Amid the changing GST trends & complicated compliance, many Businesses look for a reliable, economic, & effective solution for GST compliance.

Currently, the e-Invoice implementation is in trend & is dated to implement from October 1st 2020 on Large Enterprises.

And businesses are overwhelmed with the e-Invoicing compliance burden & all the changes that they will need to make to the systems & the working of the entire business.

Do you wish you could automate your e-Invoicing, e-Way Bills & GST Compliance with a robust solution that can also handle large volume of invoices seamlessly?

But then there are data security issues with the external solutions, right?

What if there were a perfectly reliable e-Invoicing Software that offers you advanced automation, data security/encryption & more?

Well there is a tool that would be the perfect match for your Accounts Team.

In this article, we have uncovered the working of the best e-Invoicing, GST returns, GSTR-2A reconciliation, & e-Way Bill solution you could ask for.

GSTHero's RPA-SAP Integration is the only 3-in-1 e-Invoicing software you will ever need if you are an SAP user to comply with e-Invoicing, e-Way Bills, & GST Return Filing.

GSTHero provides seamless integration with ERPs like SAP, Tally, Marg, Oracle, Microsoft & other ERPs to make GST compliance simple for you.

e-Invoicing, E-Way Bill Generation & GTS Return Filing with GSTHero

Get Free Bonus Report: Discover how to automate e-Invoicing

The e-Invoicing & GST Compliance Burden that has Business Owners & Tax Departments in Dilemma

GST just completed its three years in our country, is definitely a success & way better than the previous VAT system of taxation.

But what are the views of businesses about GST? Well, it's no secret that one of the most major concerns businesses have is the highly complicated GST compliance.

Businesses still find it difficult to comply with & understand various provisions of the GST Law.

Let's see the case of Mr. Singh who is Business Owner having an annual turnover of more than Rs. 500 Crores & here is how he is currently handling the GST compliance-

- Invoices- The invoices are created & accounted in the billing systems, manually.

- e-Invoicing- Mr. Singh was troubled with the idea of making too many changes to his business to comply with the new provision of e-Invoicing.

But for the sake of compliance & to avoid friction, he has revamped his billing System & ERP to comply with the Schema Format.

Currently, his invoices are created within the ERP in the format > converted into JSON > uploaded on the IRP > The IRP validates the invoice & assigns IRN & QR code > The e-Invoices are then downloaded from the IRP & uploaded on the ERP again for accounting.

Since the IRP has not yet rolled out the bulk generation facility, the same process applies to individual invoices.

- e-Way Bills- Invoices are converted into JSON Files & uploaded on the e-Way Bill Portal to generate e-Way Bills. The e-Way Bill data is then manually accounted back in the Billing system.

- GST Return Filing- Mr. Singh uses the GST offline utility tool to file his GST returns. The invoice data is downloaded from the ERP, but the utility has a defined format of its own & so the data must be manually copy-pasted into the Offline utility Excel.

Errors are also checked & rectified manually, the Utility is then converted to JSON & uploaded to the GST Portal for filing the return.

- ITC or GSTR-2A-Reconciliation- Mr. Singh's accounts team reconciles the data manually by matching individual columns of GSTR-2A with that of the Books of accounts.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Now, there are a few major issues with this process that concerns Mr. Singh-

1. Time Consumption

The entire GST compliance process takes up too much time of his Accounting team. The team has to work dedicatedly days before the due date to meet the deadline efficiently.

2. Requires too many efforts

The process also consumes a lot of effort since there is too much manual work that requires focus & dedicated efforts

3. Lack of accuracy

Despite the efforts & Time investment manual errors are very common, but errors in GST return Filing can affect the business.

4. Hampered Business Growth & productivity

5. Integration

Opting for external solutions like ASPs to ease up the compliance burden can be a solution but the integration is highly complex, requires external licenses & changes to the ERPs & Billing Systems

6. Handling High Volume

Being a large Business, handling the high volume manually, using the utility tool & the external solutions like ASPs, is one of the most difficult task for Mr. Singh’s Accounts Team.

7. Security & Confidentiality

The external solutions do not guarantee the data security & Businesses are well aware of the consequences of data leakage or theft. It can be fatal for the business in multiple ways & cause more than just monetary trouble

8. Monetary Losses

GST compliance is the most important factor to determine the smooth running of a Business, any glitches may result in notices, scrutiny, & penalties

Get Free Bonus Report: Discover how to automate e-Invoicing

e-Invoicing software Solution for e-Invoicing, GST Filing & e-Way Bills for your Business

More than 80% of the businesses are looking for a more cost-effective & precise e-Invoicing software solution for their GST Compliance.

A solution that would do the work efficiently, without burning a hole in the pocket.

Many solutions in the market promise the above but fail to fulfill it, unlike GSTHero.

GSTHero's RPA Integration with SAP & Other ERPS is the most cost-effective solution that will fulfill your GST compliance vows effectively without costing you a fortune & having to make big changes to your ERPs.

GSTHero also provides ready Tally Plug-ins for integration with Tally ERP.

GSTHero RPA integration ensures to reduce your time consumption & work, whilst making you 100% accurately compliant with GST, so you can shift your focus, manpower & capital in the growth of your business.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

The Most Ultimate e-Invoicing Compliance Automation is here!

Unlike the others of the niche, we mean it when we say that we offer complete compliance automation through our solutions, & the live example of that is GSTHero's RPA integration Solution.

RPA or Robotic Process Automation is an advanced AI process, that tends to automate the working of your software (in this case the ERPs). Which is why it is sometimes also called, Software Robotics.

GSTHero's RPA solution integrates with your ERP to enable a 3-in-1 solution on one single dashboard- SAP.

This integration connects your ERP to the Government portals in the most secure yet substantial way, so you can perform the GST compliance activities within your ERP.

GSTHero RPA-SAP integration eliminates the most tedious tasks involved in the compliance process- juggling from the ERP to the Portals & back with the data, and then manually entering them.

With the elimination of these two processes, three most major issues are also nullified- Error count, time consumption, & the unnecessary consumption of efforts.

The Integration of the Robotic Automation Process is the most wholesome & ultimate solution for any business, especially when it all comes cost-effective

Get Free Bonus Report: Discover how to automate e-Invoicing

Everything you must know about Our 3-in-1 e-Invoicing Software: SAP-RPA Integration

Note- GSTHero's RPA integration is possible with SAP & other ERPs as well. Whereas, GSTHero has a ready Tally connector for the Direct Tally Integration.

