As the implementation date for e-invoicing in Malaysia comes close, businesses are looking for the best ways they can comply with new regulations in time. Luckily, the Malaysian tax authority plans to introduce e-invoicing with a phased approach.

Starting from 1st August 2024, the implementation is estimated to finish within 2 to 3 years, with 1 July 2025 as the final e-invoice implementation date.

Sr. No | Date | Implementation Plan |

1 | 1st August 2024 | Largest Taxpayers - E-invoicing will be in effect for taxpayers with an annual revenue/turnover of more than RM 100 million. |

2 | 1st January 2025 | Standard Taxpayers - E-invoicing will be in effect for taxpayers with an annual revenue/turnover of more than RM 25 million and within RM 100 million. |

3 | 1st July 2025 | All Taxpayers - E-invoicing will be in effect for all taxpayers (small, medium, or large). The specific size of the turnover for e-invoicing will not be a relevant factor after this implementation. |

To simplify the transition to e-invoicing, the Inland Revenue Board of Malaysia offers 3 methods for the generation, processing, and transmission of invoices in Malaysia.

This article will explain everything businesses need to know about these methods and their processes for effortless e-invoice implementation.

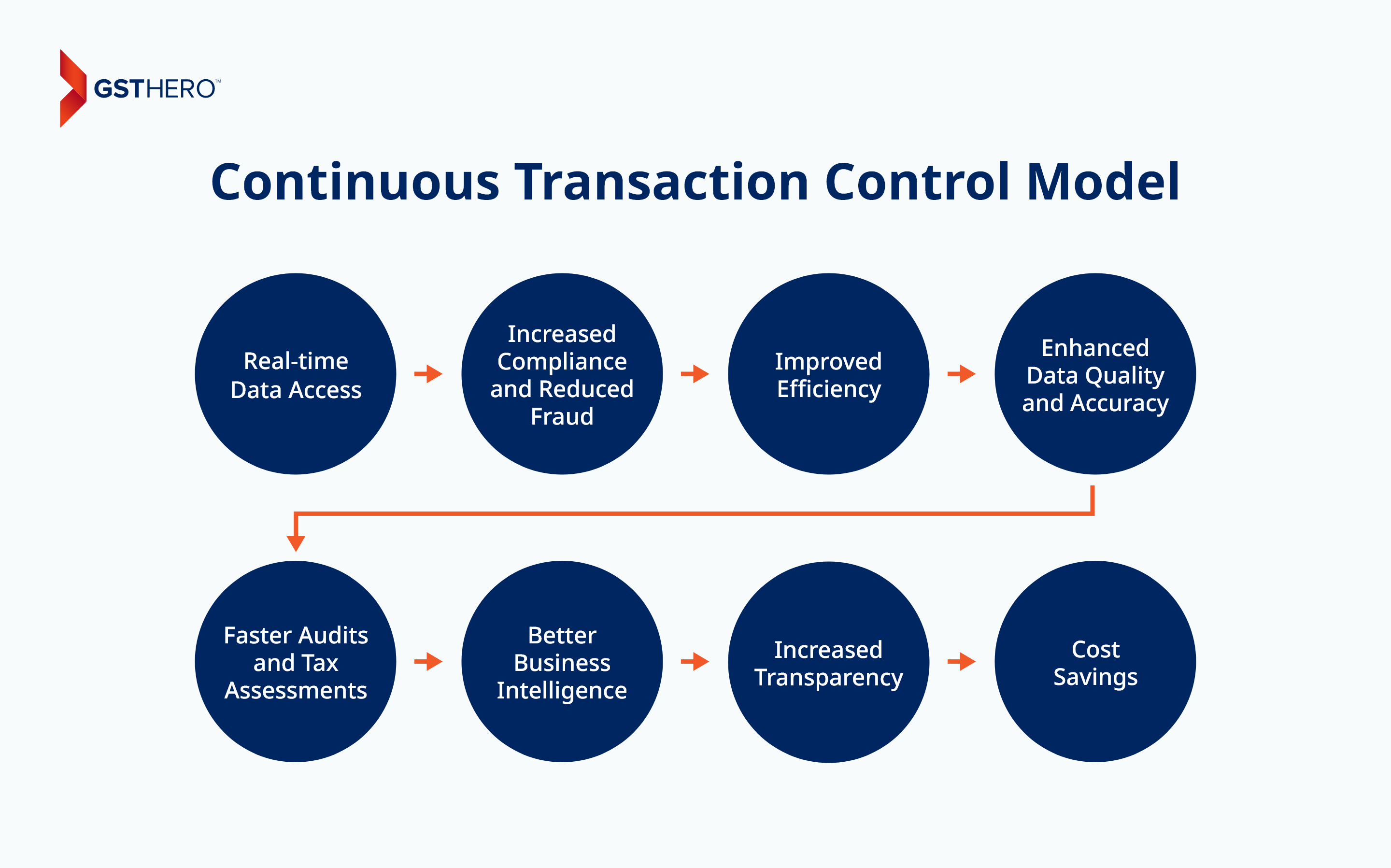

Continuous Transaction Control Model

The Malaysian government will use a Continuous Transaction Control (CTC) model for verifying sales invoices via the government’s API

The Continuous Transaction Control model includes a set of system protocols enabling real-time tracking of transactions and financial data by the official tax authorities. It helps them verify the compliance of a business through electronic invoicing while offering benefits like :

Real-time Data Access

CTC enables tax authorities to access transaction data in real-time or near real-time.

Increased Compliance and Reduced Fraud

By automatically reporting transactions as they occur, the CTC model minimizes the opportunity for tax evasion and fraud.

Improved Efficiency

Automating the process of transaction reporting through a CTC system reduces the administrative burden on businesses.

