The Inland Revenue Board Malaysia (IRBM), which in Malay, is known and pronounced as the Lembaga Hasil Dalam Negeri Malaysia (LHDN), is the Malaysian tax authority currently under the spotlight due to its highly compliant e-invoicing in Malaysia initiative.

The IRBM is at the helm of managing the complex systems of taxation in Malaysia, including responsibilities like overseeing the nation’s tax affairs (from income and property tax to service and corporate tax). In short, the Inland Revenue Board is a ship that keeps the tax administration of Malaysia afloat and sailing in the right direction.

That is why business owners and taxpayers in Malaysia must learn about the duties, functions, responsibilities, and limitations of the IRBM. It will help you ensure compliance-driven practices in your business while avoiding legal issues, late fees, and penalties.

This article will help you do exactly that and more as you explore every aspect of the Inland Revenue Board of Malaysia and how it works. Let’s get to it.What is the IRBM (LHDN)?

The Inland Revenue Board of Malaysia (IRBM), or Lembaga Hasil Dalam Negeri (LHDN) is the government authority in Malaysia for conducting, managing, and regulating all tax and revenue matters in Malaysia. It was formerly known as the Department of Inland Revenue Malaysia.

Lembaga Hasil Dalam Negeri Malaysia was officially established on 1st March 1996, under the direction and control of the Ministry of Finance (MOF) in Malaysia. It was created to streamline tax management and improve financial transparency in the country.

