In the 35th GST Council Meeting held on 21st June 2019, Council has finally announced the process for implementation of New Return Forms. New return forms will contain basically 3 forms GST Anx – 1, GST ANX – 2 and GST Ret – 01. New return forms will be applicable from October 2019.

Transition to New Return Forms –

Trial Phase - From July 2019 to September 2019, users can upload invoices using Form GST Anx -1. Also, GST Anx-2 (for purchases) will be available for view and download. No actions can be taken. GSTR 3B and GSTR 1 will have to be filed during this period.

Implementation –

Particulars | Month | Forms to be filed |

|---|---|---|

Large Tax Payer (turnover more than INR 5 crores) | October and November | Form GSTR 3B |

December | Form GST Anx 1 | |

Small Tax Payers (Turnover up to INR 5 crores) | October and November | Form PMT-08 |

December | Form GST Ret 01 |

Large taxpayers - From October 2019, it will be mandatory for larger taxpayers (aggregate turnover exceeding INR 5 crores in previous year) to file Form GST Anx -1 on monthly basis.

Also, GST Anx-2 (for purchases) will be available for view and download. No actions can be taken. Large taxpayers will have to file GSTR 3B for October 2019 and November 2019 but for December 2019 they will have GST Ret-01 in January 2020.

Small taxpayers - For small taxpayers (aggregate turnover up to INR 5 crores in previous year), Form GST Anx-1 to be filed for October 2019 to December 2019 in January 2020.

Also, GST Anx-2 (for purchases) will be available for view and download. No actions can be taken. Small taxpayers will not have to file GSTR 3B from October 2019 onwards.

They have to file Form PMT-08 for October 2019 and November 2019. They will file GST Ret-01 in January 2020 for the period October 2019 to December 2019. GSTR 3B will be discontinued from January 2020

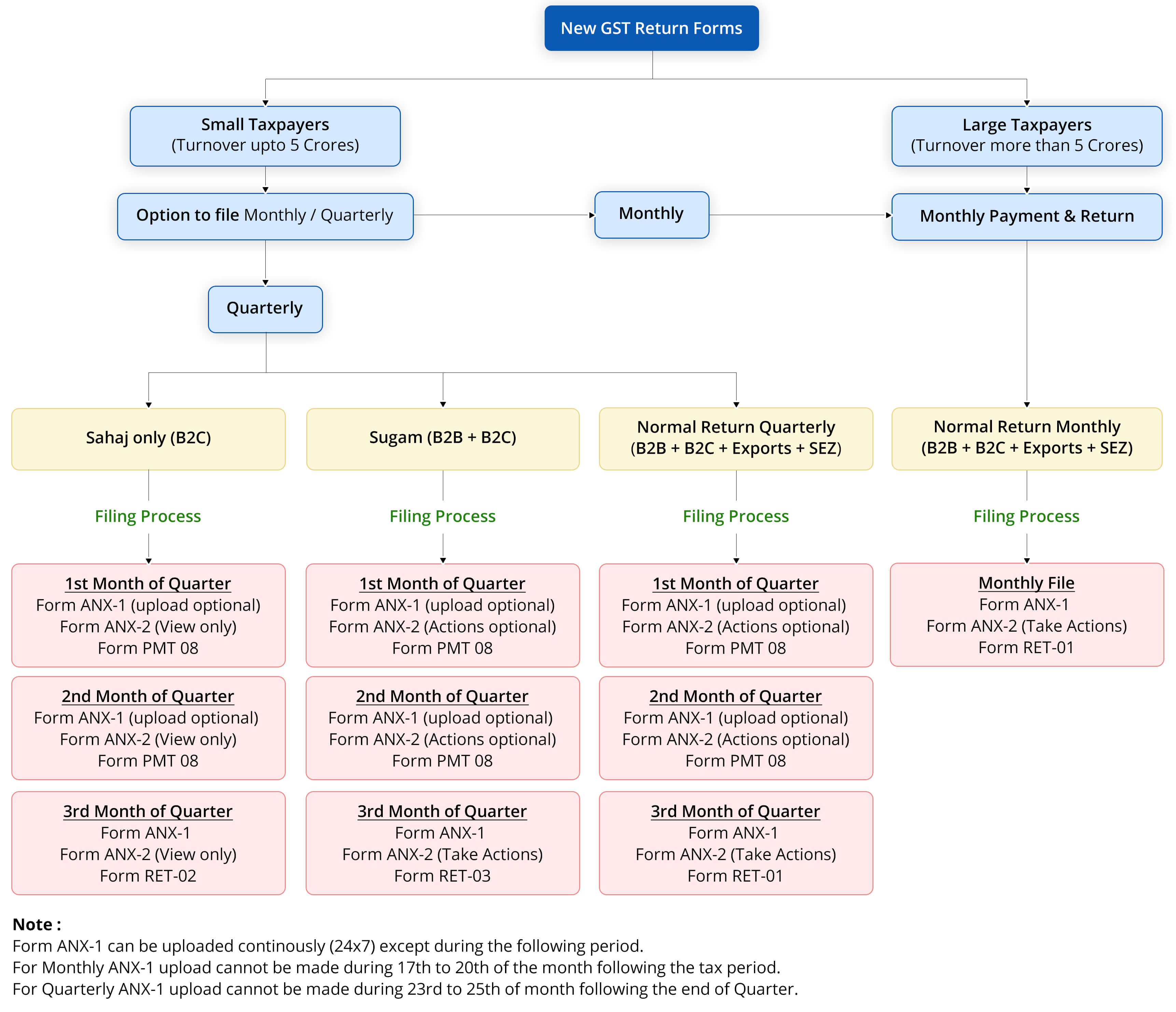

Various New Return Forms and its Applicability –

Note – Large taxpayers and small taxpayers opting for Sugam and normal return filing have to upload invoices on Form GST ANX-1 every month. Such upload may be made on continuous basis. Further, they also have to reconcile purchases uploaded in Form GST ANX-2.

1. For Large taxpayers

Large taxpayers are those registered dealers who are having turnover of more than INR 5 crores in the previous financial year. Large taxpayers are required to file return and make payment of liability on monthly basis.

2. For Small taxpayers

Small taxpayers are those registered dealers who are having turnover up to INR 5 crores in the previous financial year. Such taxpayers can either opt for monthly or quarterly filing of return. In case, he opts monthly filing, he will have to file returns on monthly basis. In case, he opts for quarterly return filing, he will have make payment on monthly basis in Form PMT -08 for first two months of the quarter and file return on quarterly basis. For quarterly return filing, three types of forms are available-

Sahaj – This form may be opted if the taxpayer has only outward supplies to unregistered persons i.e. only b2C sales. Such taxpayers cannot make supplies through e-commerce operators, take credit on missing invoices or allowed to make any other inward or outward supplies.

Sugam – This form allows you to record details for outward supplies made to both registered and unregistered dealers i.e. B2B plus B2C. However, no export details (exports, deemed exports, SEZ) are allowed to be recorded here. Such taxpayers cannot make supplies through e-commerce operators or take credit on missing invoices.

Normal return – This return allows recording of all outward supplies made including exports.

Preference Selection and Switchover –

Currently Opted For | Switch to | Frequency |

|---|---|---|

Quarterly filing or Monthly filing | Monthly filing or Quarterly filing | At the beginning of the financial year |

Normal (Quarterly) | Sahaj or Sugam | Once a year - at the beginning of the quarter |

Sahaj | Sugam / Normal (Quarterly) | More than once - At the beginning of quarter |

A taxpayer has to choose at the beginning of the year whether he is opting for monthly or quarterly filing. Once the selection is made, the same cannot be changed subsequently for that year.

For FY 19-20, such selection has to be made before filing return for October 2019. In case of quarterly return filing, preference may be changed as follows –

Downward revision – Change from normal return to Sahaj or Sugam or change from Sugam to Sahaj.

Such revision is allowed only once a year- at the beginning of the quarter.

You May Be Also Interested in Reading This Post:

Form GST Annexure 1 –

Particulars | |

|---|---|

Details to be uploaded | All liability payable – |

Who is required to upload? | Every registered person (Large taxpayers + small tax payers including those opting for Sahaj and Sugam) |

Periodicity | By 10th of every month However, it is a continuous activity. |

Credit availability to recipient | Monthly filing- For details uploaded till 10th – in the same month in which the sale is made For details uploaded after 10th – in the next month in which the sale is made |

Other details | - HSN wise data is not mandatory for small tax payers |

Form GST Anx-1 includes details of all liabilities payable. Thus, liability payable on inward supplies liable to reverse charge and on import of goods or services (excluding import of services from SEZ) are also to be reported in GST Anx-01.

Uploading details

Details of documents may be continuously uploaded in GST Anx-1. However, in case of monthly filing, taxpayer will not be able to upload details of documents from 18th to 20th of the month following the tax period for which the return is to file.