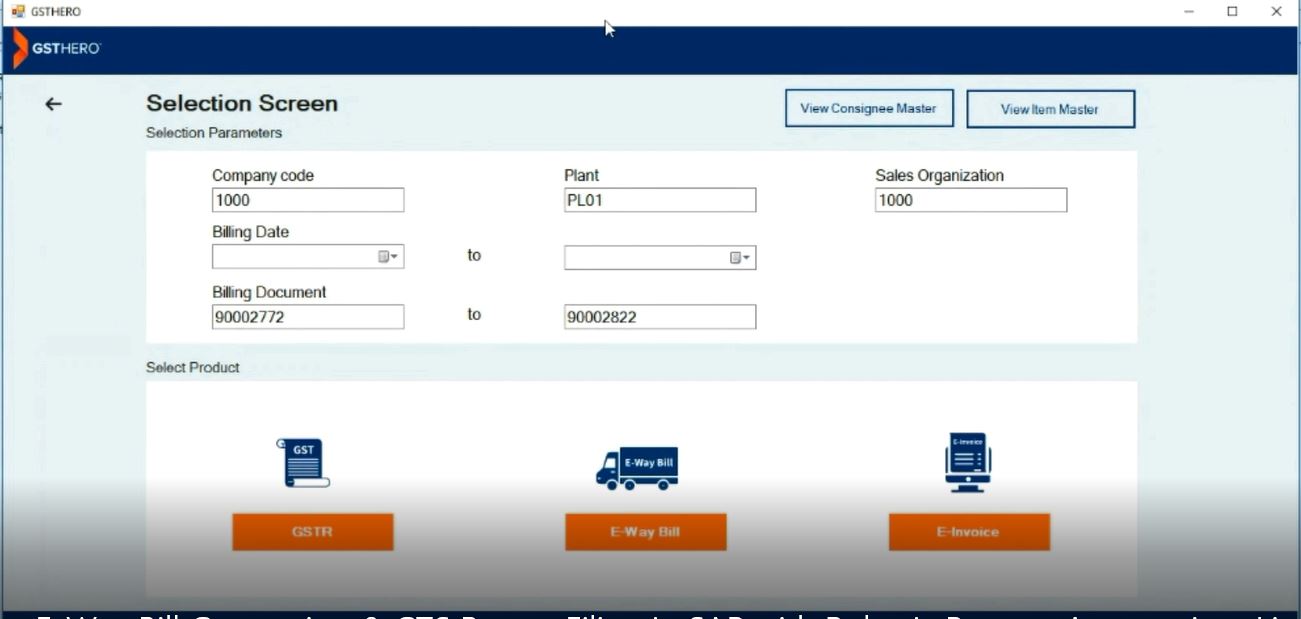

It's called the 3-in-1 Solution because it offers you 3 solutions- e-Invoices, e-Way Bills & GST Return Filing, under the roof of one dashboard that is your ERP.

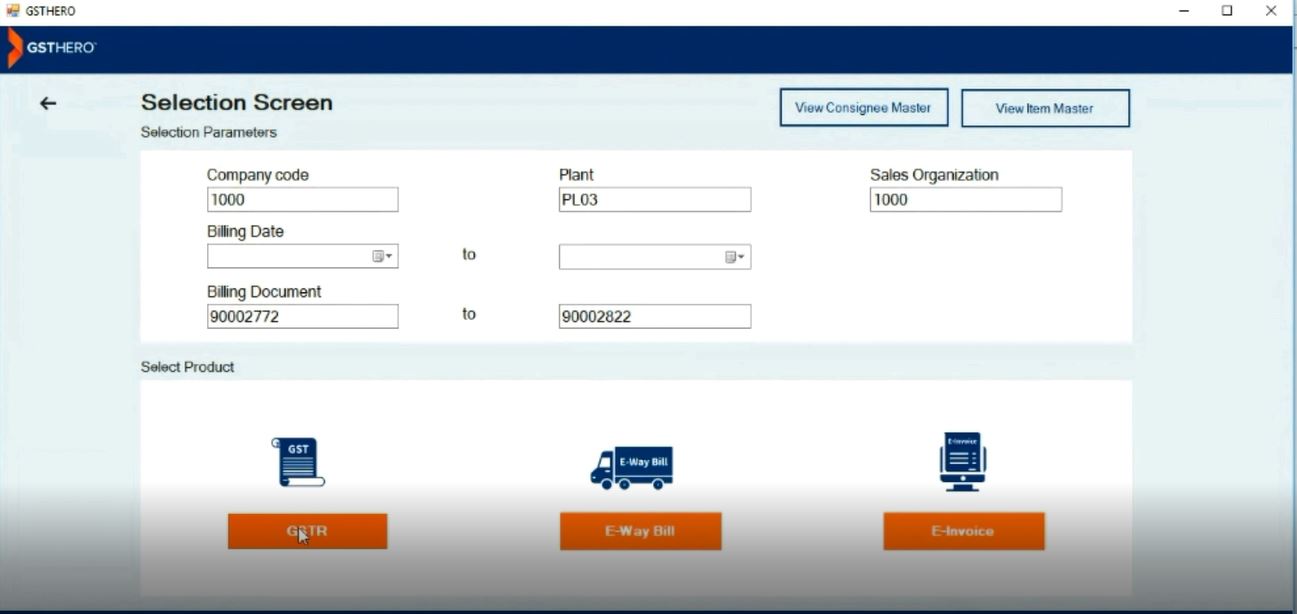

So, upon the RPA-SAP integration, there are three options enabled on your SAP dashboard-

Let us see how the RPA-SAP integration works-

After the integration, you can perform all the GST compliance-related activities, such as-

- Preparing, maintaining & exporting the data for GST filing

- Generating, canceling, consolidating & editing the e-Way Bills

- Generating, canceling, validating & editing the e-Invoices

within the ERP, so you won't have to manually enter the data anywhere.

Now, let us look at each of these solutions in detail, individually

e-Invoice Generation using RPA-SAP integration

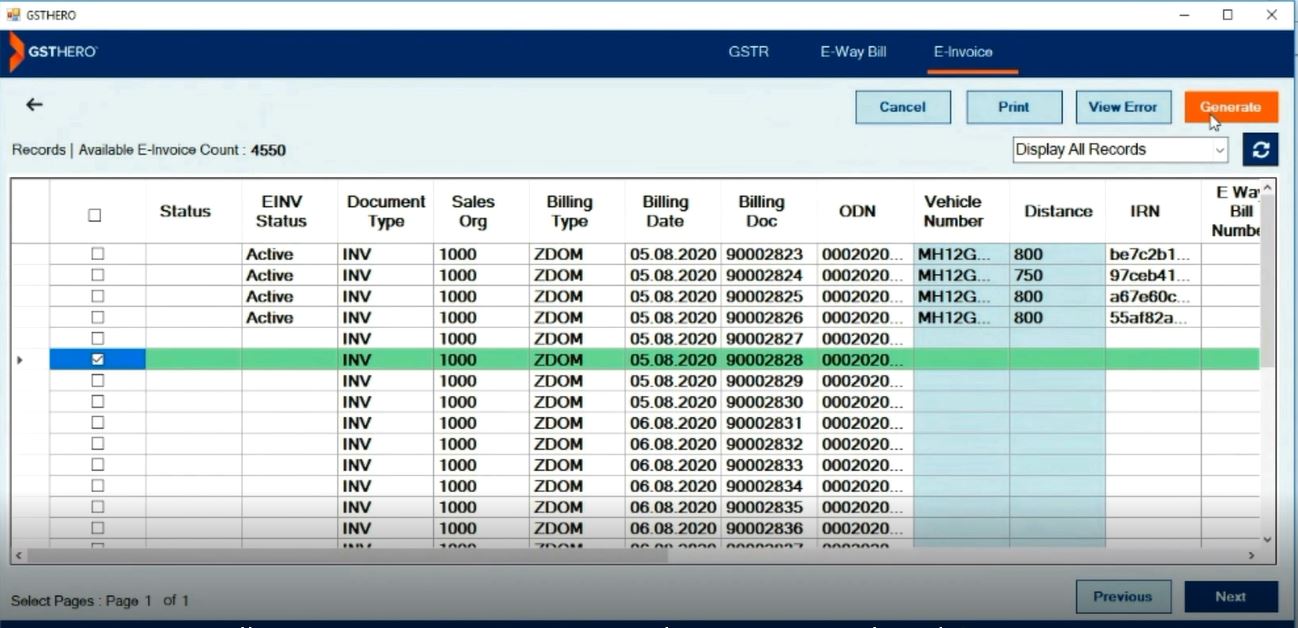

Follow the steps given below to generate an e-Invoice within SAP using the GSTHero e-Invoicing feature given on the SAP dashboard

