Did you know that businesses in the UAE must provide proper credit notes in UAE issuance to comply with VAT regulations and avoid penalties? Credit notes in UAE, specifically under the developing e-invoicing in UAE regulations, play a crucial role in adjusting VAT amounts when a sale or service invoice is partially or fully canceled.

Business owners should understand how credit notes in the UAE fit into this new environment and what they should include to ensure compliance with mandatory e-invoicing by July 2026. Properly issued credit notes help businesses align with VAT regulations and avoid penalties for non-compliance.

In this guide, we will explore the essentials of tax credit notes in the UAE under VAT regulations, including their purpose and benefits. We will also examine the key information credit notes must contain and the formatting rules required for compliance.

By understanding these elements, businesses can avoid costly penalties and ensure smoother VAT transactions, preparing effectively for the mandatory adoption of e-invoicing.

What Are the Key Challenges in Managing Credit Notes in UAE VAT Under E-Invoicing?

As the UAE progresses toward mandatory e-invoicing by July 2026, businesses must address several challenges, particularly in handling credit notes in UAE VAT within this digital framework:

- System Integration and Compliance: Businesses must upgrade accounting systems to process credit notes in UAE VAT, ensuring alignment with FTA standards and recent VAT amendments.

- Data Accuracy and Real-Time Reporting: Real-time reporting of credit notes in UAE VAT to the FTA requires precise integration with Emirates tax invoice processes to avoid penalties.

- Staff Training and Adaptation: Employees need training to effectively manage credit notes in UAE VAT, especially with new e-invoicing systems and VAT amendments.

- Regulatory Compliance and Updates: Ensuring compliance with VAT amendments and FTA regulations for Emirates tax invoices and credit notes is critical to avoid fines.

- Data Security and Confidentiality: The digital exchange of credit notes in UAE VAT demands robust security measures to protect financial data and ensure compliance.

What is a Credit Note in UAE VAT?

Under the UAE VAT regime, a credit note is a document issued to correct or reduce the amount of VAT on a previously issued tax invoice.

Specific situations where credit notes are used include product returns, pricing errors, discounts applied after the original sale, or service cancellations.

The business must issue a credit note reflecting the adjusted amount when the amount of a taxable supply is reduced or corrected. This document acknowledges the VAT reduction to ensure compliance with Federal Tax Authority (FTA) regulations.