Enhanced Data Quality and Accuracy

Continuous transaction controls help improve the accuracy and quality of financial data.

Faster Audits and Tax Assessments

Malaysian tax authorities can conduct audits more efficiently with real-time data at their fingertips.

Better Business Intelligence

The data collected through CTC can provide valuable insights into market trends and business performance.

Increased Transparency

CTC systems promote transparency in the business environment, as all transactions are recorded and easily traceable.

Cost Savings

CTC reduces the need for manual interventions and corrections, which ensures significant cost savings for businesses and tax authorities.

e-Invoicing Methods in Malaysia

Now, the 3 key methods offered by the Malaysian tax authority allow businesses to choose according to their requirements in customization and volume. These models simplify the reporting/transmission of invoices to the IRBM.

- The MyInvois Portal

- Application Programming Interface (API)

- Peppol Service Providers

The MyInvois Portal

The MyInvois Portal is a free web-based platform hosted by IRBM/Lembaga Hasil Dalam Negeri Malaysia (LHDN). It is ideal for uploading invoices, especially when connecting to APIs for E-invoice is an obstacle.

Regardless, it is more suitable for small and medium-sized businesses or large enterprises with low invoice volume requirements. In short, it can only process limited volumes of data.

The MyInvois portal offers e-invoicing templates to ensure businesses can conduct hassle-free e-invoicing without needing any additional tools or invoice software. Malaysia’s tax authority facilitated this process further by making ERP integration with MyInvois easy and faster.

And more, the portal offers flawless compatibility with both Web and Mobile Interfaces.

To manually upload an invoice to MyInvois, follow these steps :

- Visit the MyInvois website and log in to your account.

- Click on the “Invoices” tab.

- Select “Add New Invoice”.

- Choose the “Manual Upload” option.

- Browse for the invoice file you wish to upload.

- Click the “Upload” button.

