Beyond e-Invoice Compliance in Malaysia

10,000+

More than 10,000

Companies Trust

GSTHero®

135M+

GSTHero® Processes

More Than 135 Million

E-Invoices Annually

100+

GSTHero® is Integration

Ready with 100+ ERPs

including SAP & Oracle

Mastering Compliance Ecosystem :

A CFO's Roadmap to E-Invoicing Integration in Malaysia

Experience the power of 100% real-time compliance, backed by intelligent analytics and a comprehensive dashboard. Establish a single source of truth for compliance, ensuring auditability and data purity.

Why Inland Revenue Board of Malaysia (IRBM) is introducing E-Invoicing

Manual Invoicing Vs.

E-Invoicing

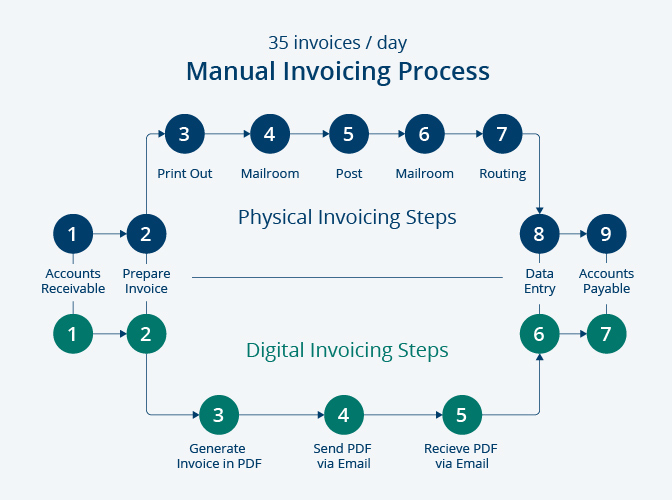

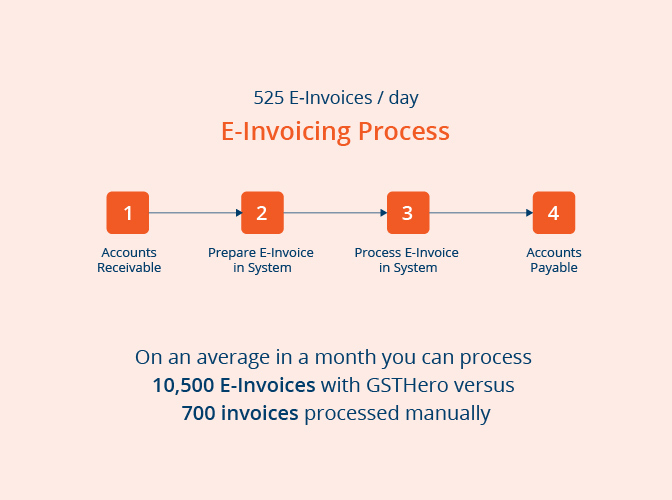

Manual invoicing in Malaysia involves the cumbersome process of creating, printing, and mailing paper invoices, leading to delays and errors. E-invoicing, however, revolutionizes this process by enabling electronic exchange, ensuring efficiency, accuracy, and compliance with Malaysian tax regulations.

Want To Learn More About E-Invoicing in Malaysia? Here's a Comprehensive Guide.

The GSTHero® Business Advantage

What GST Hero's E-Invoicing

Solution Can Do For Your Business!

GSTHero® is an intelligent middleware solution provider since 2017. Our e-invoicing solution provides

meaningful value to businesses - from cost savings to faster payment cycle - our solution can help

your business with increased profitability, cost savings and working capital.

84%

Savings in Cost

Experience Increase in Profitability

15x

Process Efficiency

Observe Increase in Process Efficiency

100%

Accurate Compliance

Eliminate Compliance Risk due to inaccuracies

100%

On-Time Compliance

Eliminate Delays with on-time compliance

99.99%

Uptime

Assured Business Continuity

80%

Faster Payment Cycle

Increase in Working Capital

96%

Shipment Cost Savings

Increase in Profitability

The Impact of GSTHero® on Your Business

Why GSTHero® is the Preferred

Choice of Businesses

GST Hero® offers more than just e-invoicing solutions; it provides a comprehensive automated business solution that ensures IRBM compliance. From safeguarding your reputation to offering analytics and streamlining business processes, GST Hero® is an LHDN-compliant solution for businesses seeking efficiency and regulatory adherence.

Brand and Reputation

Protection

Pure Data

Accessibility

Smart Analytics

and Dashboard Access

High Volume

Handling Capability

Real-time

Visibility

Supplier Relationship Improvement

Stringent Data

Protection

Process

Standardization

The Impact of GSTHero® on Your Business

What you will get with GSTHero

Over 1 billion e-invoices have been processed till date by GSTHero®. The solution is robust with capacity to handle high volume and loaded with features developed through customer research and feedback.

