The buzz is growing as the Malaysian government moves closer to rolling out the e-invoice mandate under the e-invoice LHDN system. Questions like "When should we start preparing?" and "How complex will this be?" are becoming regulars in boardrooms. For many, pushing this task closer to the deadline seems easy, but here's the reality—waiting can lead to more headaches than you think.

Onboarding an e-invoicing Malaysia LHDN solution isn't just about new software; it's about aligning processes, cleaning up data, ensuring compliance with IRBM Malaysia (Inland Revenue Board of Malaysia), and avoiding operational disruptions. Now imagine multiplying that effort across departments, clients, and ERP systems. Starting early—ideally two months before the e-invoice mandate implementation date—isn't just brilliant; it's essential.

The 2024 malaysia e-invoice mandate is more than a compliance requirement; it's a shift toward modernized tax reporting, bringing opportunities to enhance operational efficiency and transparency. Delaying this process can cause technical glitches, workflow disruptions, and compliance risks that could have been avoided with proactive onboarding.

This blog will explain why early onboarding of your e-invoicing Malaysia solution is critical and how to address challenges proactively. It's about avoiding chaos and setting your business up for long-term success. Let's dive in and get ahead of the curve with e-invoicing Malaysia LHDN compliance!

What are the implications of E-Invoice Mandate in Malaysia for businesses?

Malaysia is embracing the future of tax compliance with the rollout of e-invoicing Malaysia, led by Lembaga Hasil Dalam Negeri (LHDN) under the e-invoice LHDN Guideline. This initiative aims to modernize invoice Malaysia processes, streamline reporting, and enhance transparency, aligning with global efforts to tighten tax compliance and close revenue gaps.

The Malaysia e-invoice format, as specified in the e-invoicing Malaysia guidelines pdf, mandates businesses to generate, validate, and transmit invoices electronically via a government-prescribed platform. This system ensures real-time reporting to IRBM Malaysia, reduces errors, curbs fraud, and makes audits more efficient for businesses and authorities.

The implementation of e-invoicing in Malaysia is being rolled out in phases based on annual turnover thresholds, giving businesses time to prepare. However, operational readiness will vary, and early adoption is crucial to avoid disruptions.

By embracing e-invoicing in Malaysia, businesses can streamline operations, ensure compliance, and contribute to a more transparent tax ecosystem.

Why Two Months is the Magic Number for E-Invoice Malaysia

1. Time for Customization and Integration

Implementing an e-invoicing solution in Malaysia involves more than adopting off-the-shelf software. Businesses must customize APIs, configure templates to meet the Malaysia e-invoice format, and ensure seamless integration with ERP systems like SAP, Oracle, or Netsuite. Staying ahead of the e invoice Malaysia implementation date gives teams the runway to get this right.

2. Mitigating Data Migration Challenges

Transitioning to an e-invoice LHDN platform can uncover challenges like inconsistent data formats, missing client information, and discrepancies in invoice numbering sequences. Early preparation following the lhdn e invoice guideline helps mitigate these risks.

3. Training and Change Management

Shifting to e-invoicing Malaysia requires hands-on training for accounts payable, finance, and IT teams. Employees must adapt to changes to minimize workflow disruptions.

4. Ensuring Compliance with Mandate Requirements

Compliance with Malaysia e-invoicing 2024 involves:

- Adhering to LHDN's schema.

- Implementing Peppol-based standards.

- Maintaining audit trails accessible to IRBM Malaysia in real time.

5. Stress-Testing the Solution

Real-world testing addresses scenarios like handling foreign currency invoices, managing discounts, and ensuring compliance with client-specific requirements, such as the e-invoicing Malaysia budget 2023 standards.

What Are the Common Operational Challenges in Implementing E-Invoicing in Malaysia?

Implementing an e-invoicing Malaysia system may seem straightforward but involves navigating challenges across technology, vendors, teams, and processes. Addressing these ensures a smoother transition.

IT Infrastructure Limitations

Ensuring your IT infrastructure is ready for e-invoicing in Malaysia is a significant challenge. Many businesses need help with outdated systems, exposing compatibility, capacity, and cybersecurity gaps.

Outdated Hardware and Software: Older systems often need more capability for real-time validation and secure transmissions required by e-invoicing Malaysia. Upgrades are time-intensive and require careful planning.

