Govt. of India Authorized GSP

|

Tax Technology Firm of 2024

Ensure ITC Accuracy,

Avoid Compliance Risks

with GSTHero IMS

Stop ITC Mismatches Before They Impact Your Business

Unmatched invoices, vendor delays, and missing records can put your ITC at risk. With the Invoice Management System (IMS) now in place, your Input Tax Credit (ITC) accuracy depends on seamless reconciliation.

FIVE-LEVEL QUALITY ASSURANCE TESTS

High-Volume Performance Tested

Data Security Tested

Regression Tested

Smoke Tested

Integration

Tested

4.87 Customer Support Rating

ISO 27001:2013 CERTIFIED

Experience this Solution First-Hand with a 25-minute Demo On Video-Call!

Your information is safe with us - confidential

and never shared, sold, or traded.

Govt. of India Authorized GSP

Tax Technology Firm of 2024

The All-New Invoice Management System (IMS) Automated Solution, with Lightning Fast Invoice Processing Capability.

We have spent 287 hours building a super-accurate solution so that you can process your invoices in under 11 minutes.

FIVE-LEVEL QUALITY ASSURANCE TESTS

4.87 Customer Support Rating

ISO 27001:2013 CERTIFIED

Experience this Solution First-Hand with a 25-minute Demo On Video-Call!

Your information is safe with us - confidential and never shared,

sold, or traded.

What is IMS, and why is it important?

