Electronic invoicing Malaysia is shaking up the financial services landscape, paving the way for innovative, faster, and more transparent operations. Led by the Inland Revenue Board (LHDN), this mandate goes beyond compliance—it's an opportunity to eliminate tedious paperwork and embrace Electronic Invoicing Malaysia's efficiency.

For the financial services sector, electronic invoice system presents an opportunity to transform invoicing workflows and stay ahead of the curve. This blog explains what e-invoicing Malaysia means for the industry, its benefits, and how to navigate the transition smoothly. Let's dive in!

How Is Electronic Invoice System Transforming the Financial Services Industry?

E-invoicing Malaysia refers to the electronic exchange of invoice data in a standardized structure, replacing traditional paper-based systems. Malaysia's approach aligns with international frameworks like the Pan-European Public Procurement Online (PEPPOL), ensuring compatibility with global and domestic transactions.

The implementation of e-invoicing in Malaysia will roll out in phases, with the e-invoice start date for large enterprises kicking off in August 2024, followed by medium and small businesses. This staggered approach provides financial institutions a strategic window to align their processes with e-invoicing Malaysia guidelines while leveraging operational benefits.

Why Is Electronic Imvoice System Strategically Important for Malaysia's Financial Services Industry?

Banks, insurance providers, and investment firms form the backbone of Malaysia's economy. E-invoicing in Malaysia offers transformational benefits, such as:

Regulatory Precision

Automated invoicing ensures accuracy in tax reporting and mitigates regulatory risks—a vital aspect for heavily regulated sectors. Say goodbye to late-night reconciliations (and the caffeine overdoses they cause).

Optimized Operations

Automation reduces manual interventions, accelerating invoice processing and lowering administrative overheads. Who doesn't love saving time and money?

Financial Agility

Real-time tracking of invoices improves cash flow visibility, allowing for more effective management of payables and receivables. Imagine a smoother process without the need for uncomfortable follow-ups on late payments.

Fraud Reduction

Standardized invoicing formats reduce vulnerabilities to fraud, strengthening financial security. It's like putting your finances in a virtual Fort Knox.

Market Leadership

Early adoption of e-invoicing in Malaysia signals innovation, fostering trust among clients and business partners. Nobody wants to be the company that still uses fax machines in 2024.

What Is the Electronic Invoice System Compliance Checklist for Malaysia's Financial Services Industry?

Meeting e-invoicing Malaysia compliance requires careful attention to key regulatory standards and operational adjustments. Following the essential steps outlined below, businesses can ensure smooth implementation while maintaining data security and interoperability:

Mandatory Registration

Register with LHDN to obtain e-invoice LHDN credentials, which is your first official stamp of approval.

Adherence to PEPPOL Standards

Ensure interoperability by integrating with the PEPPOL network—think of it as learning the universal language of invoices.

Invoice Structure Compliance

Include mandatory details in the e-invoice format such as:

- Business and client information

- Unique invoice ID

- Service descriptions

- Tax details (e.g., GST/SST)

Data Security Measures

Adopt stringent cybersecurity protocols for data storage and exchange. Nobody wants their invoices to star in a data breach headline.

How Can Malaysia's Financial Services Industry Overcome E-Invoice Implementation Challenges?

Transitioning to e-invoicing in Malaysia comes with its share of challenges. Some of the primary hurdles include:

Legacy System Limitations

Outdated IT systems often struggle to integrate with modern e-invoicing platforms—much like attempting to stream a 4K movie on a cassette player.

Data Sensitivity

Financial institutions must navigate stringent data privacy laws to safeguard client information. Secure platforms and e-invoice training for employees can help institutions stay compliant.

Investment Costs

Initial expenses for technology upgrades and staff training can be substantial. But think of it as buying high-quality shoes—the comfort and longevity are worth it.

Workforce Adaptation

Change resistance among employees accustomed to manual systems is a common roadblock. Time for some pep talks (and maybe donuts).