Insufficient Server Capacity: High transaction volumes in e-invoicing Malaysia demand robust servers to handle increased workloads without slowing down or crashing.

Enhanced Cybersecurity Needs: Digital systems for e-invoicing in Malaysia require advanced security measures like encryption, firewalls, and multi-factor authentication to protect financial data.

Vendor Coordination

Choosing the right e-invoicing Malaysia vendor is crucial, as their expertise and support greatly influence success. However, challenges can arise:

Evaluating Multiple Vendors: Businesses must assess vendors' compliance capabilities, integration options, and customer reviews to meet e-invoicing Malaysia standards.

Negotiating Contracts: Service-level agreements SLAs for support, updates, and maintenance take time, especially with evolving regulatory requirements under e-invoicing in Malaysia.

Collaborating on Integration: Effective integration between the vendor and IT teams is critical for seamless implementation.

Cross-Departmental Collaboration

Implementing an e-invoicing solution in Malaysia impacts multiple departments, including finance, IT, compliance, and sales. This cross-functional involvement poses challenges:

Conflicting Priorities: Departments may have competing goals, such as finance compliance deadlines versus IT system stability. Aligning these requires communication.

Communication Gaps: Miscommunication can delay tasks, leading to missed responsibilities in e-invoicing Malaysia implementation.

Lack of Ownership: Tasks can only fall through the cracks with a designated project owner. A lack of accountability often results in delays and unaddressed challenges.

Addressing Legacy Workflows

Shifting from manual or hybrid systems to a digital e-invoicing Malaysia platform requires significant workflow changes, often underestimated.

Standardizing Data Entry Practices: Inconsistent manual data entry can hinder smooth integration with e-invoicing Malaysia systems. Standardization is key.

Eliminating Paper-Based Processes: Paper invoices are incompatible with e-invoicing in Malaysia, necessitating a transition to digital workflows.

Automating Validation Processes: Manual validation of invoices can be error-prone and time-consuming. Implementing automated checks for tax codes, invoice formats, and client details ensures accuracy but requires meticulous setup and testing.

The Risks of Waiting Too Long in Implementing E-Invoicing Malaysia

Let's take a closer look at the critical risks businesses expose themselves to by delaying the adoption of an e-invoicing solution in Malaysia.

- Non-Compliance Penalties

Adhering to the e-invoice mandate in Malaysia is mandatory. Delaying the implementation of an e-invoicing Malaysia solution can leave your business unprepared to meet the requirements by the stipulated deadline. This absence of enthusiasm could result in:

- Hefty Fines: Authorities may impose significant financial penalties for failing to comply with the e-invoicing Malaysia mandate, with fines escalating for repeated violations.

- Legal Complications: Non-compliance can invite audits, investigations, or legal proceedings, consuming time and resources that could be better spent elsewhere.

- Business Disruptions: An inability to generate compliant invoices could lead to operational standstills, delaying payments and revenue recognition.

- Operational Disruptions

E-invoicing Malaysia isn't just a technical shift; it impacts workflows across finance, IT, and operations departments. Delaying implementation compresses the time available for critical integration and testing, which can lead to the following:

- Extended Downtime: Rushed implementations increase the likelihood of technical glitches or system crashes, causing downtime that disrupts daily operations.

- Delayed Invoicing: Any interruptions in generating or transmitting invoices can delay client payments, affecting cash flow and financial stability.

- Workflow Bottlenecks: Employees unfamiliar with the new e-invoicing Malaysia system may struggle to adapt quickly, leading to inefficiencies and delays in processing invoices.

- Increased Costs

The cost of waiting until the last minute to implement an e-invoicing Malaysia solution often outweighs any perceived savings from delaying. Businesses that procrastinate may find themselves facing the following:

- Premium Charges: Vendors and consultants may charge higher fees for expedited implementations or last-minute support.

- Additional IT Support Costs: A rushed implementation often requires hiring extra IT resources to troubleshoot and fix integration issues.

- Potential Overruns: Unanticipated expenses related to emergency fixes, extended downtime, or temporary workarounds can quickly add up.

- Reputational Damage

Your reputation with clients, partners, and stakeholders is a critical asset, and delays in implementing an e-invoicing Malaysia solution can erode trust in several ways:

- Missed Deadlines: Non-compliance or delays in issuing invoices can strain client relationships significantly if payments are delayed or disputes arise due to errors.