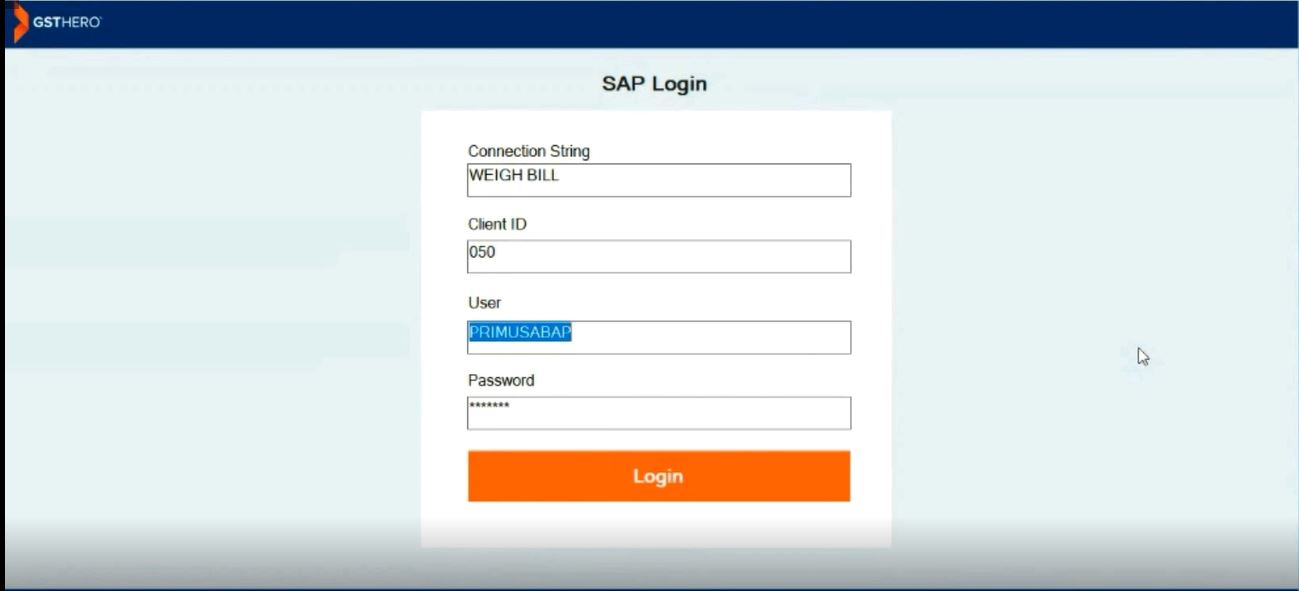

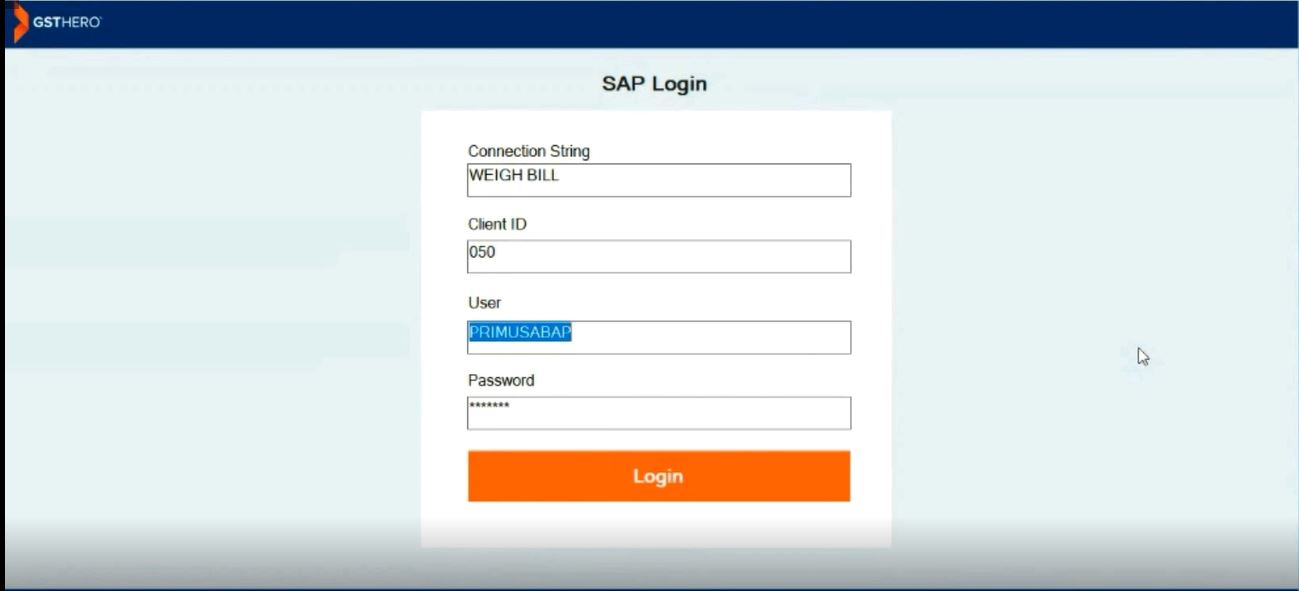

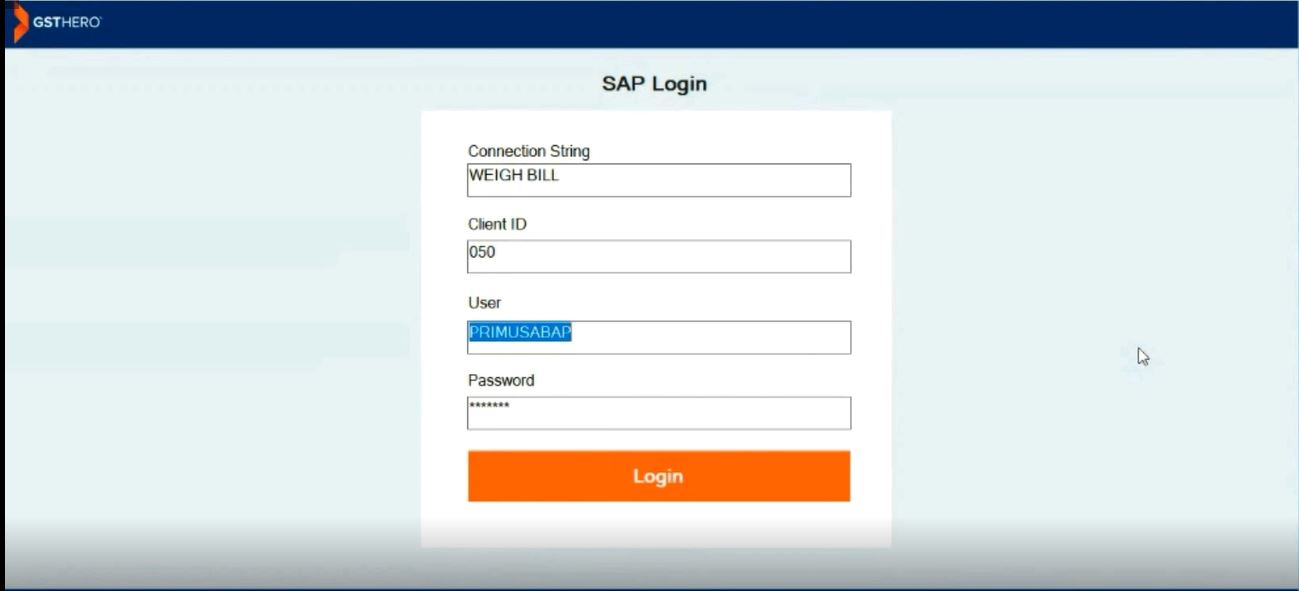

1. Log-in to SAP using your client ID, username and password

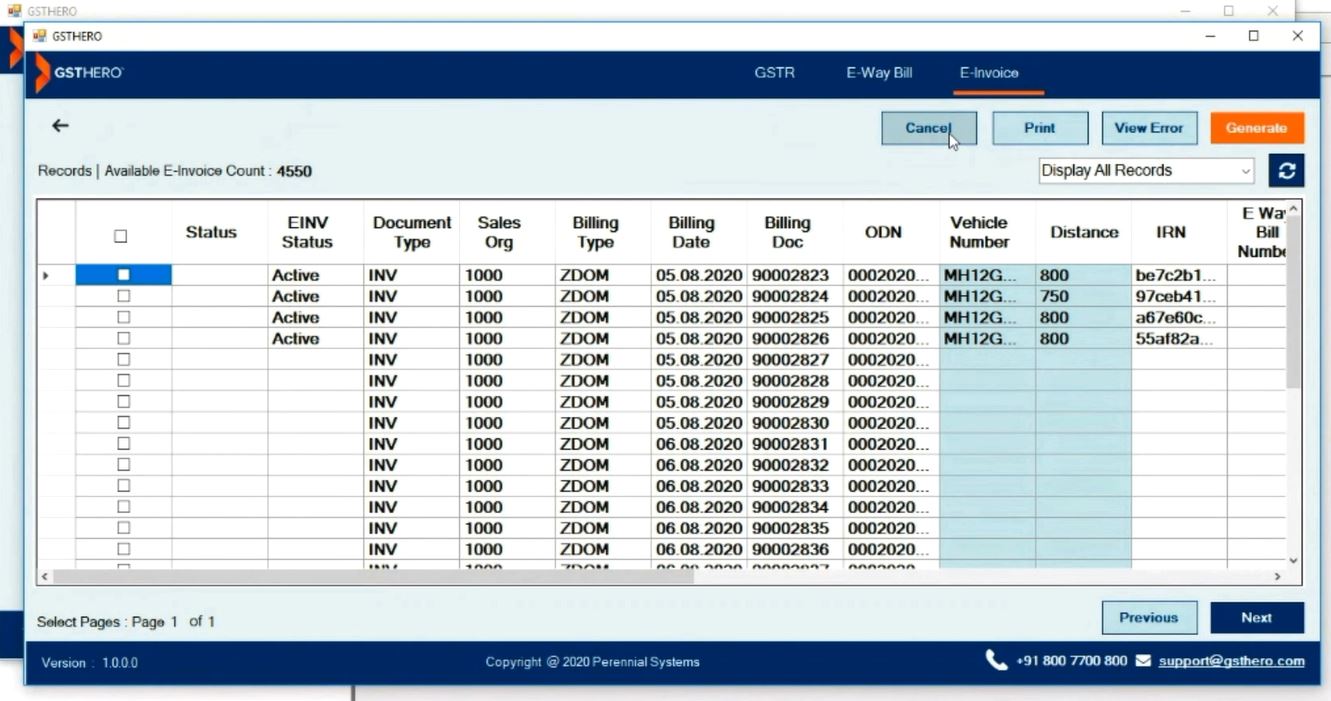

2. Click on the e-Invoice Button on the SAP dashboard & the invoice data fetching will begin

3. Once the fetching is successfully done, various options like generate, cancel, print, and view errors will be enabled