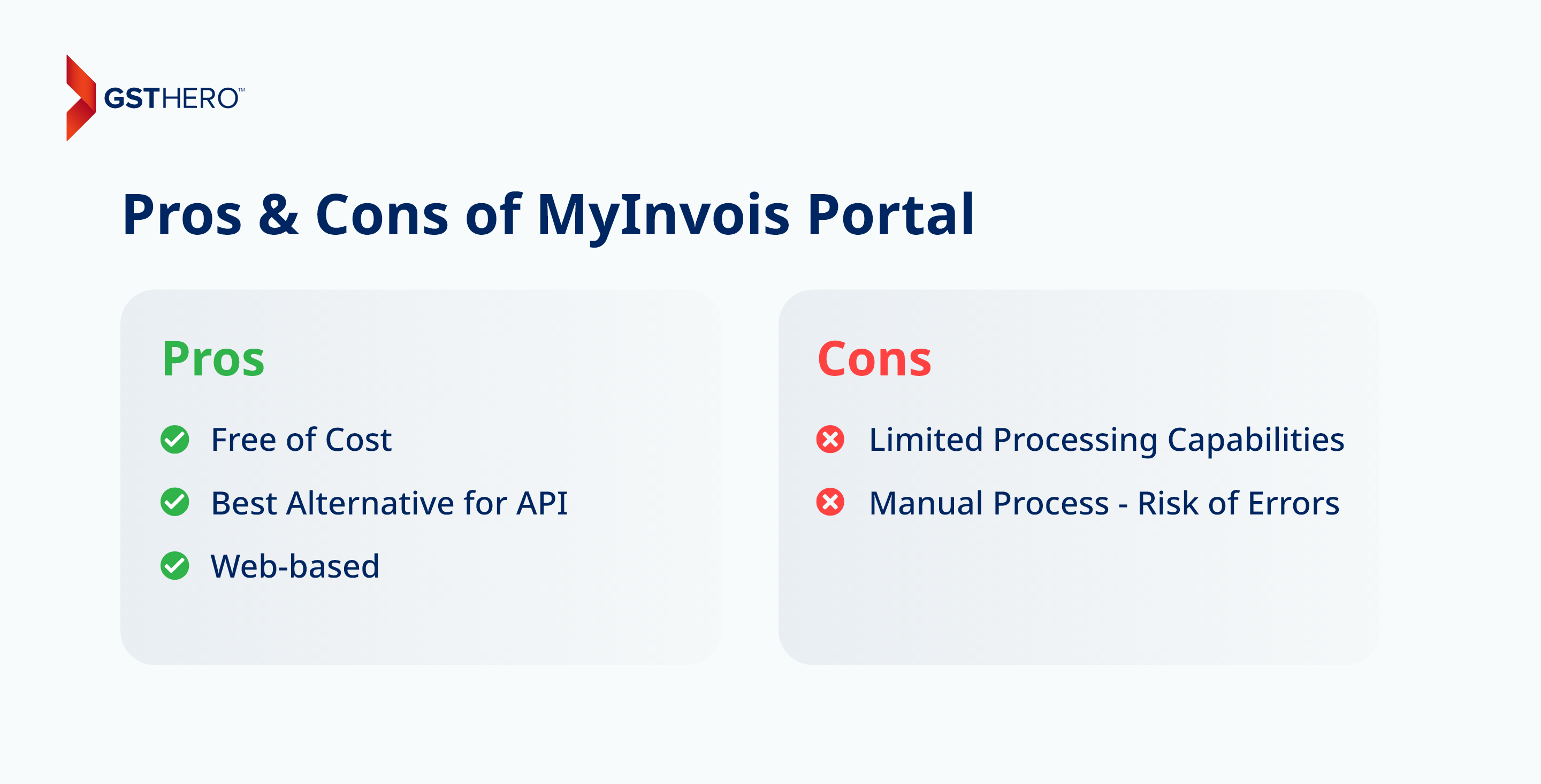

Pros of The MyInvois Portal

When considering the benefits of e-invoicing, the MyInois Portal stands out in terms of availability, user-friendly features, and IRBM compliance.

Free of Cost

A free portal offering ease of use, an ideal option for Micro, Small, and Medium Enterprises (MSMEs).

Best Alternative for API

A perfect alternative when your business is having trouble connecting to APIs for e-invoice generation.

Web-based Platform

It is a web-based platform offering user-friendly compatibility with both mobile and web interfaces.

Cons of The MyInvois Portal

While the cons are few, they must be known by every business before using the MyInvois portal.

Limited Processing Capabilities

It can only process small or limited volumes of data, making it unsuitable for large enterprises.

Manual Process - Risk of Errors

The MyInvois portal includes a manual process for managing invoices digitally, which increases the chances of errors and slows down the B2B invoicing process.

Application Programming Interface (API)

The API option is a powerful solution for E-invoice transmission, especially when you have to generate and process large volumes of invoices.

It enables direct transmission between the system used by taxpayers and the MyInvois Portal.

Businesses can take advantage of the real-time generation of E-invoices within the ERP systems, directly delivering them to the IRB database without manual intervention.

These API-generated E-invoices are also instantly available for validation and approval process.

With integration and automation, API methods offer better operational efficiency and customization to businesses in e-invoicing.