- Perception of Inefficiency: Clients and partners may perceive your business as disorganized or unprepared, which could harm long-term collaborations.

- Competitive Disadvantage: Early adopters of e-invoicing in Malaysia may gain a reputation for efficiency and compliance, leaving late adopters struggling to catch up.

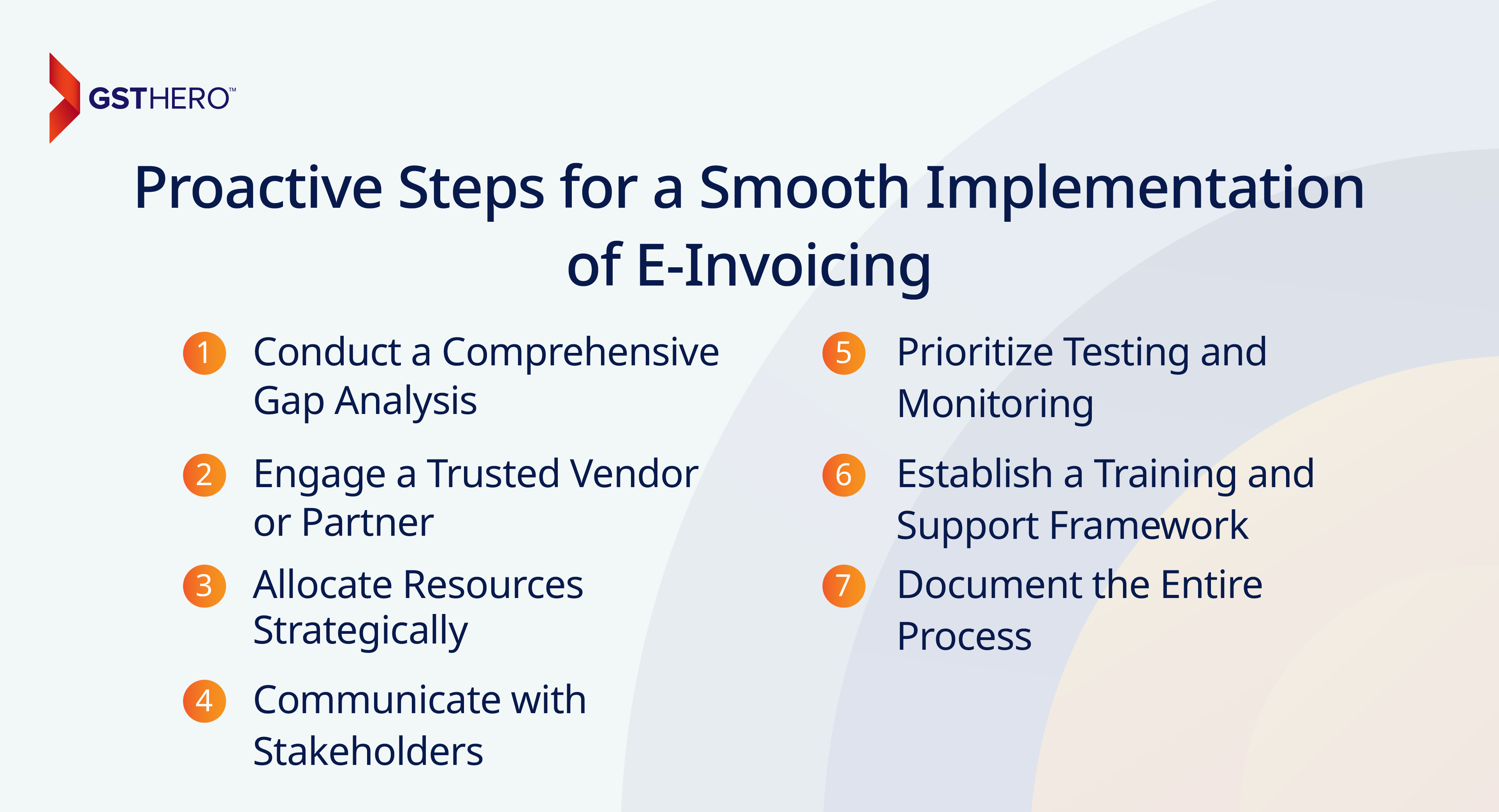

Proactive Steps for a Smooth Implementation of E-Invoicing

Here's a detailed roadmap to guide you through this transition effectively:

- Conduct a Comprehensive Gap Analysis

Before diving into implementation, it's critical to evaluate your current invoicing systems and processes against the requirements of the e-invoicing mandate.