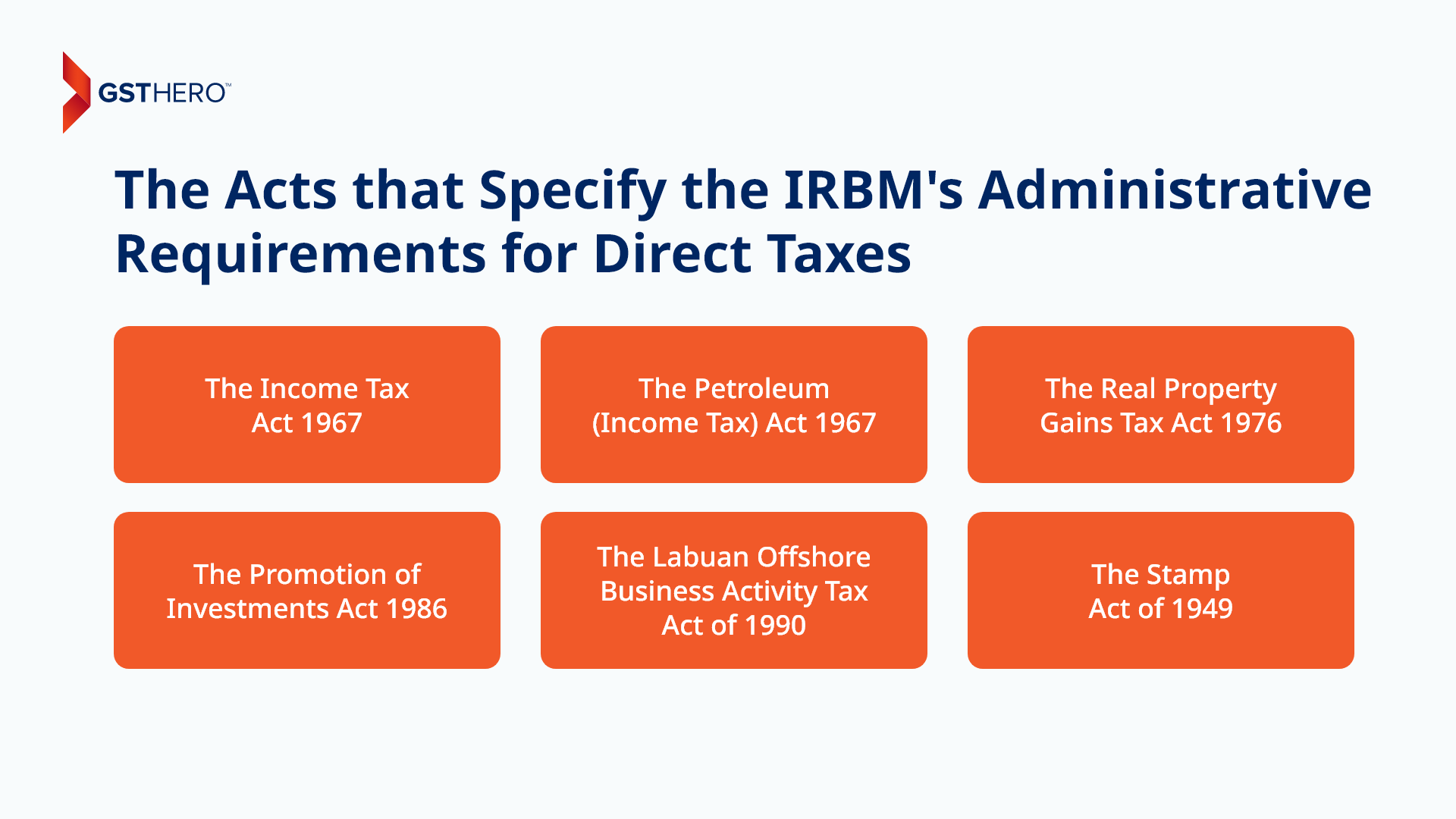

The IRBM/LHDN manages the overall administration of direct taxes included under the following acts :

- The Income Tax Act 1967

- The Petroleum (Income Tax) Act 1967

- The Real Property Gains Tax Act 1976

- The Promotion of Investments Act 1986

- The Labuan Offshore Business Activity Tax Act of 1990

- The Stamp Act of 1949

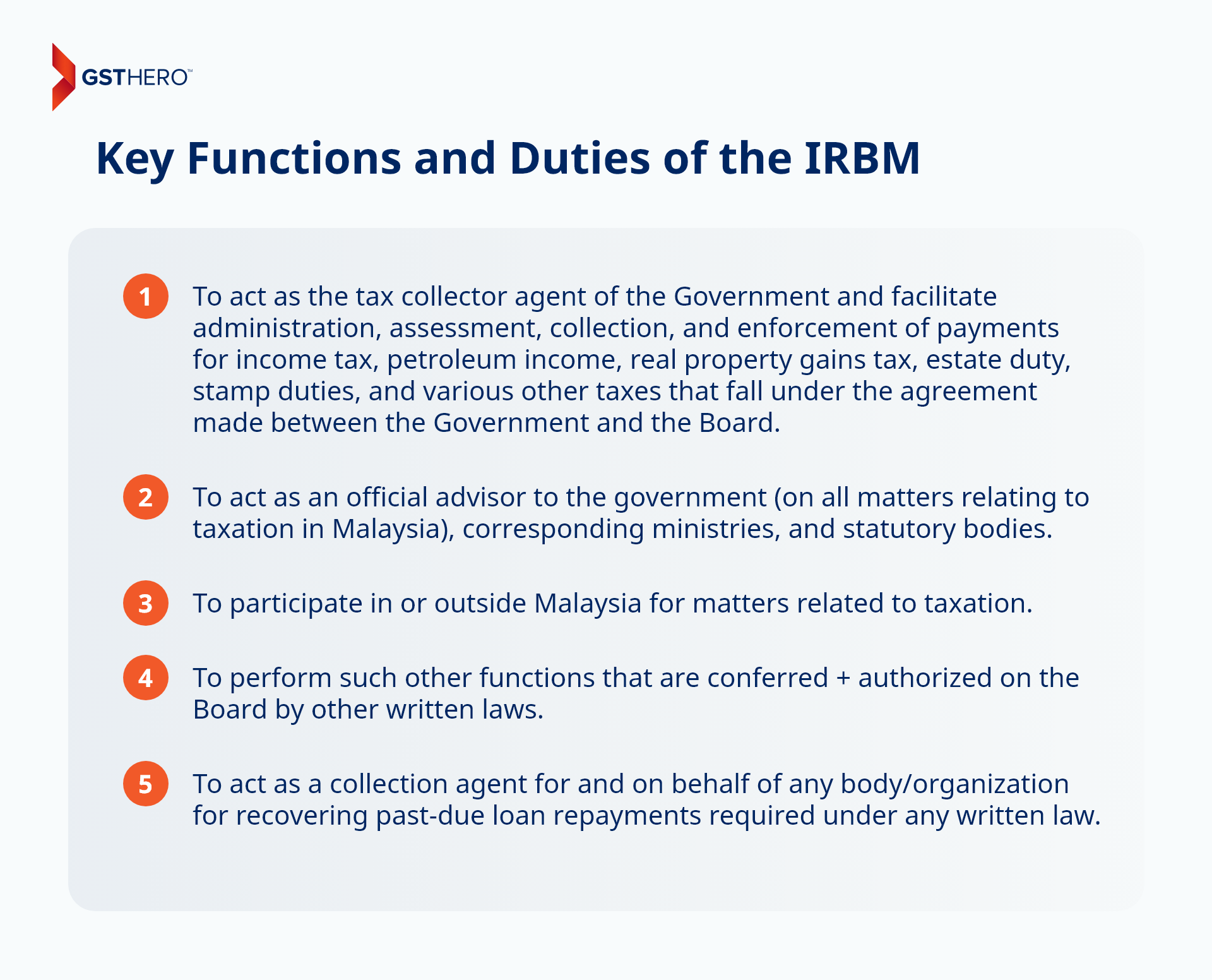

Key Functions and Duties of the IRBM

The Inland Revenue Board of Malaysia (IRBM) has certain key duties and functions that every business owner in Malaysia must know about.

