The introduction of the e-Invoicing system was one such step taken towards this goal of easy record keeping and authentication from the government’s end for every invoice record.

The plan of government to bring maximum businesses under e-Invoicing is evident from the decision to bring businesses with aggregate turnover of INR 50 Cr. annually, under e-invoicing umbrella.

There is going to be a huge increase in the e-Invoice mandated businesses in the FY 2021-22.

Though e-Invoicing is mandatory for most businesses, there are still some prominent challenges looming around the businesses.

In this short article, we will discuss some of the major challenges that companies are facing while e-invoice generation.

ERP System Integration e-Invoicing

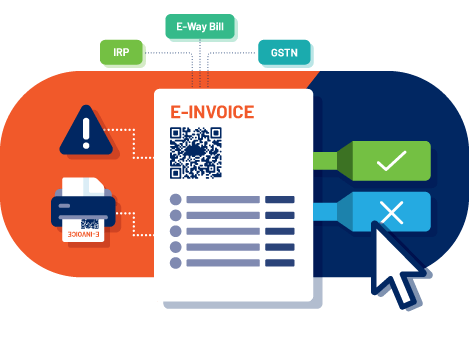

The invoices to be uploaded to the IRP should be in the e-Invoicing SCHEMA as prescribed by the IRP portal.

The businesses have to re-calibrate or integrate their ERP systems with the Invoice Registration Portal (IRP).

GST Network provides APIs for the integration between the ERPs and the IRP portal.

Get Free Bonus Report: Discover how to automate e-Invoicing

What does Integration of ERP mean?

A business is e-Invoicing eligible.

The primary ERP used by the business is TALLY.

Now, this business can integrate Tally directly with the IRP portal by either buying APIs from an authentic GST Suvidha Provider or directly taking service from Service Providers like GSTHero.

If this business subscribes to the GSTHero’s Tally Connector, it can easily generate e-Invoices right from the Tally software without visiting the IRP platform even once.

From the example, we understand that Integration of the ERP system simply means providing an intermediate interface between the ERP system and the IRP portal for a smoother flow of the invoices and faster generation of the e-Invoices from the IRP.

What is the Challenge?

Separating B2B from B2C Invoices

- e-Invoice & e-Way Bill is required to be generated for the B2B Invoices.

- But for the B2C invoices, only e-Way bill generation is required wherever applicable.

What is the Challenge?

- On the taxpayer’s side, he has to segregate the B2B invoices from the B2C invoices.

- This classification can eat up some time on the taxpayer’s side and can be a tedious task when there are bulk invoices to be uploaded.

- An automated process of segregation can ease the entire process with minimum time & human resource consumption.

e-Invoice Cancellation & Amendment

IRP portal allows the businesses to cancel the generated e-Invoice within 24 hours from the time of its generation.

Once the e-Invoice is cancelled, you cannot issue a fresh invoice with the same Invoice Reference Number (IRN).

The taxpayer has to issue a fresh e-Invoice with another unique IRN from the IRP portal to make amendments in the e-Invoice after 24 hours.

For editing and amending any e-Invoice on the GST portal after 24 hours of its generation, there has to be proper explanation and clarification to be provided to do the same.

This tricky step for editing the e-Invoice can be a challenge in case there are some errors introduced in the generation of the e-Invoices.

It is better to avoid errors in the first go and an automated system can help you in doing so.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

e-Invoice vs. GSTR-1 Reconciliation (Process after e-Invoice generation)

The government has now introduced a new automation facility in the GST portal which auto-fetches the e-Invoice data from the Invoice registration Portal (IRP).

One of the major benefits of e-invoicing is that its details will get auto-populated while filing GSTR-1returns.

This feature will act as a basis for all the processes that fall further such as, reconciliation, or claiming maximum Input Tax Credit.

e-Invoice is a government authenticated document, hence only the authentic data must be uploaded on the IRP.

For this purpose, Reconciliation of your e-Invoices against the GSTR-1 (outward supplies details- monthly) is required.

The businesses should use Reconciliation Tools to carry out the e-Invoice vs. GSTR-1 recon. Process.

This allows the taxpayer to stay 100% compliant with the GST laws and he can minimize the errors to avoid any penalties due to furnishing false information on the IRP portal.

B2C Invoices are Exempted From e-Invoice Generation

The volume of B2C transactions is more as compared to the B2B transactions.

Recently, Input Tax Credit frauds were exposed in Delhi which involved CAs, tax professionals, Company Secretaries and even lawyers.

The attempt to claim ineligible Input Tax Credit is done based on the B2C invoices.

B2C invoices are exempted from reporting to the government via the IRP portal. This has caused the misuse of this provision and also seen a sharp rise in the fraudulent cases corresponding to this loophole.

Indulging themselves from such fraudulent invoices is the duty of the taxpayers.

e-Invoice Data Archiving after e-Invoice generation

Get Free Bonus Report: Discover how to automate e-Invoicing

But, currently, the Invoice Registration Portal (IRP) has no such provision to store the e-invoice data.

IRP portal only saves the data for the next 24 hours from the time of its generation.

So if a taxpayer needs to revisit his e-Invoice details, he has to visit the GST portal and find his e-Invoice details in the GSTR-1.

However, GSTHero gives you an option to save your e-Invoice data on our server for about 2+ years.

Unavailability of the e-Invoice data after 24 hours can be a challenge as the auto-population of GSTR-1 gets delayed sometimes.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

IT Infrastructure Availability for e-Invoice generation

This challenge can be tackled by setting up a robust IT infrastructure with regular maintenance of the solution to be 100% compliant with the frequently changing GST laws

To Summarize about e-Invoice generation

No doubt there are certain hurdles in the 100% successful implementation of the e-Invoicing system. However, these hurdles are not too complicated to resolve.

A proper strategy, feasible IT infrastructure and coordination between the taxpayer and the IRP portal can help you enabling a smooth generation of e-Invoices.

It is advisable for businesses that they automate their GST Returns filing process as much as possible. This helps them to stay compliant with the ever-changing GST laws and help their working capital to stay unharmed.

GSTHero can be your assistance on every step of GST Returns filing, e-Invoice generation, e-Way Bill generation or Digital Signing.

Request a demo now & experts will get in touch with you shortly!

Until the next time…

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free