E-invoicing is transforming how businesses manage financial transactions. It eliminates manual paperwork, reduces errors, and ensures better tax compliance. This shift is a crucial step toward efficiency and transparency for the insurance and Takaful industry.

Handling policy premiums, claims, payouts, and commissions involves multiple invoicing processes. With e-invoices, these transactions can be processed faster and with greater accuracy. It will help reduce delays and improve financial tracking.

However, adopting e-invoicing comes with challenges. Many companies still use outdated systems that may not support e-invoice generation. Compliance with tax regulations and data security are also significant concerns.

A well-planned approach can make the transition smoother. Upgrading systems, automating e-invoice generation, and training employees are key steps. Understanding the implementation process will help insurers and Takaful operators adapt successfully.

Regulatory Framework and Compliance Requirements

1. LHDN's E-Invoicing Mandate for Insurance & Takaful

The Malaysian Inland Revenue Board (LHDN) has mandated e-invoicing for businesses, including the insurance and Takaful sectors. This mandate ensures that all business transactions are reported digitally, simplifying tax reporting and enhancing compliance.

This involves generating e-invoices for transactions such as premiums, claims, and commissions for the insurance industry.

2. E-Invoice Format and Details

E-invoices must adhere to LHDN's prescribed formats, such as XML or JSON. The e-invoice needs to include essential details to meet regulatory standards:

Tax details: GST, service tax, or any applicable taxes

Transaction description: Clear breakdown of what the e-invoice represents

Digital authentication: Ensures invoice authenticity and prevents fraud

3. System Integration for Seamless E-Invoice Generation

Insurance and Takaful operators must integrate e-invoicing with their existing systems, such as policy management platforms and accounting software.

This integration ensures that transactions like policy premiums, claims payouts and reinsurance agreements are captured accurately, minimizing the risk of errors and delays in reporting to LHDN.

4. Ongoing Compliance and Monitoring

To ensure continuous compliance with LHDN's evolving guidelines, insurance, and Takaful operators need to implement automated systems to validate e-invoices.

Regularly monitoring updates from LHDN is crucial to ensure that the e-invoicing system remains in line with any regulatory changes or new tax reporting requirements.

5. Consequences of Non-Compliance

Failure to comply with LHDN's e-invoicing standards can result in serious consequences for the insurance and Takaful sectors. These include:

