E-Invoicing Solutions in malaysia are driving a significant transformation in Malaysia's retail sector. Driven by LHDN e invoice regulations and the mandated e-invoice Malaysia framework, businesses are rapidly transitioning from traditional, manual invoicing to digital systems. This shift aims to enhance accuracy, speed, and compliance in financial transactions.

As businesses prepare for the phased implementation of e-invoicing, selecting the right digital invoicing solutions is crucial for success. Beyond mere compliance, this transition offers the opportunity to build a seamless, efficient, and error-free financial process.

By embracing these solutions, businesses can streamline operations, strengthen tax compliance, and improve cash flow. However, this transition presents potential obstacles. To fully realize the benefits, businesses must address these challenges effectively. Let’s explore the core concepts of e-invoicing, the obstacles businesses might face, and the solutions to ensure a smooth implementation.

Is E-Invoicing a Game-Changer for Retail Businesses?

E-invoicing eliminates paper-based methods using digital systems to generate, send, and store invoices. This process ensures faster, error-free transactions and offers significant advantages for retailers, such as:

Better Tax Compliance: Ensures seamless integration with Malaysia's Sales and Service Tax (SST).

Increased Efficiency: Automation reduces manual effort, reducing errors and overhead costs.

Optimized Cash Flow: Quicker invoicing and payment processes help retailers better manage their finances.

What are the key developments in the new age of e-invoicing that you should know about?

