If you love a transparent and comprehensive approach when it comes to filing your GST, if you have doubts regarding your deductions, and if you want a simplified and swifter system for your business’s GST filing process, we’ve officially found you a solution that transforms GST preparation from a nightmare into a dream. We are introducing GST filing software features which will making your GST simple.

GSTR 1 return filing, GSTR 3B filing & GSTR 9 annual return are the most important GST returns under the GST taxation system. In this comprehensive article, we have explained the easiest way to file all your GST returns without any errors.

Tax preparation software for professionals contains many helpful functionalities that establishments can rely on when filing taxes.

It covers any troubles regarding GST filing errors and deduction claims that ensure maximum profit. More importantly, it supplies companies with peace of mind through guarantees that confirm you’ve filed your taxes in the most efficient and effective way that benefits your enterprise.

To help you understand the very important facts about GST return filing online, we have created a detailed blog to help you devise a perfect GST plan for your business.

Because of this, the demand for tax preparation & filing software for professionals continues to expand, with Research and Markets predicting that the worldwide tax software market will hit $24.8 billion by 2027, with a compound annual growth rate of 11.2% during the forecast 2020 to 2027 forecast period.

If your company needs what we have just described above, then you might want to consider obtaining a GST filing software of your own. In addition to this, you might also want to get a brief background regarding the integral capabilities that you require in your GST filing process and in your enterprise’s environment to make sure that you get the best GST filing software for your business and that you find the best way to file GST online.

Here’s our take on the 3 most vital GST filing software features you need from your GST preparation and filing software for professionals.

Accurate and quicker filing of GST returns

If you’re considering to e-file your GST returns, you need a slew of capabilities that will make the entire process less complex and more seamless.

For instance, you need advanced reconciliation to claim as much Input credit as you can for your company. To easily examine this aspect, you can also rely on your software to download reconciliation reports with sole command.

Your tax filing app should also be able to guarantee no problems when it comes to using one time passwords and must always promise precision and safety towards anything concerning the information you’re entrusting them with.

It must also be up to speed with any changes in GST return filing.

For example, there might be a new distinction between exports and deemed exports in the new GST return process. Your software for e-file must be able to accommodate these modifications and to what your venture demands.

To ensure a more streamlined process, check if your tax preparation software for professionals offers integrations with other platforms such as bookkeeping systems and enterprise resource planning software, so that you can easily merge your GST return filing process with the rest of your accounting pipeline.

Lastly, be sure to hop on the cloud computing trend and check whether your tax filing app is online and anchored on the cloud. One of the Tax software features that are important for business is convenience, and nothing spells it like the cloud.

Having a GST filing Software that is cloud-based eliminates the strain of hardware and on-premise deployment and ensures that you can access your system and file your GST returns anywhere and anytime.

Read this post to know more about GST Filing

E-invoicing through Your ERP

For a more streamlined way to file GST online, you can also utilize another key functionality in your GST filing platform: generating invoices through your ERP software (Tally, SAP, Oracle, Microsoft and Others).

Having an ERP is absolutely necessary for any organization that aspires to thrive, since it automates and supports a wide array of organizational and operational company mechanisms, including procedures that involve e-file.

When your GST filing Software and ERP collaborate, you can skip manual data entry and produce an e-invoice with a single click.

Integrations are important if you want to effectively file your GST online. For instance, you’re a Tally user. You’re enjoying the platform’s ability to adhere to GST policies and oversee all your customers’ information, and you’re also using it for issuing e-invoices. You need a GST software that can easily merge with Tally so that you can be confident when it comes to compliance for your venture.

With these capabilities, you can eliminate the unnecessary drop-by at a government e-invoice portal. You can even download and put your electronic invoice on paper complete with a QR code and an IRN - Invoice Reference Number.

If you’re worried about security, be sure to select a GST filing software that possesses an ISO 27000 certification. After all, safety is part of the best way to file GST online.

You want to give your customers the best possible service without compromising the data they’ve entrusted you with, and you also want your reputation to remain stellar and trustworthy.

Because all these are linked with your ERP, you can directly input an automatic account of acquisition invoices into your system to make sure that this step in e-file is fully integrated with your entire tax preparation pipeline.

Best of all, you can perform bulk actions in less than 5 minutes. When you encounter any issue, you can contact tech support to help you jump back to smooth sailing.

With these features, you can create a more effective, convenient and cost-efficient electronic invoicing mechanism for your patrons. Plus, you’ll have more time to focus on more pertinent elements of your tax preparation process, on other pressing concerns surrounding your company or on matters that encourage enterprise growth.

