Most frequent DSC Error

GST taxpayers have been facing a very common error while filing their GSTR-1 & GSTR-3B.

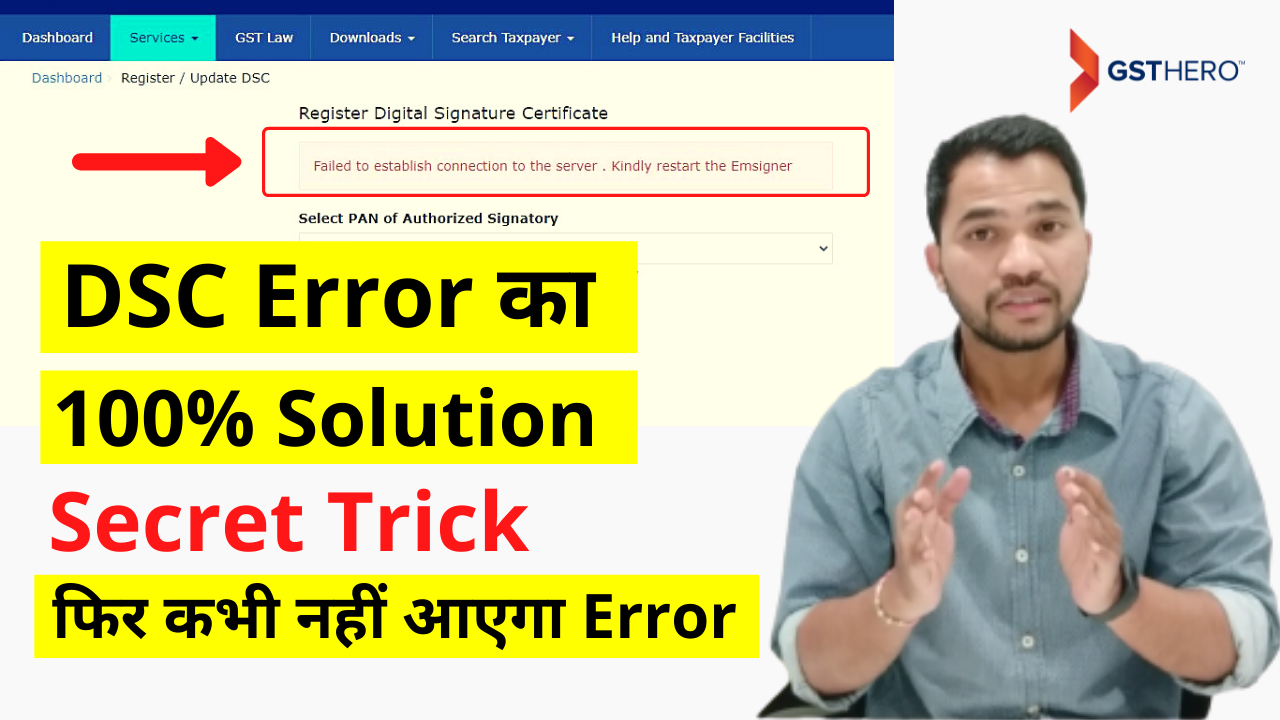

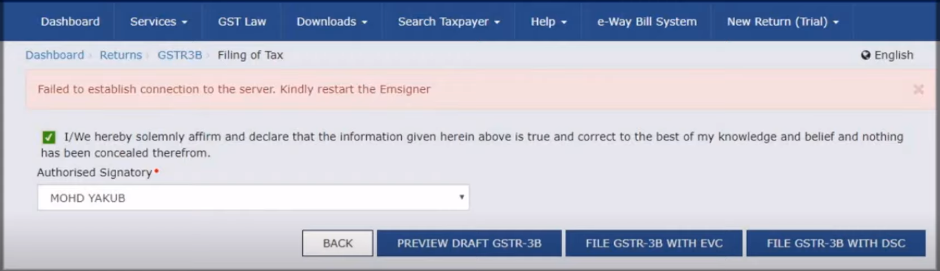

The dialogue box that appears on the GST Portal is as follows:

The Problem:

Most frequent error messages that taxpayers encounter are as follows:

1. Failed to establish connection to the server

2. Restart/reset the EMsigner.

There can be multiple technical reasons for this error, one of them being a server issue at the GST portal.

In this short article, we will guide you through a video to resolve this issue.

Using the fix discussed in the video, taxpayers shall NOT encounter this error again and can easily submit their GST information on the portal.

The Solution:

In this video, Atish has discussed a simple fix that the taxpayers can apply to resolve the DSC error in EMsigner for GST.

Advantages of How digital signing services beneficial for many businesses along with we discussed digital signing PDF documents and more

For a super user-friendly Digital Signing software to digitally sign PDF documents in bulk consider using GSTHero SafeSign.

Following are some of the highlights:

Digital signing is more important now a day because many businesses working remotely. Digital signature services is comes under many benefits in this fast paced of businesses we design a complete guide how digital signature services help to your firms?