In the 37th GST Council Meeting held on 20th September, 2019, decision was made to implement e-invoice. Further, in support of this decision, CBIC has issued Notification No 68/2019 to Notification No 72/2019 dated 12th December. 2019. In these notifications, CBIC has laid down guidelines for implementation of e Invoicing under GST. Article mainly focused on e-invoicing applicability in GST, some facts that we don't know.

To understand the e-invoicing generation process and its benefits go through this article.

e-Invoicing Applicability under GST

Get Free Bonus Report: Discover how to automate e-Invoicing

What is E-Invoicing?

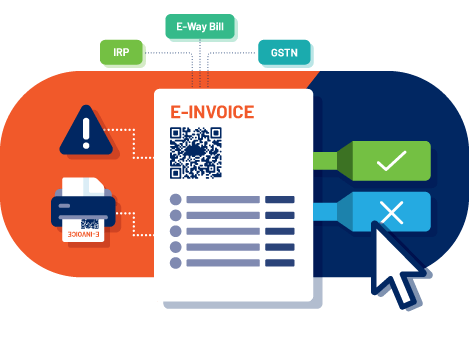

E-invoicing or electronic invoicing is a process of uploading and verifying invoices electronically through GSTN portal. Such invoices shall have multiple uses on the portal like being used for e-way bill generation, GST return filing, etc.

E-invoicing Applicability in GST

E-invoice shall be implemented phase wise.

As per Notification No 68/2019 dated 12th December, 2019, every registered taxpayer whose turnover exceeds Rupees 100 crores shall mandatorily use e-invoicing system from 1st April, 2020. Thus, every taxpayer falling under this category should upload invoices on Invoice Registration Portal (IRP). Here under there are some myths and facts on e-invoicing applicability in GST.

E-invoice system can be voluntarily used by a registered taxpayer from 1st January, 2020.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Myths & Facts About E-invoicing

Sr. No | Myth | Facts |

|---|---|---|

1 | Invoices are to be issued through Invoice Registration Portal (IRP) | Invoices are to be generated through ERP or billing software and uploaded on Invoice Registration Portal (IRP) |

2 | E-invoice is required for all transactions | E-invoice is now mandatory only for B2B and exports transactions |

3 | E-invoice cannot be generated without a billing software or ERP | Free billing software will be provided by GSTN for registered taxpayers having turnover below INR 1.5 crores |

4 | Major changes will be required in ERP or billing software | No major changes will be required at taxpayers end. Certain updates and changes will be required to be made by the ERP or billing software |

5 | Generation of Invoice Registration Number (IRN) will take time | IRN will be generated almost immediately by the IRP. |

6 | IRN generated will be invoice number | Invoice number will be as per ERP or billing software. IRN will be a reference number GSTN |

7 | Separate invoice formats will be available for different businesses | There will be one standard format. Certain fields will be mandatory and others optional. These fields may be filled depending upon nature of businesses. |

Steps for E-Invoice Generation Process

Using Invoice Registration Portal (IRP), the following steps are to be followed for e-invoice generation

1. Generate Invoice in ERP or Billing Software

The registered taxpayer (seller) shall generate invoice in his ERP or billing software. The invoice generated shall have all mandatory and optional fields as required by e-invoice schema. All mandatory fields are necessary to be filled whereas optional fields may be filled depending upon business requirement.

Where a registered tax payer whose turnover does not exceed INR 1.5 crores, does not use an ERP or billing software may use software provided by GSTN.

2. Generate JSON of the invoice generated

The registered taxpayer is required to generate a JSon file of the invoice generated from the ERP or billing software.

3. Upload the JSON file on IRP

The JSon downloaded from ERP or billing software needs to be uploaded on Invoice Registration Portal (IRP).

4. IRP will validate the JSON / invoice

IRP will check from Central Registry of the GST portal and validate the invoice on 4 parameters:

- Customer GSTN

- Invoice number

- Type of Document

- Financial Year

The uniqueness of an invoice will depend on invoice number within the same financial year.

5. If the invoice is validated, IRP will generate an Invoice Registration Number (IRN)

Once the invoice is validated, IRP will generate a unique Invoice Reference Number (IRN) for the invoice based on JSON uploaded. This IRN shall be used to identify the invoice by GSTN.

6. IRP will digitally sign the invoice and add QR code

Once IRN is generated, IRP will digitally sign the invoice and also add a QR code to the JSon file uploaded on the portal.

7. IRP will return the digitally signed and QR code added JSON along with IRN to the seller

IRP will send the digitally signed JSON file along with IRN and QR code to the seller. This file shall be maintained by the seller. The seller shall also update IRN in the ERP for reference purposes.

8. This invoice shall be sent to buyer on their registered e-mail Ids

IRP shall also a send a copy of e-invoice along with IRN to the buyer for his reference.

Get Free Bonus Report: Discover how to automate e-Invoicing

Important Terms and Points

QR code – QR code will help in quick view of E-Invoice. It shall contain – GSTN of buyer and seller, invoice number, invoice date, number of line items, HSN of major commodities, invoice value, invoice reference number (IRN).

Validity of E-Invoice – IRN and QR code shall define the validity of an E-Invoice

Signature on E-Invoice – Once the E-Invoice is digitally signed by the IRP, it is optional for taxpayer to sign the same. E-invoice shall be valid even if the same is not signed by registered taxpayer (seller)

No E-Invoice – E-invoice is not required to be generated for bill of supply and delivery challan.

Cancellation of E-Invoice – E-Invoice can be cancelled within 24 hours of its generation. Once an e-invoice is cancelled, its invoice number cannot be used again.

IRN – Invoice Reference Number (IRN) should be part of invoice and printed on the invoice.

Line Items - The line items can be 10000 per E-Invoice.

JSON Sharing – IRP will only share digitally signed JSon with the registered taxpayer. No PDF will be provided. Registered taxpayer (seller) can print the invoice using QR code.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Benefits of E-invoicing

Modes of Generation of E-Invoice

- Web Based

- API Based

- Mobile App Based

- Through SMS

- Offline Tool

- Through GSP

E-Invoicing Vs GSTR-1 Reconciliation Process

Get Free Bonus Report: Discover how to automate e-Invoicing

Conclusion

The introduction of e-invoice system shall result in more streamlining of GST process. However, there are still some clarifications that are required from the Government on process and legal validations of e-invoice.

Generate complete and ready-to-use

e-Invoices in just 1-click !

Generate e-Invoices directly from your ERP Hassle-free