Get Free Bonus Report: Discover how to automate e-Invoicing

Introduction to e-Invoicing penalties

e-Invoicing under GST has rolled out in October for all businesses having an annual aggregated turnover of Rs. 500 Crores and above.

The government is even considering to expand e-Invoicing to businesses with annual turnover of Rs. 100 Crores and above, from January 2021, and to all the remaining businesses by April 2021.

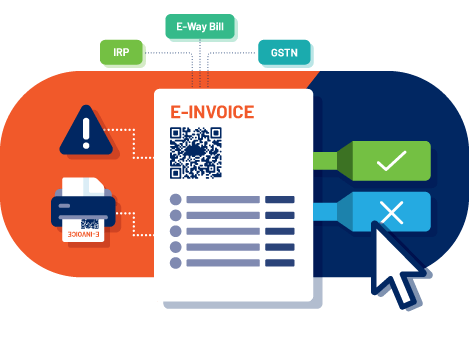

It is the process of creating invoices in a standard (SCHEMA) format & getting them validated in real-time of the Invoice Registration Portal.

The portal will in return assign unique IRNs (Invoice Reference Number) & QR Codes to the successfully validated e-Invoices, which you can use for further transactions.

e-Invoice generation is a mandatory process that these businesses need to adapt in order to continue the business transactions.

Invoices without IRNs & in the old format or in any format other than the one specified under e-Invoicing, will be considered as void & any transactions done using such invoices will attract penalty for e invoice as per e invoice penalty notification.Taxpayers are searching about Penalty for late generation of e invoice and also for Penalty for non issuance of e invoice under GST? Read this article to get your answers regarding e-Invoice penalty.

e-Invoice Portal Live Demo | Watch video to know more

e-Invoicing penalties: Possible errors under e-Invoicing

Here are the possible errors under e-Invoicing that can cause you penalties under GST of any kind

- 1Failure to generate IRN is considered a failure of the issuance of an invoice.

- 2If an invoice is not registered on the IRP, then such an invoice would not be treated as a valid tax invoice for all GST related matters and therefore attract a penalty of ₹10,000 for each instance of non-compliance.

- 3Initiating the transportation of goods without a valid tax invoice containing an IRN may cause the detention of goods and vehicles and the imposition of the standard penalty.

- 4Customers can refuse to accept the goods and/ or make payments in the absence of a valid tax invoice as this would impact a recipient’s eligibility to avail of ITC.

- 5Further, the Government also plans to implement a check which would restrict the generation of e-way bill in the absence of IRN.

Now, essentially there are only 2 types of e-Invoicing penalties

Get Free Bonus Report: Discover how to automate e-Invoicing

As per sub-rule (5) of Rule 48 under the CGST Act 2017, there are the following 2 penalties in case of any discrepancies in e-Invoices-

- Penalty for non-issuance of e-Invoice- 100% of the tax due or Rs.10,000 whichever is higher.

- Penalty for incorrect or erroneous e-Invoice is Rs.25,000

However, you can avoid the second e invoice penalties by considering the following notes-

- Note- e-Invoices cannot be amended once the IRN is generated. You can only cancel the erroneous e-Invoice

- Note- e-Invoices & IRN once generated can only be canceled within 24 hours from the time of generation.

- Note- If you exceed this limit you will have to nullify the e-Invoice by generating a Credit Note against the same.

An Ultimate Solution to avoid e-Invoice Penalties

There are two basic methods to avoid the two e-Invoice penalties mentioned in sub-rule (5) of Rule 48, first is to generate the IRN for each & every invoice without fail & the second is to deal with erroneous invoices in a proper manner.

In other words, you can dodge the penalties by making the e-Invoicing process accurate from all the aspects.

Now, this may not always be possible considering that with manual work comes manual errors & e-Invoicing process, done manually, can be a highly tedious task that involves multiple steps.

Amid such haste, there are higher chances of errors & mistakes.

To avoid this, you can take help from an automated solution such as an advanced GST Suvidha Provider.

GSTHero (eInvoice software) is the best authorized GSP in the market currently that provides high automation in the e-Invoicing process & is stacked with features to help the user make their work 100% accurate.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Read more about e-Invoicing penalties :

Here is a list of Features that GSTHero offers its users-

Watch how to manage e-Invoice in Tally

Get Free Bonus Report: Discover how to automate e-Invoicing

Here is a list of Benefits that GSTHero users can enjoy-

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free