For example, a business can use an enterprise resource planning (ERP) system like SAP to integrate with the MyInvois portal invoice transmissions. Direct integration enables close to real-time data synchronization between the ERP and the MyInvois portal.

However, investment in customization and technology is necessary for using API in Extensible Markup Language (XML) or JavaScript Object Notation (JSON format).

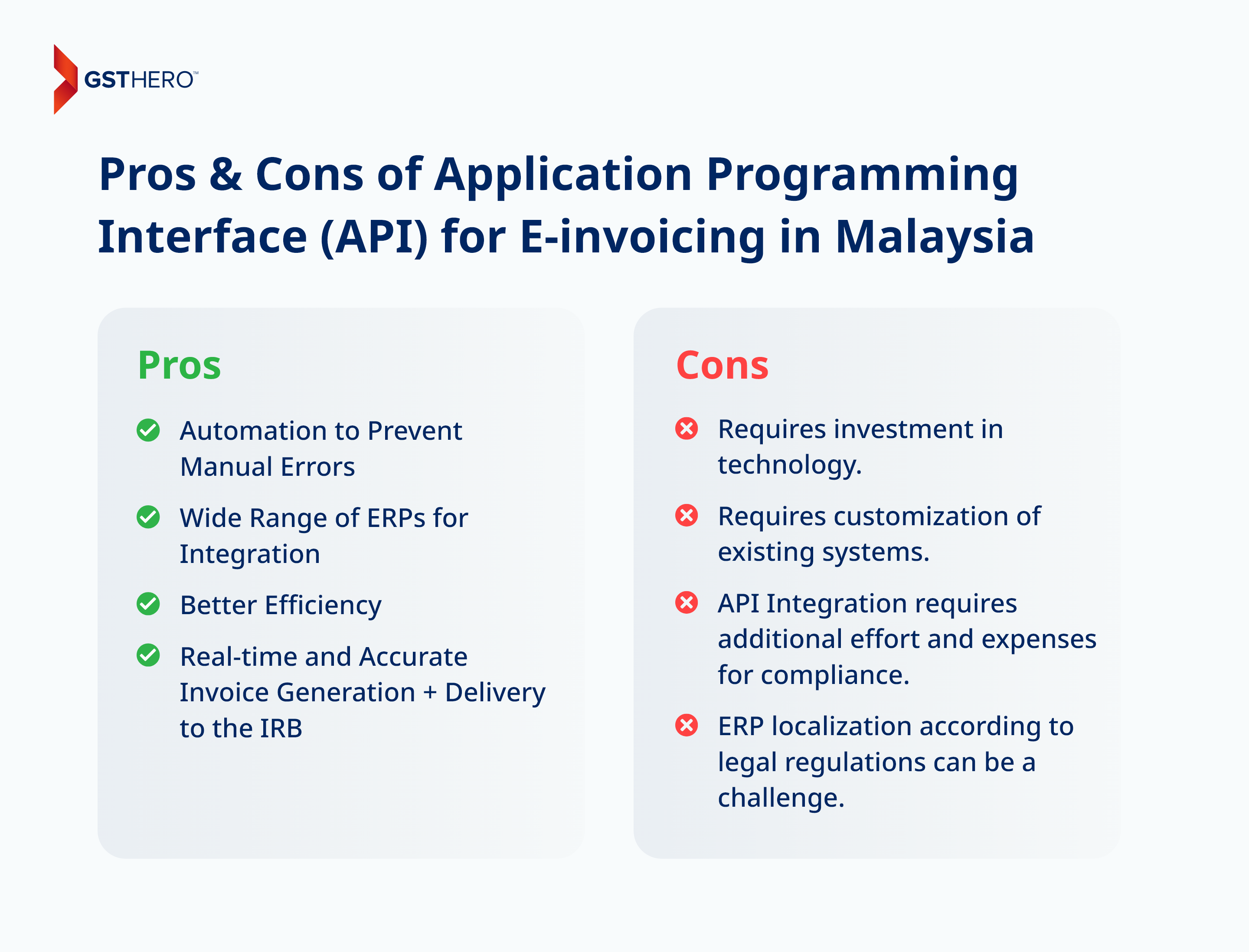

Pros of Application Programming Interface (API) for E-invoicing in Malaysia

Implementing e-invoicing in Malaysia will be much easier for businesses if they choose the API model for transmission.

