For small and medium businesses in India, managing accounts payable and ensuring GST compliance can be a daunting task. Manual processes involving paper invoices, data entry, and record-keeping are not only time-consuming but also prone to errors. One critical aspect that often gets overlooked is the proper claiming of input tax credit (ITC), which can have severe financial implications if not handled correctly.

Input Tax Credit is a mechanism that allows businesses to deduct the GST paid on their purchases from the GST collected on sales, thereby reducing their overall tax liability. However, failing to claim ITC on eligible purchases or making erroneous claims can result in significant financial losses and potential legal consequences.

This is where accounts payable (AP) automation comes into play as a powerful solution to streamline the accounts payable process, ensure accurate data capture, and safeguard your GST Input Tax Credit.

What is Accounts Payable Automation?

Accounts payable (AP) automation is the use of technology to digitize, streamline, and optimize the entire accounts payable process, from invoice receipt to payment processing.

It involves the integration of various technologies and software solutions to eliminate manual tasks, reduce errors, and improve overall efficiency.

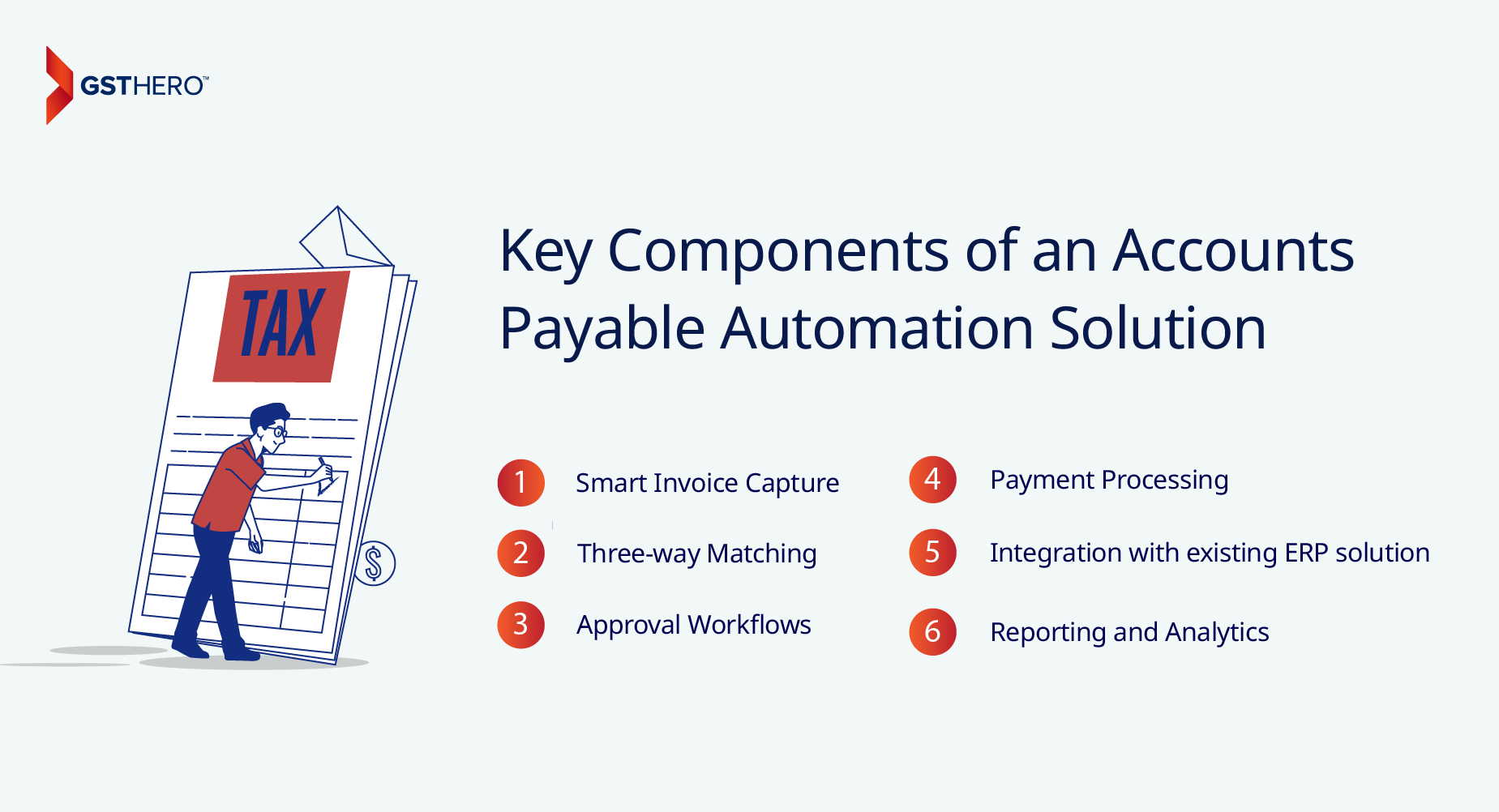

A typical accounts payable automation solution comprises the following key components :

- Smart Invoice Capture :

This involves the automated capture and extraction of invoice data using advanced technologies like optical character recognition (OCR), machine learning, and intelligent data capture. This eliminates the need for manual data entry, which is time-consuming and prone to errors. - Three-way Matching :

AP automation software automatically verifies the invoice details against the corresponding purchase order and goods receipt note. This three-way matching process ensures that only legitimate and approved transactions are processed for payment, reducing the risk of errors and fraud. - Approval Workflows :

Based on the complexities if the organizational hierarchy, automating accounts payable will enable creation of approval workflows.

Automated approval workflows route invoices through predefined approval hierarchies and escalation rules, based on factors such as invoice amount, vendor, or department. This streamlines the approval process and ensures timely processing of invoices. - Payment Processing :

