Goods and Services Tax, the biggest tax reform in India, is escorted by the concept of ‘reconciliation’. Consequently, reconciliation can be termed as one of many GST compliance challenges, as it is unavoidable, time-consuming, and oftentimes tedious. Furthermore, GST reconciliation is not at all a single-time obligation, but a continuous process. That is why it is recognized as one of the common GST challenges in India.

What is GST Reconciliation?

GST reconciliation means the comparison of two sets of data i.e. details submitted/to be submitted via GST returns with actual purchase, sale, and credit. It figures out any type of error, mismatches, wrong entries, etc.

In this article, you will learn about the basics of reconciliation vis-à-vis GST law, different types of reconciliations under GST, and various challenges of GST faced by the manufacturing units in Input Tax Credit reconciliation.Types of reconciliations under GST

Sales Reconciliation

To find discrepancies in sales registers, a reconciliation between Form GSTR-1 and Form GSTR-3B needs to be carried out.

Input Tax Credit (ITC) Reconciliation

Input Tax Credit reconciliation can be carried out in the following two ways –

- Reconciliation between provisional Input Tax Credit claimable as per books of accounts and actual Input Tax Credit claimable as per auto-populated statement in Form GSTR-2B.

- Reconciliation between Input Tax Credit reflected in Form GSTR-2A/ GSTR-2B and Input Tax Credit reflected in Form GSTR-3B.

2 Common Challenges Faced by Manufacturing Units in Input Tax Credit Reconciliation

Input Tax Credit discrepancies are the prevailing errors in reconciliation, causing multiple challenges for the manufacturing supply chain, some of which are highlighted hereunder:

Different Comparisons of Input Tax Credit

Input Tax Credit reflected in books of accounts should be compared with credit reflected in Form GSTR-3B. Further, the Input Tax Credit reflected in Form GSTR-3B should be compared with credit auto-populated under Form GSTR-2A/ GSTR-2B.

Firstly, total reflected figures should be compared and in case of any difference, individual reflection needs to be compared. This individual comparison of each invoice makes the entire Input Tax Credit reconciliation task challenging and time-consuming.

Input Tax Credit Vis-à-Vis Non-Compliance On the Part of the Supplier

Input Tax Credit is largely dependent on the fulfillment of various compliances on the part of the supplier. In case of supplier non-compliance risks/non-compliance from the supplier’s end, Input Tax Credit tends to be denied/blocked.

Importantly, manufacturing units have to deal with various suppliers. Accordingly, figuring out due compliance/ non-compliance on the part of every supplier and for each invoice is truly pains-giving.

Related articles:

Positive And Negative Impact of GST on the Manufacturing Sector

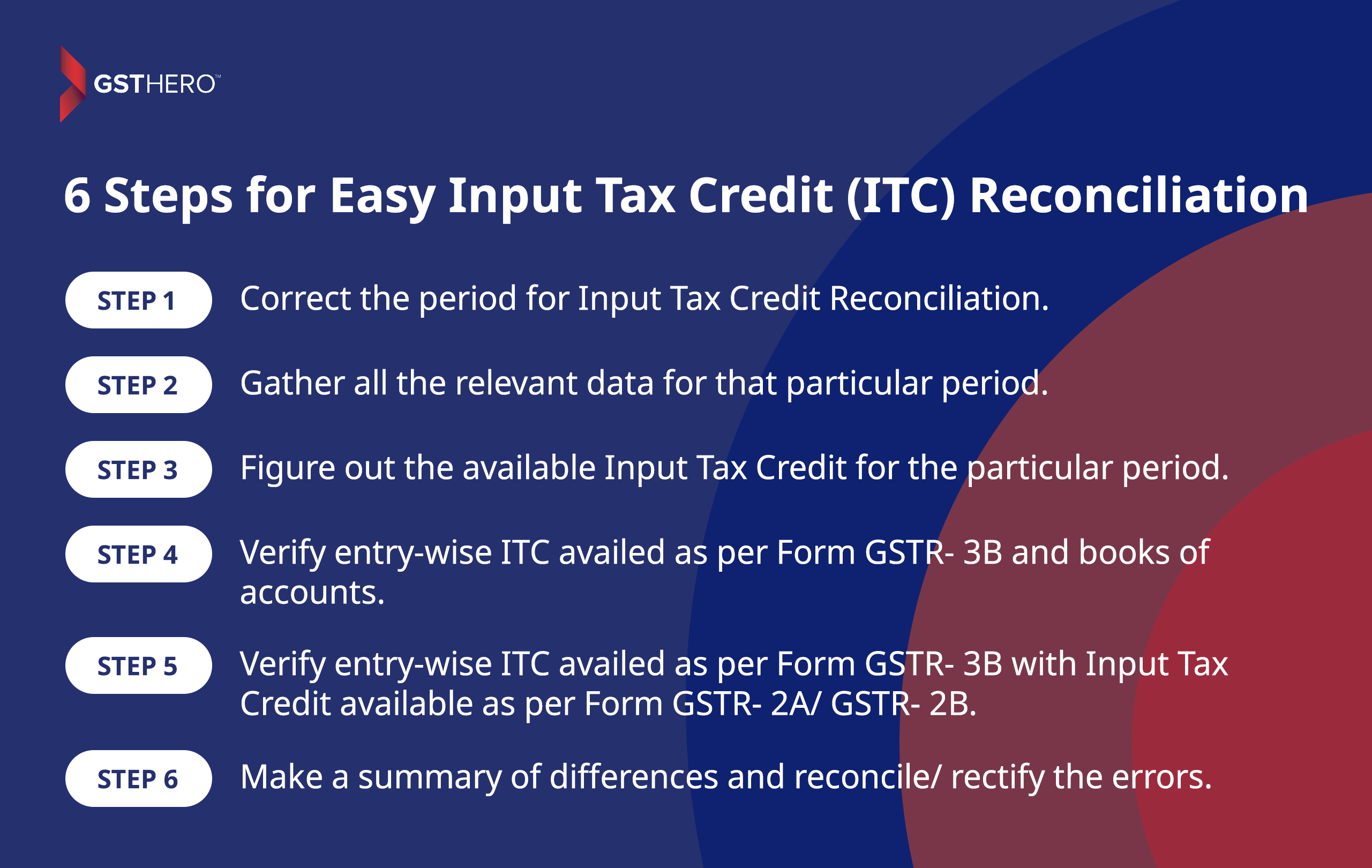

6 Steps for Easy Input Tax Credit (ITC) Reconciliation

Here’s a step-by-step and simplified GST guide for manufacturers to conduct hassle-free Input Tax Credit reconciliation:

STEP 1 – Fix the particular period for which Input Tax Credit reconciliation is to be done.

STEP 2 – Collect all the relevant data for that particular period like purchase details, invoice, number and date, taxable value, input tax credit involved, etc.

STEP 3 – Figure out the available Input Tax Credit for the particular period.

STEP 4 – Verify entry-wise Input Tax Credit availed as per Form GSTR- 3B and books of accounts.

STEP 5 – Also, verify entry-wise Input Tax Credit availed as per Form GSTR- 3B with Input Tax Credit available as per Form GSTR- 2A/ GSTR- 2B.

STEP 6 – Make a summary of differences and reconcile/ rectify the errors.

After going through the above steps, one may find that carrying out the Input Tax Credit reconciliation is quite simple, however, note that the same is not. Depending upon the quantum, it is always advisable to go for efficient accounting software that effectively provides Input Tax Credit reconciliation.

Conclusion

GST reconciliation is an unavoidable task for any manufacturing unit. It is a must for maximization of Input Tax Credit availed and for avoiding unwanted levies of interest and penalties, which are likely to be suffered for availing excess Input Tax Credit. However, to avoid time-consuming GST compliance challenges, it is sensible to adopt suitable accounting software.

Why Choose Us as Your GST Return Filing Partner?

GSTHero is a Govt. Appointed GST Suvidha Provider, streamlining GST Compliance and Tax Management for enterprises through simplified processes and automation.

Here’s what you can expect from us:

- 100% GST Compliance

- Hassle-free GST Return Filing

- 99.98% ITC Reconciliation (error-free)

- Tested and Proven GST Solutions

- Centralized GST Litigation Management

- Bulk E-Invoice Generation

Our Key Solutions:

Our GST Returns Filing solutions are customized for every enterprise we serve, to ensure up-to-date and real-time compliance according to GST laws.

GSTR Filing

Utilize automated and 1-click solutions to reduce hours of manual work in preparing e-invoice and e-way billing data for GSTR-1 to GSTR-9.

ITC Reconciliation

Automated and error-free Income Tax Credit Reconciliation with advanced features to auto-notify your vendors and suppliers.

E-Invoicing

Offering compatibility with numerous ERPs, our e-invoicing solutions help you generate and print 100% GST-compliant invoices with 1-click solutions.

E-Way billing

Using automation, you can save time and prevent errors while generating, printing, and managing multiple e-way bills.

GST Litigation

Our user-friendly and centralized Litigation Management System (LMS) simplifies Notices tracking and management to streamline GST Litigation and Compliance.

Third Eye

A smart MIS and pre-auditing solution to get Compliance Diagnosis, Risk Exposure Alerts, and strategic information to make informed decisions.

SafeSign

A digital signature solution to authorize your confidential documents faster and with better security.