At the 37th GST Council meeting held at Goa on 19th September 2019, GST Council has decided that the New GST Return system will be applicable from 1st April 2020. The new Return system is based on the principle of matching.

Input Tax Credit availability will depend on, uploading of said details by Supplier.

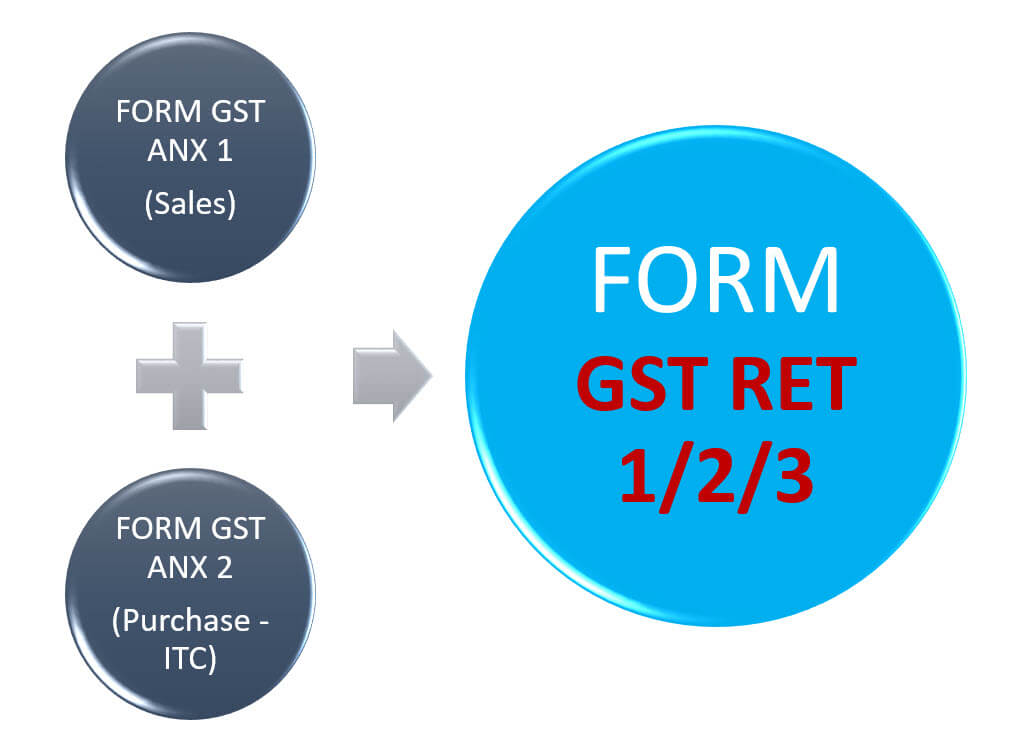

New Return has three internal Forms and required to be filled as per given due date: Form GST ANX 1 (Details of Sales), Form GST ANX 2 ( Details of ITC), and GST RET 1/2/3. Form GST ANX 1 is returned in which the taxpayer will upload details of sales. This return is similar to GSTR 1.

Most probably due dates for filing ANX 1, is going to the same like GSTR 1. Form GST ANX 1 is either required to be filled every month or quarterly basis, as per Return Frequency selected by the taxpayer.

Analysis of Form GST ANX 1 vis-a-vis GSTR 1

In this article, we will be discussing on Comparison of GSTR 1 vis a vis ANX 1 and what are the similarity as well as differentiating points.

You May Be Also Interested in Reading This Post:

Similarity Between Form GST ANX 1 and GSTR 1:

- Even though ANX 1 is different than GSTR 1, it has many similarities. The primary purpose of both of these forms is the same, and this is GSTIN wise details. Below are essential points, highlighting the similarity between both of there forms:

You May Be Also Interested in Reading This Post:

Difference between Form ANX 1 and Form GSTR 1:

Form GST ANX 1 is different from GSTR 1 in many points and structure. It contains not only details of Sales but also Reverses Charge liability, Import, etc. Below are essential differentiating points.