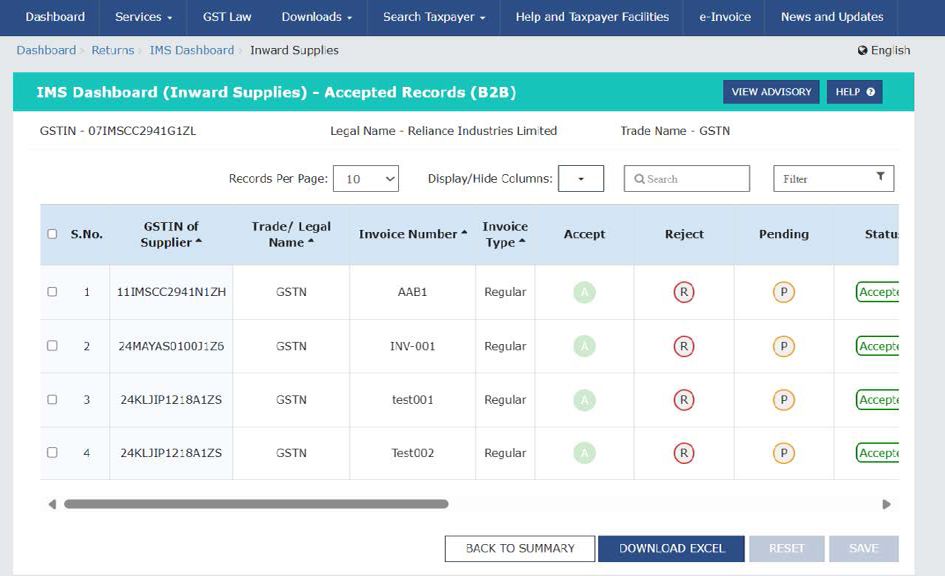

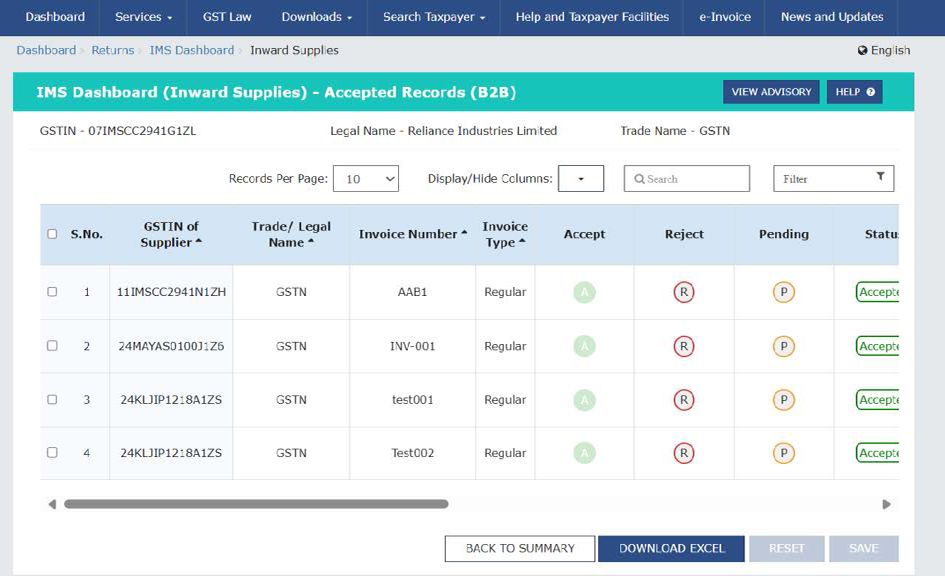

Introduced by GSTN on 1st October 2024, the Invoice Management System (IMS) is a digital platform that helps businesses manage their invoices, Credit Notes, & Debit Notes efficiently under India's GST system.

Why IMS is important?

- Risk of 'Deemed Accepting' Fake Invoices

- Risk of Tax Liability

- Risk of getting Notice/s from GST

What is IMS, and why is it important?

Introduced by GSTN on 1st October 2024, the Invoice Management System (IMS) is a digital platform that helps businesses manage their invoices, Credit Notes, & Debit Notes efficiently under India's GST system.

Why IMS is important?

- Risk of 'Deemed Accepting' Fake Invoices

- Risk of Tax Liability

- Risk of getting Notice/s from GST

🚨 Wrong ITC = GST Notices & Penalties

🔥 AI-powered validation flags risky invoices before filing & provides audit-ready ITC documentation.

💡 Avoid GST audits & financial penalties

A Solution Designed for Businesses that Process High Volume of Invoices.

The GSTN IMS portal caters to small businesses. Despite bulk action options, the annoying need to constantly check for invoice changes remains, making the solution incomplete.

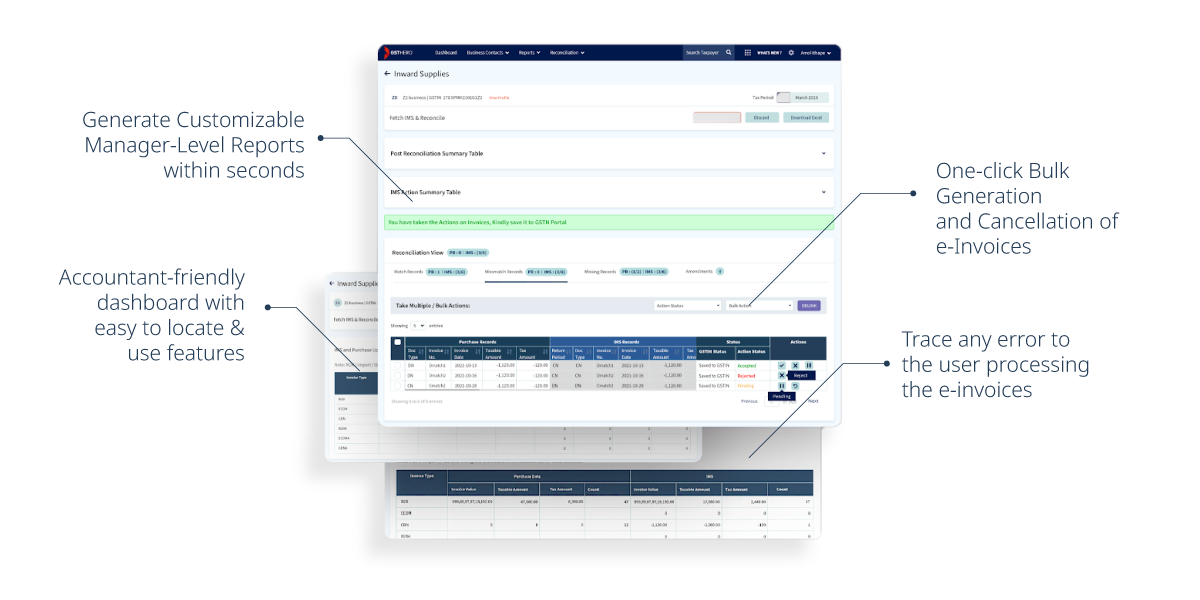

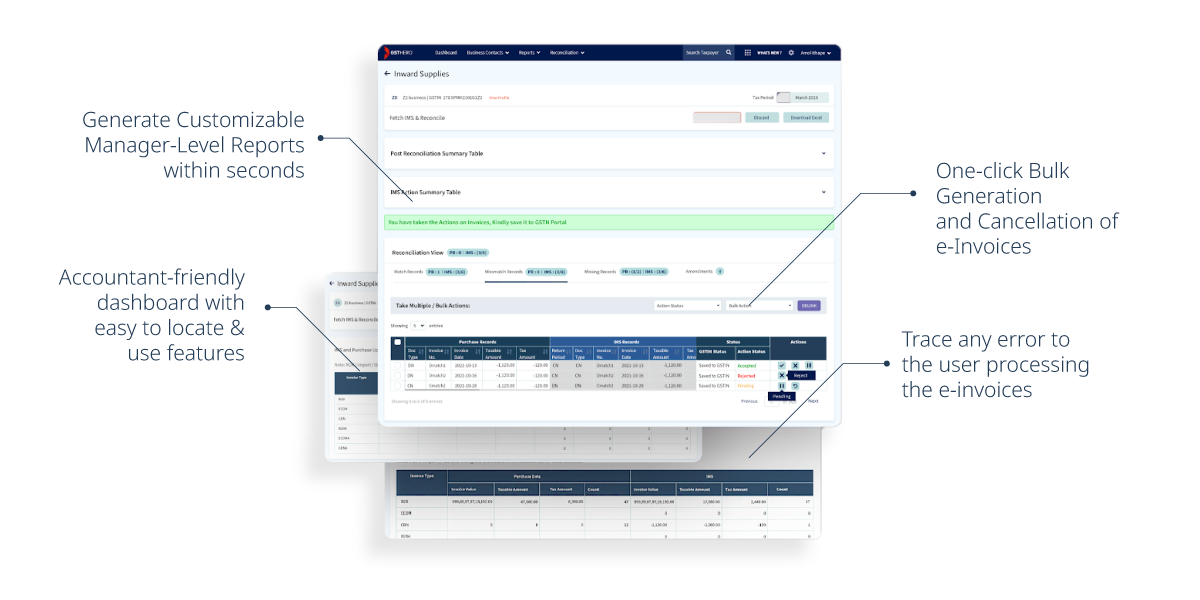

Our IMS solution has features designed to guarantee high accuracy in large volumes, saving you from costly mistakes caused by oversight.

UNIQUE FEATURES

Why IDT Leaders Trust GSTHero for IMS & ITC Reconciliation

Supplier-Wise Invoice Management

Know exactly which vendor invoices are accepted, rejected, or pending—in one simple dashboard. No more manual tracking.

Reconciliation with Tolerance Limits

Prevent unnecessary mismatches by setting custom tolerance levels, ensuring minor differences don’t disrupt ITC claims.