In case of quarterly filing, taxpayer will not be able to upload details of documents from 23rd to 25th of the month following the quarter for which the return is to be filed.

Availability of credit

In case of monthly filing, recipient will get credit based on details of documents uploaded by the supplier till the 10th of the following the month. Where documents have been uploaded after 10th, credit will be available in the next month and not in the month of receipt.

In case of quarterly filing, recipient will get credit based on details of documents uploaded y the supplier till the 10th of the month following the quarter. E.g. For quarter Jan 20 to Mar 20, recipient will get credit on documents uploaded by supplier till 10th April 20.

Other Information

Advances received on supply shall not be reported in Form GST Anx-1 but reported in Form GST Ret-01 on aggregate basis based on place of supply and tax rate

Nil rated, non-gst supply and exempt supply shall not be reported in Form GST Anx-1 but aggregate value (net of credit note / debit note) shall be reported in Form GST Ret-01. Non-gst supply shall include no supply.

HSN level details are not mandatory for small tax payers (having turnover below INR 5 crores). However, large taxpayers are required to mention HSN level data.

In case of supplies received from unregistered person and liable to reverse charge, PAN of such unregistered person is required to be mentioned.

Value of supplies and tax amount is to be reported either in whole number or up to two decimal points. No rounding off is available.

In case of credit notes, no original invoice details like invoice number or invoice date are required to be reported.

Negative values are accepted where supplies are reported net of credit / debit notes. It means where no supplies are made during the period but only credit notes are issued, negative values of such credit notes will be accepted.

There is no duplicate check at item level.

Option to mark invoices liable to refund in case of SEZ supplies, exports and deemed exports.

Advances for B2B liable to reverse charge (reported in table 3H) included in Form Anx-01 and ITC availed in Form GST Anx-02 to be reversed in Form GST Ret-01.

Missing invoices of Form GST Anx-2 to be reported in Form GST Anx-01. (See section missing invoices for details)

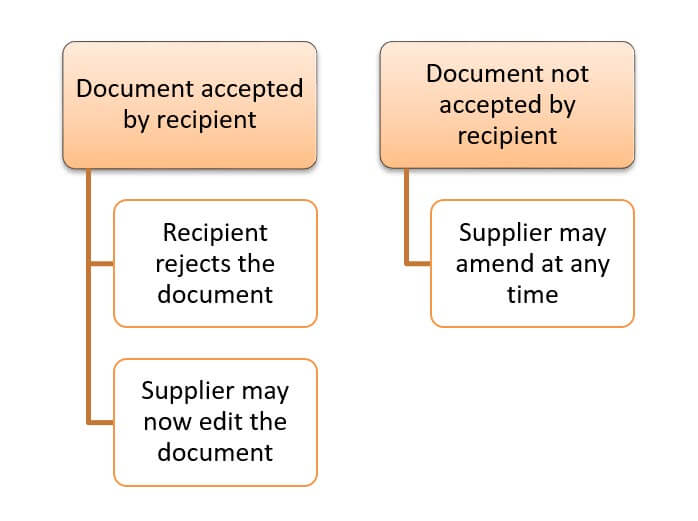

Edit / Amendment of uploaded documents –

Documents uploaded may be edited up to the 10th of the following month by the supplier only if the same are not accepted by the recipient.

Documents accepted by recipient up to 10th of the following month may be edited only after the same has been unlocked by the recipient for editing.

Amendments can be made only by the supplier. Where the recipient has accepted a document and later any amendment is required, the same shall be rejected by the recipient and then it shall be amended by the supplier.

Documents rejected by the recipient shall be intimated to the supplier only after the recipient has filed his return.

Amendment of supplies made to composition tax payer, Input service distributor, unregistered person, etc. may be made anytime

Amendments to be reported at full value in Form GST Anx-01 whereas only delta value is to be reported in Form GST Ret-01.

No amendments after six months from the end of the financial year to which the original document pertains.

Form GST Annexure 2 –

Particulars | |

|---|---|

Details mentioned | Details of documents uploaded by the supplier |

What is to be done? | Action is to be taken on the details – accept, reject or pending |

Who is required to take action? | Every registered person except those opting for Sahaj quarterly return filing. |

No action taken | No action taken of details uploaded and main return is filed, documents are assumed to be deemed accepted |

Status | Supplier filing status will be shown in this form |

Unavailable credit | If a supplier hasn’t filed return for two consecutive period, no credit will be available to the recipient |

Form GST Anx-02 is an auto drafted form giving details of inward supplies. Details of documents are auto populated in this form based on information uploaded by the supplier. These details are updated on real time basis and actions on such documents may be taken by the recipient. Recipient can accept, reject or keep the document pending on continuous basis.

