India's 50 million small and medium-sized companies provide about 40% of the country's GDP (MSMEs). In addition, the industry contributes to the nation's industrial output, employment, and exports. e-Invoicing for MSMEs beneficial for the all small and medium sized firms, article speaks on 5 critical challenges business might be face in future.

The daily operations of an MSME need them to carry out various tasks, one of which is maintaining Goods and Service Tax compliance (GST).

These statistics are impressive but cannot be used to draw firm conclusions.

The MSMEs businesses have progressively taken over the spotlight and ensured that the nation's wealth is distributed fairly. As a result, the government has prioritised MSME growth and promotion because it understands their importance.

Small companies find it challenging to secure financing, whether it's for a pharmacy or a medical supply store. A typical small business organisation encounters several difficulties.

The e-Invoicing, or electronic invoicing system, debuted in 2020. Since then, many businesses, particularly micro, small, and medium-sized enterprises (MSMEs), have had to deal with a slew of regulations. However, it is still tricky for newly included small businesses that have been pushed into the compliance system.

The Indian government's long-term goal is to change the way businesses interact with one another through e-Invoicing. Some of the envisioned goals include transparency, efficiency, and productivity.

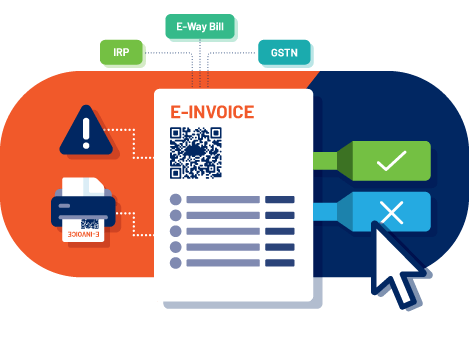

The goal of E-Invoice is to reduce mismatch mistakes in data reconciliation between sellers and purchasers under the GST Input Tax Credit system. e-Invoices generated by one programme may be read by another, providing compatibility and consistency. This technique eliminates fake GST invoices.What real challenges do MSMEs face

A lower e-Invoicing threshold is intended to lower tax evasion and false billing. Businesses must now synchronise their departments with the electronic invoicing site IRP (Invoice Registration Portal) for all B2B invoices to quickly generate IRNs (Invoice Reference Numbers).

In addition, they must convince their accounting software to undergo modifications to comply with the e-invoice structure framework. The following are some ways that the e-invoice generation will affect e-Invoicing for MSME processes:

- Updating ERP - Companies will need to update and upgrade their systems to be ready for e-Invoicing. This can be difficult if no separate team manages the process's technicalities. Essentially, the data points required for generating an IRN must be extracted from the systems, which necessitates a review of data points to ensure they are present in the systems.

Furthermore, after IRN generation, the signed QR, IRN, and other details can be updated in ERPs so that QR printing on invoices can be handled from ERP. - Connecting to IRP (Invoice Registration Portal) through APIs and Data Mapping - IRP is accessible to taxpayers who meet the threshold through APIs, providing a mechanism for sending and receiving taxpayer data.

- Handling errors and exceptions - e-Invoicing applies to B2B (Business to Business) transactions (including B2G - Business to Government). Therefore, domestic supplies, Exports (including Deemed Exports), Supplies to SEZ, B2B, Reverse Charge Invoices, and Supplies through E-commerce Operators, RCM, are all covered by e-Invoicing.

As a result, the likelihood of errors and exceptions is high. In addition, many people find the process of creating e-invoices difficult. There have been several roadblocks and hurdles in successfully generating IRN - through the portal or GSPs. - E-way Bill - E-way Bill generation is now integrated with e-Invoicing. For documents that qualify, IRP can be used to generate not only IRN but also E-way bills. As a result, depending on the data sent, the IRP system will return an IRN, an E-way Bill Number, or both.

If the taxpayer includes transportation information with the invoice, IRP communicates with the E-way Bill portal in real-time and E-way bill generation. - Data extraction by the e-invoice standard- This should note that the schema and validation rules may differ from how data is captured—

for example, rounding off, decimal places for quantity, HSN code maintenance, etc. In addition, HSN rules have changed as of April 1st, and e-invoice validation rules have also been updated.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

e-Invoicing for MSMEs : Why there is a need for it

e-Invoicing has so far proven to be a significant change under GST. However, there are some drawbacks to using an e-invoicing system:

- Invoices issued to end consumers are exempt from the current e-Invoicing system, which only includes B2B and export supplies.

