing in Malaysia?

AP automation solutions work seamlessly with Malaysia's e-invoicing framework, streamlining processes and ensuring compliance with LHDN regulations. Here's how automation enhances efficiency and accuracy in invoice management:

- Invoice Capture and Validation

Automated systems use OCR technology to extract data from invoices, validating them against purchase orders (POs). Reduces human error and ensures that only correct invoices proceed for approval. - Real-Time Compliance with LHDN

The AP automation process integrates directly with LHDN's MyInvois portal, enabling instant invoice validation and submission. This ensures businesses meet Malaysia's tax regulations efficiently, minimizing the risk of penalties. - Workflow Automation for Approvals

Invoices are routed automatically based on pre-defined approval hierarchies, reducing approval delays and speeding up payment processes. - ERP Integration

AP automation solutions integrate with ERP systems like SAP or Oracle, keeping financial data synchronized across platforms and improving accuracy in reporting.

How Does AP Automation Solutions Support Business Heads in Streamlining Financial Processes?

AP Automation Solutions simplifies complex financial workflows, offering tangible benefits that drive efficiency and cost savings. Here are some key ways it supports businesses:

Cost Savings and Efficiency

Automating AP processes reduces labor costs, reduces manual errors, and eliminates the need for paper, printing, and storage, resulting in significant long-term savings.

Real-Life Example: PepsiCo

PepsiCo, a global leader in food and beverages, implemented an AP automation process to handle its vast supplier network. With thousands of invoices processed globally, manual handling could have been more efficient and error-prone. Through automation, PepsiCo reduced invoice processing times by 87%. Saved costs and improved supplier relationships by ensuring timely payments—a vital issue for any business dealing with large invoices. Malaysian companies can expect similar improvements by automating their AP workflows, especially in the FMCG and manufacturing sectors.

Improved Cash Flow Visibility

Businesses can track cash flow and liabilities in real-time. The AP automation process also helps companies take advantage of early payment discounts, improving working capital.

Enhanced Supplier Relationships

Automation ensures timely payments, reduces supplier disputes, and improves relationships, leading to smoother operations and potential cost benefits from better negotiation terms.

How Does AP Automation Drive Scalability and Deliver Long-Term ROI?

One of the most substantial reasons to adopt an AP automation process is its scalability and ROI. As businesses grow, automation handles increasing invoice volumes without additional staff or resources.

Handling Increased Volume: Growing businesses face more suppliers and invoices. Manual systems require more staff, but AP automation can process thousands of invoices automatically, keeping costs low and workflows efficient.

Adapting to Complexities: Expansion into multiple regions adds complexities like multi-currency transactions and cross-border regulations. The AP automation process easily adapts to these challenges and integrates with ERP systems like SAP or Oracle.

Cost Savings and ROI: Automation reduces manual errors and late payment penalties and capitalizes on early payment discounts. Companies typically see ROI within 12–18 months and benefit from better financial planning.

For instance, A study by Ardent Partners found AP automation reduces invoice processing costs by up to 80%, creating significant long-term savings for businesses.

Improved Supplier Relationships: Timely payments enhance supplier trust, enabling better negotiation terms, such as volume discounts or exclusive agreements, that boost profitability.

How Did AP Automation Transform a Malaysian Manufacturing Firm?

A medium-sized manufacturing firm in Malaysia struggled with manually processing over 1,000 invoices monthly. This led to delayed payments, frequent errors, and compliance issues. With the implementation of an AP automation system, the company was able to:

- Reduce processing time by 50%, with invoices processed and approved within hours instead of days.

- Improve accuracy by automatically validating invoices against purchase orders, reducing discrepancies, and preventing duplicate payments.

- Enhance compliance with LHDN e-invoicing requirements, thanks to the real-time data transmission between the AP system and the government's tax portal.

As a result, the company achieved full compliance and significantly improved its cash flow and supplier relations, leading to better negotiation terms and cost savings.

What Can We Learn from Siemens' AP Automation Journey?

Siemens, a multinational company operating in over 200 countries, faced significant challenges in managing more than 5 million invoices annually. Manual processes were prone to errors and delays, making maintaining efficiency on such a large scale difficult.

