Introduction

e-Invoicing under GST has implemented for all the large enterprises so far, and is one of the most successful provision of GST.

There were a number of compliance ease measures that the government had promised the taxpayers & to keep up with their word, the GST is gradually rolling them out.

One such word was regarding the auto-population of gst e-Invoicing data in the GST returns especially in the form GSTR-1.

The same was delayed for some anticipated reasons & the taxpayers had to manually add the e-Invoicing data in GSTR-1 for the months of October & November.

So GSTN has recently rolled out an update clarifying the working of the auto-population

Watch Video on e-Invoice Generation Process From GSTHero Dashboard

Get Free Bonus Report: Discover how to automate e-Invoicing

Read articles on e-Invoicing under GST:

e-Invoicing under GST a series of business benefits:

e-Invoicing or electronic invoicing has been implemented on all businesses having an annual aggregated turnover of INR 500 Crores & above from October 2020 & has been nothing but a success ever since.

e-Invoicing in GST has immensely benefited the businesses as well as the government by reducing malpractices & increasing automation that led to accuracy & ease in work load.

The process of e-Invoicing is simpler, however there are a few more steps than the traditional paper invoicing but the addition is for the better which is why e-Invoices remain better than paper invoices.

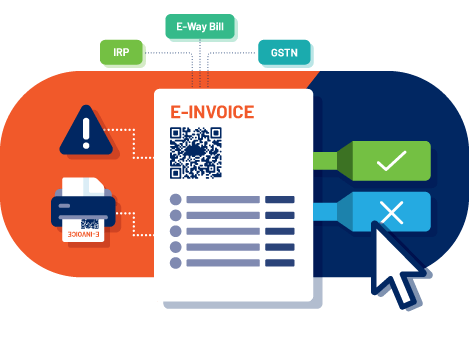

Under e-Invoicing taxpayers are required to generate the invoices in their billing systems & ERPs but in the format SCHEMA (e-Invoicing ) specified by the Government.

This format is a fit for all format that will suit all the businesses & all types of supplies.

The accountants will then have to upload the e-Invoice on the IRP which will validate the e-Invoice for any sorts of errors & duplications.

In the case of erroneous upload the IRP will revert with an error file, taxpayers can rectify the errors & re-upload their data.

Up on successful validation, the IRP will assign the e-Invoices with unique IRN & QR Codes that will later be used to identify & store the e-Invoice data.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Read articles on e-Invoicing under GST:

This is the entire process of e-Invoicing that all the liable businesses are required to perform on a daily & real-time basis.

Here is a list of all the benefits of e-Invoicing that businesses are availing currently-

Here is a list of documents you must report to the IRP-

- 1B2B Invoices

- 2B2G Invoices

- 3Credit Notes

- 4Debit Notes

- 5RCM Invoices

- 6Export Invoices

List of businesses that are exempted from e-Invoicing under GST:

The working of e-Invoicing data auto-population in GSTR-1

Get Free Bonus Report: Discover how to automate e-Invoicing

As per the above list one of the perks of e-Invoicing is the auto-population of the e-Invoice data in the GST returns.

This will act as a basis for all the processes that fall further such as release of taxes, reconciliation, claiming Input Tax Credit under GST etc.

Which makes it essential for taxpayers to understand the working of this auto-population.

Due to obvious & anticipated issues, the government delayed the implementation of the auto-population of the e-Invoice data in GSTR-1 up until now.

However, recently the government has rolled out a notification informing the taxpayers that the e-Invoice data will auto-populate in their GSTR-1 & how.

A verbatim of the notification in mentioned below for your reference but let us see how it works.

Read articles on e-Invoicing under GST:

The e-Invoicing data will auto-populate in the respective tables of form GSTR-1 as given in the below table-

Sr.No | Auto-populated in GSTR-1 Table | Type of Supply |

|---|---|---|

1 | B2B 4A –Supplies other than those (i) attracting reverse charge and (ii) supplies made through e-commerce operator | Taxable outward supplies made to registered persons other than RCM under GST (reverse charge) |

2 | B2B 4B –Supplies attracting tax on reverse charge basis | Taxable outward supplies made to registered persons on which RCM (reverse charge) is applicable |

3 | EXP 6A – Exports | Export supplies |

4 | CDNR 9B – Credit or debit notes (Registered) | |

5 | CDNUR 9B – Credit or debit notes (Unregistered) – with UR type as Exports with payment and without payment of tax | Credit or debit notes issued to unregistered persons |

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

As per the GSTN, the e-Invoice data for October & November 2020 will start to auto-populate in the GSTR-1 in an incremental or gradual manner from December 13th & will take up to 2 weeks to be fully furnished.