4. Now, to generate an e-invoice, you need to select a particular record & then click on the 'Generate' button

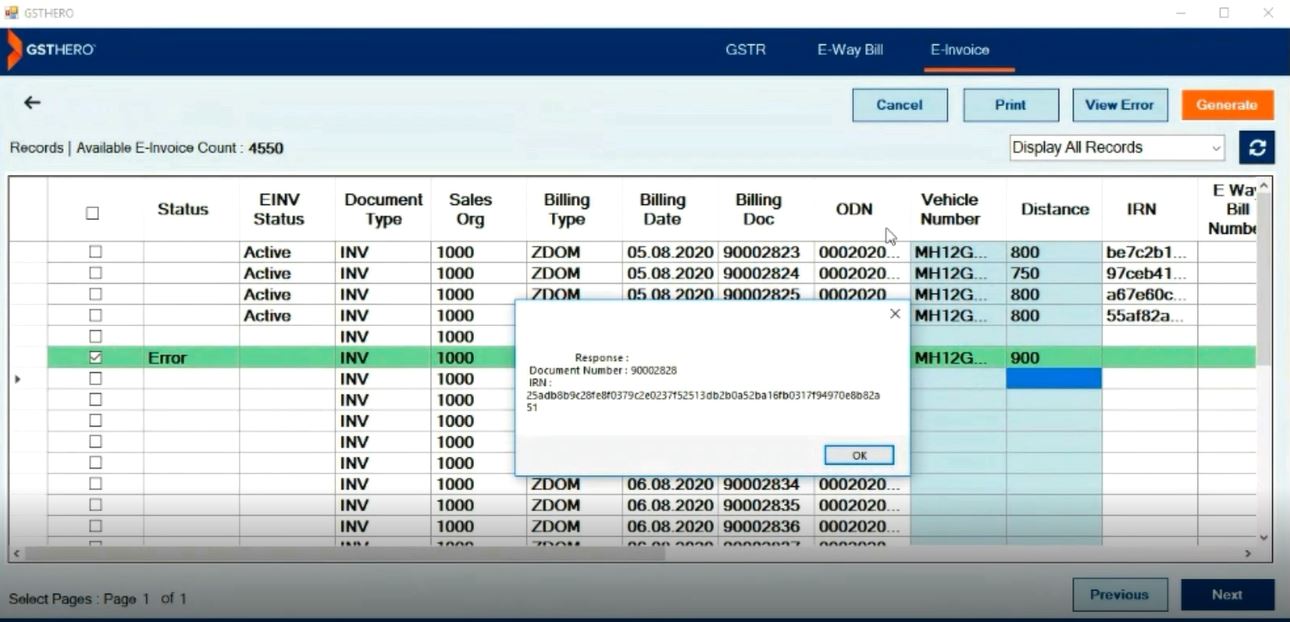

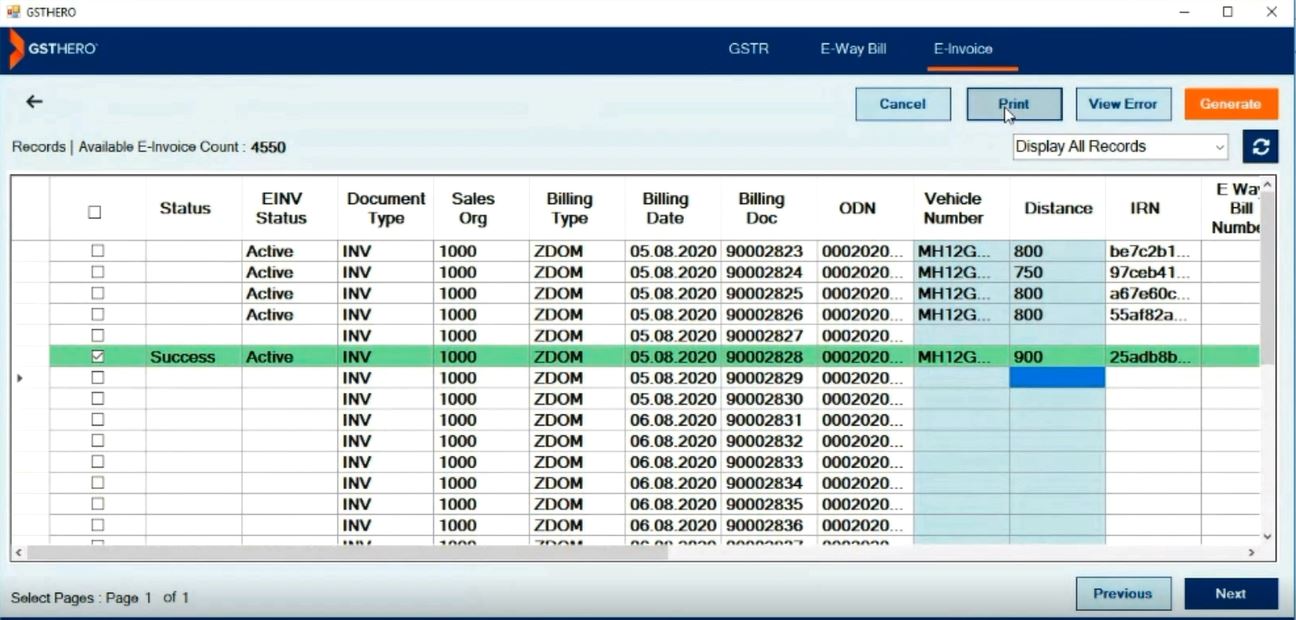

5. A message indicating that the e-invoice has been generated successfully with a unique IRN, doc number & QR Code will be displayed

6. To get a print of e-Invoice, just click on the 'Print' button

Note- While generating an e-Invoice, if any data is missing as per the SCHEMA format, an error indicating the flawed fields will be displayed, you can enter the required information then click on 'Generate' again.