Is saying Form GST ANX 1 is just sales annexure and not separate return, whereas Form GSTR 1 was altogether separate return, in legal terminology.

However, in the real and practical sense, Form ANX 1 is nothing but return only. Therefore it is just playing with words by the government by calling sales-related Form as Annexure.

- The facility of amendment Return / Revised Return

There is no facility to amend or file a revised GSTR 1 return of a particular month. This has created a lot of issues and practical difficulties for the industry.

However, Form ANX 1, to some extent, gives facility to file amendment Return / Revised Return of particular month. For this purpose Form ANX 1A is required to be filed.

However, this facility in limited entries. For amendment of B2B entries on Form ANX1, the same procedure as Form GSTR 1 is required to be followed.

- Negative values

Form ANX 1 allows us to enter and report negative values in each field, whereas GSTR 1 doesn’t allow us to enter negative values. This is a welcome correction made by the government in the New Return System.

- SIX Digit HSN Details Required

GSTR 1, 4 digit HSN details were required to be given. However, in the New Return system, six-digit HSN Details are required to be provided. However, this is as per the draft form released by the government.

If 6 digit HSN is required to be given in Form ANX 1, then it will necessitate, amendment in Tax Invoice Rules, Rate notification as well.

It is recommended to the government that, instead of making it 6 digit, better make HSN 8 digit as per Custom Tariff so that classification issues under GST can be reduced.

- Refund Option for Deemed Exports and SEZ supply

Case of Deemed Exports ( Supply against Advance Authorisation, Supply to EOU, Supply against EPCG Authorisation ) and supply to SEZ unit, there is an option of claiming a refund of the unutilized balance of ITC or ITC charged on supply.

Said refund, either can be claimed by supplier or recipient. Under New Return System, in Form ANX 1, the Supplier needs to select the option “whether he will claim a refund or he allows the recipient to claim a refund.” No such field was there in GSTR 1.

As per the option selected by the supplier, a refund claim can be filed, either by the supplier or receiver. Therefore, due care needs to be taken while filling said details. Incorrect reporting will lead to restrict supplier/receiver from filing a refund claim.

You May Be Also Interested in Reading This Post:

- Reverse Charge Liability

- Implementation of GST, RCM is a big issue. Many taxpayers are required to obtain because of RCM liability, even though they mostly have exempted turnover. Under GSTR 1, RCM liability is never needed to be reported.

In Form GSTR 3B, simple summarized reporting of RCM liability is required to be done. However, under the New Return System, under Form ANX 1, RCM liability is also expected to be reported, as under:

- GSTIN wise, Place of Supply wise and Tax Rate wise details to be reported. (If the supplier is unregistered, then his PAN details to be submitted)

- Amount Net of Debit/Credit Notes is to be reported.

- ITC of this amount will be auto-populated in RET 1 in Table 4(A)(5)

This is a significant deviation in Form GST ANX 1 than Form GSTR 1.

GSTIN wise/ PAN wise details of RCM liability is required to be reported in ANX 1. This also necessitate

- Imports

Import of Services having RCM liability is required to be reported in Form ANX 1. This was not required in GSTR 1. Also, Import of Goods details is also required to be given in Form GST ANX 1.

However, said details are to be reported under ANX 1, till integration of ICEGATE Portal with GSTN Portal. Thereafter, said details auto-populate in ANX 2 and will not be required to be manually punched in ANX 1.

- GST on advances

Details of GST payable on advance received and Advance to be adjusted against invoice raised are required to be reported in GSTR 1. Said details are not required to be reported in GST Form ANX 1. It will be reported in Form RET 1/2/3 as applicable.

- ITC details of the missing invoice of more than two tax period

This is totally new reporting requirement in Form ANX 1. This was never required under the Old GST Return System. Under this table of ANX 1, such details of missing ITC availed is required to be reported, whose details are not uploaded by supplier for more than two tax period.

To give such details its going to be a complicated activity for professionals.

You May Be Also Interested in Reading This Post:

Final Verdict

This article is only for educational purposes. This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. We can accept any responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication.