When the Goods and Services Tax was introduced, the primary projection was to make GST a progressive tax. In this article we cover the GSTR2B details.

GSTR 2B means a auto-drafted statement for regular tax payers (monthly).

One would certainly be wondering that if filing of form GSTR-2B is not to be carried out by the registered person, and it is a system generated auto-drafted ITC statement, then, why is GSTR-2B so important?

In order to get the answer, provisions of rule 36(4)(b) of the Central Goods and Services Tax Rules, 2017 need to be referred.

The said provisions state that ‘No Input Tax Credit shall be availed by the registered person in respect of invoices/ debit notes unless the details of the same Input Tax Credit is communicated to the registered person in Form GSTR-2B’.

We will also look at the eligibility, the GST rules and GSTR 2B due dates in detail.

Is GSTR 2B Mandatory?

Recently, government has scraped 5% provisional Input tax credit rule. Thus tax payers have to avail only eligible ITC as per GSTR2B. You should always check mismatches between eligible ITC amount in GSTR3B and GSTR 2B.

If you spot any difference in those values, you may consider the transactions reported in credit notes and debit notes, and recalculate it.

What is GSTR2B Form in GST?

GSTR-2B was introduced after the GSTR-2A form, but the intention was not to completely replace the GSTR-2A form. Although they may look alike, there are some significant differences between GSTR2A and GSTR2B.

In the later sections, we have highlighted 'What are GSTR2A and GSTR2B differences?’

You would also be able to know that, what is key difference between GSTR2A and GSTR2B and which one you should choose as a taxpayer.

Let’s understand,

Understanding GSTR2B in detail:

When is GSTR-2B generated?

Want to learn more on other related GST Returns ? Read our comprehensive article from the link provided.

How Do I Download GSTR2B?

Any taxpayer can download the Form GSTR 2B form from the GST Portal of the Government of India.

Taxpayers eligible to view the GSTR-2B statement on the GST portal:

- Normal Taxpayers

- SEZ Taxpayers

- Casual Taxpayers

GSTR-2B Download Procedure

Step 1

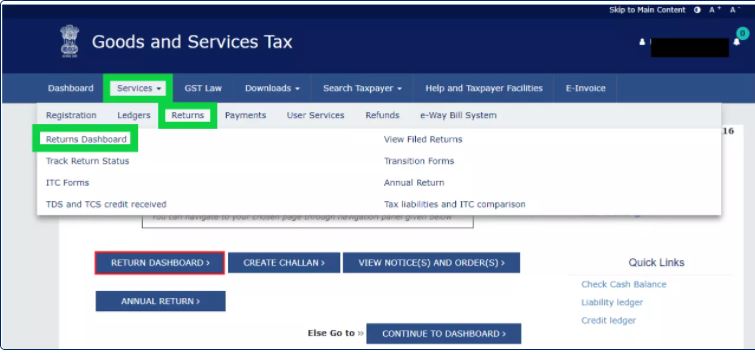

Log in to the GST portal www.gst.gov.in using your valid credentials.

Step 2

From the homepage, click on the Services tab. Navigate as

Services -> Returns -> Returns dashboard .

Step 3

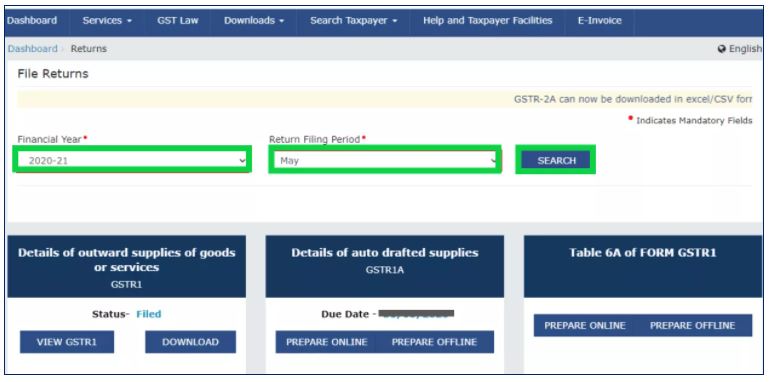

You'll see the 'File Returns' Form on the next page. Here you'll have to furnish the required details like 'Financial Year’, ‘Return Filing Period’.

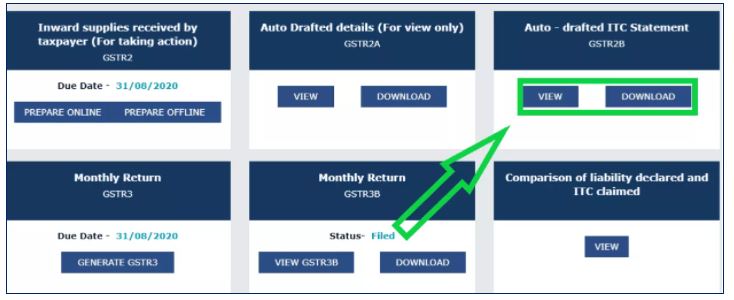

When you scroll down on the same page, you’ll see the tab for the GSTR-2B Download and View button.

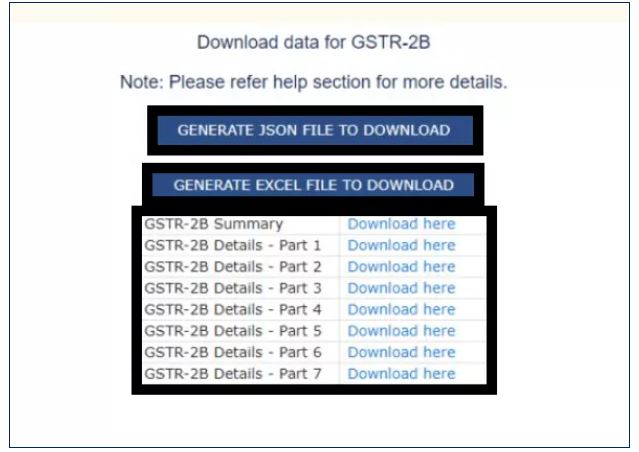

GSTR-2B statement can be downloaded in JSON or EXCEL format.

NOTE:

You can download individual table-wise details in Form GSTR-2B by clicking the Download Excel tab.

This link will be available only when the total number of documents across all tables is up to 1000 documents.

After clicking on the ‘Download’ button, you can see the following page:

You can download the FORM GSTR-2B from the GST portal directly in this simple way.

How does GSTR2B work?

As mentioned in the earlier section, GSTR2B under GST gets generated based on the GSTR 1 return filed by your respective suppliers.

But what is the timeline of all these activities? When will I get the credit, OR When will I NOT get the credit?

For this understanding, we have devised a simple example:

Example:

There is a Supplier ‘Modi Traders’

A Recipient ‘Jethabhai Agency’ purchases goods worth Rs. 10 Lakh from ‘Modi Traders’.

The transaction details are:

Worth of goods= Rs. 10, 00,000

GST collected = 18% = Rs. 1, 80, 000

Total amount collected from the recipient = Rs. 11, 80,000

In this case, the supplier ‘Modi Traders’ is supposed to file his GSTR-1 for this transaction before the GSTR1 filing date, i.e. 11th of the month.

The Supplier files his GSTR-1 return on time and with accurate details.

Supplier files his GSTR-1 on time and with the correct details for this transaction.

The GSTR-2B of Jethabhai that will get generated after the 12th of the month will contain the ITC details of this transaction, and Jethabhai can easily claim ITC as per his GSTR-2B.

Let’s look at the other part of this example:

Jethabhai has one more Supplier, ‘ Joy Traders’.

The transaction details between Jethabhai and Joy Traders are as follows:

Amount of goods purchased in October 2022 | Rs. 4,00,000 |

GST paid (18%) | Rs. 72,000 |

Total billing amount | Rs. 4,72,000 |

In this case, the supplier ‘Joy Traders’ delays his GSTR 1 filing.

This Supplier has filed his GSTR-1 AFTER the GSTR 1 filing due date, i.e. 11th November in this case.

What are the consequences of this delayed GSTR-1 filing?

- These transaction details shall NOT reflect in the Recipient’s GSTR-2B statement for November 2022. It means that the ITC for this transaction will not be available in this month.

However, the ITC details shall reflect in the GSTR-2B of the following month, i.e. December 2022. (Because GSTR-1 has been filed through late).

It means that Jethabhai, the Recipient’s eligible ITC, has been blocked, and he has to pay the outward liabilities in cash.

- The second consequence in this example is that the Supplier has filed his GSTR-1 though after the due date. Hence, the details of this transaction will REFLECT in GSTR-2A of the Supplier for the month of November 2022.

To summarise the example:

Jethabhai now has three answers to his available ITC:

- ITC as per Purchase Register - Rs. 72, 000

- ITC as per GSTR-2A - Rs. 72, 000

- ITC as per GSTR-2B – 00.

Now, what should Jethabhai the Recipient consider?

Should he claim the ITC or not?

Should I refer to GSTR-2A or GSTR-2B to find my eligible ITC?

GSTR-2A in a snapshot

- GSTR 2A is a tax form related to purchases of goods and services in a given month.

- GSTR-2A is dynamic in nature.

- This form auto-generates from the GSTR 1 of the seller by the GST portal.

- Any information filed in GSTR1 by the seller is captured in GSTR 2A of the purchaser.

- GSTR 2A is an automatically generated form from the seller’s GSTR 1 for each business by the portal of GST.

CBIC has clearly stated that ‘GSTR-2B will be the final and definitive source to find out your eligible ITC for the month.’

This means that, in this example, the Recipient shall NOT be able to avail ITC for this transaction as it is NOT reflected in the GSTR-2B statement.

From this example, businesses must understand that GSTR-2B form is an essential document for claiming your eligible ITC for the month. Hence, businesses must reconcile their books of accounts against the auto-generated GSTR-2B statement.

GSTR 2B reconciliation helps businesses to identify their GST defaulting suppliers. When spotted earlier, these suppliers can be notified about the discrepancies to take corrective actions and get our eligible ITC on time.

GSTR2B vs Books Reconciliation

GSTR-2B plays a vital role in making ITC reconciliation easier.

As mentioned in the earlier section, GSTR-2B is essential for claiming maximum & eligible Input Tax Credit.

Details of your purchases shall reflect in your GSTR-2B ONLY if your Supplier has filed his GSTR-1 correctly & on time corresponding to the purchase.

Businesses must check their GSTR-2B form before claiming GST Input Tax Credit for the month, as GSTR-2B shall give you a final confirmation regarding the eligible ITC.

Click to learn more on GSTR 2B Reconciliation in Excel.

But how will you reconcile your GSTR-2B?

How to handle a large volume of transactions in GSTR-2B reconciliations?

What is the benefit of GSTR 2B reconciliation?

Following are some key benefits of GSTR2B reconciliation

GSTR-2B vs GSTR-3B Reconciliation

Importance of GSTR-3B and GSTR-2A/2B Reconciliation

- Some of the fields are auto-populated in the GSTR-3B form. For example, ITC claimed and ITC Reversal details are auto-fetched from your auto-generated GSTR-2B statement.

- So, while furnishing the ITC details in your GSTR-3B summary, you must have accurate data from your GSTR-2B auto-generated statement.

- A registered taxpayer will be eligible to claim GST credit paid on inward supplies.

- GSTR 2A contains the detail of inward supplies made.

- GSTR-2A will show the details uploaded by the Supplier, but under GSTR 3B, the taxpayer will himself upload the details to claim ITC for the particular tax period.

- Only ITC available in the GSTR-2B form of the month shall be considered the eligible ITC.

Thus, GSTR-3B vs GSTR2B reconciliation is essential for 100% GST compliance.

NOTE: GSTR 2B Reconciliation in Tally is now possible!

Businesses must note that, it is now possible to reconcile your GSTR-2B against GSTR-3B consolidated summary directly from Tally ERP using GSTHero Tally Connector.

How to file GSTR 2B?

This section explains the important tables of a GSTR-2B statement that the taxpayers should focus upon.

1. PART A of ITC Available

The PART-A of ITC Available contains details of inward supplies (invoices, debit notes, and amendments related to invoices and debit notes) and import of goods received from suppliers, in the following manner:

All Other ITC – Supplies from registered persons

- B2B – Invoices

- B2B – Debit notes

- B2B – Invoices (Amendment)

- B2B – Debit Notes (Amendment)

Inward Supplies from Input Service Distributor/ISD

- ISD – Invoices

- ISD – Invoices (Amendment)

Inward Supplies liable for reverse charge

- B2B – Invoices

- B2B – Debit notes

- B2B – Invoices (Amendment)

- B2B – Debit Notes (Amendment)

Import of Goods

- IMPG – Import of goods from overseas

- IMPG (Amendment)

- IMPGSEZ – Import of goods from SEZ

- IMPGSEZ (Amendment)

2. PART B – ITC Reversal

The PART-B of ITC Reversal contains details of credit notes and amendments thereof issued by the suppliers:

- B2B – Credit Notes

- B2B – Credit notes (Amendment)

- B2B – Credit Notes (Reverse charge)

- B2B – Credit notes (Reverse charge) (Amendment)

- ISD – Credit notes

- ISD Amendment – Credit Notes

To learn more on ‘ITC Reversal under GST', visit the detailed blog from the link provided.