Penalties and fines for late or inaccurate compliances

Delays in processing claims or financial transactions

Legal repercussions for not adhering to mandatory regulations

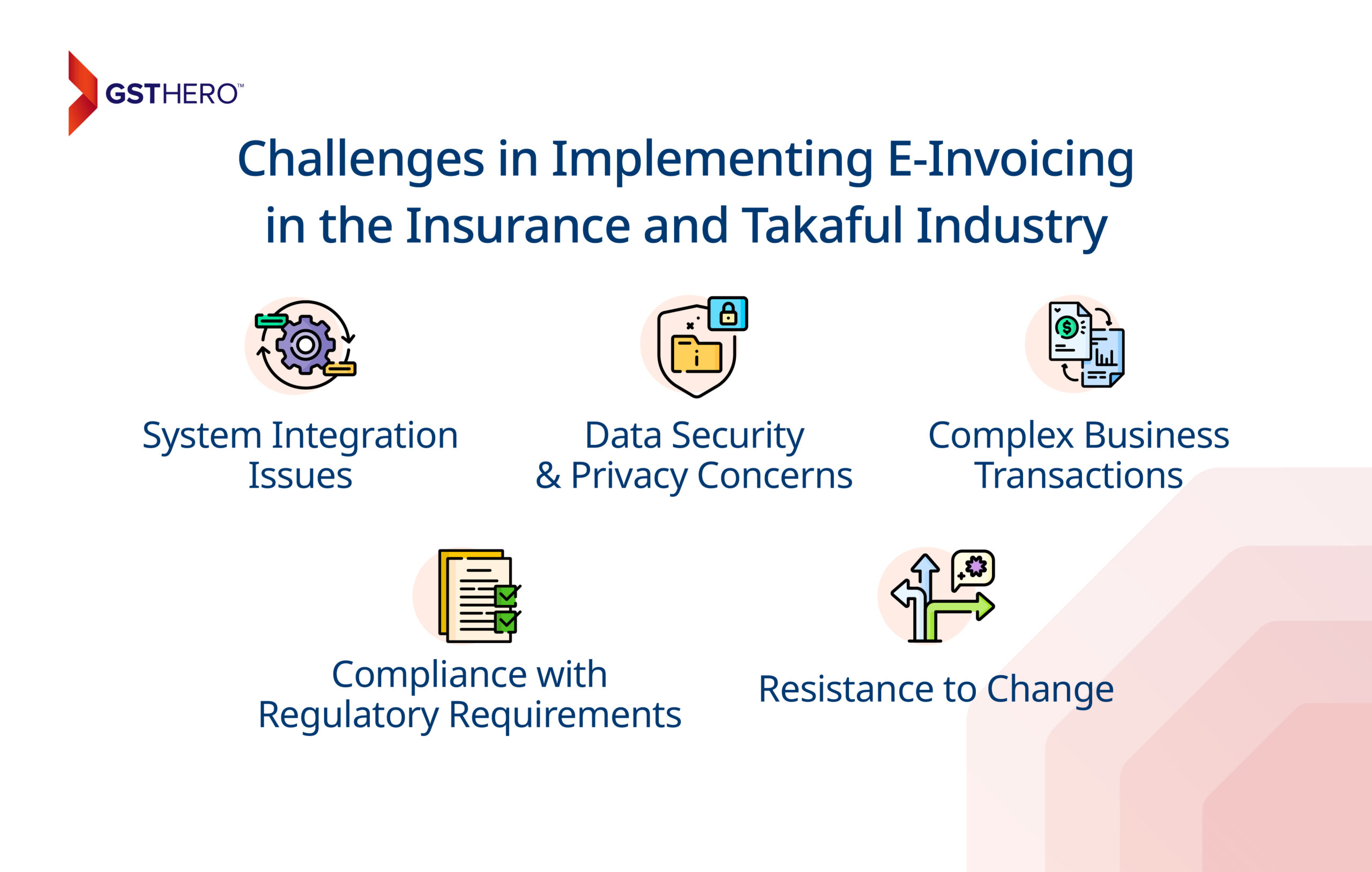

What Are the Challenges in Implementing E-Invoicing in the Insurance and Takaful Industry?

While the move towards e-invoicing offers multiple benefits, its adoption presents several challenges, particularly in the insurance and Takaful industry:

System Integration Issues

Many insurers and Takaful operators rely on legacy systems that may not be compatible with LHDN's e-invoicing framework.

Upgrading or substituting these systems can be expensive and time-consuming.

Data Security & Privacy Concerns

E-invoicing involves the exchange of sensitive policyholder data, requiring robust cybersecurity measures.

Ensuring compliance with Malaysia's Personal Data Protection Act (PDPA) is crucial.

Complex Business Transactions

Insurance and Takaful companies deal with diverse transactions, including policy premiums, reinsurance agreements, claims payouts, and commissions.

Ensuring that all these transactions are accurately captured under e-invoicing can be challenging.

Compliance with Regulatory Requirements

Companies must ensure that e-invoices meet LHDN's prescribed format (such as XML or JSON).

Non-compliance could lead to penalties or delays in processing financial transactions.

Resistance to Change

Employees, intermediaries, and policyholders may struggle to adapt to the new digital e-invoicing system.

Training and stakeholder engagement are necessary to ensure smooth adoption.

How Can Insurance and Takaful Operators Overcome E-Invoicing Challenges?

