In the 47th GST council meeting, the company will be declared invalid and ineligible for an ITC if it does not comply with e-invoicing. Soon, government plans for GST e-invoicing mandatory for those business whos yearly revenue exceeds 10 crore rupees and then 5 crore rupees, respectively.

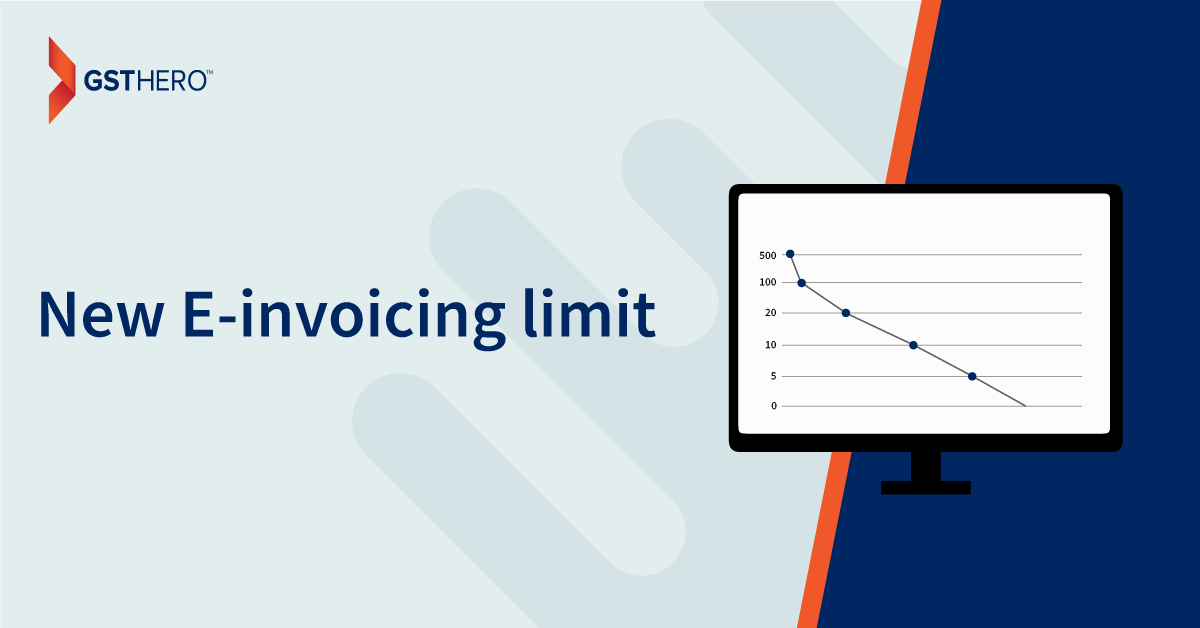

According to Revenue Secretary Tarun Bajaj, the e-invoicing process began with companies with a 500 crores yearly revenue and was then scaled back to ₹ 100 and ₹ 20 crores rupees. The current strategy is to reduce it first to ₹ 10 crores and eventually to ₹ 5 crores.

"There is a schedule for lowering the threshold to 10 crores, but first, we need to stabilise the IT system.". We want to ensure our IT system is effective since the number of assessments between 10 crores and 20 crores will significantly increase. In an interview with BusinessLine, he said, "GSTN is working on the plan, and they should be ready in the next 3–4 months.

Earlier companies with an annual turnover of more than ₹ 20 crores must use e-invoices.

This article will help you understand the change in the e-invoicing applicability under GST and more discussed on why GST e-invoicing mandatory .Overview Of e-Invoice- Read This First

On September 20, 2019, the GST Council made a recommendation to phase in the use of electronic invoices (often known as "e-Invoices") for GST. The GSTN has accredited numerous accounting and billing software solutions that offer primary accounting and billing systems free of charge to small taxpayers. The government has already clarified that compulsory requirements would not financially strain businesses.

Get Free Bonus Report: Discover how to automate e-Invoicing

Note: Tax authorities claim that firms use various accounting and billing software, each of which creates and stores invoices in its electronic format. These multiple forms, however, are not recognised by the GST System nor the systems of suppliers and receivers.

It isn't easy to have links for all of the more than 300 accounting/billing software applications. In this situation, the goal of "e-Invoicing" is consistent interpretation and machine-readability.

For example, without the usage of a connection, a computer running the "Tally" system cannot read an invoice created by the SAP system.What is an e-Invoice?

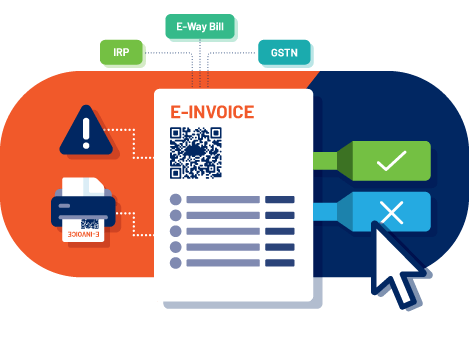

e-Invoice is a mechanism through which GSTN electronically authenticates B2B invoices for use on the common GST portal.

Every invoice will receive an identification number under the electronic invoicing system from the Invoice Registration Portal (IRP), which will be run by the GST Network (GSTN).

Advantages of e-invoice

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Penalties under e-Invoicing Stated by the GST Council

Get Free Bonus Report: Discover how to automate e-Invoicing

The following are some of the consequences for failing to provide an invoice or issuing an inaccurate invoice:

We covered all major aspect in single briefly written guide on Penalties under e-Invoicing go through the detailed parameters to avoid penalties and possible errors.

GSTHero will Help you to Scale your Business

GSTHero captures critical events, has over 1200+ active GSTNs using GSTHero e-invoicing and has handled 1 Lac+ invoice from 15% of industries in a month.

- GSTHero provided APIs for different accounting software.

- Smooth processing of large volume data.

- Seamless integration with several complex government servers like GSTN, IRP(e-invoice Portal), NIC (e-way bill portal) etc.

- Seven layers of data security.

- With GSTHero, you may manage and access your IRNs for years.

- 100% automated.

- GSTHero provides 24/7 support for all queries of their customers.

Check out the product today to discover more about e-Invoicing software for small businesses

Even though this seems like a situation where everyone wins, for companies with a revenue of ₹ 10 cr & then ₹ 5 cr, it would be fascinating to observe this compliance.

We'll ensure your IT stack for e-invoicing and GST compliance is ready for the forthcoming phase of e-invoicing.

Final Call on GST e-Invoicing Mandatory Process

Businesses that will be drawn up in the e-Invoicing system for the first time must upgrade their infrastructure and make minor adjustments to their existing ERPs.

To understand more about e-Invoicing under GST, please read our informative blogs.

Stay aware; stay ahead!

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free