3. PART A – ITC NOT Available

The details of inward supplies received from the suppliers are to be furnished in this part:

All Other ITC – Supplies from registered persons

- B2B – Invoices

- B2B – Debit notes

- B2B – Invoices (Amendment)

- B2B – Debit Notes (Amendment)

Inward Supplies from Input Service Distributor/ISD

- ISD – Invoices

- ISD – Invoices (Amendment)

Inward Supplies liable for reverse charge

- B2B – Invoices

- B2B – Debit notes

- B2B – Invoices (Amendment)

- B2B – Debit Notes (Amendment)

4. PART B – ITC NOT Available

This section contains the details of credit notes and amendments issued by the suppliers.

- B2B – Credit Notes

- B2B – Credit notes (Amendment)

- B2B – Credit Notes (Reverse charge)

- B2B – Credit notes (Reverse charge) (Amendment)

- ISD – Credit notes

- ISD Amendment – Credit notes

How to minimize the loss of input tax credit post introduction of GSTR-2B?

As already referred to in the introduction of the present article, input tax credit not reflected in form GSTR-2B cannot be availed. Accordingly, the same will result in a loss of input tax credit. Hence, the following steps should be followed to minimize such loss of input tax credit

- Suppliers should be insisted to file GSTR-1 (monthly or quarterly) and/ or Invoice Furnishing Facility (IFF) on or before the due date so as to timely avail input tax credit in the respective month. Suppliers should be insisted to file GSTR-1 (monthly or quarterly) and/ or Invoice Furnishing Facility (IFF) on or before the due date so as to timely avail input tax credit in the respective month.

- Suitable software should be used for reconciling ITC as per books of accounts and ITC as reflected in GSTR-2B.

- Reasons should be figured out and accordingly due action should be taken for the mismatch between ITC as per books of accounts and ITC as per GSTR-2B.

Cases of Ineligible ITC in GSTR-2B

There are some instances where the GST Input Tax Credit remains unavailable in Form GSTR 2B:

GSTR2B FAQs

- IMPG stands for Import of Goods.

- These details are captured in PART A of the ITC available section in GSTR-2B

- The data from GSTR-1 will auto-populate into Table 3.1 (a, b, c ,e) & Table 3.2 (d).

- Table 4 will get auto-populated once GSTR-2B is generated on the portal.

- No, it is not possible for you as a taxpayer to make any changes or add a document to Form GSTR-2B, as it is a read-only static ITC statement.

- Yes, GST Portal allows you to download individual table-wise details for the Form GSTR-2B.

- The GST Portal shall provide the link to download the Excel file but only when the total number of documents across all tables is up to 1000 documents.

- Yes. The government has provided a provision to auto-populate GSTR-1 and GSTR-2B values into your GSTR-3B return.

- ITC details and ITC reversal details are auto-populated in GSTR-3B from your GSTR-2B return.

- The government has recently scrapped the ‘Provisional ITC’ facility that earlier allowed taxpayers to avail 5% provisional ITC on the eligible ITC.

- Hence, businesses now CAN NOT claim more ITC than the GSTR-2B statement mentioned.

In Conclusion

GSTR-2B, by far, is the most important document required for claiming ITC for a month. Hence, businesses must notify their defaulting suppliers on time and ask them to file their

GSTR-1 return on time.

This segment will cover more essential details about GSTR-2B and GST Input Tax Credit in the later blogs.

Try GSTHero GSTR 2B Reconciliation Tool for getting reports for internal and departmental audits with 100% accuracy.

Stay updated; stay ahead!

Until the next time…..

Claim upto 100% Input Tax Credit

Easiest GSTR 2B Reconciliation With Reverse ERP Integration