To ensure the smooth implementation of e-invoicing, insurance, and Takaful operators can take the following steps:

Upgrade IT Infrastructure & Integrate Systems

Invest in e-invoicing software that seamlessly integrates with existing ERP and accounting systems.

Work with IT service providers to develop customized solutions that cater to industry-specific needs.

Enhance Data Security Measures

Implement encryption and access controls to protect sensitive policyholder and financial data.

Conduct regular cybersecurity audits and ensure compliance with PDPA regulations.

Develop a Standardized E-Invoicing Framework for the Industry

Collaborate with regulators, industry bodies, and stakeholders to define e-invoicing standards that cater to the unique needs of insurers and Takaful operators.

Ensure that e-invoices for different types of transactions (such as claims payouts and commissions) comply with LHDN's guidelines.

Ensure Regulatory Compliance Through Automation

Implement automation tools that validate e-invoices before submission to LHDN to avoid errors and delays.

Stay updated on tax authority guidelines and participate in industry discussions to ensure compliance.

Conduct Training and Change Management Programs

Organize workshops for employees, agents, and brokers to familiarize them with the new e-invoicing system.

Develop user-friendly guides and FAQs to assist stakeholders in adopting e-invoices.

What Are the Benefits of E-Invoicing for Insurance and Takaful Operators?

Despite the challenges, the implementation of e-invoicing brings several advantages:

Improved Compliance and Transparency

Reduces manual errors and ensures accurate tax reporting, minimizing the risk of penalties.

Increased Operational Efficiency

Reduces paperwork and speeds up e-invoice processing, allowing for faster transactions.

Enhanced Fraud Prevention

Digital e-invoices lessen the chances of invoice manipulation, improving financial security.

Seamless Financial Integration

E-invoicing can be integrated with policy management and claims processing systems for real-time tracking.

Cost Savings on Administrative Processes

Automating e-invoice generation and submission reduces administrative overhead.

How Does E-Invoicing Apply to the Insurance and Takaful Industry?

E-invoicing applies to various revenue and expense transactions in the insurance and Takaful sector.

Revenue Sources Requiring E-Invoicing

Policy Premiums

Reinsurance Agreements

Claims Management Fees

Underwriting Services

Commissions from Agents and Brokers

Profit-sharing from Takaful Pools

Administrative Fees

Expenses Covered by E-Invoicing

Claims Payouts

Reinsurance Premiums

Commissions Paid to Agents and Brokers

Regulatory Fees and Taxes

What Are the Key Steps for Insurance and Takaful Operators to Ensure E-Invoicing Compliance?

Insurance and Takaful operators should follow these steps to ensure a smooth transition to e-invoicing:

Understand Regulatory Requirements:

Stay updated with LHDN's e-invoicing guidelines and ensure that invoices meet prescribed formats.

Assess Current Systems and Identify Gaps:

Conduct an IT audit to evaluate e-invoice readiness.

Implement or Upgrade E-Invoicing Software:

Select an e-invoicing platform that integrates with tax reporting and financial systems.

Train Internal Teams and External Partners:

Educate employees, agents, and brokers on e-invoice processes.

Pilot Test Before Full Implementation:

Run a small-scale test before rolling out e-invoices company-wide.

Ensure Continuous Monitoring and Compliance:

Regularly update systems to stay compliant with regulatory changes and enhance operational efficiency.

How GSTHero Simplifies E-Invoicing for Malaysia's Insurance and Takaful Industry

GSTHero is a cutting-edge e-invoicing solution tailored to help businesses seamlessly transition to digital invoicing, including those in Malaysia's insurance and Takaful sector. Here's how GSTHero can transform your e-invoicing process:

Seamless Integration with Existing Systems

GSTHero effortlessly integrates with your current ERP and accounting platforms, ensuring a smooth transition to e-invoicing without disrupting your operations. This particularly benefits insurance and Takaful operators who are managing complex transactions like policy premiums, claims payouts, and commissions.