Automation to Prevent Manual Errors

API integration can offer the full power of automation in e-invoicing to accelerate processes, prevent manual errors, and improve cash flows.

Wide Range of ERPs for Integration

Several enterprise resource planning (ERP) systems for e-invoicing are available for businesses to compare and choose from.

Better Operational Efficiency

The electronic medium and automation will improve the overall operational efficiency of the business in invoice generation, processing, and validation.

Real-Time Invoice Generation and Validation + Delivery to the IRB

Real-time generation + validation is a valuable benefit of an API, along with quick delivery to the IRB portal for validation.

Cons of Application Programming Interface (API) for E-invoicing in Malaysia

As mentioned before, even if the cons are few, you must know everything about them before choosing any e-invoice Malaysia model.

Requires investment in technology

MSMEs or even large enterprises may struggle if the investment in technology required for e-invoicing does not guarantee a lucrative ROI.

Requires customization of existing systems

Customizing your existing system (according to the standards of the IRB) may prove to be a challenge for some businesses.

API Integration requires additional effort and expenses for compliance

The API integration process can prove to be time-consuming and costly for meeting the compliance requirements.

Challenging ERP localization according to legal regulations

Ensuring your ERP systems meet all the criteria of e-invoicing regulations in Malaysia can be a hassle.

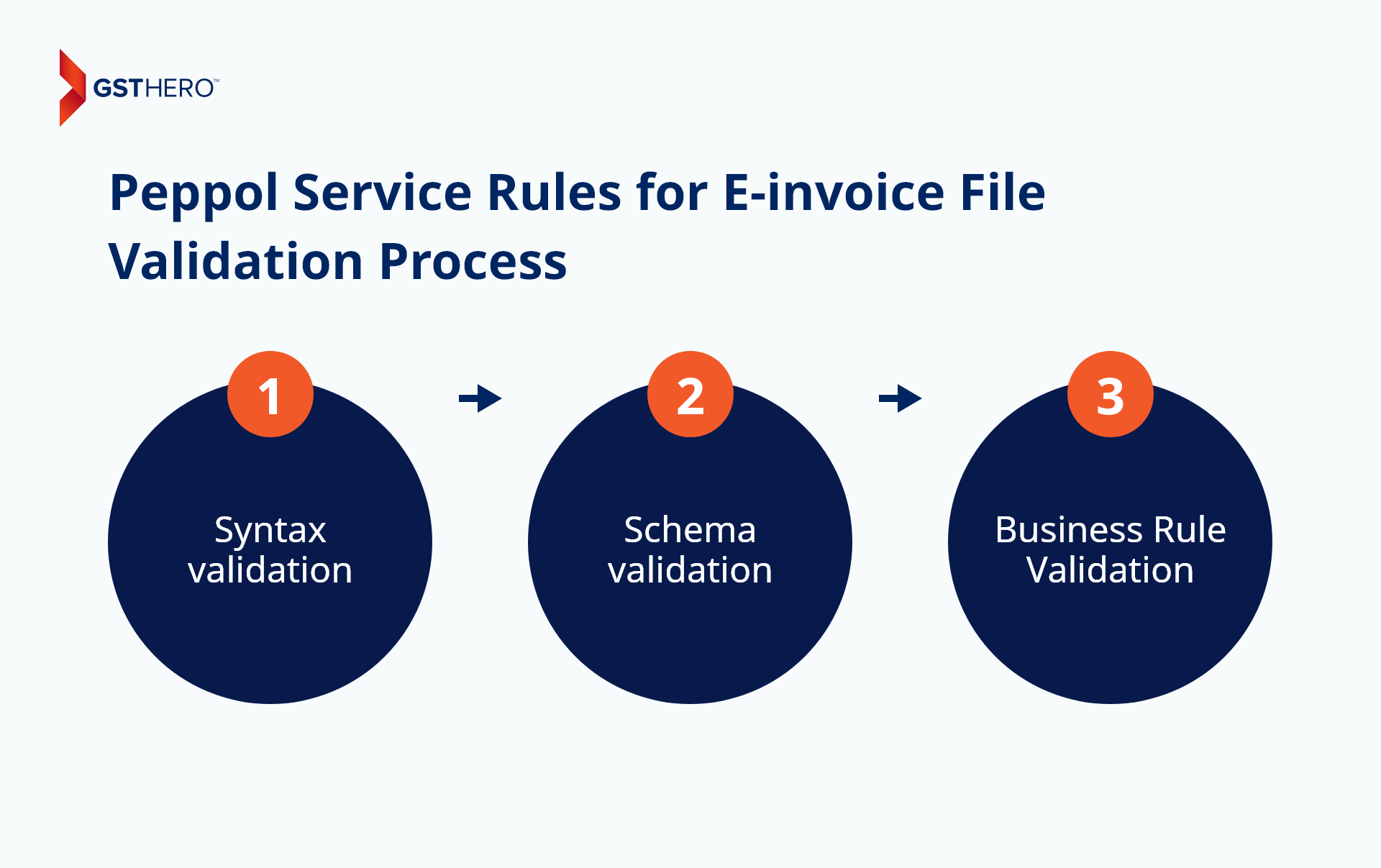

Peppol E-invoicing Service Providers (API Integration)

Using API integration through a PEPPOL service provider, Malaysia’s and cross-border suppliers will be able to incorporate better interoperability while transmitting e-invoices to the LHDNM.

For API :

During the E-invoice file validation process, the implementation of three types of validation takes place :

- Syntax validation

- Schema validation

- Business Rule Validation

These validations manage text and character data according to the UTF-8-character encoding standard. Following validation, buyers have a 72-hour window to request rejection, while taxpayers can request cancellation within 72 hours of receiving API notification.