- - Accepted documents signify that the details uploaded by the supplier are correct and that there is no dispute against same. Accepted document will not available for editing or amendment by the supplier until the same is rejected by the recipient.

- - Rejected documents will be informed to the supplier after the return for that period is filed by the recipient. In case of monthly filing, it will be informed after the monthly return is filed and for quarterly filing, it will be informed after the return for that quarter is filed.

- - Where no action is taken by the recipient but return is filed for that period, all documents in Form GST Anx-02 will be deemed accepted.

- - In case of pending documents, no input tax credit for the same may be availed. Documents may be kept pending for a period of 18 months or end of six months from the end of financial year to which it pertains. After such period, the document will be rejected and no credit for the same can be availed.

- - Form GST Anx-02 will also show the filing status of the supplier whether filed / not filed.

- - Where a supplier has not filed his return for consecutive two return periods, all invoices uploaded by him in the consecutive tax period will be visible to the recipient but no credit on the same can be availed by the recipient. Such input tax credit can be availed by the recipient only after all pending returns are filed by the supplier.

- - Details of input tax credit on imports have to be uploaded by the recipient based on tax paid by him under reverse charge as per Form GST Anx-01.

Missing Invoices –

Taxpayer may identify all the documents that have not been uploaded by the supplier.

- If the supplier has not uploaded documents up to T+2 period (for monthly filing) or T+1 (for quarterly filing), the recipient may report the details of such documents in his Form GST Anx-01.

- The recipient may avail the credit on such missing documents on provisional basis. He shall then have to reverse the credit availed on provisional basis when the supplier has uploaded the document and the same is being reflected in Form GST Anx-02 of the recipient.

- If no details are uploaded by the supplier till the end of 18 months then such credit if already availed will have to be reversed by the recipient.

Form GST Ret-01 (For monthly and quarter (normal) filing) –

Particulars | |

|---|---|

Details pertaining to | It is a main return determining liability payable. |

Who is required to file? | Every registered person who has opted for – - Monthly filing - Quarterly (Normal) filing |

Monthly filing – By 20th of the next month to which the liability pertains Quarterly filing – By 20th of the next month of the quarter to which the liability pertains | |

Payment of tax | Monthly filing – Through this form i.e Form GST Ret-01 Quarterly filing - Through Form PMT-08 for first two months of the quarter and for the 3rd month through Form RET 01 |

The taxpayer shall file main return i.e. Form GST Ret-01 after he has uploaded details in Form GST Anx-01 and taken action on details in Form GST Anx-02.

Details uploaded in Form GST Anx-01 and actions taken on Form GST Anx-02 will be auto populated in Form GST Ret-01.

Advances received / adjusted, value of nil rated, non-gst and exempt supplies, RCM on outward supplies, supply of goods by SEZ may be updated by the tax payer.

Taxpayer may claim provisional input tax credit for invoices missing in Form GST Anx-02.

Any ineligible input tax credit under GST availed by the tax payer shall be reversed.

Out of the total available input tax credit (ITC), taxpayer is required to give breakup of it into capital goods and input services. The balance shall be credit available on inputs.

Late fees will be auto calculated whereas interest payable, if any will have to be calculated by the taxpayer.

Other Forms –

Particulars | |

|---|---|

Form PMT -08 | - To be filed by tax payer opting for quarterly filing. - Due date – 20th of the month succeeding the month to which the liability pertains. - To be filed for only first two months of the quarter. - Only eligible input tax credit shall be availed through this form. Thus, ineligible credit shall be reduced from total input tax credit before reporting the same here. |

Form GST Ret – 2 (Sahaj) | - Quarterly filing - Details of only B2C for outward supplies and inward supplies liable to reverse charge may be uploaded - E-commerce operators cannot file this form - Details of exports, SEZ sale, deemed exports cannot be uploaded here. |

Form GST Ret – 3 (Sugam) | - Quarterly filing - Details of only B2B and B2C for outward supplies and inward supplies liable to reverse charge may be uploaded - E-commerce operators cannot file this form - Details of exports, SEZ sale, deemed exports cannot be uploaded here. |

File your GST returns in minutes, not hours!

Get Live Demo and experience the simplicity by yourself.