Your e-Invoice is generated, within the ERP, with validation, IRN & QR Code without JSON Files & visiting the IRP.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

e-Way Bill Generation using RPA-SAP integration

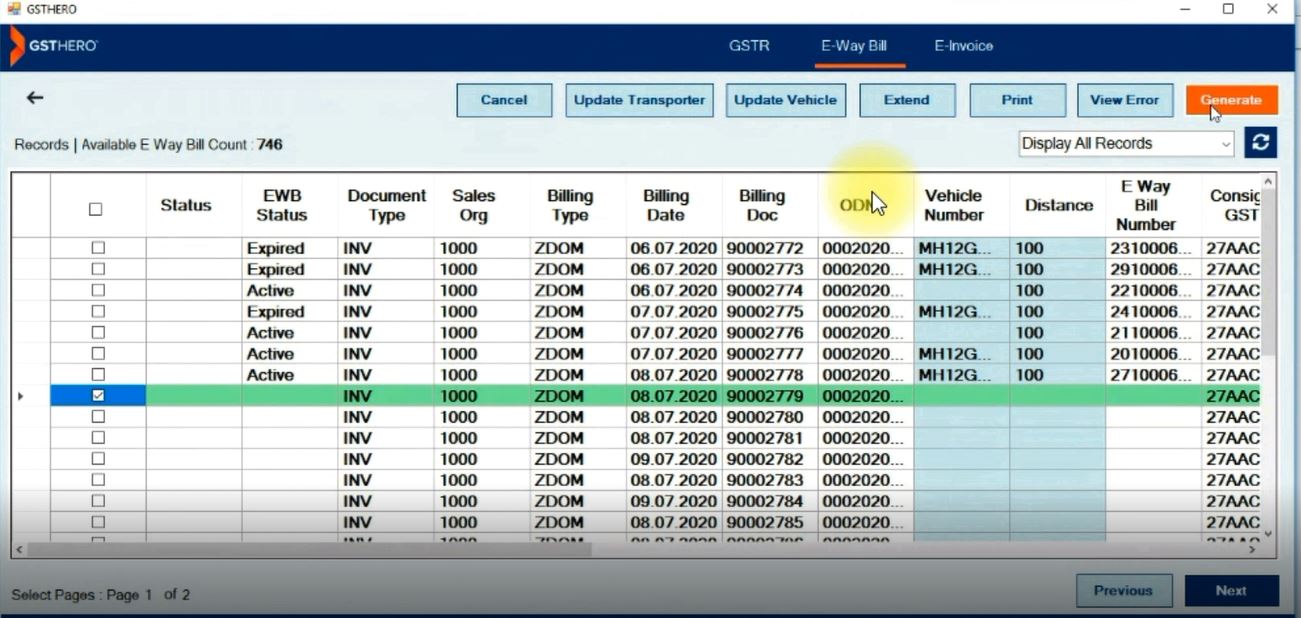

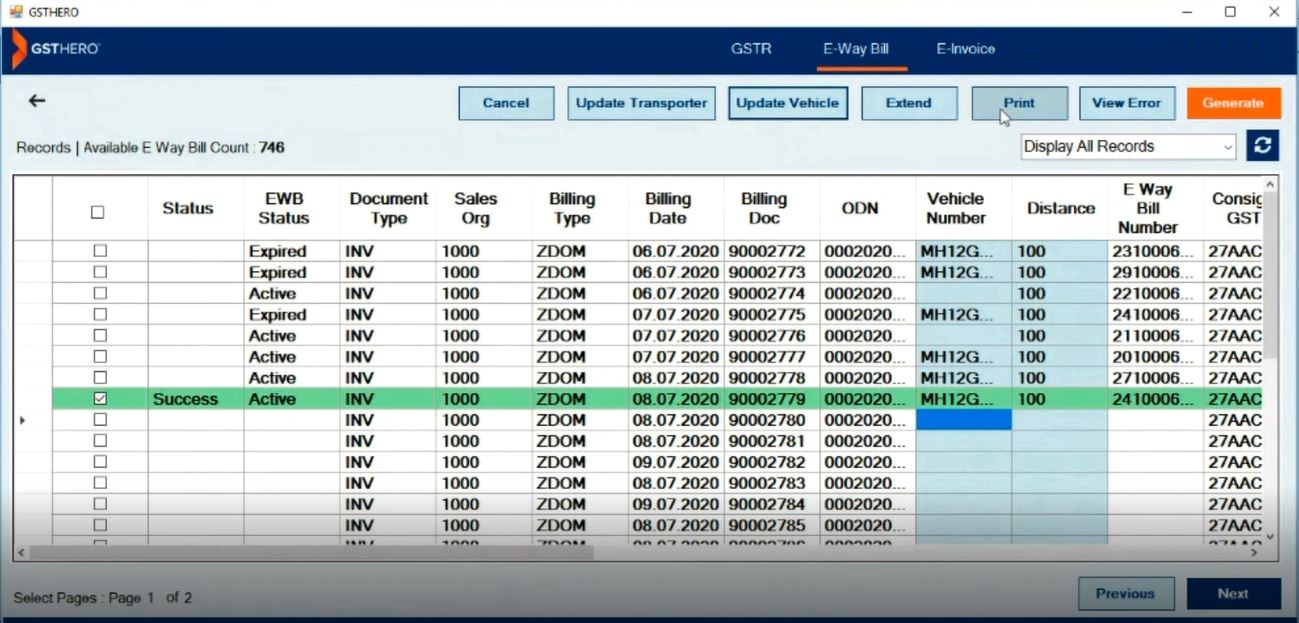

Follow the steps given below to generate an e-Way Bills within SAP using the GSTHero e-Way Bills feature given on the SAP dashboard

1. Log-in to SAP using your client ID, username and password

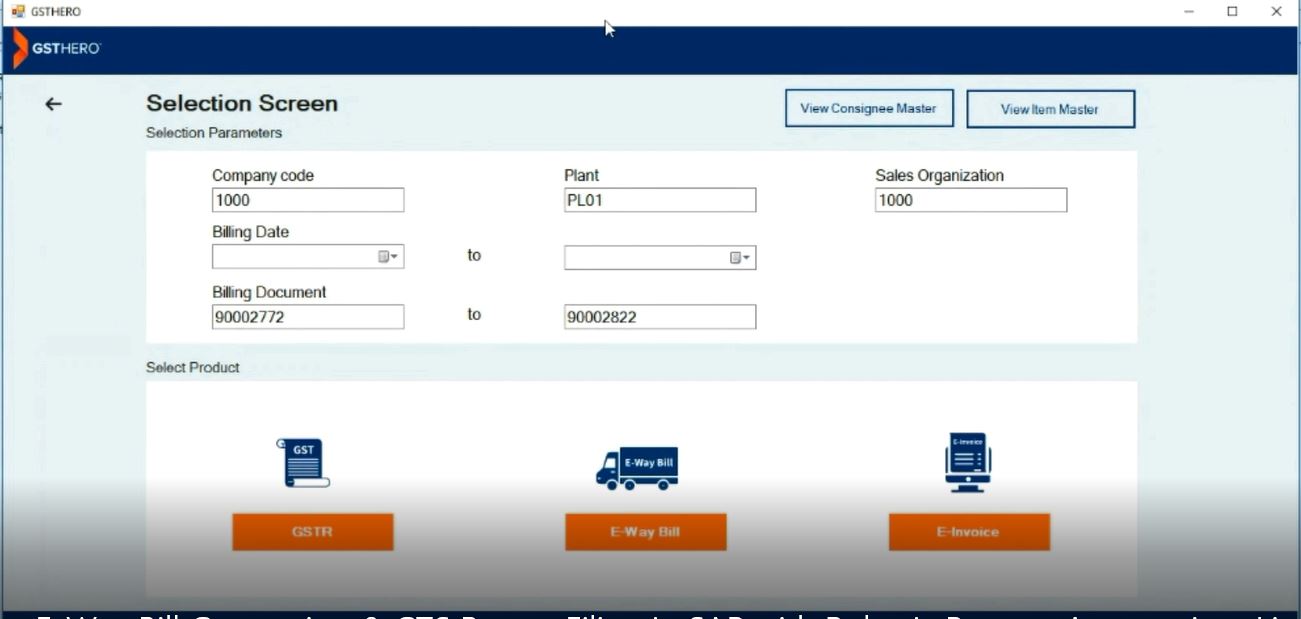

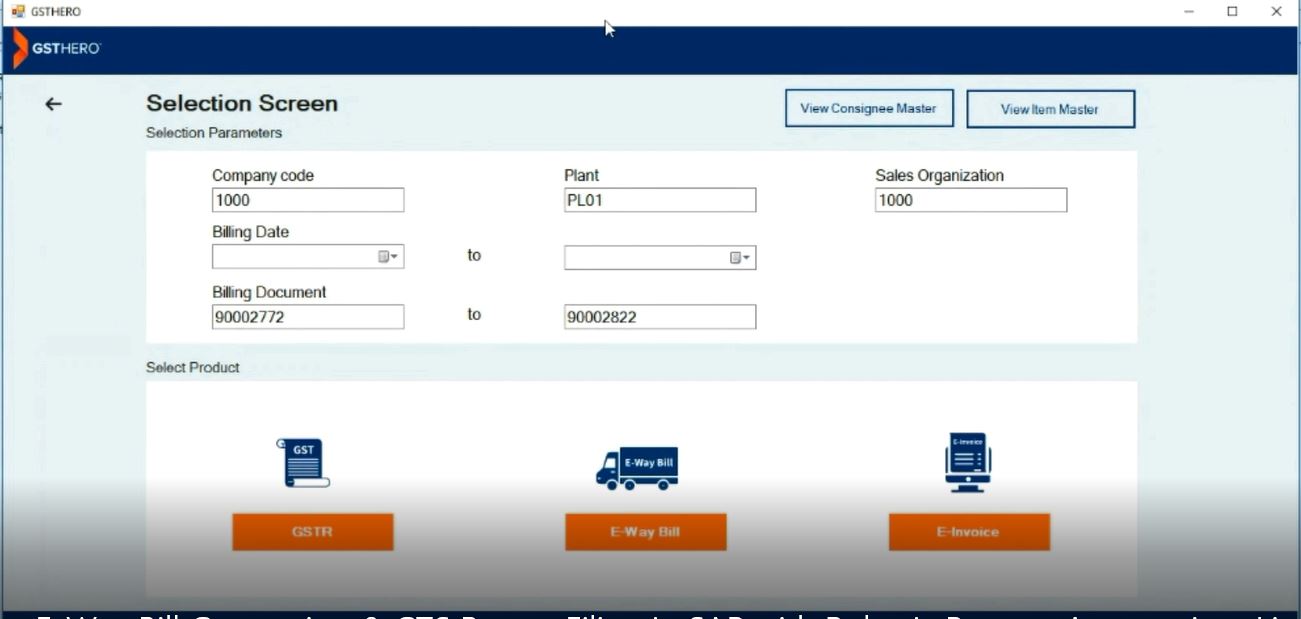

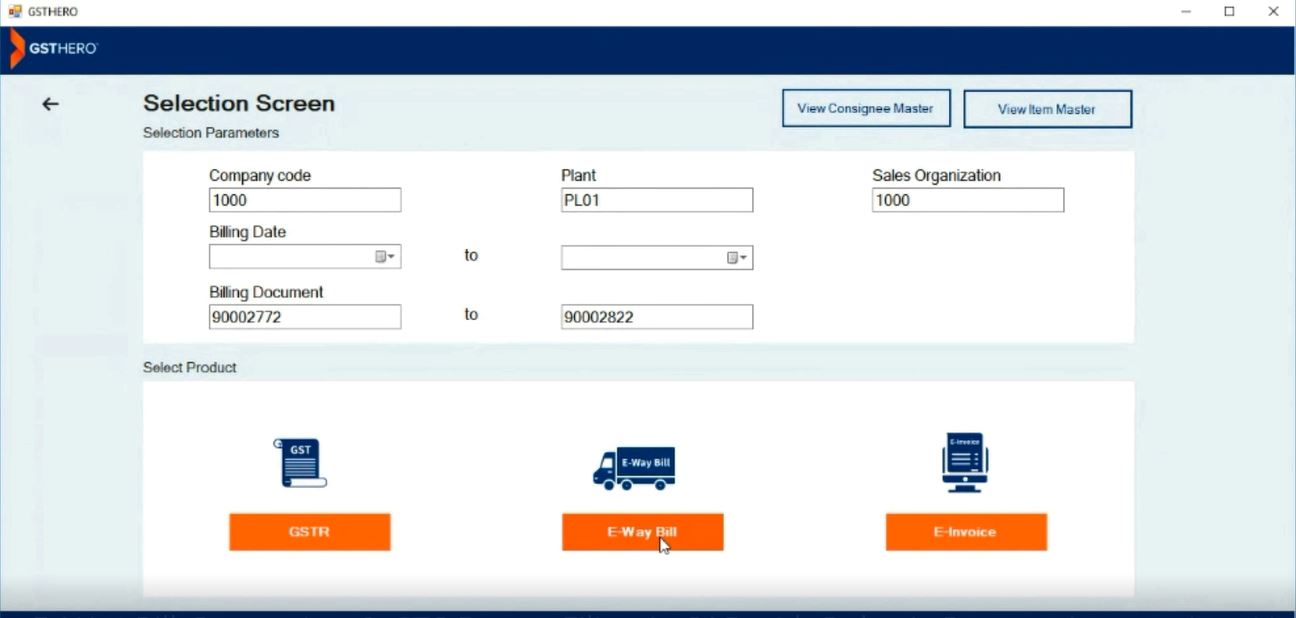

After logging into SAP the selection screen will appear.

2. Select the parameters along with the details like company code, plant code, and billing details

3. Now, click on the e-Way Bill Button on the SAP dashboard & the invoice data fetching will begin

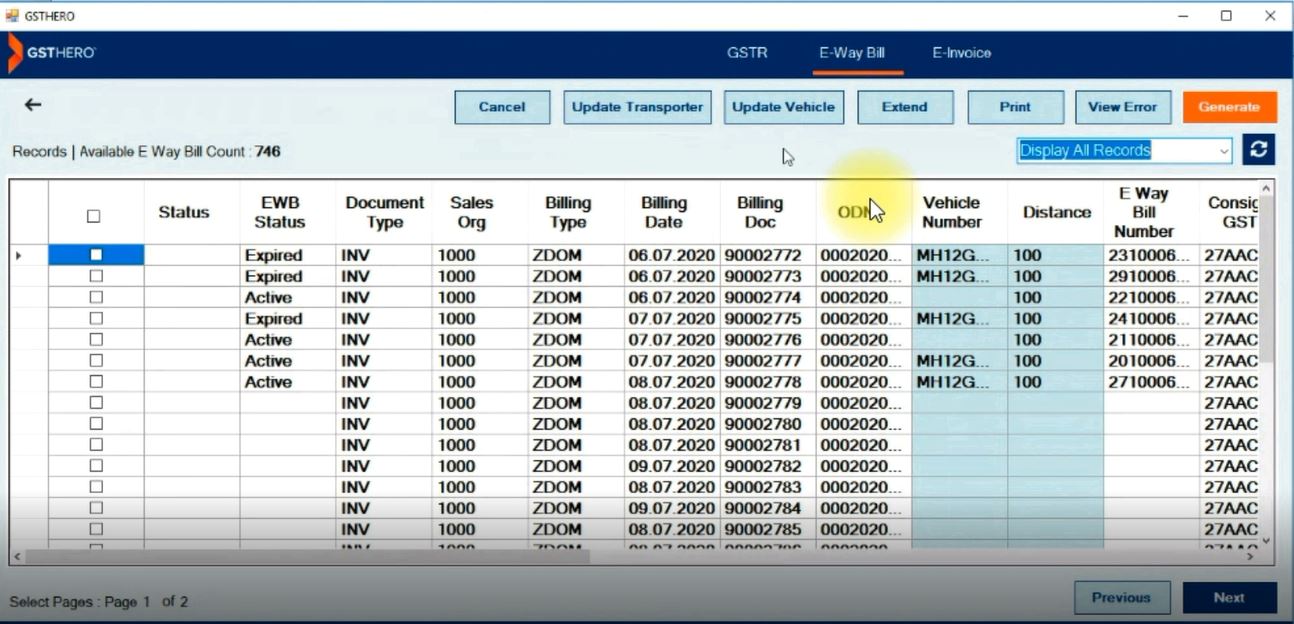

4. Once the fetching is successfully done, various options like generate, cancel, print, view errors & update vehicle number, etc will be enabled