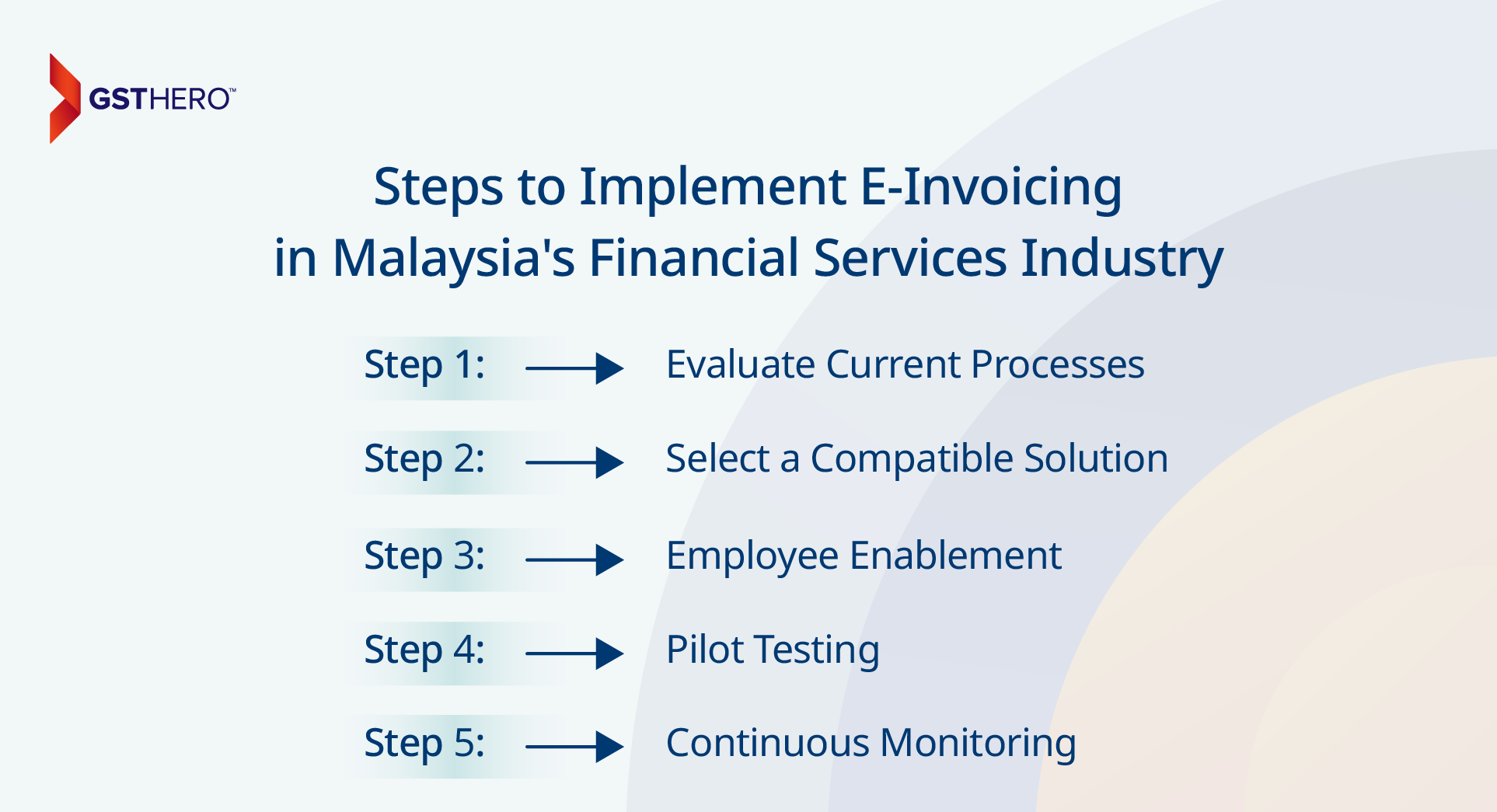

What Are the Steps to Implement E-Invoicing in Malaysia's Financial Services Industry?