By integrating AP automation with its ERP system (SAP), Siemens successfully reduced processing errors and shortened invoice cycle times. The automation streamlined its invoice-to-payment process, ensuring greater accuracy and faster approvals.

This transformation saved Siemens millions in operational costs and improved overall financial management. For Malaysian companies using ERP integration systems, Siemens' success demonstrates the potential of AP automation to reduce errors, simplify workflows, and enhance economic efficiency.

The Future of AP Automation in Malaysia

- AI and Machine Learning

AI can predict patterns, detect invoice anomalies, and improve decision-making by CFOs. Machine learning ensures the system learns and adapts to reduce errors over time. - Sustainability

As businesses prioritize sustainability, paperless invoicing will become the standard, reducing environmental impact while saving costs. - Cloud-Based Solutions

Cloud-based AP systems allow businesses to manage invoices from anywhere, supporting flexible work models and ensuring business continuity during disruptions.

How GSTHero Supports AP Automation and Compliance in Malaysia

GSTHero's advanced AP automation and e-invoicing solutions simplify compliance with LHDN requirements while streamlining business accounts payable processes. Here's how GSTHero helps:

Real-Time Compliance: Automates invoice validation and ensures real-time compliance with LHDN e-invoicing mandates, reducing the risk of penalties.

Seamless ERP Integration: Integrates effortlessly with ERP systems like SAP and Oracle for synchronized financial data and accurate reporting.

Error Reduction: Utilizes automated invoice capture and validation to eliminate manual errors and discrepancies in payment workflows.

Enhanced Cash Flow Management: Provides real-time insights into cash flow and liabilities, empowering businesses to make informed financial decisions.

Improved Supplier Relationships: Ensures timely payments, fostering trust and enabling better negotiation terms with suppliers.

Scalability: Handles increasing invoice volumes efficiently, supporting business growth without additional staffing costs.

Cost Savings: Reduces labor and operational costs through automation, delivering long-term ROI while simplifying compliance processes.

GSTHero empowers Malaysian businesses to stay ahead in a competitive market by streamlining operations and ensuring regulatory compliance.

Conclusion

AP automation is no longer optional for Malaysian businesses aiming to stay compliant and efficient. Integrating the best AP automation software with LHDN's e-invoicing framework ensures real-time compliance, reduces manual errors, and simplifies financial workflows.

Beyond compliance, the best AP automation software delivers cost savings, improves cash flow management, and supports scalability for long-term growth. It empowers businesses to manage complexities like multi-currency transactions and cross-border operations while remaining competitive in a dynamic market. Choosing the best AP automation software is key to optimizing these processes and achieving sustainable success.

FAQ on AP Automation in Malaysia

An AP automation tool is software designed to streamline and automate the accounts payable process, including invoice capture, validation, approval workflows, and payments, reducing manual errors and improving efficiency.

AP automation focuses on automating accounts payable processes, such as invoice processing and payments, while AR automation manages accounts receivable tasks, including invoicing customers and collecting payments.

Automating accounts payable reduces manual errors, ensures compliance, speeds up invoice approvals, improves cash flow management, and enhances supplier relationships through timely payments.

Electronic document management digitizes and organizes invoices and other financial documents, enabling easy retrieval, automated processing, and integration with AP automation systems for seamless workflows.

Non-PO processing refers to handling invoices that don't have a corresponding purchase order. AP automation tools validate and process these invoices efficiently, ensuring compliance and reducing errors.

AP automation helps Malaysian businesses comply with LHDN e-invoicing requirements, reduces processing errors, and enhances operational efficiency by integrating with local tax audit regulations and ERP systems.

The main objectives of AP automation solutions are to streamline invoice processing, ensure compliance, reduce manual errors, enhance financial visibility, and improve overall efficiency in account payable workflows.

The key benefit of AP automation is its ability to reduce processing time and costs while improving accuracy, compliance, and cash flow management, leading to better financial decision-making.

Accounts payable (AP) refers to the money a business owes its suppliers for goods or services. Cloud-based AP automation digitizes and streamlines AP tasks. The best AP automation software integrates advanced features, enabling companies to manage AP workflows seamlessly while improving accuracy and scalability.

AP automation simplifies non-PO invoice processing by automatically validating and approving them based on pre-set rules, reducing delays and ensuring consistency in payment workflows.