Introduction: GST Complexity Meets Intelligent Automation

The Goods and Services Tax (GST) system, introduced to unify India's fragmented tax regime, has itself become a maze for Indian enterprises. As regulations have matured, compliance demands have risen exponentially, placing an increasing strain on businesses' finance and tax teams.

While digital tools have simplified some reporting, the manual burden remains high, and regulatory dynamism adds frequent uncertainty. Instead of incremental fixes, a paradigm shift is needed. Covoro, in its evolved form (and as GSTHero in the Indian market), is uniquely positioned to lead that shift, leveraging its domain expertise and the breakthrough capabilities of Agentic AI.

This partnership is far more than a routine automation upgrade: it is a reimagining of how GST processes are managed, monitored, and mastered in the age of artificial intelligence.

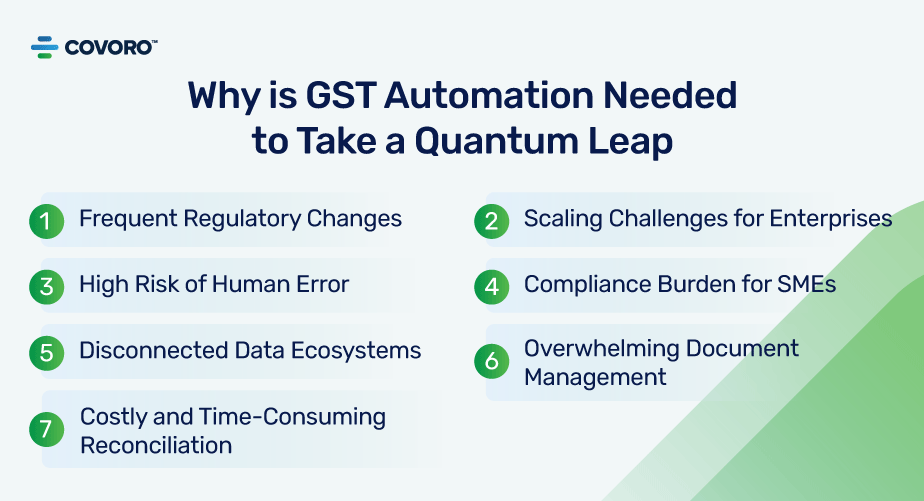

Why is GST Automation Needed to Take a Quantum Leap

Even after years of GST implementation, the majority of businesses contend with:

Overwhelming Document Management

Businesses struggle to manage the growing volume of paper and digital invoices, e-way bills, GST return filings, and credit notes, each requiring distinct validation processes and formats.

Frequent Regulatory Changes

The GST regulatory landscape remains dynamic, with new notifications, circulars, or amendments being released nearly every month, making manual compliance a persistent challenge.

High Risk of Human Error

Manual activities in matching input tax credits, reconciling invoices, and tracking interstate transactions increase the likelihood of costly errors.

Costly and Time-Consuming Reconciliation

Error correction, adjustments, and periodic audits demand resources and time, which leads to expensive reconciliation cycles that drain productivity.

Disconnected Data Ecosystems

Many organizations face fragmentation across their ERPs, accounting platforms, and GST applications, resulting in data silos and inefficient data flow.

Scaling Challenges for Enterprises

For large companies, ramping up compliance efforts without proportionally increasing compliance overhead is nearly impossible without automation.

Compliance Burden for SMEs

Small and medium enterprises (SMEs) find that managing GST compliance diverts attention from core business activities, hampering growth.

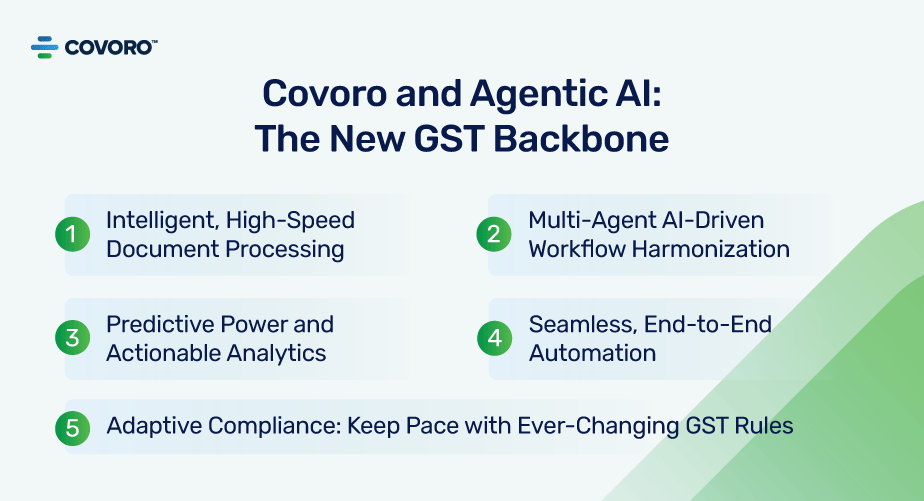

Covoro and Agentic AI: The New GST Backbone

1. Intelligent, High-Speed Document Processing

Covoro’s collaboration with Agentic AI transforms GST document processing, delivering speed and precision that were previously unattainable. This intelligent platform:

- Scans, decodes, and verifies batches of invoices, e-way bills, and itemized returns within minutes, translating hundreds or thousands of pages into structured data.

- It leverages state-of-the-art optical character recognition and deep-learning networks fine-tuned to the full spectrum of Indian GST document layouts and field configurations.

- Any anomalies, typos, absent mandatory fields, or mismatched HSN/SAC codes are highlighted in real time, empowering teams to intervene before errors proliferate.