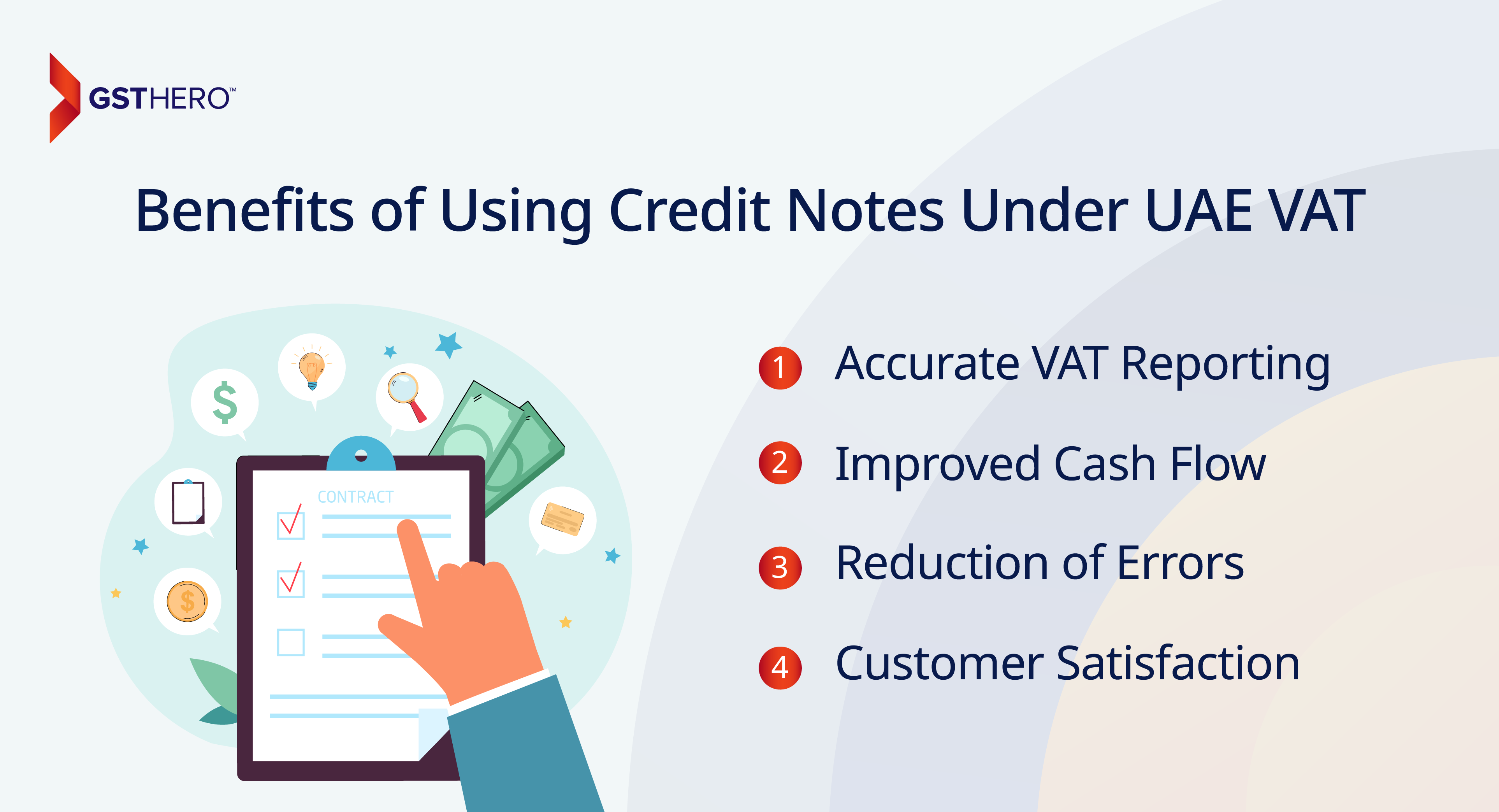

What Are the Benefits of Using Credit Notes Under UAE VAT?

Credit notes provide several key benefits for businesses, particularly in the context of VAT compliance:

- Accurate VAT Reporting: Credit notes ensure businesses only pay VAT on the actual taxable amount. Adjusting invoices when necessary helps maintain accurate VAT records.

- Improved Cash Flow: Issuing a credit note can prevent VAT overpayments, freeing up cash flow that would otherwise be tied up in tax overpayments.

- Reduction of Errors: Credit notes allow businesses to rectify mistakes on original invoices without creating confusion in their financial records.

- Customer Satisfaction: In situations involving product returns or pricing adjustments, credit notes help maintain good relationships by ensuring customers aren't overcharged on VAT.

Details contained in the Tax Credit Note under UAE VAT

The format credit note required under UAE VAT regulations must include key details such as the supplier's and customer's information, the original invoice reference, the reason for issuance, and the adjusted VAT amount.

The tax credit note format should clearly state the label "Tax Credit Note" along with the issue date, supplier's TRN, and customer details where applicable. It must also reference the original invoice and provide an apparent reason for the adjustment to meet the Federal Tax Authority's standards.

A tax credit note must contain specific information, as required by the FTA, to comply with UAE VAT law.

Information | Details |

|---|---|

The label | "Tax Credit Note" clearly states the document's identity. |

Supplier Information | Supplier's name, address, and Tax Registration Number (TRN). |

Customer Information | Customer's name, address, and TRN (if applicable). |

Original Invoice Reference | Original invoice number and date for traceability. |

Reason for Issuance | Reason for the credit note (e.g., return, discount, pricing error). |

VAT and Net Adjustments | Adjusted VAT amount and net total after correction. |

Date of Issue | Date the credit note is issued. |

Authentication | Supplier's signature or digital verification for authenticity. |

How Should Tax Credit Notes Be Delivered?

Credit notes can be issued in physical (written) or electronic form. Many businesses now opt for electronic credit notes to streamline their operations in line with the UAE's push toward digital transformation and paperless transactions.

Electronic Tax Credit Notes

With the introduction of e-invoicing regulations, businesses are encouraged to issue electronic tax credit notes. These notes:

It must be generated using FTA-approved software.

It should be in a format that ensures integrity, such as PDF or XML, making them tamper-proof.

It can be transmitted through secure electronic channels (e.g., email, B2B platforms) to ensure swift and documented delivery.

Electronic tax credit notes also simplify archiving and retrieval for audits, as they are securely stored within digital systems, reducing the risk of loss or misplacement.

Written Tax Credit Notes

Many businesses are adopting digital solutions; however, some still use physical, written credit notes.

Physical credit notes must meet the exact content requirements of electronic ones.

Delivery of physical credit notes should be done through appropriate channels, such as physical mail or in-person handover.

Transitioning to electronic formats is strongly encouraged, especially with mandatory e-invoicing set for 2026.

How Credit Notes Fit into UAE E-Invoicing

As the UAE prepares for mandatory e-invoicing, credit notes must align with the new e-invoicing requirements. The Federal Tax Authority (FTA) has mandated that all taxable transactions, including credit notes, be reported in real-time via the e-invoicing platform by 2026. his means that:

Credit notes must be generated, validated, and stored electronically in real time to ensure accuracy and compliance.