- Assess System Readiness:

Examine whether your ERP or accounting systems can integrate with an e-invoicing solution.

Identify areas where manual processes still exist and assess their compatibility with automated workflows.

- Map Out Compliance Gaps:

Compare your invoicing formats, data fields, and workflows with the LHDN-prescribed standards.

Ensure your system generates and transmits invoices in the required schema without errors.

- Analyze Resource Needs:

Evaluate if your internal IT team has the capacity and expertise to manage the integration or whether you'll need external support.

Plan for additional resources if gaps are identified in data accuracy, team training, or system upgrades.

- Engage a Trusted Vendor or Partner

Selecting the right e-invoicing solution provider is one of the most critical steps in the implementation process. A trusted partner will provide the necessary tools and guide you through the complexities of compliance and integration.

- Evaluate Vendor Credentials:

Look for vendors with a proven track record in e-Invoicing solutions, particularly those experienced in Malaysia's LHDN and Peppol-based requirements.

Verify their client portfolio and case studies to ensure they can handle businesses of your size and complexity.

- Check for Customization Options:

Ensure the vendor can tailor their solution to your unique business needs, such as handling multi-currency transactions, incorporating discounts, or integrating specific workflows.

- Prioritize Support and Scalability:

Choose a partner that offers robust customer support, including training, troubleshooting, and updates to meet evolving compliance standards.

Consider scalability if your business is expected to grow or expand internationally.

- Allocate Resources Strategically

Implementing an e-invoicing solution is a collaborative effort that requires contributions from multiple departments. Having a dedicated team in place ensures accountability and efficiency.

- Form a Cross-Functional Team:

Include finance, IT, compliance, and operations representatives to address the various implementation aspects.

Designate a project manager to oversee the process, track milestones, and coordinate between departments and vendors.

- Budget for Implementation:

Allocate financial resources for software licensing, data migration, employee training, and hardware upgrades.

Set aside contingency funds to address unforeseen challenges.

- Communicate with Stakeholders

The transition to e-invoicing affects internal teams and external stakeholders, such as clients, suppliers, and regulatory bodies. Clear and timely communication is key to avoiding misunderstandings and fostering collaboration.

- Inform Clients and Suppliers:

Notify your business partners about the transition, including key dates, new requirements, and any changes in the invoicing process.

Please guide them on how to adapt to the changes, such as accepting or issuing e-invoices through your system.

- Engage Internal Teams:

Keep employees notified about the implementation timeline and how the transformations will impact their roles.

Encourage open communication to address concerns or suggestions from team members.

- Maintain Transparency with Authorities:

Stay in touch with LHDN or other relevant bodies to clarify compliance requirements and receive updates on changes to the mandate.

- Prioritize Testing and Monitoring

The success of your e-invoicing implementation depends on thorough testing and ongoing monitoring.

- Pilot Testing:

Begin with a small batch of invoices to test the system's functionality, integration, and compliance with LHDN guidelines.

Identify and resolve any errors or inefficiencies before full-scale deployment.

- Stress Testing:

Simulate high-volume transactions to ensure the system can handle peak invoicing periods without downtime or delays.

- Continuous Monitoring:

After going live, monitor system performance and user feedback regularly to identify areas for improvement.

Maintain way of regulatory updates to ensure ongoing adherence.

- Establish a Training and Support Framework

Transitioning to e-invoicing involves a learning curve for employees, particularly those in finance, IT, and operations. Comprehensive training ensures that your team can adapt to the new system effectively.

- Provide Role-Specific Training:

Tailor training sessions to address the specific needs of each department, such as invoice creation for finance teams or troubleshooting for IT staff.

Use hands-on workshops, video tutorials, and user guides to make learning engaging and practical.

- Set Up a Support System:

Create an internal help desk or appoint a go-to person to address employee queries during the initial stages of implementation.

Work with your vendor to provide additional support and updates as needed.