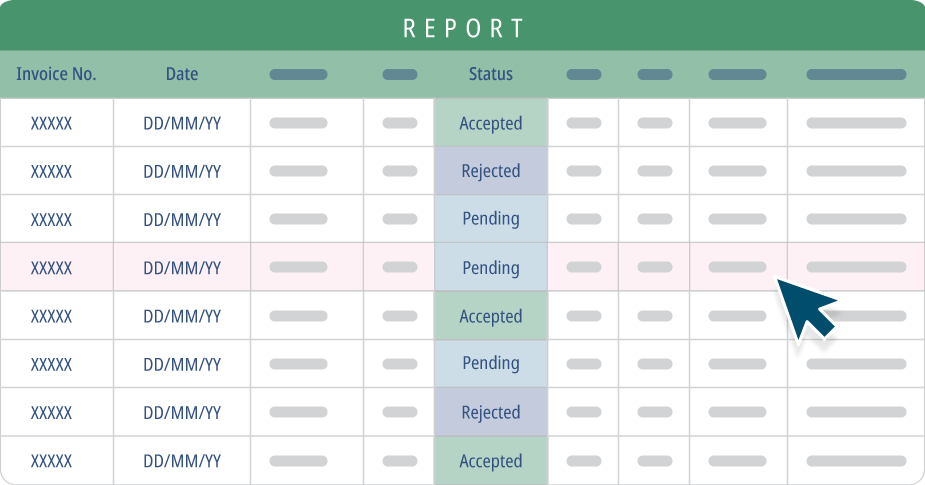

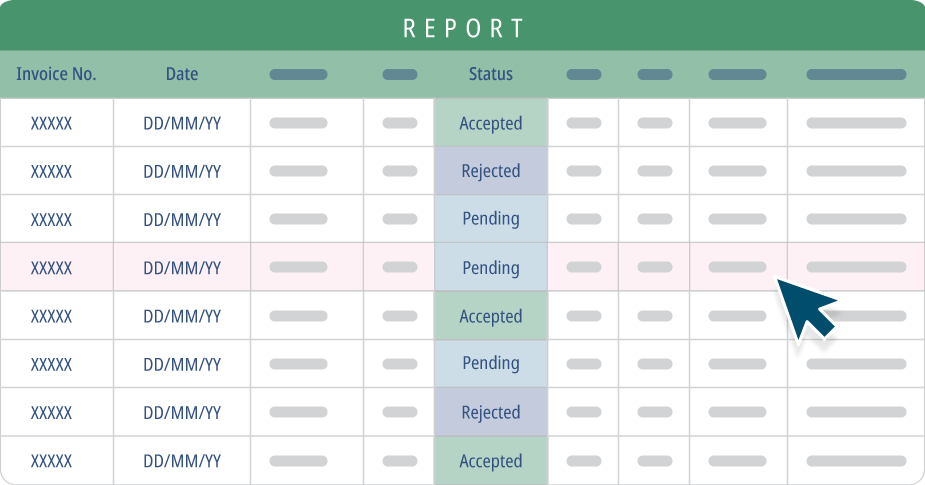

Smart IMS Reconciliation Reports

Get a vendor-wise post-reconciliation report with a breakdown of accepted, rejected, and pending invoices—stay audit-ready.

Defaulting Vendor Detection

Identify high-risk suppliers who delay or fail to report invoices, preventing ITC losses and compliance headaches.

Missing Invoice Finder

Instantly spot gaps between IMS, purchase records, and GSTR-2B—so no invoice goes unaccounted for.

Real-Time ITC Health Dashboard

Gain instant visibility into ITC status, pending reconciliations, and vendor compliance risks—all in one powerful dashboard.

📢 “GSTHero helped us reduce ITC mismatches by 90%. Vendor compliance tracking is now effortless!”

CFO

Leading FMCG Conglomerate, India

📢 “Before GSTHero, our ITC tracking was chaotic. Now, we get full visibility into our invoices in one dashboard.” – Taxation Head, IT Firm

Indirect Taxation Head

Leading Manufacturing Conglomerate, India

UNIQUE FEATURES

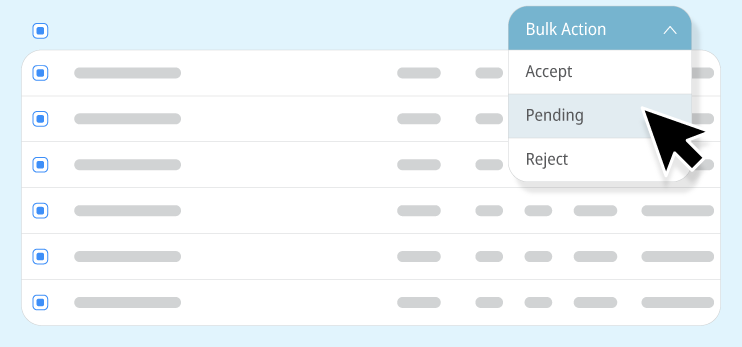

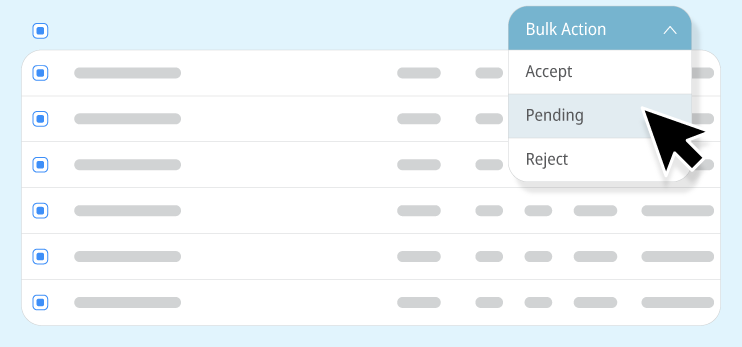

Get Bulk of Your Work Done,

in Minutes.

You don't need to individually accept or reject thousands of invoices, you can select as many invoices as you like with our bulk selection option and accept, reject or keep invoices pending with one click.

GSTR 2B vs. Purchase Records Reconciliation.