- Every edit, submission, and communication is recorded in a secure, tamper-proof audit trail, ensuring full traceability and compliance.

Personnel previously absorbed in tedious data entry can now focus their skills on complex compliance interpretation, strategic planning, and advisory services that drive business value.

2. Multi-Agent AI-Driven Workflow Harmonisation

Legacy solutions impose rigid, linear steps that rarely adapt. Covoro, augmented by Agentic AI, instead deploys autonomous digital agents, each with a tailored role in the GST ecosystem:

- Invoice Agent: Ingests, parses, matches supplier and recipient data, and prepares summaries for returns.

- Reconciliation Agent: Compares purchase and sales ledgers, handling ITC matching and flagging exceptions for rapid closure.

- Return Filing Agent: Pre-populates GSTR-1, GSTR-3B, GSTR-9, and other forms, applies GSTN validation rules, and even schedules automated filings ahead of the deadline.

- Compliance & Alert Agent: Monitors regulatory feeds (notifications, amendments) and triggers workflow adjustments instantly.

- Audit Trail Agent: Compiles full transaction trails and documentation packs automatically for audit preparedness.

These autonomous agents communicate laterally, distributing the compliance load, sharing learnings, and ensuring real-time coordination across the GST lifecycle.

3. Adaptive Compliance: Keep Pace with Ever-Changing GST Rules

Agentic AI’s built-in regulatory intelligence allows Covoro’s platform to:

- Scan and interpret every circular, government notification, and legislative amendment as soon as it’s released.

- Recalibrate workflow logic instantly, ensuring processes, from invoice capture to filing, adhere strictly to prevailing regulations.

- Notify users of potential regulatory impacts in language tailored to their business, backed by auto-generated recommended actions.

Never again will teams be caught off guard by a sudden change in return format or a new reporting requirement.

4. Predictive Power and Actionable Analytics

With Covoro’s AI-augmented analytics suite, users gain a bird’s eye view, not just of compliance status, but of what lies ahead:

- Predict upcoming tax burdens, likely ITC receivable values, and cash flow impacts in real time.

- Run scenario analyses, e.g., “What if a particular supplier’s invoice is delayed?”, to play out compliance and liquidity consequences.

- Integrate exception reports and predictive risk scoring for priority case management.

Leadership can thus move GST from a reactive chore to a source of forward-looking strategic insight.

5. Seamless, End-to-End Automation

Covoro’s end-to-end solution, supercharged by Agentic AI, means:

- E-invoice generation, e-way bill creation, invoice reconciliation, return preparation, validation, submission, payment tracking, and audit management are handled on a single, connected platform.

- No more switching between government portals, ERP plugins, and spreadsheets; everything flows through a unified interface, with data integrity maintained at every step.

- APIs ensure instant, bi-directional data exchanges with all major ERPs, accounting packages, and banking platforms.

This unified ecosystem not only accelerates compliance cycles but also eliminates the persistent risk of manual handovers and data loss.

Real-World Results, Real Business Value

Automotive Giant: A Case in Scale and Precision

A Covoro client in the automotive sector, handling over 25,000 GST invoices each month across multiple states, saw its end-to-end return preparation timeline reduced from weeks to just hours, while boosting data capture accuracy past 99%. Automated reconciliation flagged mismatched invoices and ITC claims instantly, meaning zero last-minute surprises and a perfect audit record.

Pan-India SMEs, Compliance Without Overhead

Thousands of growing businesses, operating with lean teams and limited budgets, now automate all GST returns, e-invoice generation, and reconciliation with Covoro. By connecting directly to their existing accounting software via Covoro’s open APIs, tax filing no longer dominates their quarter ends, freeing business owners to focus on growth and customer success.

Unparalleled Scale and Trust

Covoro’s GST platform handles over 135 million e-invoices annually, interfaces natively with 100+ ERP systems, and safeguards the compliance of over 10,000 Indian enterprises, offering industry-leading uptime, security, and support.

The Agentic AI Edge: More Than Automation, True Intelligence

- Autonomous extraction and cross-checking, for every type of GST document, delivering instant, error-free data with traceable proof.

- Collaborating AI agents adapt their roles and methods in real time, distributing tasks, learning from exceptions, and self-optimizing for peak throughput and accuracy.

- Continuous adaptation to legal and industry change, without the need for engineer or administrator intervention.

- Predictive, actionable decision support, so finance leaders can pull insights instantly on risk exposure, audit trails, and tax trends.

Strategic Benefits: Beyond Compliance, Towards Operational Excellence

- Streamlined audit readiness: Every change, transaction, and submission is rigidly linked to a comprehensive digital audit trail, so organizations face no audit with anything but calm readiness.

- Accelerated working capital: Accelerated return filings and input tax credit, which means refunds and credits arrive sooner, improving working capital.

- Risk reduction and confidence: AI-guided exception spotting and self-tuning processes deliver compliance confidence never before seen, critical as enforcement tightens.

- People empowerment: Teams trade hours of data wrangling for strategic planning, trend analysis, and collaboration with executive leadership.

Conclusion: The Future of GST Compliance Has Arrived

The union of Covoro and Agentic AI signals a seismic shift in GST management, equipping companies of every size with an AI-powered, genuinely intelligent tax operations core. Compliance ceases to be a worry, a resource sink, or an opportunity forgone. GST becomes an edge, an assured base for growth, transparency, and innovation.

When your organization is ready to adopt frictionless GST compliance, foresight-driven insights, and operations built for change, Covoro’s agentic, AI-centric platform is primed to deliver the outcomes you require today and as the GST landscape keeps evolving.