Compliance with LHDN Regulations

GSTHero ensures that all e-invoices adhere to LHDN's mandated formats, such as XML or JSON. The platform automates the generation, validation, and submission of e-invoices, reducing the risk of errors and ensuring timely compliance with tax regulations.

Enhanced Data Security

With robust encryption and access controls, GSTHero safeguards sensitive policyholder and financial data, ensuring compliance with Malaysia's Personal Data Protection Act (PDPA). Regular cybersecurity audits further strengthen data protection.

Fraud Prevention

Digital e-invoices generated through GSTHero reduce the risk of invoice manipulation, enhancing financial security and transparency.

Scalability for Diverse Transactions

Whether policy premiums, reinsurance agreements, or claims payouts, GSTHero is designed to handle the diverse and complex transactions typical of the insurance and Takaful industry.

Why Choose GSTHero?

Regulatory Compliance: Stay updated with LHDN's evolving guidelines.

Operational Efficiency: Streamline invoicing processes and reduce manual effort.

Data Security: Protect sensitive information with advanced cybersecurity measures.

Cost-Effective: Save on administrative costs and avoid penalties.

By leveraging GSTHero, insurance, and Takaful operators can overcome e-invoicing challenges, ensure compliance, and position themselves for long-term success in Malaysia's digital economy.

Is your company ready to embrace e-invoicing? Let GSTHero guide your transformation.

Conclusion

The adoption of e-invoicing in Malaysia’s insurance and Takaful industry marks a significant step toward digital transformation, transparency, and efficiency. While the transition presents challenges, companies can overcome them with the right technology, proper training, and regulatory compliance measures.

By proactively implementing e-invoicing, insurance and Takaful operators can enhance operational efficiency, improve tax compliance, and position themselves for long-term success in the digital era.

Is your company ready for e-invoicing? Now is the time to prepare and embrace this transformation

FAQ On E-invoice Implement for the Insurance and Takaful Industry in Malaysia

Yes, insurers can issue a consolidated e-invoice for policyholders who do not require one. That will simplify tax reporting while ensuring compliance with LHDN regulations. Insurers should refer to Section 3.6 of the e-Invoice Specific Guideline for proper procedures.

Yes, annual premium statements can be used for consolidated e-invoicing when policyholders do not request individual invoices. These must be submitted for validation within seven (7) days after the issuance month, which will ensure compliance while maintaining smooth financial operations.

Yes, insurers must provide an e-invoice upon request, even if the product is ineligible for tax relief. Policyholders are considered buyers in e-invoicing, and their requests must be honored. That maintains transparency and compliance with tax regulations.

The primary policyholder should be listed as the buyer in the e-invoice. If another policyholder requests one, the insurer must issue a separate e-invoice, which ensures proper documentation while complying with LHDN requirements.

Yes, a refund note e-invoice must be issued for returned premiums upon policy termination. Exceptions apply for mistaken payments, overpayments, or security deposit refunds. Insurers must ensure compliance with LHDN's e-invoicing guidelines.

For minor policyholders, the e-invoice should use the parent's or guardian's details. Minors cannot be listed as buyers for tax purposes under e-invoicing rules. It ensures compliance while maintaining accurate financial records.

If the employee is the policyholder, the e-invoice must be issued to the employee, not the employer. The employer is only a payment collector, not the buyer. So it will comply tax documentation correctly reflects the policyholder's financial responsibility.

No, insurers can continue their cash-before-cover policy without changes. They must still ensure e-invoices are generated at the correct transaction stage. Existing invoicing and payment processes remain valid under the new system.

If the reinsurer is in Malaysia, they must issue an e-invoice to the insurance company. If the reinsurer is overseas, the insurer must generate a self-billed e-invoice. So, it ensures compliance with LHDN's e-invoicing framework.

Yes, insurers must issue self-billed e-invoices for claims, benefits, and compensation payouts. So, it will apply even if payments go directly to hospitals, workshops, or third parties. Consolidated self-billed e-invoices can be used for non-business policyholders.