VAT amounts adjusted through credit notes will be updated within the same VAT return period, and VAT liabilities will be immediately corrected.

Issuing and submitting credit notes will be fully automated, reducing the administrative burden on businesses.

How Are Credit Notes Practically Applied Under VAT?

In business operations, credit notes correct errors in VAT invoices or adjust for transaction changes. For example, they reduce VAT and taxable amounts when customers return defective products or cancel services, ensuring accurate VAT liability and avoiding overpayment.

Credit notes are also used for post-sale discounts or pricing error corrections. Prompt issuance helps maintain accurate VAT records, preventing overpayments and fostering customer trust.

With mandatory e-invoicing by 2026, businesses must issue credit notes promptly through FTA-approved systems to ensure compliance and avoid penalties under the new regulations

What Are the Best Practices for Managing Credit Notes?

Businesses should adopt the following best practices when managing credit notes to ensure compliance and avoid penalties.

Use FTA-approved software to generate and issue tax credit notes to ensure they meet the regulatory requirements.

Train employees in accounting and VAT compliance to issue credit notes correctly and ensure timely submission to the FTA.

Keep digital records of all issued credit notes for audit purposes, ensuring they are easily retrievable.

Review and audit VAT returns regularly to ensure that all credit notes are accurately reflected in the VAT records.

