File GSTR 9 & 9C

Before 30 November to Avoid Penalties

Last Chance to File GSTR 9 & 9C Automatically

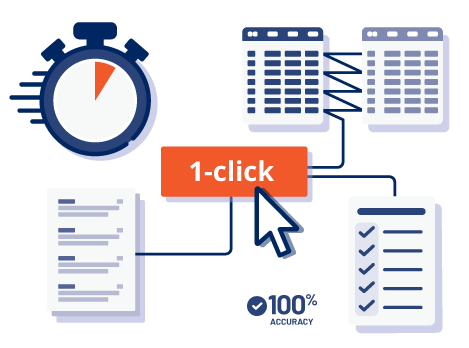

100% accuracy and compliance

- 1 Click Auto Fetch Data in GSTR-9

- 1 click download of GSTR 1, 2A, and 3B data

- Auto bifurcation of purchase Records

- Monthly and Multi Month wise Supporting Reports

- Save Your Time in Data Preparation

- Accurate Data Population

- Dedicated support (chat, email, phone)

Prepare and File GSTR-9C With Free GSTHero Plugin

- No More Errors with Free Tally Plugin

- Smart Ledger Mapping

- Tally Plugin Setup in 5 Minutes

- Verify & Edit Auto Populated Data

- Dedicated support for CA's

- 100% accuracy and compliance

Avoid Late Fee and Penalties for GSTR-9 Return Filings

- Download all GSTR-1, GSTR-2A and GSTR-3B data for all months in a single click

- 1 click download supplies and amendments report

- 1 click download of GSTR-1 vs GSTR-2A reports

- 1 click download of GSTR-3B vs GSTR-2A reports

- Auto Reconciliation with 50+ validations

- Quickly know which of your suppliers have not filed GSTR-1

- Integrates with your ERP's - Tally, SAP and Other's

- Claim up-to 100% Input Tax Credit

- Able to handle huge data without any errors

All GSTHero Reports for Your GST Compliance

- GSTR-2A vs GSTR-3B

- GSTR-1 vs GSTR-3B

- GSTR-1 Annual Reconciliation

- GSTR-2A reconciliation

- Supplies and Amendments reports

- GSTR-1 Month wise & Multimonth wise

- GSTR-2A Month wise & Multimonth wise

- GSTR-3B Month wise & Multimonth wise

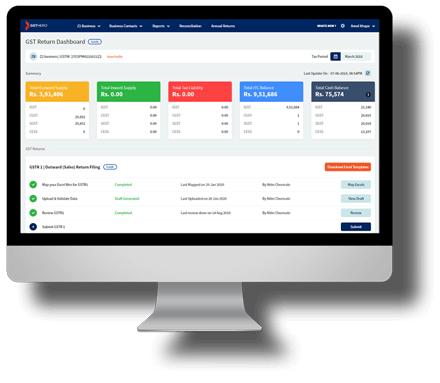

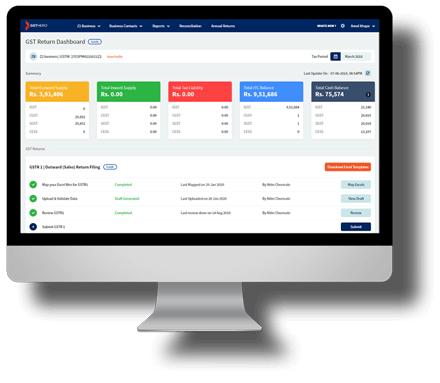

About GSTHero®

GST Hero®, launched in 2017 by Perennial Systems (part of Bafna Group - a $100million enterprise). GST Hero® offers a complete eco-system of compliance solutions for global market. With over 200 employees, it supports more than 10,000 businesses, processes around 135 million E-Invoices annually. Certified by ISO 27001 and affiliated with GSTN, GSTHero® provides efficient services in BFSI and Indirect Tax Automation, focusing on simplifying tax compliance for its users.

Our Accreditations

Legal

Contact Us

Follow Us

© Copyright @2025 of GST Hero®. All rights reserved.

GSTHero | Making Life Simple!

GSTHero is a best GST filing software and E-Way Bill Generation Software in India. GSTHero is a government authorized GST Suvidha Provider. We provide GST Compliance, E-Invoicing Integrated Solution and E-Way Bill Automation for both Businesses and Tax Practitioners.

Address: Perennial Systems , Office#1, Mahavir Park Complex, 5th Floor, Pune-Satara Road, Pune, MH 411 037.

Email:info@gsthero.com

Phone: +918007700800

Kindly subscribe for our latest news & articles

© GSTHero.com | 2017 - 2020 | GSTHero is a trademark and copyright of Perennial Systems Inc.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.