Once invoices are approved, the AP automation solution can automatically schedule and execute payments based on due dates, vendor preferences and available discounts for early payment. - Integration with existing ERP solution :

AP automation solutions enable seamless integration with an organization's accounting software and enterprise resource planning (ERP) systems. This integration enables real-time data exchange, reducing the need for manual data entry and ensuring consistency across systems. - Reporting and Analytics :

Advanced AP automation platforms offer comprehensive reporting and analytics capabilities, providing real-time visibility into invoice processing metrics, payment status, cash flow projections, and potential areas for cost savings or process improvements.

By automating these processes, businesses can significantly reduce manual effort, minimize errors, and achieve substantial cost savings compared to traditional paper-based or manual accounts payable methods. Additionally, AP automation solutions often incorporate robust security features, such as role-based access controls, audit trails, and fraud detection mechanisms, to ensure data integrity and compliance.

How AP Automation Protects Your Input Tax Credit

Accounts payable automation plays a crucial role in safeguarding your GST Input Tax Credit by ensuring accurate data capture, validation, and compliance throughout the accounts payable process. Here's how it helps :

- Accurate Data Capture and Validation of Vendor Invoices :

AP automation employ intelligent data capture technologies like optical character recognition (OCR) and machine learning to accurately extract invoice data from various formats, including PDFs, scanned documents, and even paper invoices. This eliminates the risk of manual data entry errors, which can lead to incorrect ITC claims.

To learn more about Ineligible ITC claims, click on the link provided. - Automated Three-way Matching :

The three-way matching process verifies that the invoice details match the corresponding purchase order and goods receipt note. AP automation software automates this process, ensuring that only legitimate and approved transactions are processed for payment and ITC claims. - Integration with GST Portals and E-way Bill Systems :

Many AP automation solutions offer direct integration with GST portal and e-way bill system, enabling seamless data exchange and validation. This ensures that ITC claims are filed accurately and in compliance with GST regulations.