- Document the Entire Process

A well-documented implementation process is a valuable reference for current and future needs.

- Create a Transition Plan:

Outline each step of the implementation process, from vendor selection to post-launch monitoring, with clear timelines and responsibilities.

- Maintain Records:

Keep detailed records of compliance checks, testing results, and system configurations for audit purposes.

Document best practices and lessons learned to streamline future updates or expansions.

- Develop a Knowledge Base:

Compile guides, FAQs, and troubleshooting tips into a centralized repository for easy access by employees.

GSTHero: Simplifying E-Invoicing for Malaysian Businesses

GSTHero's e-invoicing Malaysia solution is designed to help businesses transition while ensuring compliance with LHDN and Peppol standards. Here's how GSTHero supports your compliance journey:

- Customizable API Integration: Easily integrates with leading ERP systems like SAP, Oracle, and Netsuite.

- Real-Time Validation: Ensures invoices meet e-invoice LHDN requirements before submission.

- Advanced Automation: Minimizes manual errors and streamlines invoicing workflows.

- Global Trust: Trusted by over 10,000 businesses worldwide for compliance and efficiency.

- Proactive Support: Expert guidance tailored to meet evolving compliance needs under the e-invoicing Malaysia budget 2023.

Conclusion

Onboarding an e-invoicing Malaysia solution at least two months before the E-Invoice mandate is a strategic move to safeguard your business. Businesses can avoid penalties and operational risks by addressing integration challenges, training teams, and ensuring compliance with IRBM Malaysia while setting the stage for efficiency and transparency. Don’t wait—start your transition to e-invoicing Malaysia LHDN compliance today!

FAQs on E-Invoicing in Malaysia

The benefits of e-invoicing Malaysia include real-time reporting to LHDN, enhanced compliance with tax regulations, reduced errors in invoicing, and streamlined audits. Additionally, adopting e-invoice LHDN facilitates transparency, curbs fraud, and improves overall operational efficiency for businesses.

The e-invoicing Malaysia rollout allows businesses a phased grace period based on turnover thresholds. This timeline, outlined in the Malaysia e-invoicing 2024 framework, ensures firms have sufficient time to comply with IRBM Malaysia requirements and adapt their systems.

The threshold for e-invoice LHDN compliance in Malaysia depends on annual business turnover. Businesses exceeding these thresholds must adopt the Malaysia e-invoice format as mandated under the e-invoicing Malaysia budget 2023.

E-invoicing Malaysia offers improved accuracy, faster processing, reduced fraud, and real-time tax reporting to authorities like IRBM Malaysia. It also minimizes manual intervention, enabling businesses to save time and resources.

Efficient invoicing enhances cash flow, improves client relationships, and ensures accurate records for audits. In Malaysia, adhering to the Malaysia e-invoice format ensures compliance with LHDN requirements while streamlining operations.

The adoption of e-invoice LHDN impacts businesses by increasing transparency, reducing errors, and ensuring real-time tax compliance. It also enhances workflow efficiency and reduces the risk of non-compliance penalties under the Malaysia e-invoicing 2024 mandate.

E-billing integrates digital invoicing to ensure faster payment cycles, reduced errors, and compliance with standards like e-invoicing Malaysia LHDN. It also supports automation, improving operational efficiency.

Individuals operating as freelancers or small business owners can issue invoices in Malaysia, provided they adhere to the prescribed Malaysia e-invoice format and ensure compliance with IRBM Malaysia regulations.

Under the e-invoicing Malaysia budget 2023, specific exemptions apply to businesses with an annual turnover below the threshold limit for e-invoice in Malaysia, currently set at RM500,000. As outlined by IRBM Malaysia, these businesses are not required to comply with Malaysia's e-invoicing mandate.

The e-invoicing Malaysia rule mandates businesses to generate, validate, and transmit invoices electronically using a government-approved platform like e-invoices LHDN, ensuring adherence to LHDN standards.

The E-invoicing Malaysia mandate requires businesses to comply with LHDN regulations, using standardized e-invoice formats and real-time validation through the MyInvois Portal. It improves tax compliance, reduces fraud, and enhances transparency. Businesses must upgrade their systems for e-invoice integration, ensure timely compliance, and may face penalties for non-compliance. Long-term benefits include cost savings, faster payments, and better cash flow management