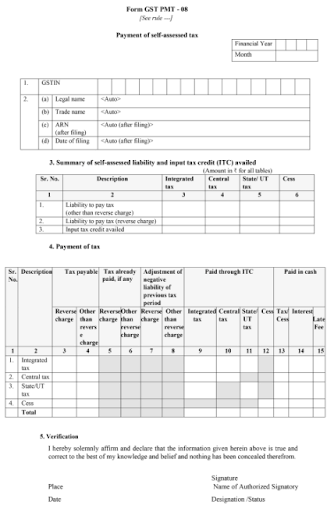

At the 37th GST Council meeting held at Goa on 19th September 2019, GST Council has decided that the New GST Return system will be applicable from 1st April 2020. The new Return system is based on the principle of matching.Input Tax Credit availability will depend on, uploading of said details by Supplier. New Return

October 21, 2019