Submit all the details to discuss your e-Invoice landscape and how you can go live within 1 day

e-Invoicing is Mandatory for

20 CR+ Turnover Businesses

Is your business e-Invoicing ready from 1st Apr 2022?

e-Invoicing is Mandatory for 20 CR+ Turnover Businesses

Is your business e-Invoicing ready from 1st Apr 2022?

Not having an

e-Invoicing solution in place puts your business at a loss.

Even though it is now mandatory for businesses with turnover above 20 crores, the Government will soon make it compulsory for every business to reduce tax evasion.

Loss of money

Creating and Sending regular invoices takes much time to process and send, causing your business a loss.

Penalty for non compliance

If your furnished invoice data is incorrect and identified as non-compliant in the GST audit, you'll attract a penalty.

Incorrect data entry

Incorrect data due to accounting & clerical mistakes may hamper your GST Filing. It may lead to big compliance troubles.

Authenticity of invoice

Normal invoices are not authenticated by the Government, whereas e-Invoice has IRN and QR code records & thus are Government authenticated.

Integrate GSTHero e-Invoice Plugin

In Your Accounting Software Today

Your business can generate e-Invoice with 100% data security and compliance. GSTHero Smoothly processes large and varied data volumes with 100% GST compliance.

Ready Plugin For Integration

GSTHero is integration-ready with the world's best and most used accounting software enabling you to integrate within a day.

Bulk Generation & Cancellation

Bulk generate & cancel e-Invoices (IRN) without visiting govt portal even once.

8 Years Data Storage Free

Govt. portal stores e-Invoice data for up to 48 hours only. GSTHero stores it for up to 8 years for audits & assessments purposes.

Why GSTHero Is The Best Alternative to Tally Prime?

All your data storage is on cloud and not on local machine. We store your data upto 8 years. It makes you future audit proof.

GSTHero ensures 100% Disaster Recovery. You can use cloud e-Invoice App or from your ERP, or both.

GSTHero e-Invoice module is well connected with e-Way Bill , GSTR Filing and Reconciliation module. No further integration required.

Reconcile your Sales Register with E-invoice data in 1 click to avoid incorrect data reporting to GSTN portal.

Tally plugin that enables Advanced GSTHero E-invoicing with various features, configurations and facilities

Generate e-Invoice with B2C Dynamic QR Code soon will be mandatory for businesses of all size.

Digitally Sign the E-invoices as one of the legal requirements for Invoices in India.

Create a combo package with various other GSTHero products that will inter-operate and create the right ecosystem

Why GSTHero Is The Best Alternative to Govt. e-Invoice Portal?

Government portal for e-Invoice generation stores your data for up-to 48 hours only. Whereas GSTHero can save your date for up-to 8 years.

GSTHero gives you e-Invoice MIS Reports which are not available on government portal. It makes your Auditing data 100% compliant.

GSTHero is a government appointed GST Suvidha Provider. Our e-Invoice generation software/system are up to date as per the latest government changes.

Government portal do not provide facility to reconcile your GSTR-1 and e-Invoice. Whereas with GSTHero you can reconcile GSTR-1 & e-Invoice for internal audit purpose.

Are you looking for e-Invoice API's for Custom In-house ERP?

GSTHero provides enhanced API support as government appointed GST Suvidha Provider

GSTIN Validation

Access GSTIN validation and for more than 50 other required checkpoints

Data Privacy

Provides end-to-end data encryption for 100% secured user environment

API Report & Metering

Real-time report of API usage for GST returns and E-Way Bill

99% API Uptime

Highest up-time and sound API support while accessing API services of GSTHero.

Value Added API's

SMS, email and other notifications to the respective parties involved in the trade through APIs.

Easy ERP Integration

Smooth integration with Tally, Sap, Busy, Marg and other ERPs.