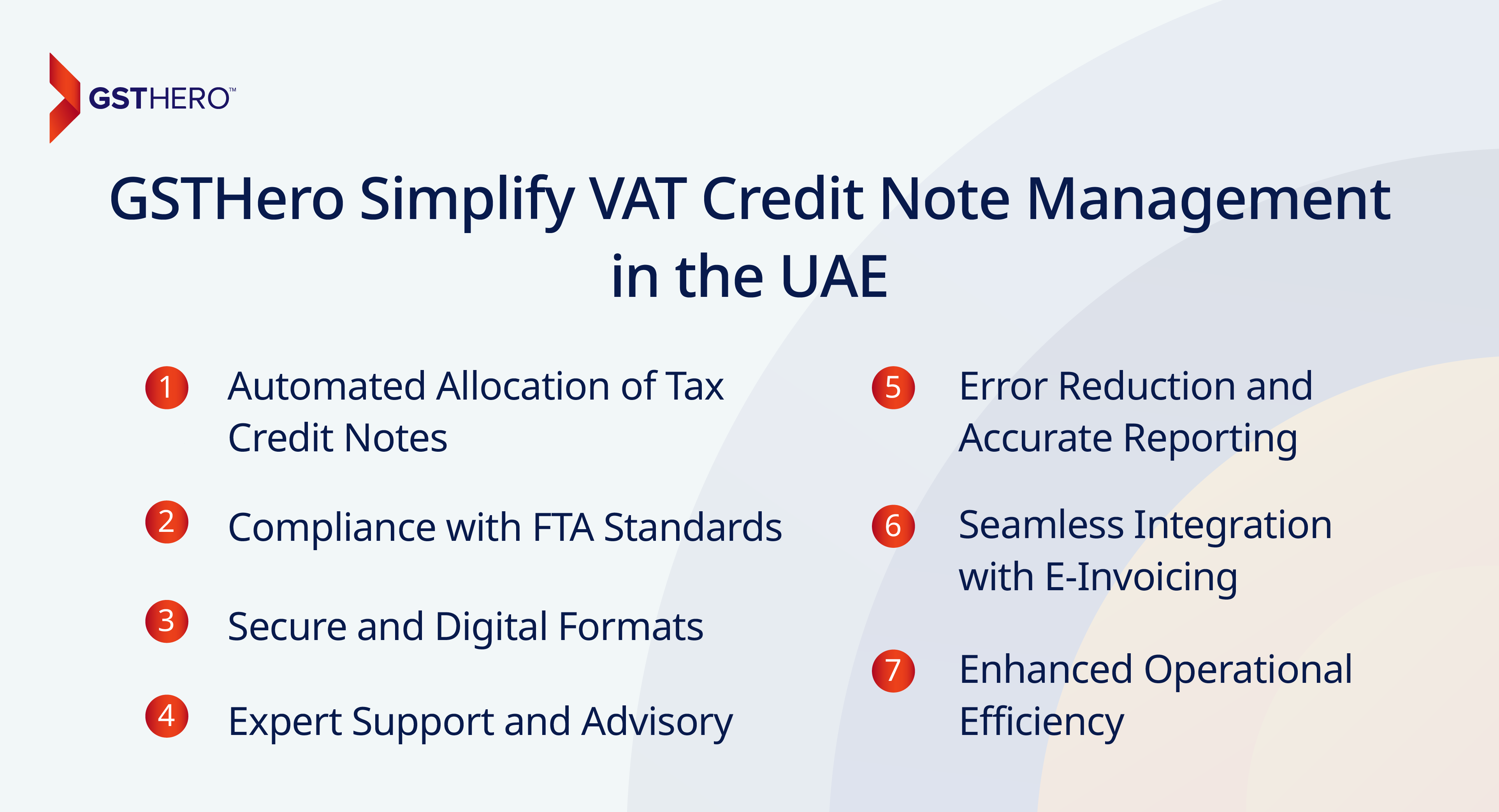

How Can GSTHero Simplify VAT Credit Note Management in the UAE?

GSTHero simplifies the management of tax credit notes under UAE VAT regulations, providing businesses with a reliable and compliant solution. Our platform is designed to automate processes, ensuring accuracy, efficiency, and seamless integration with FTA requirements. Here's how GSTHero can help:

- Automated Allocation of Tax Credit Notes

GSTHero automates the generation of tax credit notes, ensuring they include all mandatory details such as supplier and customer information, VAT adjustments, and invoice references. - Compliance with FTA Standards

Our solution is fully FTA-approved, ensuring all credit notes adhere to UAE VAT regulations, including real-time validation and reporting requirements. - Secure and Digital Formats

GSTHero supports secure electronic formats like PDF and XML, making credit notes tamper-proof and easy to share and archive, aligning with the UAE's digital transformation goals. - Error Reduction and Accurate Reporting

By automating calculations and validations, GSTHero minimizes manual errors and ensures accurate VAT reporting, helping businesses avoid costly penalties. - Seamless Integration with E-Invoicing

GSTHero integrates with existing accounting and ERP systems, ensuring businesses can efficiently transition to mandatory e-invoicing by 2026 without disruption. - Enhanced Operational Efficiency

With automated workflows and secure data storage, GSTHero reduces the administrative burden on businesses, improving overall operational efficiency. - Expert Support and Advisory

Our team of VAT compliance experts provides ongoing support and advisory, ensuring businesses stay updated with regulatory changes and fully compliant with VAT amendments.

Conclusion

As businesses in the UAE prepare for full e-invoicing compliance by July 2026, it's essential to understand the critical role of credit notes in VAT transactions. Issuing and managing credit notes correctly helps businesses stay compliant and optimizes their VAT reporting process. By using FTA-approved software and staying updated on regulatory changes, companies can ensure they avoid penalties while benefiting from accurate VAT adjustments.

Implementing best practices around credit notes will safeguard businesses from fines and improve overall operational efficiency as the UAE transitions into a fully digital VAT compliance system.

FAQs on Credit Notes in UAE E-Invoicing

A tax credit note decreases the VAT amount on a formerly issued invoice. It is usually given for cancellations, product returns, or pricing errors, providing the taxable amount reflects the actual transaction.

A tax credit note must include essential details such as the supplier's and customer's names, addresses, TRNs, the reason for issuance, VAT adjustments, and references to the original invoice for traceability. Including these ensures adherence to FTA requirements and avoids penalties.

Yes, businesses are encouraged to issue electronic credit notes using FTA-approved software, which ensures compliance with VAT regulations and streamlines the process. Electronic issuance also supports the UAE's digital transformation goals.

A credit note should be issued when an adjustment is required on a previous invoice due to returns, price changes, or other corrections that affect the taxable amount. Prompt issuance ensures VAT liability is accurately reported

Under e-invoicing, credit notes must be reported and validated electronically in real-time through the FTA system, ensuring accurate and compliant VAT adjustments. As a result, it reduces the likelihood of manual errors and enhances the overall efficiency of VAT reporting processes.

Issuing incorrect or incomplete credit notes can result in fines ranging from AED 1,000 to AED 10,000, depending on the nature and severity of the error. Adhering to FTA guidelines minimizes the risk of such penalties.

Credit notes adjust the taxable amount and VAT payable. These adjustments must be accurately reflected in the VAT return for the same tax period. Properly issued credit notes also prevent discrepancies in tax records.

Electronic credit notes such as PDF or XML must be issued securely to ensure data integrity and compliance with FTA standards. This format ensures tamper-proof records that are easily auditable.

A tax credit note in the UAE is a document issued by a supplier to adjust or reduce the VAT amount on a previously issued tax invoice. It is typically used in product returns, pricing errors, discounts applied after the original sale, or service cancellations.

A tax credit note under VAT in UAE is a mandatory document required by the Federal Tax Authority (FTA) to reflect adjustments in VAT liability. It ensures that corrections to taxable amounts on original invoices are accurately reported and compliant with VAT regulations.