Duplicate E-Invoice

Protection

Access to

Reports

Bulk Generation

Option

Dedicated

Support Team

On-boarding

Support

Seamless

Integration with

any ERP

Single Dashboard

for all E-Invoice

Management

Supercharging your E-Invoice Process

How GSTHero® Works!

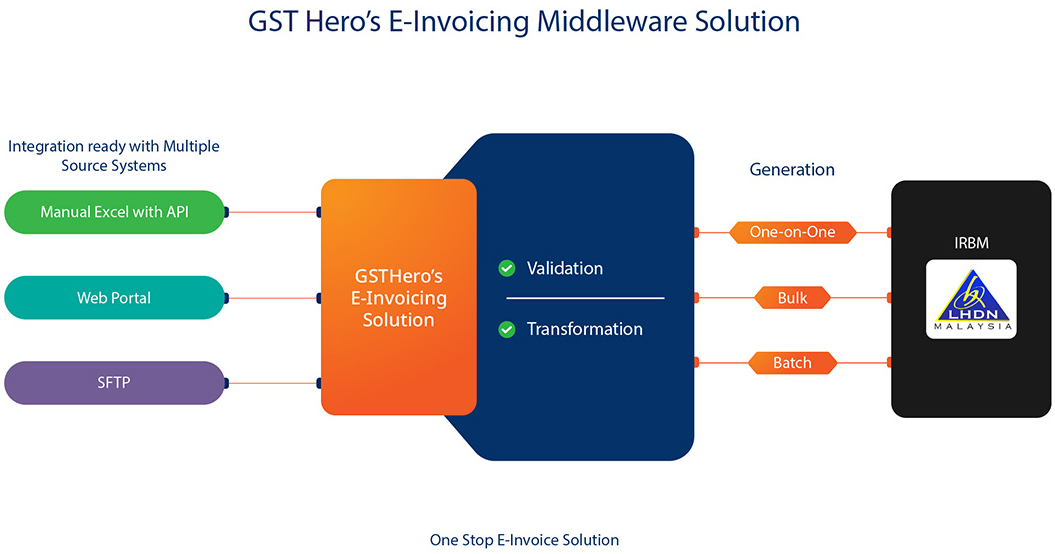

GST Hero’s middleware solution acts as a bridge between a business's internal systems and the IRB's platform. It converts invoices to the required format, ensures seamless integration, and provides real-time data transmission for verification.

Malaysia Regulatory Updates

Malaysia's e-Invoice Rollout Dates

1st January, 2025

Extension of e-invoicing mandate to taxpayers with an annual turnover exceeding MYR 25 million.

1st July, 2025

Full implementation of e-invoicing for all other taxpayers.

Transition to LHDN-Compliant E-invoicing in Malaysia.

Book a 15-minute demo with us, and see the value of our E-Invoicing solution, firsthand.

GST Hero E-Invoicing will help you in :

- Auditability & Traceability

- Faster Vendor Dispute Resolution

- Increase Overall Transparency

- Enhanced Reconciliation

Book a Demo

Integration Ready with 100+ ERPs

Global Brands Powered by GSTHero®

Frequently Asked Questions (FAQ)

GSTHero is the ideal solution for effortless and secure e-invoicing in Malaysia.

Key benefits include:

- 100% IRBM Compliance

- Individual Support to Prevent Technological Obstacles

- Easy ERP Integration

- Bulk Generation - processing speed of 8 million records in 40 minutes.

- Tested Automation Solution

- Faster Generation and Cancellation

By adopting e-invoicing solutions, companies can benefit from improved invoice accuracy, reduced processing time, and lower administrative costs. Moreover, e-invoicing helps maintain compliance with Malaysian tax regulations, including the SST invoice format.

As Malaysia progresses towards e-invoicing implementation, businesses can explore Electronic Resource Planning (ERP) systems integrated with e-invoicing capabilities to streamline their invoicing processes further. Additionally, leveraging PEPPOL service providers ensures seamless interoperability with global partners, facilitating cross-border trade.

With the Continuous Transaction Control (CTC) model, e-invoicing in Malaysia ensures real-time validation and monitoring of invoice transactions, enhancing tax administration efficiency and reducing the risk of tax evasion.

Overall, the adoption of e-invoicing in Malaysia signifies a significant step towards modernizing business practices, enhancing tax compliance, and fostering economic growth.

The Peppol Framework will be the leading solution in managing the e-invoicing system in Malaysia. Any software businesses use for e-invoicing in Malaysia will need to be Peppol-certified software.

For effortless and IRB-compliant adoption, it’s best to get assistance from a Peppol-certified e-invoicing solution provider in Malaysia. Such providers will ensure that your transition from traditional to electronic invoicing happens without any hassles and meets the standards of the Inland Revenue Board of Malaysia (IRBM).

The e-invoicing system in Malaysia will be introduced gradually, encompassing all sectors including B2B, B2C, and B2G transactions.