In the last article on GSTR 9 we'd explained "what is GSTR 9, applicability, late fees and requirements". In this blog we will see how GSTR 9 is organised in total 6 parts and each part having various tables.

Having doubts about GSTR-9 ? Watch our video now

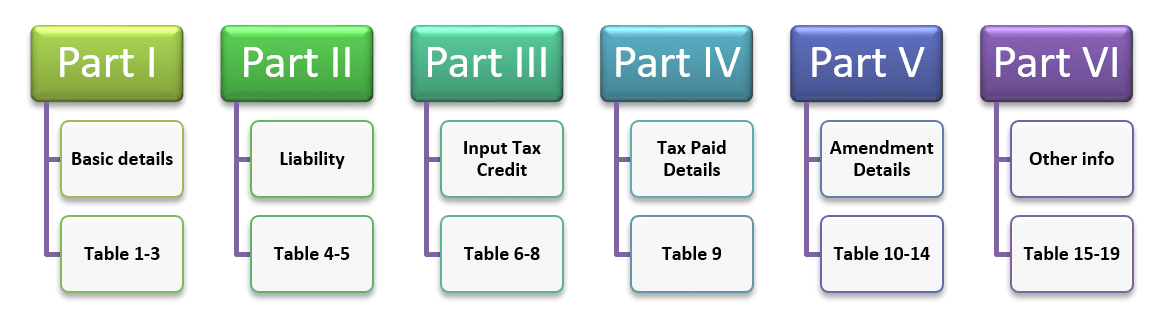

GSTR 9 consists of 6 parts and 19 tables as summarised below:

Part I: Basic details

Part I seeks to capture the basic details of the registered person which is important for disclosure requirements. Part 1 is split into 4 clauses as follows:

Financial Year:

Financial year is the period for which the return is to be filed. It generally means period commencing from 1st April and ending on 31st March. However, for FY 17-18, financial year shall mean the period commencing on 1st July 2017 (date on which GST came into force) and ending on 31st March 2018.

You May Be Also Interested in Reading This Post:

GSTIN:

GSTIN means the “Goods and Services tax Payer Identification Number” of the Registered Person. The same shall be auto updated by GSTN

3A and 3B. Legal name and Trade name: Legal name means as recognised by statute whereas trade name is a name used by industry to identify their business signifying their reputation. Common errors like mismatch of legal name as per legal documents and as per GST registration certificate or non-disclosure of trade name on registration certificate may be noticed. Such errors can be rectified through amendment of core registration fields available on GSTN portal.

This part consists of details of outward supplies and advances received during the financial year for which annual return is to be filed.

This part consists of details of all input tax credit availed, reversed, available as per GSTR 2A, ITC lapsed in the financial year for which annual return is filed.

You May Be Also Interested in Reading This Post:

It includes details of actual tax paid during the financial year.

This part consists of details of transactions pertaining to the previous financial year but paid and reported in the current financial year

This part requires disclosure of information with respect to demands, refunds, supplies received from composition taxpayers, deemed supply, etc. , HSN wise details.

File your GST returns in minutes, not hours!

Get Live Demo and experience the simplicity by yourself.