5. Then, to generate an e-way bill just select the particular invoice for which you wish to generate an e-Way bill & click on the 'Generate' button

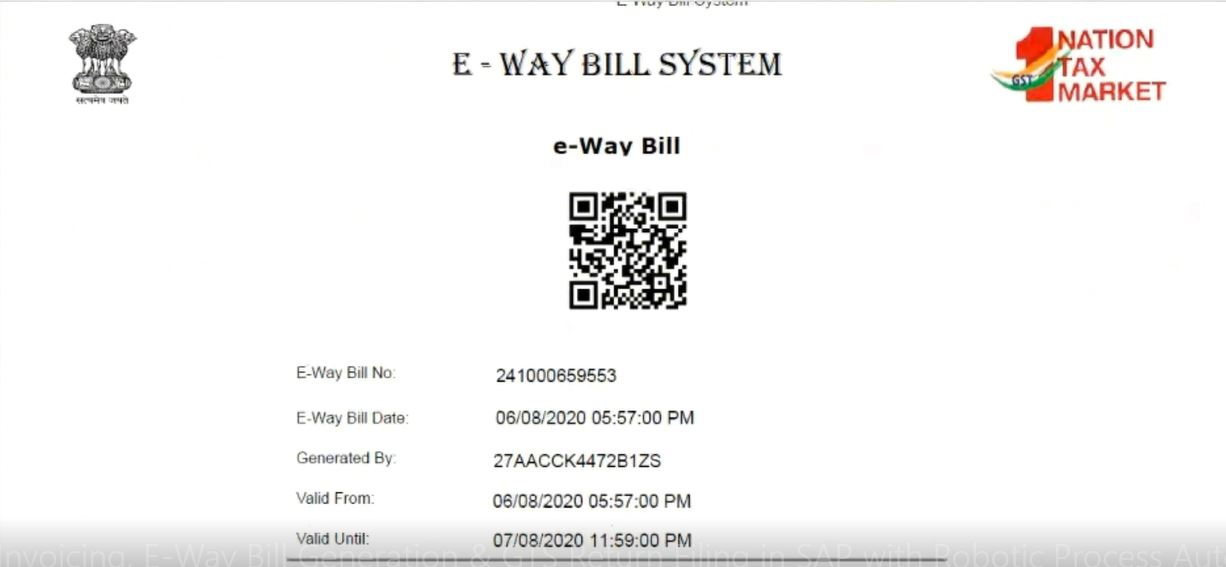

6. Within a second your e-Way bill will be generated, along with the e-way bill no., document no., e-way bill date, Barcodes & QR Codes

7. To print the e-way bills just click on the 'Print' button

Note- While generating an e-Way Bill, if any data is missing, an error indicating the flawed fields will be displayed, you can enter the required information & click on 'Generate' again.

