GST Council, in its 37th Council meeting held in Goa, announced that new GST returns shall be implemented from April 2020 instead of September 2019. This new return filing system shall replace the existing GST return filing system.

This new simplified return filing system will be introduced to ease the compliance process and identify defaulting taxpayers.

Under the New GST Return Form, taxpayers are given an option to file returns on a monthly or quarterly basis. For quarterly return filing, the taxpayer may opt for Form GST RET-01 (Normal), Form GST RET-02 (Sahaj), or Form GST RET-03.

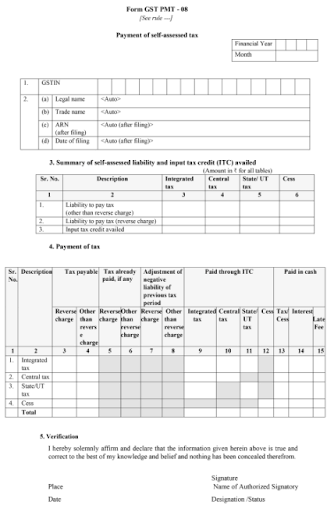

Even though the taxpayer opts to file a return on a quarterly basis, he has to pay tax on a monthly basis. Such tax liability is to be discharged by filing Form GST PMT-08.

You may be also interested in reading this post:

Let us now understand Form GST PMT-08 in detail -

Who Need to File FORM GST PMT 08 -

This form is to be filed by those registered taxpayers who have opted for filing GST returns on a quarterly basis under the new return format

Form GST PMT-08 is a declaration form from the registered taxpayer to pay tax on a self-assessment basis.

Liability assessed in Form GST PMT-08 may be discharged either through balance in electronic credit ledger or balance in electronic cash ledger.

Liability paid or input tax credit availed through Form GST PMT-08 shall be adjusted in the main return to be filed for the quarter

Due Date for Form GST PMT-08 -

Example - For the quarter April to June, Form GST PMT-08 shall be filed for the month of April and May, whereas Form GST RET-01/ 02/ 03 shall be filed for the month of June.

Liability paid or input tax credit adjusted through Form GST PMT-08 for April and May shall be adjusted while filing a main return for June.

You may be also interested in reading this post:

Table Wise Understanding of Form GST PMT 08

Table 1 and Table 2

Table 3 - Summary of self-assessed liability and input tax credit (ITC) availed

Table 4 - Payment of Tax

You may be also interested in reading this post:

Table 5 - Verification

Other Important Points

EndNote -

From the above points, we understand that Form GST PMT-08 cannot be prepared on an ad-hoc basis as any short liability declared or excess credit claimed may attract interest. In order to save this extra cost of interest due to incorrect reporting in Form GST PMT-08, one must select a GST Filing Software that will help to solve such problems and ease the filing process.