- To act as the tax collector agent of the Government and facilitate administration, assessment, collection, and enforcement of payments for income tax, petroleum income, real property gains tax, estate duty, stamp duties, and various other taxes that fall under the agreement made between the Government and the Board.

- To act as an official advisor to the government (on all matters relating to taxation in Malaysia), corresponding ministries, and statutory bodies.

- To participate in or outside Malaysia for matters related to taxation.

- To perform such other functions that are conferred + authorized on the Board by other written laws.

- To act as a collection agent for and on behalf of any body/organization for recovering past-due loan repayments required under any written law.

Roles and Responsibilities of the Inland Revenue Board

The IRBM has a plethora of roles and responsibilities to ensure the smooth execution of taxation in Malaysia. Let’s learn a bit about them.

Tax Compliance Guidance

The IRBM offers practical guidance with comprehensive resources and assistance to taxpayers regarding their tax obligations, non-compliance issues, and late filing fees/penalties. From clarifying tax laws to providing informative materials, the IRBM simplifies compliance for businesses in Malaysia.

Taxpayers and businesses can look for this guidance on the Inland Revenue Board of Malaysia official website.

Tax Collection and Enforcement

IRBM utilizes proper enforcement protocols to ensure compliance with tax laws, executing regulatory activities like essential audits and preventing tax evasion.

It collects taxes such as but not limited to:

Income Tax : Levied on the income of individuals and businesses subject to income tax in Malaysia.

Corporate Income Tax : Levied on the profits of companies operating in Malaysia.

Property Tax : Levied on the ownership of real estate in Malaysia. It is evaluated based on the annual rental value of the property and is payable by property owners.

Excise Duty : Levied on the manufacturing or importing of specific goods like tobacco, alcohol, and motor vehicles into Malaysia. The purpose of excise duty is to deter the consumption of these goods and generate revenue for the government.

Stamp Duty : Levied on various legal documents and transactions, including property transfers, tenancy agreements, and loan agreements. The rate of stamp duty varies depending on the type of document or transaction.

Real property gains tax (RPGT) : Levied on the gains made from the disposal of real property or land in Malaysia, applicable to both citizens and non-citizens who dispose of real property in Malaysia, including residential, commercial, and agricultural properties.

Customs Duties : Levied on the imported goods entering Malaysia. The rates of customs duties vary depending on the type and value of the goods imported.

Taxpayer Education and Outreach

The IRBM conducts various outreach programs and initiatives to improve taxpayers' understanding of tax matters. Workshops, seminars, and online resources are employed to ensure taxpayers have the knowledge needed to fulfill their tax obligations accurately.

Facilitating Taxpayer Services

The core aspect of IRBM’s services is streamlining taxpayer services. From facilitating tax registration processes to assisting with tax filing procedures, the IRBM helps make tax compliance as effortless as possible for individuals and businesses alike.

It offers various online services to simplify tax return filing and payments, which makes it easy for businesses to stay compliant.

Taxpayer Registration

To properly track and manage eligible taxpayers, the IRBM is required to register taxpayers and issue a Tax Identification Number (TIN) to them.

Ensuring Fairness and Transparency

The IRBM is committed to administering tax laws impartially through principles of fairness and transparency by conducting rigorous audits and investigations. It ensures that all taxpayers contribute equitably to the nation's development to uphold the integrity of the tax system.

Addressing Taxpayer Concerns

Recognizing taxpayers' needs and concerns about taxation, the IRBM offers a platform for individuals and businesses to get clarification or resolution on tax-related matters.

Policy Development

The IRBM is responsible for making adjustments to tax policies based on changing requirements of the financial landscape. This includes updating tax laws for digital transactions and making tax policies compatible with new technology advancements.

International Collaboration for Global Compliance

The IRBM strengthens its efforts to implement transparency and uphold tax compliance standards worldwide by creating partnerships with international tax bodies. It collaborates with tax authorities globally to combat tax evasion and facilitate information exchange.