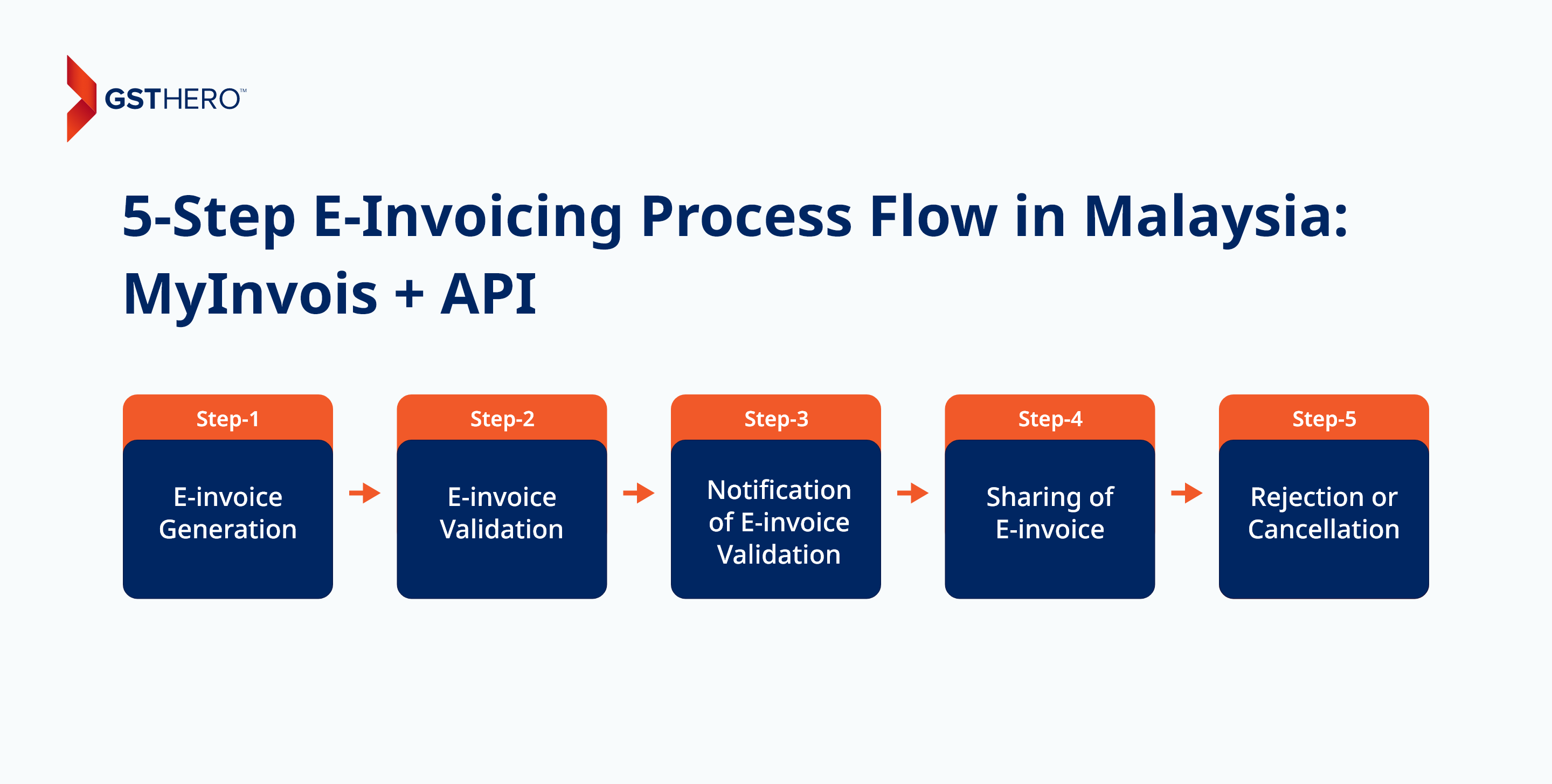

5-Step E-Invoicing Process Flow in Malaysia: MyInvois + API

Knowing how to generate e-invoices in Malaysia (Via MyInvois + API) is crucial to understanding the process workflow. It helps you ensure IRBM-compliant practices for e-invoicing in your business.

Step 1: E-invoice Generation

After a sale or transaction, the supplier will create e-invoices and share them for validation to the IRBM portal via MyInvois or an API.

Step 2: E-invoice Validation

The Inland Revenue Board of Malaysia conducts validation of these e-invoices in real time to verify compliance with the essential regulations and standards.

The IRBM then sends a Unique Identification Number (UIN) to the supplier via MyInvois or API post-validation. It will help suppliers have better traceability and prevent e-invoice tampering.

Step 3: Notification of E-invoice Validation

The IRBM sends a notification to both the supplier and buyer via MyInvois or API after the successful validation of e-invoices.

Step 4: Sharing of E-invoice

Post-validation, the supplier has the obligation to share with the buyer a validated E-invoice with an embedded QR code. The QR code generation helps verify the status and authenticity of the e-invoice through the MyInvois portal.

Step 5: Rejection or Cancellation

The buyers have a specific amount of time to accept or request the rejection of the e-invoices after the generation and successful validation.

Similarly, the supplier has a specific period of time to conduct the cancellation of e-invoices.

The approval of both actions requires valid justifications from each party.