This is highly useful for taxpayers who have not filed their returns for the concerned 2 months.

As far as the auto-population for December 2020 is concerned, the auto-population of e-invoice details pertaining to the tax period December into GSTR-1 (in incremental manner on T+2 day basis) will start from the first week of December.

In simpler words, the actual e-Invoice data auto-population will begin from the tax period December from the first week & for the two older tax-periods from the second week of December in an incremental manner.

So businesses can start availing the benefit of this automation from December 2020.

e-Invoicing has already eased up the e-Way Bill compliance as soon as it got implemented earlier in October.

And this new update is a proof that e-Invoicing will roll out in its full bloom & is here in the GST regime to stay.

Read articles on e-Invoicing under GST:

Recent GSTN Update on the e-Invoicing data auto-population in GSTR-1

Get Free Bonus Report: Discover how to automate e-Invoicing

Since now you are clear with the working of the e-Invoicing data auto-population in GSTR-1, here is a verbatim of the GSTN update, dated Nov. 13th 2020-

Certain notified taxpayers have been preparing and issuing invoices by obtaining Invoice Reference Number (IRN) from Invoice Registration Portal (IRP) (commonly referred as ‘e-invoices’). Details from such e-invoices are be auto-populated in respective tables of GSTR-1.

An update on the status of such auto-population was earlier published on 13/11/2020.

Due to some unanticipated issues, there has been delay in auto-population of e-invoice details into GSTR-1.

Hence, such taxpayers who had reported GST e-invoices should not wait for auto-populated data and they are advised to proceed with preparation and filing of GSTR-1 for the months of November, 2020 (before the due date) and for October, 2020 (in case not yet filed, as on date).

The auto-population of e-invoice details pertaining to the period December, 2020 into GSTR-1 (in incremental manner on T+2 day basis) will start in the first week of December.

The details of e-invoices pertaining to periods of October and November, 2020, would be processed and made available in incremental manner from 13th December 2020 onwards.

The processing and availability of complete data for the months of October and November, 2020 may take upto 2 weeks.

The detailed advisory with methodology of auto-population etc. is already made available on the GSTR-1 dashboard (‘e-invoice advisory’) and also e-mailed to relevant taxpayers.

It may also be noted that the auto-population of details from e-invoices into GSTR-1 is only a facility for the taxpayers.

After viewing the auto-populated data, the taxpayer shall verify the propriety and accuracy of the amounts and other data in each field, especially from the perspective of GSTR-1 and file the same, in the light of relevant legal provisions.

Once the auto-population into GSTR-1 gets started, the taxpayers are requested to verify the documents present in the excel and may share feedback on GST Self Service Portal, on below aspects:

Read articles on e-Invoicing under GST:

Conclusion

So, we understand that e-Invoicing compliance is of high priority for all businesses that are liable to it irrespective of its impact as it is mandatory, but is also complex.

Despite all the ease & measures taken by the government, it can sometimes be a little bit difficult than it seems considering the complex SCHEMA Format, Real-time Validation, Bulk operations & more.

The Government thus recommends the use of external solutions such as GSPs to comply better with e-Invoicing

One such GSP is GSTHero which is also the best e-Invoicing Solution in the market currently.

GSTHero makes e-Invoicing simple to understand & operate with its user-friendly features & prominent support.

So why GSTHero?

- Simple integration

- Data Security

- Direct integration with the IRP

- Scalable for high data volume

- Highly Automated- requires minimal human input

- Reduced Errors with automation

- Enhanced productivity of your accounts team

- Compliance in real-time

- Bulk Operations- Generate, cancel, print, validate & edit e-Invoice in bulk within the ERP

- Achieve 100% Compliance with e-Invoicing

- Cost-effective

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free