By reconciling GSTR 2B data with your purchase records in your ERP, our solution speeds up the process of accepting, & rejecting invoices.

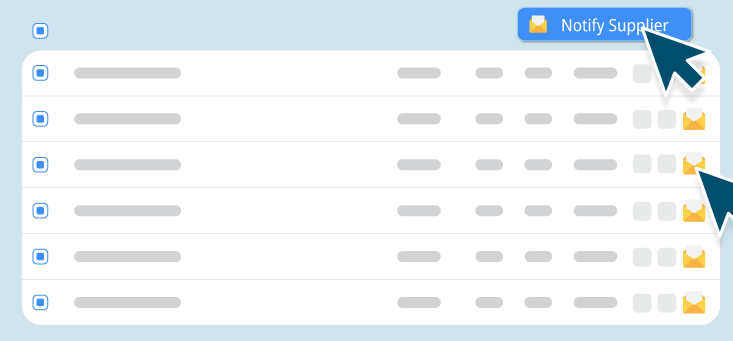

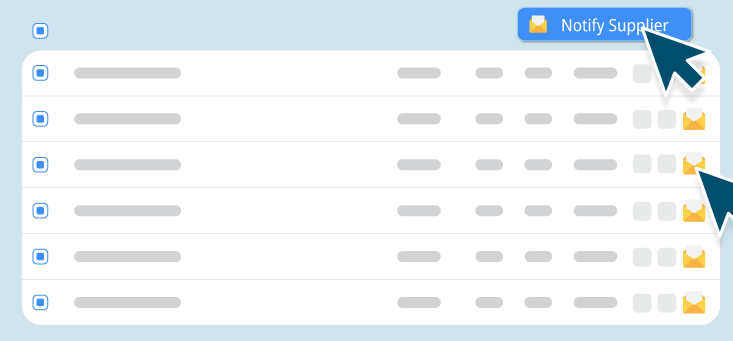

Notify All Your Suppliers, Instantly.

Incase of discrepancies, select as many invoices as you like and send an email to the respective suppliers with a single click of a button.

Pin-point the 'exact action' taken on any invoice - with a single click.

The GST IMS Portal doesn’t log accepted or rejected invoices, but we do. You can access the entire history of accepted, rejected, pending actions taken on invoices with only a single click.

Get Bulk of Your Work Done, in Minutes.

You don't need to individually accept or reject thousands of invoices, you can select as many invoices as you like with our bulk selection option and accept, reject or keep invoices pending with one click.

GSTR 2B vs. Purchase Records Reconciliation.

By reconciling GSTR 2B data with your purchase records in your ERP, our solution speeds up the process of accepting, & rejecting invoices.

Notify All Your Suppliers, Instantly.

Incase of discrepancies, select as many invoices as you like and send an email to the respective suppliers with a single click of a button.

Pin-point the 'exact action' taken on any invoice - with a single click.

The GST IMS Portal doesn’t log accepted or rejected invoices, but we do. You can access the entire history of accepted, rejected, pending actions taken on invoices with only a single click.

Integrates with over 100 ERPs.

Whether you use SAP, Oracle, Microsoft, Tally or any other ERP - our IMS solution can integrate with your ERP smoothly.

Integrates with

over 100 ERPs.

Whether you use SAP, Oracle, Microsoft, Tally or any other ERP - our IMS solution can integrate with your ERP smoothly.

GSTHero IMS Solution Vs. GSTN's IMS Portal

Let's look at the clear advantages of processing invoices using our IMS Solution versus directly processing from GSTN's IMS Portal.

Features | GSTHero's IMS Solution | GSTN's IMS Portal |

|---|---|---|

Cloud Based Storage | ||

ERP Integration Ready | ||

Multi-user Access | ||

Instant Report Access | ||

Advance Configuration with |

GSTHero IMS Solution Vs. GSTN's IMS Portal

Let's look at the clear advantages of processing invoices using our IMS Solution versus directly processing from GSTN's IMS Portal.

Features | GSTHero's IMS Solution | GSTN's IMS Portal |

|---|---|---|

Cloud Based Storage | ||

ERP Integration Ready | ||

Multi-user Access | ||

Instant Report Access | ||

Advance Configuration with |

Get a live-demo of our IMS solution and see first-hand how it works.

Why book our 25-minute live?

Your information is safe with us - confidential

and never shared, sold, or traded.