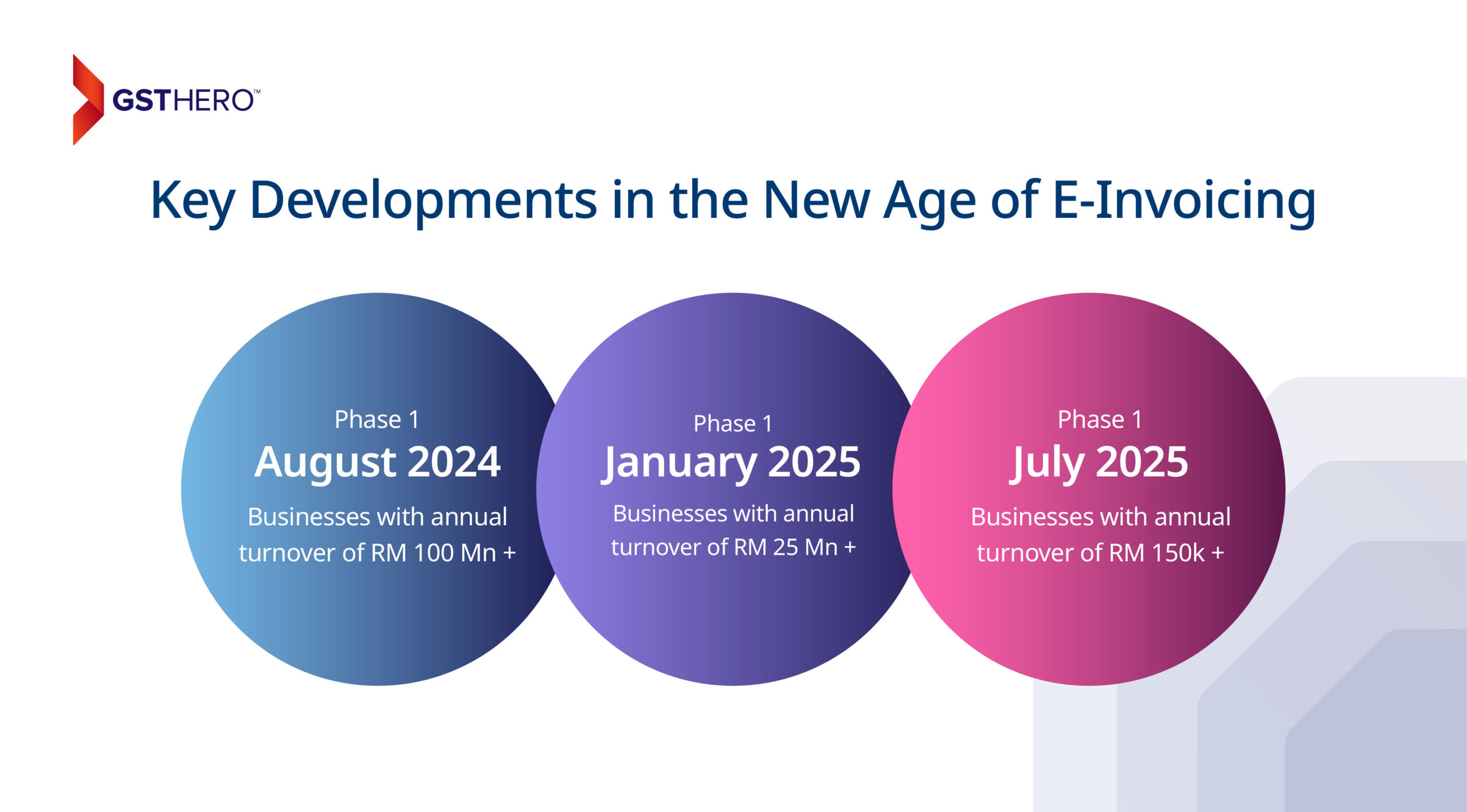

Recent statistics show a remarkable shift toward digital invoicing, with over 7,400 businesses in Malaysia adopting the e-invoicing system, issuing more than 58 million invoices by October 2024. The timeline for full adoption is progressing in stages:

- Phase 1 (August 2024): Large companies with sales exceeding RM100 million are required to implement e-invoicing.

- Phase 2 (January 2025): The e invoice Malaysia implementation date for businesses with annual revenue between RM25 million and RM100 million is set for January 2025.

- Full Implementation (July 2025): E-invoicing will be mandatory for all businesses, including SMEs.

What Challenges Do Retailers in Malaysia Face with E-Invoicing?

Despite the benefits, implementing e-invoicing can present several challenges. Here's what businesses may encounter:

High Initial Costs: The upfront expense for software, system integration, and employee training can be a barrier, especially for smaller businesses.

Cultural Resistance: Employees familiar with manual processes might resist transitioning to digital tools. So it can slow down the implementation.

Security Risks: As financial data is stored and transmitted electronically, ensuring robust security protocols is crucial to avoid data breaches.

Integration Issues: Retailers with legacy systems may struggle to integrate e-invoicing seamlessly with their existing platforms.

How Can Retailers in Malaysia Navigate the Challenges of E-Invoicing and Succeed?

To make e-invoicing a success, retailers must address these hurdles with targeted solutions:

Managing Implementation Costs: Consider cloud-based solutions with flexible pricing models that reduce upfront costs and allow scalability as your business grows.

Facilitating Employee Adoption: Invest in training programs demonstrating the value of e-invoicing. Encourage staff to see the new system's benefits and provide ongoing support.

Strengthening Data Security: Ensure that your e-invoicing platform follows industry best practices for cybersecurity. Regular security audits and encryption can safeguard your financial data.

Smooth System Integration: Select software compatible with existing systems, such as POS, inventory, and accounting tools. Collaboration with experienced vendors can ease integration.

What Key Insights Can Retailers in Malaysia Use to Excel with E-Invoicing?

Success with e-invoicing requires careful planning and the right tools. Retailers should:

Stay Compliant: Keep up to date with the latest regulations from the Inland Revenue Board of Malaysia (IRB), such as Version 3.1 of the e-Invoice Guidelines released in July 2024.

Select the Right Software: Look for e-invoicing systems that seamlessly integrate your POS, inventory, and accounting systems.

How E-Invoicing Enhances Customer Experience in Retail

E-invoicing not only streamlines internal operations but also significantly enhances the customer experience. Retailers increasingly recognize that a smooth, digital transaction process can improve operational efficiency and customer satisfaction.

- Faster Transactions: E-invoices eliminate delays by speeding up invoicing, allowing customers to receive receipts and invoices instantly. This efficiency results in quicker transactions, improving the overall shopping experience for customers.

- Transparency and Accuracy: Digital e-invoices provide customers with clear, accurate records of their purchases, enhancing trust. Gone are the days of lost receipts or missing details—everything is easily accessible, securely stored and available at a customer's fingertips.

- Sustainability: Consumers today are increasingly conscious of sustainability. By adopting e-invoices, retailers can significantly reduce paper usage, aligning with eco-friendly trends and improving their brand image as a sustainable business.

Providing a seamless, modern customer experience in a competitive retail environment can help build stronger customer loyalty and attract more buyers. E-invoices help achieve this by enabling smoother transactions, fostering trust, and offering greater transparency.

How Does E-Invoicing Play a Role in Enabling Data-Driven Decisions for Retailers in Malaysia?

One of the most potent advantages of e-invoicing is its ability to provide valuable data that can guide business decisions. By moving to a digital platform, retailers can access real-time insights beyond just processing invoices.

- Real-Time Financial Reporting: With e-invoicing systems, retailers can generate instant reports on sales, expenses, and tax liabilities. So, it will allow for better cash flow management and provide a clearer picture of the business's financial health.

- Trend Analysis: By analyzing invoicing data, retailers can track purchasing trends, customer preferences, and peak shopping periods, which can inform inventory decisions, marketing strategies, and even promotions.