- Furthermore, e-Invoices cannot be stored in the IRP for more than 24 hours. You can, however, use this e-Invoicing software to store e-invoice data.

- There is no input tax credit (ITC) involved, and there are still instances of fraud in the case of B2C invoices in GST.

- The primary goal of implementing e-Invoicing is to reduce tax evasion. However, the new system only allows for e-Invoicing B2B invoices under GST, not B2C ones. Because no ITC is involved, B2C invoices have the highest number of frauds.

- As a result, a system that allows customers to report non-compliant invoicing and thus helps to curb tax evasion at its source should be implemented.

These disadvantages effects the e-Invoicing generation process for the MSME business. But with, the new e-Invoicing slab for companies with 10 Cr turnover e-Invoice mandatory for their businesses.

What challenges are faced while e-Invoicing generation, we covered all related article for those particular topics.

What are the advantages of e-Invoicing For MSMEs

- Invoice tracking in real-time: e-Invoicing allows suppliers to track invoices in real-time. This expedites the availability of input tax credits (ITC).

- One-time reporting of B2B invoices: Under e-Invoicing, a taxpayer only needs to report the invoices once and have them authenticated by the Invoice Registration Portal (IRP), which validates the invoice and assigns it an Invoice Reference Number (IRN). The details will be auto-populated into GSTR-1 return after authentication. This eliminates the previously used manual reporting process.

- Easy generation: e-Invoicing facilitates the easy E-way bill generation because the taxpayer only needs to update details. The details in Part-A of the e-way bill will auto-populate from the GST portal-authenticated e-invoice.

- Supports buyers: Once uploaded to the GST portal for authentication, the e-invoice will be shared with the buyer via the e-mail address specified on the e-invoice. This allows the buyer to reconcile his purchase order with the e-invoice in real time and accept/reject the invoice.

- Reduced fraud: Real-time data availability with tax authorities will lead to a reduction in fraud.

- QR Code: GST invoices with QR codes are required for calculating the amount of ITC. The QR code will benefit if an assessee misplaces an issued invoice or needs additional copies. Scanning this code, the assesses can generate the invoice in PDF format unlimited.

A significant economic foundation in our nation is MSME's businesses. GST assists with accurate data accounting, fraud reduction, compliance simplification, and smooth remote administration of enterprises.

So it would be correct to claim that it is a solution from which both MSMEs businesses and the government can benefit!

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Why should MSME businesses use e-invoices?

Get Free Bonus Report: Discover how to automate e-Invoicing

- One thing is sure: implementing the e-invoice system will create a win-win situation for both enterprises and the national economy.

- Internal or external fraud can cause firms to lose customers and hurt the economy by causing tax evasion.

- The tax compliance system is hampered by fake invoices or other forms of fraud, which significantly impacts how much money the government can collect.

- Adopting electronic invoicing is an attractive solution for resolving these issues and increasing revenue collections. However, MSMEs must understand that e-Invoicing mandatory in governments latest updates on e-Invoicing.

- It involves knowing how to produce IRNs through the e-invoice portal and the e-Invoicing and e-way bill system, who needs to generate IRNs and who does not.

- Documents to be submitted to the GST System, transactions covered, data points necessary, generating IRNs, e-Invoicing software, and much more are needed to create e-invoices.

- A common assumption is that an E-invoice can be created using any programme or application that supports the specified e-Invoicing format. Therefore, it is critical to configure the system to transmit and receive invoice data.

However, due to the recent slab of e-invoices, every business with a turnover of 5 Cr has to use e-Invoices. Read more about this here: GST e-Invoice is mandatory for 5 Cr & above Business from January 2023.

e-Invoicing will be required for all enterprises whose aggregate revenue has exceeded the Rs.10 crore limit in the prior financial year from 2017-18 to 2021-22, beginning on October 1, 2022.

Why choose GSTHero Software Solution?

Our GSTHero software is all set up for your GST returns.

GSTHero is a powerful e-Invoicing software solution that can make the process easy for you.

It is a cloud-based sophisticated e-Invoicing solution that can smoothly create IRN without interfering with your ongoing business activities and interface with your billing systems in various ways.

As a result, a One-Stop solution like GSTHero is required, which provides end-to-end solutions such as E-way billing, e-Invoicing, Inventory management, GST filing, and ERPs all under one roof. So what exactly are you waiting for?

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free