And in a few seconds & even fewer steps, your e-Way Bills are generated with Barcodes & QR Coes within the ERP. You do not have to manually account these e-Way Bills as they are generated within the ERP they are auto accounted!

Get Free Bonus Report: Discover how to automate e-Invoicing

Data for GST Return filing using RPA-SAP integration

Follow the steps given below to export data for GST Filing from SAP using the GSTHero GSTN feature given on the SAP dashboard

1. Log-in to SAP using your client ID, username and password

2. Click on the GSTN Button on the SAP dashboard & the invoice data fetching will begin

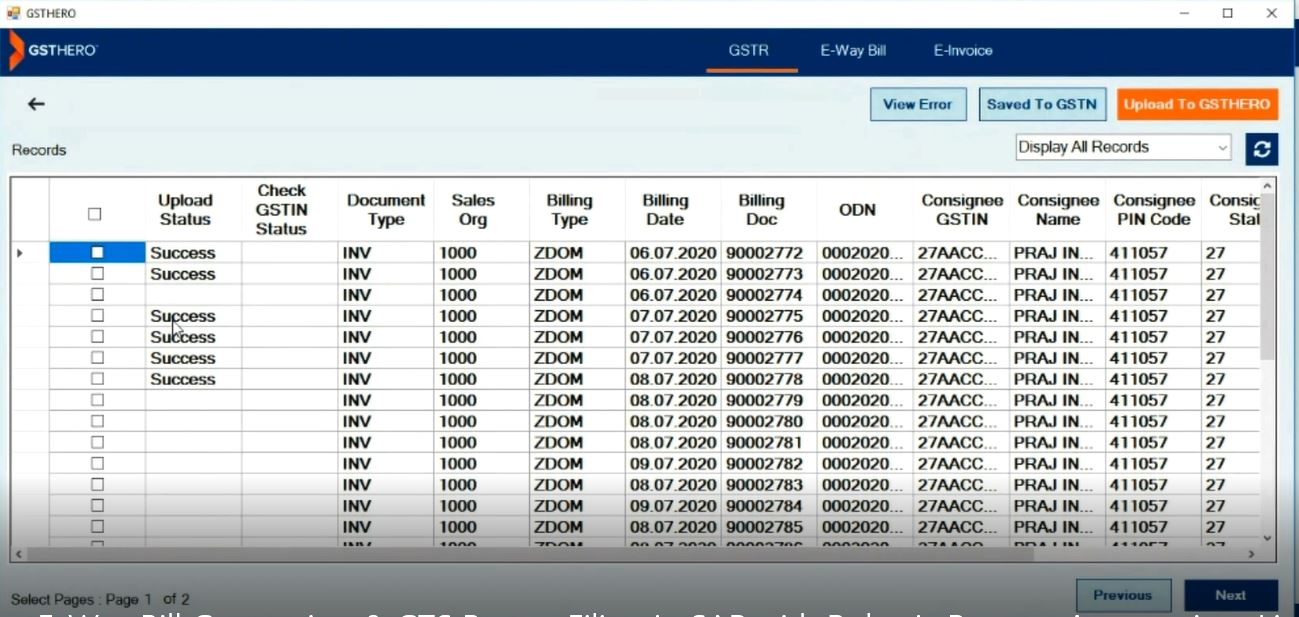

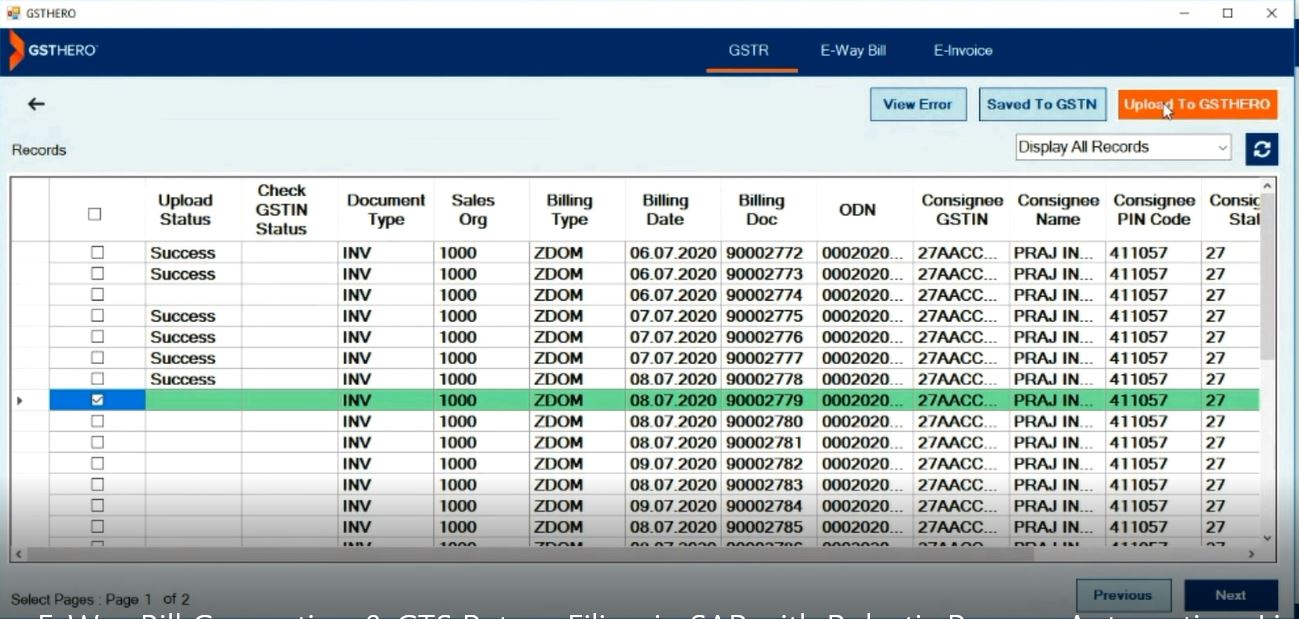

3. Once the fetching is successfully done, a new dashboard will appear containing all the invoices

4. You will have three options here-

Now, to export the records to GSTHero Portal for GST Filing

- Select the records you wish to upload to the GSTHero Portal for filing

- A new window is displayed, where you are required to choose the tax period of that selected record. Now, click on the 'Ok' button.

- Your data will then be sent to GSTHero and a new window will display all the document details.

And that is all, in three simple steps your data is transferred to the GSTHero portal, where you can file your GST returns with more features & accuracy.

GSTHero just saved a load of your time & the manual work

Conclusion

So, to conclude it is safe to say that GSTHero is the perfect solution for your Business's GST compliance vows!

There are so many other options available in the market including the offline utility tool, but the effectiveness of them may not be as reliable.

The offline utility offers only functional features & does not help a lot with the GST compliance burden.

On the other hand, the efficiency of GSTHero's services remains unmatched, with the most robust software & prompt technical support.

GSTHero is an authorized GSP & comes with the ISO promise of data security being ISO 27001 : 2013 Global Certification Services Certified.

Being a GSP GSTHero works close with the GSTN team, to help them improve the GST process.

With such an amicable association, we are always a step ahead of others in ensuring compliance with the most latest trends & changes.

Why GSTHero?

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free