All about e-Invoicing under GST portal watch video to under the process

Important Integration Ready for 100% compliance

We’ve already brought up the Tally connector in our third point, but a robust GST filing software can guarantee compliance upon integration with various other platforms.

While some people prefer to use Tally, others can view SAP as a platform that can help them follow the best way to file taxes online, e-Invoicing and E-way Bill combine.

SAP enables your company to effectively facilitate demands related to transactional and analytical GST demands by recording and registering compliance, and precise calculation and validation.

These integrations usually do not involve extra license or plugins, so you don’t have to worry about purchasing or searching for other tools to accomplish the merge.

SAP and Tally are but two integrations we have mentioned. It’s best if you look at the other integrations being offered by your GST filing Software to measure the extent of your platform’s capabilities.

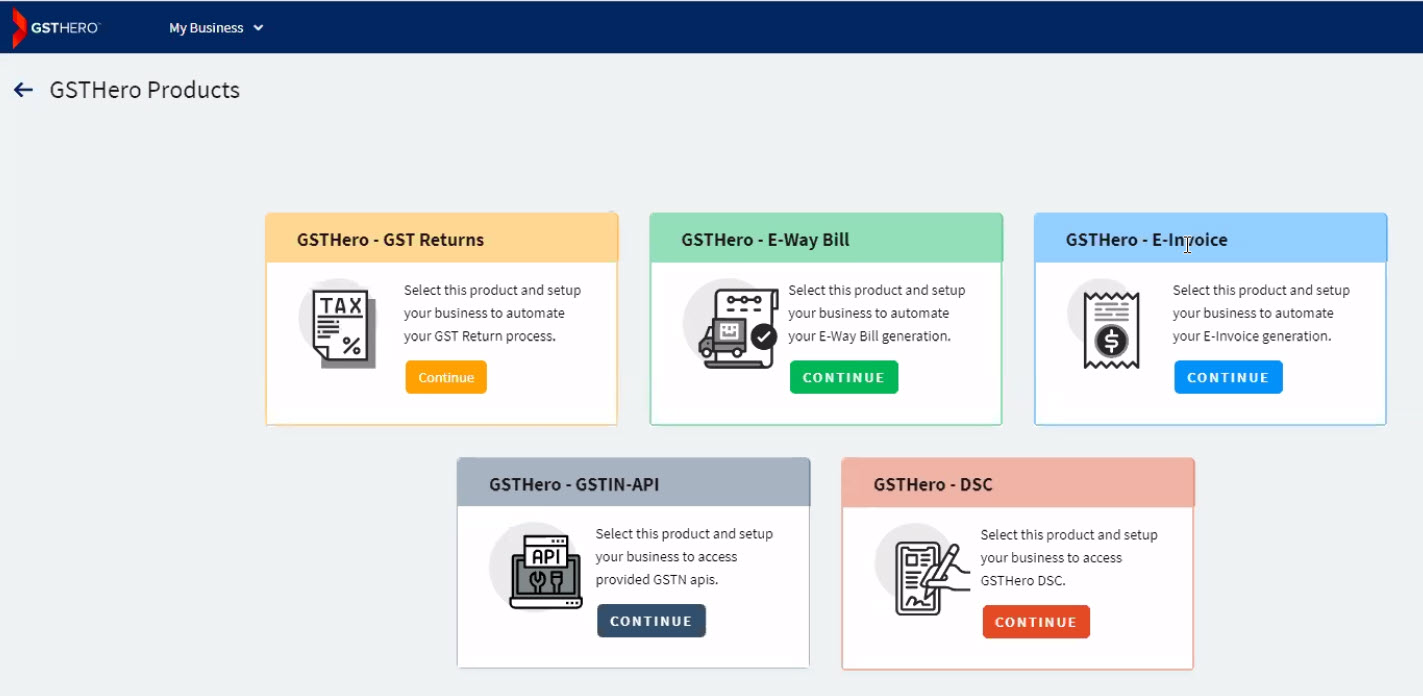

GSTHero provides 3 in 1 platform for GST Return Filing, e-Invoice and e-Way Bill together from one dashboard. This ensures 100% GST Compliance right from your ERP.

GST Filing Cloud Software: Making GST preparation & Filing A Breeze

GST filing can never be engaging or might not be that easy, but with the right GST preparation & filing software for professionals, you can turn the year’s worst accounting process to a quicker experience.

If you’re looking for the best way to file GST online and if you’re convinced about having the features we’ve listed and discussed above, you can turn to GSTHero and give our services a try.

File your GST returns in minutes, not hours!

Get Live Demo and experience the simplicity by yourself.