Cancellation or Rejection of E-invoices

In the event of errors in an E-invoice, the buyer has a window of 72 hours from the validation time via the MyInvois portal or Application Programming Interface (API) to request its rejection.

A notification is promptly sent to the supplier upon initiating the rejection request with a specified reason.

Recently clarified by the IRB, if the supplier acknowledges the reason provided by the buyer, they may proceed to cancel the e-invoice within the same 72-hour timeframe from validation.

However, if the supplier does not acknowledge the buyer's request or fails to withdraw the e-invoice within the appropriate time, cancellation will not be allowed after 72 hours.

A new invoice will need to be issued for any essential modifications (like credit note or refund note E-invoice).

Conclusion

E-invoicing in Malaysia will bring about a lucrative shift in the country’s economy by streamlining invoicing and cash flows for numerous businesses. However, every business must carefully evaluate the regulation of e-invoicing in Malaysia by IRB before implementation.

It will help you build and determine an effective strategy for the transition to electronic invoicing and choose the right e-invoicing model suitable for the requirements of your business.

Since both the options, MyInvois or API, offer uniquely similar advantages and disadvantages, choosing the most ideal one could prove to be a hassle.

Consider using one of the best e-invoicing software in Malaysia, GST Hero, which offers easy integration with your existing ERP systems.

