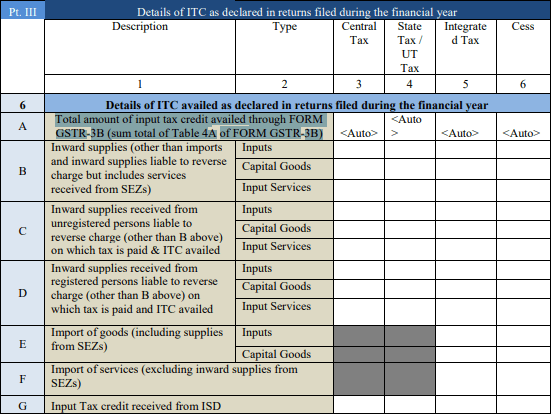

GSTR 9 Part III section consists of details of all input tax credit availed and utilised/ reversed in the financial year for which GSTR 9 is to be filed. All details with respect to Input tax credit shall be reported under Table 6, 7 and 8 of Part III of GSTR 9. Detailed analysis as below:

Clear all your doubts with our exclusive video

(A) Table 6:

This table provides details about input tax credit availed for the financial year in which GSTR 9 is to be filed.

1. Table 6A: Total amount of input tax credit availed through FORM GSTR-3B (sum total of Table 4A of FORM GSTR-3B)

This is an auto populated section from table 4A of GSTR 3B as filed by the taxpayer. Thus, this section cannot be revised.

2. Table 6B: Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs)

3. Table 6C: Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed

4. Table 6D: Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed

5. Table 6E: Import of goods (including supplies from SEZs)

6. Table 6F: Import of services (excluding inward supplies from SEZs)

Input tax credit availed on all import of services where tax has been paid under reverse charge. It shall exclude services received from SEZs.

Ref: Table 4(A)(2)

7. Table 6G: Input Tax credit received from ISD

Input tax credit received from Input service distributor (ISD) shall be reported here. Credit shall be availed on the basis of invoice issued by the input service distributor.

You May Be Also Interested in Reading This Post:

8. Table 6H: Amount of ITC reclaimed (other than B above) under the provisions of the Act

- Amount of input tax credit availed, reversed and reclaimed during the financial year shall be declared here.

- E.g. : Reversal of ITC due to non-payment to vendor within 180 days. The same is reclaimed on payment.

- Input tax credit claimed and reversed in 17-18 but reclaimed in 18-18 shall not be reported here.

9. Table 6I: Sub-total (B to H above)

10. Table 6J: Difference (I - A above)

11. Table 6K: Transition Credit through TRAN-I (including revisions if any)

Transition credit received in the electronic credit ledger on filing of Form GST Tran – I shall be included here. Any revision made to Form Tran-I shall be considered while entering details under this section.

12. Table 6L: Transition Credit through TRAN-II

13. Table 6M: Transition Credit through TRAN-II

14. Table 6N: Sub-total (K to M above)

Total of ITC availed through Trans-I, Trans-II or any other form during the financial year.

15. Table 6O: Total ITC availed (I + N above)

Total of input tax credit availed during the financial year either through GSTR 3B or through credit in electronic ledger by filing various other forms.

(B) Table 7:

Details of ITC Reversed and Ineligible ITC as declared in returns filed during the financial year

1. Table 7A – As per Rule 37

- Where, a registered supplier, fails to pay the supplier of goods or services or both within 180 days of date of invoice, any input tax credit availed thereon, shall be reversed / added to his output tax liability with interest thereon.

- The following supplies shall not be considered for reversal:

- Supplies made without consideration

- Any liability of the supplier discharged or incurred by the recipient of supply and not included in the price actually paid or payable by him.

- ITC reversed can be reclaimed after the payment has been made to the supplier.

2. Table 7B: As per Rule 39

Where credit note has been issued to Input Service Distributor by any supplier, the credit shall be apportioned to each recipient in proportion of the invoice issued earlier. The ITC claimed earlier shall be reversed under this section.

3. Table 7C: As per Rule 42

- Rule 42 prescribes for reversal of input tax credit of input and input services under the following situations:

- Credit used for business or non-business purposes

- Credit used for effecting taxable supply and exempt supply. (Taxable supply shall include zero rated supply)

- ITC used exclusively for non-business purposes or for completing exempt supply, Blocked credit as per section 17(5) shall be reversed.

- Common ITC used for non-business purposes shall be reversed at 5% whereas common ITC for effecting exempt supply shall be reversed in proportion of exempt turnover to total turnover.

4. Table 7D: As per Rule 43

- Rule 43 prescribes for reversal of ITC claimed on capital goods under the following situations:

- Capital goods used for business or non-business purposes

- Capital goods used for effecting taxable supply and exempt supply. (Taxable supply shall include zero rated supply)

- ITC on capital goods used exclusively for non-business purposes or for completing exempt supply, blocked credit shall not be available. Credit reversal shall be deferred over a period 60 months.

- Reversal of ITC on capital goods for common credit shall be in proportion to exempt supply of total turnover over a period 60 months.

- E.g. Total credit on capital goods for the month of March is Rs. 10 lakhs (including Rs. 2 lakhs exclusively for taxable supply). Total turnover – Rs. 5 lakhs, exempt supply – Rs. 2 lakhs.

- - Credit reversal deferred over 5 years – 10lakhs / 60 months i.e. Rs. 0.16 lakhs common credit available for reversal.