To learn more about e way bill format claims, click on the link provided. - Maintenance of a Comprehensive Audit Trail :

AP automation maintains a detailed audit trail of all transactions, including invoice data, approvals, payments, and ITC claims. This comprehensive record-keeping not only facilitates GST Audit but also provides visibility into potential discrepancies or errors that could impact ITC claims.

To understand more about GST audit applicability claims, click on the link provided. - Real-time Visibility into ITC Claims and Compliance Status :

Advanced AP automation platforms offer real-time dashboards and reporting capabilities, allowing businesses to monitor their ITC claims, compliance status, and potential mismatches or exceptions. This proactive approach enables timely corrective actions and helps mitigate the risk of losing GST Input Tax Credit.

Learn more about GSTHero’s automated ITC reconciliation.

Key Features aiding 100% GST Compliance

To further strengthen GST compliance and protect input tax credit, leading accounts payable automation solutions offer specialized features tailored for small and medium sized businesses :

- Handling of Reverse Charge Mechanism and Import Scenarios :

AP automation solutions can handle complex scenarios such as reverse charge mechanism (RCM) and import transactions, ensuring accurate calculation and reporting of GST liabilities and ITC eligibility.

Read more about reverse charge mechanism under GST in the link provided. - Automated Reconciliation of GSTR-2A and GSTR-3B :

The software can automatically reconcile GSTR-2A (inward supplies) and GSTR-3B (monthly GST returns) to identify mismatches or missing invoices, allowing businesses to take corrective actions and claim eligible ITC.

To know more about ITC Reconciliation, read more about it on the detailed article. - Exception Handling for Mismatches and Duplicates :

Advanced solutions incorporate exception handling capabilities to identify and flag potential mismatches, duplicates, or errors in invoices or GST calculations. This proactive approach helps businesses address issues before they escalate and impact ITC claims. - Timely Filing of GST Returns and ITC Claims :

By automating the entire accounts payable process, businesses can ensure timely filing of GST returns and ITC claims, avoiding penalties or interest charges due to late submissions. - Reporting and Analytics for ITC Optimization :

AP automation solutions often provide comprehensive reporting and analytics capabilities, enabling businesses to analyze their ITC claims, identify areas for optimization, and make data-driven decisions to maximize their ITC claim.

Implementation and ROI of AP Automation

Implementing accounts payable automation may seem daunting, but the process is typically straightforward and can be accomplished in a phased manner. Here's a general overview of the steps involved :

- Process assessment : Analyze your current accounts payable process, identify pain points, and define requirements.

- Solution evaluation : Research and evaluate various AP automation solutions based on your requirements and budget.

- Implementation planning : Develop an implementation plan, allocate resources, and schedule training for your team.

- Data migration : Migrate existing data, such as vendor records and historical invoices, to the new system.

- Integration : Integrate the AP automation solution with your accounting software, ERP, and other relevant systems.

- User adoption : Train your team and encourage user adoption through change management initiatives.

The implementation timeline can vary depending on the complexity of your organization and the scope of the project, but most businesses can expect to see significant benefits within the first few months of implementation.

The return on investment (ROI) of accounts payable automation can be substantial, with businesses typically realizing cost savings, efficiency gains, and improved cash flow management. By protecting your input tax credit, you can also unlock significant financial benefits and avoid potential penalties under GST or interest charges.

In a nutshell….

GST Input Tax Credit and GST compliance is a dear subject to every GST registered business. In response to this scenario, accounts payable automation has emerged as a game-changer for small and medium businesses in India. By streamlining the accounts payable process, ensuring accurate data capture, and maintaining a comprehensive audit trail, AP automation solutions can effectively safeguard your input tax credit and mitigate the risk of financial losses.

If you're a small or medium business in India looking to protect your Input Tax Credit and gain a competitive edge, it's time to evaluate accounts payable automation solutions. Embrace this transformative technology with GSTHero and unlock the full potential of your business while ensuring compliance with GST regulations.

Stay updated; stay ahead with GSTHero!

Until the next time…