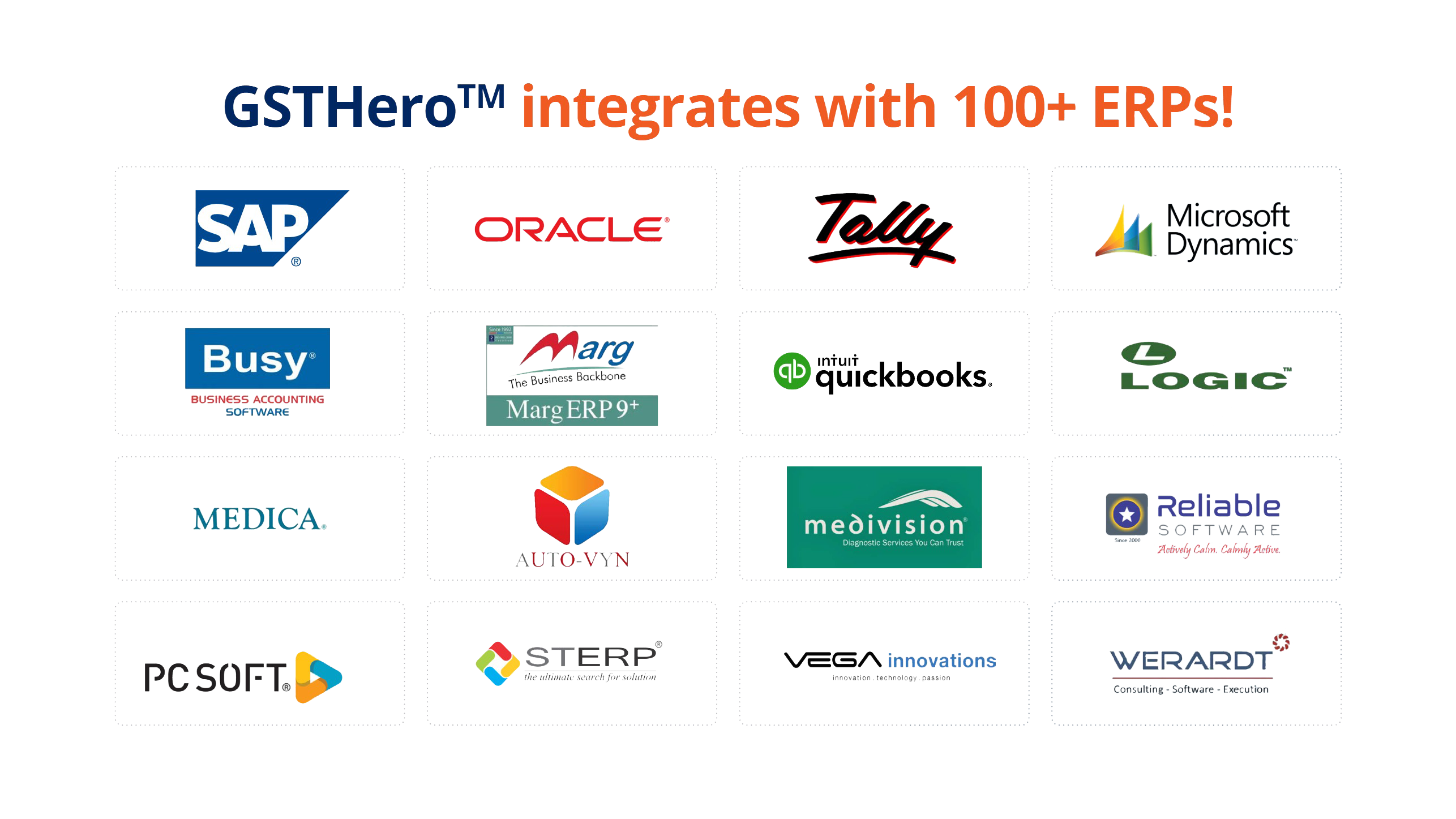

Experience the power of Best e-Invoicing Software for

Tally, SAP, Oracle, Microsoft & 100+ Other ERP's

Get your Tally connector here

Get GSTHero in your Tally system in just

5 minutes, or less.

Get your SAP integration here

Get GSTHero with an easy to setup RPA/ABAP based integration.

Integrate with other ERP's

Get GSTHero with an easy to setup RPA/ABAP integration.

Our Esteemed Customers