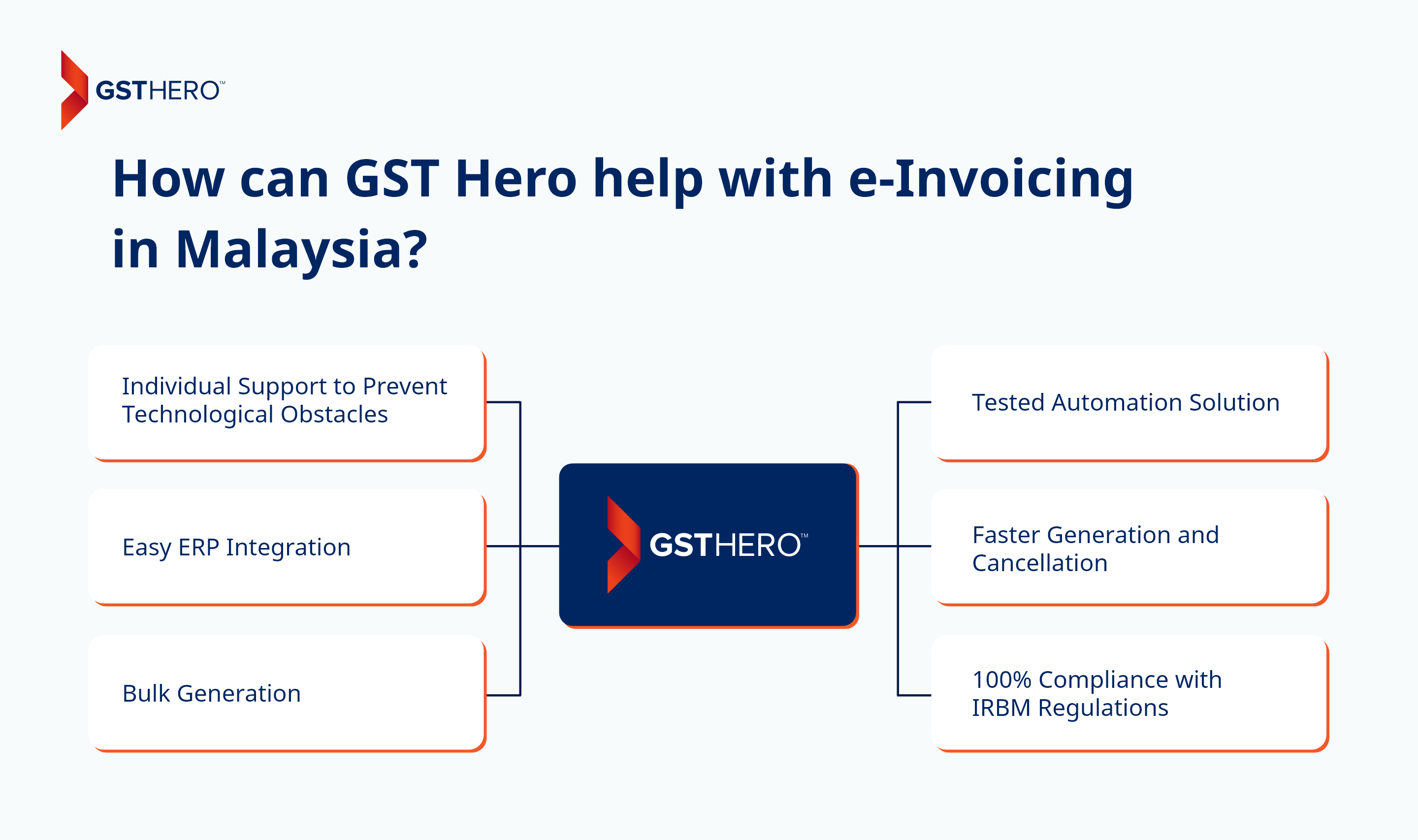

How Can GST Hero Help with E-Invoicing In Malaysia?

GST Hero is, without a doubt, the most IRBM-compliant e-invoicing solution provider in Malaysia you can find.

Key features include :

Individual Support to Prevent Technological Obstacles

You get support from a certified expert who will provide step-by-step guidance for e-invoicing in Malaysia through GST Hero and help you meet all compliance standards.

Easy ERP Integration

It facilitates quick integration with multiple ERPs like SAP, Tally, Oracle, Microsoft, and Custom ERPs to ensure compliance faster.

Bulk Generation

GST Hero has a processing speed of 8 million records in 40 minutes, helping you generate bulk invoices within minutes.

Tested Automation Solution

With GST Hero’s automation, you can expect better speed (operational efficiency), accuracy, and prevention of all manual errors.

Faster Generation and Cancellation

You can rapidly generate and cancel e-invoices with a single click.

100% Compliance with IRBM Regulations

The e-invoicing solutions are 100% compliant with IRBM’s regulations for e-invoicing in Malaysia.

GSTHero is a reliable partner in your journey towards effortless e-invoicing and compliance in Malaysia.