- Forecasting and Budgeting: With a consistent stream of data from digital invoices, businesses can use this information to forecast demand more accurately, optimize stock levels, and improve budgeting.

- Tax Optimization: Leveraging E-Invoicing Solutions that utilize a standardized e-invoice format minimizes data entry errors and ensures accurate reporting. This is critical for retailers aiming to maintain full compliance with e-invoice Malaysia tax regulations and optimize their tax reporting processes.

Why E-Invoicing is the Future for Retailers in Malaysia

E-invoicing isn't just a regulatory requirement—it's a powerful tool that offers efficiency, accuracy, and greater control over your finances. By embracing it, retailers can:

Streamline Operations: Automating invoicing reduces administrative burden, allowing your team to focus on value-added tasks.

Achieve Real-Time Insights: Access instant reporting and insights that help you make informed decisions, improving operational and financial outcomes.

Ensure Tax Compliance: Effortlessly comply with the latest SST regulations, avoiding costly penalties.

How Is GSTHero Enhancing E-Invoicing for Retailers in Malaysia?

GSTHero is a powerful e-invoicing solution that simplifies compliance, enhances efficiency, and optimizes businesses' financial operations. Automating invoicing processes and ensuring real-time regulatory compliance helps retailers transition smoothly into Malaysia's digital tax framework.

Seamless System Integration – Works effortlessly with existing ERP, POS, and accounting platforms, ensuring a hassle-free adoption process without significant disruptions.

Regulatory Compliance Made Easy – Adapts to Malaysia's e-invoicing guidelines, ensuring businesses stay compliant with minimal manual effort.

Scalable Invoice Processing – Handles bulk invoice generation, validation, and submission, allowing businesses to manage high transaction volumes efficiently.

Data Security & Confidentiality – Implements robust encryption protocols and continuous monitoring to protect financial data from breaches and cyber threats.

Comprehensive Financial Insights – Offers real-time analytics and reporting tools, empowering retailers with data-driven decision-making for better cash flow and tax management.

Conclusion

As Malaysia continues its digital journey, adopting e-invoicing will be essential for retailers who want to stay competitive. While the transition may present challenges, the long-term benefits of improved efficiency, better cash flow management, and seamless compliance are invaluable.

Retailers who take proactive steps to overcome these obstacles will comply with new regulations and future-proof their businesses for success in an increasingly digital economy. By selecting the right software, investing in employee training, and staying informed about regulatory updates, companies can fully leverage the power of e-invoicing.

FAQ On Retail Industry E-Invoicing Implementation in Malaysia

Yes, e-invoicing will become mandatory by July 2025. The transition will occur in phases, requiring larger businesses to comply first. All businesses, including SMEs, must adopt e-invoicing by the full implementation deadline.

Businesses must adhere to the standardized e-invoice format issued by the IRBM. Retailers must integrate their systems with an approved e-invoice service provider Malaysia or utilize e-invoice middleware Malaysia to ensure smooth compliance.

The Malaysian Inland Revenue Board (LHDN) has authorized several e-invoicing vendors. Businesses must choose a solution that integrates with MyInvois and complies with LHDN's requirements. Vendors are carefully vetted to ensure compliance and security.

The timeline is divided into phases:

Phase 1 (August 2024): Large businesses with RM100 million+ in revenue.

Phase 2 (January 2025): Businesses with RM25 million - RM100 million in revenue.

Businesses must submit their details to LHDN and integrate their invoicing systems with the MyInvois platform To register. Approved e-invoicing solutions are required to ensure compliance with tax laws.

Phase 2, starting January 2025, requires businesses with RM25 million to RM100 million in revenue to implement e-invoicing. Companies in this bracket must ensure their systems are ready to comply with the new regulations.

While the government may allow some flexibility, businesses should prepare in advance. A brief grace period may be offered, but delays beyond the set deadlines could result in penalties.

The standard e-invoice format includes key data such as the invoice number, buyer and seller details, tax breakdown, and digital signatures for authentication. These requirements must be met to ensure compliance.

Malaysia's e-invoicing platform, MyInvois, has not fully adopted PEPPOL. However, future integration with global systems like PEPPOL may be considered to facilitate international trade.

Businesses can issue e-invoices through approved e-invoicing platforms. These e-invoices must be validated in real-time with MyInvois before being sent to the buyer for adhering to Malaysian tax regulations.

A self-billed e-invoice is issued by the buyer rather than the seller and is typically used in specific business agreements. This method requires prior approval from LHDN and must adhere to particular invoicing regulations.

Businesses may be exempt based on the e-invoicing Malaysia threshold, particularly smaller businesses or those in specific sectors outlined by LHDN e invoice regulations.