- - Ratio of exempt supply to total turnover – 2 lakhs/5 lakhs = 0.4

- - Credit to be reversed in March – Rs. 0.16 * 0.4 = Rs. 0.064 lakhs

You May Be Also Interested in Reading This Post:

5. Table 7E: As per Section 17(5)

- Any credit availed on supplies (goods or services) as mentioned in section 17(5) shall be ineligible and reversed under this section.

- E.g. motor vehicles, food and beverages, beauty treatment, etc

- One has to carefully understand that the credit has been availed due to ineligibility under this section and can look if the same can be classified as deemed supply or composite supply.

6. Table 7F and Table 7G: Reversal of Tran I and Tran II credit

7. Table 7H: Other Reversals (pl. specify)

8. Table 7I: Total ITC Reversed (A to H above)

9. Table 7J: Net ITC Available for Utilization (6O - 7I)

Difference between net credit availed (as per Table 6O) and net ITC to be reversed (as per Table 7J) shall be reflected here.

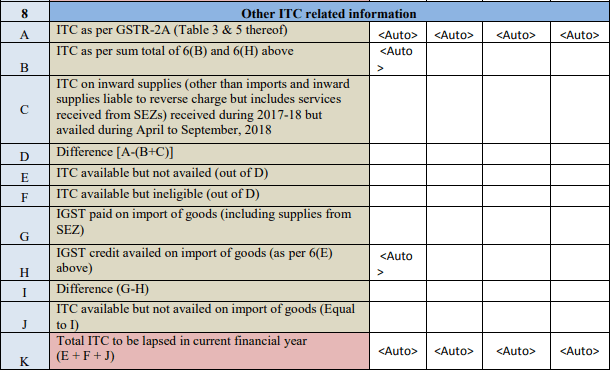

(C) Table 8: Other ITC related Information

ITC as per GSTR-2A (Table 3 & 5 thereof)

1. Table 8A: ITC as per GSTR-2A (Table 3 & 5 thereof)

This is an auto-populated table. Details uploaded in GSTR 2A for inward supplies (other than imports and supplies under reverse charge) are auto populated here.

2. Table 8B: ITC as per sum total of 6(B) and 6(H) above

This is also an auto populated section. This table is the summation of Table 6B i.e. total of inward supplier received other than imports and inward supplies liable to reverse charge but includes import of services and Table 6H amount of ITC reclaimed

3. Table 8C: ITC on inward supplies

- Input credit pertaining to 2017-18 that has been claimed in 2018-19 shall be declared here. It shall include input credit on inward supplies including import of services but excludes credit on imports and tax paid under reverse charge.

- Detailed data along with invoice wise details shall be available for any credit claimed under this section of GSTR 9.

- Ref: Table 4(A)(5) of GSTR 3B

4. Table 8D: Difference [A-(B+C)]

- This section shows details of credit available as per GSTR 2A but not availed in GSTR 3B. It is difference between credit available as per GSTR 2A (Table 8A) and sum of credit availed as GSTR 3B in respective and next financial year (Table 8B and 8C).

- Generally, the difference reflected in this table of GSTR 9 should be positive due to ineligibility of credit. However, if the difference is negative, it means more credit has been availed than that available under GSTR 2A. One of the reason for the same shall be that invoices have not be uploaded by supplier through GSTR 1.

5. Table 8E : ITC available but not availed (out of D)

This table reflects credit available but not availed by the taxpayer within the eligible period. Such credit shall lapse and cannot be availed.

6. Table 8F: ITC available but ineligible (out of D)

- Credit available but ineligible shall be reported under this table of GSTR 9. Credit may be ineligible due to following reasons:

- Input tax credit not used for business purposes

- Input tax credit linked to providing exempt supplies

- Input tax credit capitalised

- Input tax credit availed in contravention of conditions u/s 16(2) of CGST Act, 2017.

- The difference of Table 8D of GSTR 9 if positive shall be sum of Table 8E – ITC available but not availed and Table 8F – ITC available but ineligible

7. Table 8G: IGST paid on import of goods (including supplies from SEZ)

- IGST paid on import of goods along with supplies received from SEZ shall be reported here. This section shall include total GST paid on imports including any ineligible GST.

- Supply of goods from SEZ to DTA irrespective of who pays tax shall also be mentioned here irrespective of bill of entry.

8. Table 8H: IGST credit availed on import of goods (as per 6(E) above)

It is an auto generated table from table 6E of GTSR 9.

9. Table 8I: Difference (G-H)

This table shows difference between IGST paid on import of goods and IGST claimed on import of goods. The difference between the two may be either positive or negative.

Negative difference may be due to IGST paid but not availed or ITC paid but ineligible.

10. Table 8J: ITC available but not availed on import of goods (Equal to I)

It refers to IGST paid on imports but that has now lapsed as the same have not been availed or are ineligible.

11. Table 8K: Total ITC to be lapsed in current financial year (E + F + J)

This is also an auto populated section. It is the total credit that has lapsed in Table 8E, 8F and 8J.

IMPORTANT POINTS:

- Bifurcation of inward supplies into inputs, capital goods and input services is required for GSTR 9. However, the same was not required at the time of filing GSTR 3B. This additional activity is required before filing GSTR 9.

- Any negative difference in input tax credit in GSTR 3B and GSTR 2A shall lapse. The department shall seek explanation for such differences. Thus, one should keep copy of such invoices and other evidences for further reference when required.

File your GST returns in minutes, not hours!

Get Live Demo and experience the simplicity by yourself.