Through this collaboration, the IRBM contributes to a more robust global tax framework, preventing illicit financial activities and promoting fair taxation practices across borders.

In essence, the key role and responsibility of the IRBM is to collect revenue for the Malaysian government on behalf of the Ministry of Finance (MOF).

Executive Management of the Inland Revenue Board of Malaysia

The list below includes individuals who are leaders and key decision-makers at the IRBM :

- Datuk Dr. Abu Tariq Bin Jamaluddin P.G.D.K

Chief Executive Officer / Director General of Inland Revenue - Dato' Wan Ramiza Binti Wan Ghazali J.M.N, D.P.S.K

Deputy Director General (Policy) - Datuk Hisham Bin Rusli D.M.S.M

Deputy Director General (Compliance) - Shaharrudy Bin Othman

Deputy Director General (Tax Operation) - Khairul Halimin Bin Abdul Halim

Deputy Director General (Management)

Senior Management of the Inland Revenue Board of Malaysia

The list below includes other key officials at the IRBM’s Head and State Director’s office :

Head Office :

- Marside @ Marsidi Bin Julika @ Zelika

Director of Tax Collection Department - Hishamudin Bin Mohamed

Director of Tax Policy Department - Ahmad Khairuddin Bin Abdullah

Director of Investigation Department - Mohamad Fauzi Bin Saat

Director of Finance Department - Norhanadia Binti Samsudin

Director of International Tax Department - Noraini Binti Mustafa

Director of Corporate Services Department - Mohammad Nazri Bin Ismail

Director of Corporate Logistics Department - Zahari Bin Ali

Director of Human Management Department - Datuk Akmal Johari Bin Ismail

Director of Special Task Department - Rosnita Binti Ahmad

Director of Large Taxpayer Branch - Abang Ehsan Bin Abang Abu Bakar

Director of Special Industry Branch - Y.M Raja Kamarul Zaman Bin Raja Musa

Director of Legal Department - Kamarudzaman Bin Bahrainvacant

Director of Intelligence and Profiling Department - Norfaidah Binti Daud

Director of Tax Compliance Department - Norisham Bin Long

Director of Strategic and Research Department - Hamisah Binti Ismail

Director of Multinational Tax Branch - Zaleha Binti Adam

Director of RPGT and STAMP Operation Department - Abd Rahman Bin Yusof

Director of Information Technology Department - Suzaina Binti Sapian

Director of Malaysian Tax Academy - Bacho Bin Abdul Karim

Director of Tax Operation Department - Norhisham Bin Ahmad

Director of Klang Valley Litigation Branch - Mohd Zawawi Bin Razali

Director of Internal Audit Department - Rozina Binti Johan

Director of Dispute Resolution Department - Nor Azam Bin Mohamad

Director of Risk Management and Integrity Department - Mathan A/L Kaliappan

Director of Strategic Compliance Branch - Najlah Binti Ishak

Director of Chief Executive Officer Office

State Director's Office :

- Shifaak Binti Md. Amin

State Director of Johor - Vijayen A/L Nagalingham

State Director of Sarawak - Dato' Azhar Bin Husin

State Director of Federal Territory of Kuala Lumpur - Shafudin Bin Yacob

State Director of Federal Territory of Putrajaya - Azrul Hisham Bin Shamsudin

State Director of Sabah - Nasruddin Bin Mat Nasir

State Director of Penang - Badri Bin Basiran @ Basir

State Director of Perak - Jafni Bin Hashim

State Director of Selangor - Mukhtar Bin Abdul Kadir

State Director of Negeri Sembilan - Ruslan Bin Othman

State Director of Pahang - Aziz Bin Din

State Director of Kedah - Mohd Shahriz Bin Ramli

State Director of Melaka - Mohamad Rosli Bin Mamat

State Director of Terengganu - Wan Roslan Bin Wan Ismail

State Director of Kelantan - Akmal Bin Mat Said

State Director of Perlis

Conclusion

Understanding the consequential role of the Inland Revenue Board Malaysia (IRBM), AKA, Lembaga Hasil Dalam Negeri Malaysia (LHDN), will help taxpayers and businesses fulfill their tax obligations well. By learning about IRBM’s key roles, functions, and responsibilities, businesses will be able to contribute to the national economic development by staying up to date with compliance regulations.

The IRBM and its responsibilities also help promote a collaborative partnership between taxpayers, businesses, and the government.

Moreover, being aware of the IRBM's role will facilitate informed engagement with tax policies, compliance requirements, and economic initiatives. It simplifies Malaysia’s tax landscape for taxpayers and businesses, helping them comply with regulations while optimizing financial strategies for sustainable growth.