Evaluate Current Processes

Recognize bottlenecks in your invoicing processes. It's similar to organizing a messy room—identifying the problem areas comes first.

Select a Compatible Solution

Choose an e-invoicing platform that is compliant with LHDN and PEPPOL standards. Compatibility is key—just like choosing a phone charger.

Employee Enablement

Conduct e-invoice training sessions to ensure seamless adoption of new tools. Make it fun! No one said training can't include snacks and a quiz game.

Pilot Testing

Run small-scale tests to identify and resolve potential issues. Think of this as your dress rehearsal before the big debut.

Continuous Monitoring

Track system performance and optimize for efficiency post-implementation. It's like having a GPS for your invoicing journey.

Is Your Financial Framework Ready for the E-Invoicing Revolution?

E-invoicing is the cornerstone of a digitally advanced financial framework. Its long-term benefits reshape operations and decision-making:

- Simplified Cross-Border Operations: Enables seamless international invoicing and compliance.

- Stronger Client Relationships: Accelerates billing cycles, enhancing transparency and trust.

- Actionable Insights: Leverages analytics from invoices to inform strategic decisions, turning data into a compelling business story.

GSTHero: Your Partner in E-Invoicing Excellence

GSTHero offers end-to-end e-invoicing solutions tailored for Malaysia's financial sector. Key features include:

- PEPPOL Compatibility: Ensures seamless integration with global networks.

- Customizable API Support: Facilitates integration with legacy systems.

- Real-Time Error Validation: Minimizes inaccuracies in tax reporting.

- Dedicated Support Teams: Guides every implementation phase.

With GSTHero, financial institutions can transform invoicing processes, ensuring compliance while unlocking new efficiencies.

Conclusion

E-invoicing is more than a compliance mandate; it catalyzes innovation in Malaysia's financial services industry. By embracing this change, institutions can achieve enhanced compliance, operational efficiency, and customer satisfaction. The right approach and a reliable technology partner can effectively overcome these challenges.

As the e-invoicing mandate unfolds, staying proactive and informed will be crucial. GSTHero is here to simplify the journey, offering customized solutions to help your institution thrive in the digital era.

FAQ On E-Invoice Implementation for Malaysia's Financial Services Industry

The Malaysian e-invoicing mandate, led by LHDN, requires businesses to adopt electronic invoicing to replace traditional paper invoices. This move aims to modernize financial processes, improve tax compliance, and enhance transaction efficiency across all sectors.

The mandate directly affects banks, insurance companies, and investment firms due to their reliance on high-volume, complex invoicing workflows. Any financial entity issuing or receiving invoices must comply to avoid regulatory penalties.

E-invoicing reduces administrative overheads, ensures compliance accuracy, and offers real-time cash flow tracking. It minimizes fraud risks, accelerates invoice processing, and builds trust with clients and business partners.

PEPPOL provides a standardized framework for exchanging electronic invoices, ensuring local and cross-border transaction interoperability. This alignment simplifies invoicing processes, making them more efficient and globally compatible.

Institutions must register with LHDN for e-invoicing credentials, adopt PEPPOL-compliant platforms, and follow the mandated invoice structure. Strengthening data security and conducting employee training are also critical for compliance.

Financial institutions may face integration issues with legacy systems, high initial costs for technology upgrades, and employee resistance to change. Ensuring data security while complying with strict privacy laws is another key challenge.

Engaging employees early in the process and communicating the benefits can ease resistance. Providing hands-on training, offering incentives, and fostering a collaborative environment further support a successful transition.

Costs include purchasing new software, customizing APIs for integration, and training employees. While the initial investment may seem high, it is justified by long-term savings, enhanced efficiency, and improved compliance.

GSTHero provides LHDN and PEPPOL-compliant solutions tailored to the financial sector. Its features include real-time error validation, customizable APIs for integrating existing systems, and dedicated support throughout implementation.

E-invoicing simplifies cross-border transactions, improves client transparency, and offers data-driven insights for better decision-making. It also enhances operational efficiency, positioning institutions as innovative market leaders.