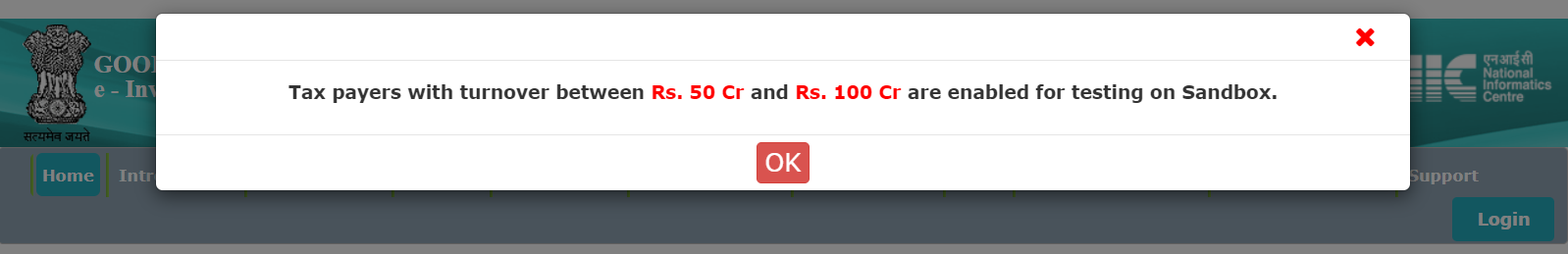

Recently, the e-Invoice portal of the Government of India has enabled an option for sandbox testing for businesses whose turnover falls in the bracket of 50 Cr. – 100 Cr.

This move indicates that the GST Council may soon start applying e-Invoicing system to the businesses falling under this turnover bracket.

It is most likely that the applicability date of the same will be 1st April 2021 however, there has been no official notification released by the Government about it.

Right now, it is high time for all the business entities that fall under the bracket of turnover of 50 Cr. – 100Cr, to start preparing for this change and equip yourselves accordingly with the necessary information about the e-Invoicing system.

Complying with the e-Invoicing norms will be mandatory for all the eligible businesses and failure in doing so will attract multiple tax implications including penalties which may go up to Rs. 10,000 per invoice.

If any business fails to generate e-Invoices or delays the e-Invoice generation process, it may cause further complications affecting the whole GST return filing process of the business himself as well as the customers.

Failure to generate e-Invoices may cause failure in auto-populating the GST returns while you file them on the portal, also your customers will not be able to claim the Input Tax Credit (ITC).

Hence, to avoid all the ill implications on your taxation process, it is always better to be well prepared with your e-Invoicing system in place and complete the sandbox testing within the prescribed time frame.

No need to be afraid of the e-invoicing system

The Government of India & the GST Council is constantly introducing new changes. These changes are not to be afraid of; rather they should be welcomed as a step towards a progressive taxation system.

The same holds for the e-Invoicing system. e-Invoicing has become very important since it was implemented first in the October of 2020.

e-invoicing will benefit the taxpayer & the government in multiple ways:

- Keeping a check on the tax evasion practices.

- Introduces transparency in the taxation system.

- Helps in claiming 100% eligible Input Tax Credit.

Getting ready in advance will help the businesses to avoid last-minute rush & make the process hassle-free. Nevertheless, businesses still have sufficient time to set up for this noteworthy change.

For more such updates stay tuned to the GSTHero portal.

You can contact us for LIVE e-Invoicing demo on - info@gsthero.com

We are catering to many e-Invoicing clients for 500 to 1000+ crore turnover bracket.