E-invoicing solution is recently the most trending topic under GST, with the continuous increase of its ambit. Smartly, in the case of e-invoice, the Government has adopted the strategy of stage-wise implementation.

Large and medium-sized firms have already adopted an e-invoicing mechanism. Now, it is most likely that sooner or later an e-invoicing solution will be made effective to small businesses as well. Presently, small businesses are more reluctant towards an e-invoicing system. However, the present article is more likely to ease up the same.

In the current article, firstly, we will go through the step-by-step implementation of e-invoicing and then we will analyze the benefits as well as obstacles of the same from the view point of small businesses.

Step-by-step implementation of e-invoicing Solution under GST-

The foundation of e-invoicing was laid down during the 35th GST Council Meeting held on 21st June 2019. Due to the likely upsurge in the compliance cost and requirement of additional technical know-how, there was a huge hue and cry amongst the trade and industry.

Post various extensions and amendments in the turnover limit for the mandatory requirement of e-invoicing, the e-invoicing got implemented in the following steps-

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Step | Implementation of | Effective date | Notification |

|---|---|---|---|

1 | The registered person having an aggregate turnover exceeding INR 500 Crores in a Financial Year. | 1st October 2020 | Notification no. 13/2020- Central Tax dated 21st March 2020 and Notification no. 61/2020- Central Tax dated 30th July 2020. |

2 | The registered person having an aggregate turnover exceeding INR 100 Crores in a Financial Year. | 1st January 2021 | Notification no. 88/2020- Central Tax dated 10th November 2020. |

3 | The registered person having an aggregate turnover exceeding INR 50 Crores in a Financial Year. | 1st April 2021 | Notification no. 05/2021- Central Tax dated 8th March 2021. |

Get Free Bonus Report: Discover how to automate e-Invoicing

Notably, e-invoicing is made mandatory only for B2B transactions (i.e., supply of goods/ services or both to the registered person). B2C transactions are not covered under e-invoicing.

As seen from the above table, from 1st April 2021, e-invoicing is made mandatory for businesses having an aggregate turnover of more than INR 50 Crores. Accordingly, we can conclude that the next in-line implementation of e-invoice will probably be for small businesses. The underlined benefits and obstacles will enable the small business players to brush up and get themselves ready for adopting e-invoice.

Benefits of e-invoicing solution from the view point of small businesses

E-invoicing solution for small businesses is a bit overwhelming. However, going through the benefits of the same will surely have a positive impact on the small businesses-

Accurate claiming of Input Tax Credit (ITC)

In the case of traditional invoicing, there are more chances of missing out of invoices for claiming ITC. However, e-invoicing, being automated, will enable to claim maximum ITC of all the invoices, without missing out any of the invoice.

Reduction in administration cost

This may sound conflicting, but yes, the adoption of e-invoicing by small businesses is likely to reduce their administration cost. Let us look how-

The major administrative expense of small businesses is printing the invoice [in duplicate in case of a supply of services or triplicate in case of a supply of goods]; sending the same to the customer and storing the remaining hard copy of the same.

In the case of an e-invoice, all the above marked expenses will be nullified. Notably, the administrative cost as well as the processing time of e-invoice is lower than the traditional invoice.

Easy tracking of invoice

An e-invoicing system facilitates the real-time tracking of invoices. Real-time tracking of invoices reduces fraud and enables faster processing of Input Tax Credit for the buyer.

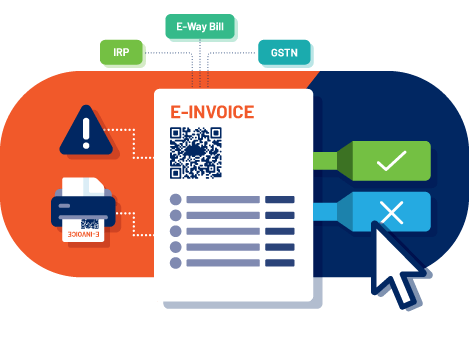

Easy filing of GST returns and easy generation of E-way bill

The details of e-invoice, post authentication and issuance of Invoice Reference Number, will be transferred to the GST portal as well as the e-way bill portal.

The details transferred to the GST portal enables auto-population of GST returns. Whereas, the details transferred to the e-way bill portal, auto-generates Part-A of the e-way bill. Accordingly, just by providing vehicle details, an e-way bill will be generated.

Both the above auto-population in the return and e-way bill will surely reduce the compliance cost of the small business. Further, the auto-population will naturally eliminate the need for manual data entry which will result in reduced clerical errors.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Obstacle for easy adoption of e-invoicing from the view point of small businesses

After going through the benefits of an e-invoicing solution, it is also important to look at some of the obstacles. The same are listed hereunder-

Continuance of fraud

The main aim behind the introduction of e-invoicing is to reduce the issuance of fake invoices. However, e-invoicing solution is mandatory only in the case of B2B transactions. Accordingly, fraud by way of issuing fake invoices under B2C transactions is more likely to continue.

Probable additional cost

Under e-invoicing, the supplier is not required to issue a hard copy of the invoice. However, some customers may still prefer a hard copy of the same which can add up to the administration cost of small business.

Less storage time in IRP

The registered person can store the e-invoice in IRP only for a maximum of 24 hours. Archiving option is not offered on IRP.

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free