E-Invoice under GST was applicable from 1st January 2020 in India on voluntary basis and then became mandatory in phases starting from big companies and then became applicable to small companies.

With the passage of time, as e Invoice applicable to E-invoicing increased its ambit and covered so many organisations.

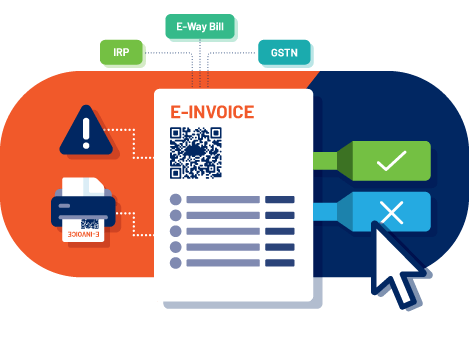

A taxpayer has to first register his business on IRP. Then he has to link it with his ERP software.

e-Invoice can be generated from official GST e-Invoice Portals or e-Invoicing Software like GSTHero which provide integration with different ERPs like Tally, SAP, Oracle, Microsoft Dynamics and many more.

There are various types of E-invoice report which will reflect all the aspects of e-invoice.

e-Invoice under GST Reports Needed by Accounts Team for Internal Audits

Here we will one by one see the types of GST E-invoice reports under ERP and their use to the organisation.

ERP reports each and every category of transaction

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Sr. No. | E-invoice Report | Use | Importance |

|---|---|---|---|

1 | Uncertain Transactions | ||

2 | Missing/ Invalid Information | ||

3 | Rejected by E-invoice system | ||

4 | Pending | ||

5 | Exported | ||

6 | Voucher Information mismatch with QR code. | ||

7 | IRN generated | ||

8 | IRN cancelled | ||

9 | User-excluded transaction |

Get Free Bonus Report: Discover how to automate e-Invoicing

Under ERP, users can view all the above-mentioned types of reports. User needs to understand this because, there are certain types of report which needs some action to be taken.

If the user is well aware about the type of report, it will be easy for him to take the steps for it well within the time.

Otherwise, if anything is missed, the user may have to face some consequences.

But as the reports are categorised, it becomes easy to get the report of the category of which is required.

As we know the impact of GST e Invoicing concept under GST, a taxpayer becomes bound to fulfil all the requirements of it.

ERP has made it easy, as everything is easily obtainable and things become convenient. This is the reason most of the enterprises chose ERP for its benefit.

As ERP is centralised, it becomes more beneficial to obtain all the data, as anything entered at one place can be viewed from are anywhere.

However, it becomes very important to make sure that whatever is entered is accurate, so that final output is perfect.

The authenticity of any data is very important, and it can be checked with proper document.

Though, e-invoice is itself a document, but still it depends on physical document which is prepared at the time when transaction takes plane.

However, there are some transactions that are not covered under the ambit of e-invoicing. Such as B2C transactions. They are to be checked separately and will not get updated on IRP.

Still their entry will appear in ERP and the entity will be able to check it.

Reports under ERP on E-Invoicing applicability is a very useful tool and it helps to get instant reports.

For enterprises, it becomes convenient to get the report on the spot as and when needed.

I hope this article on E-invoicing is helpful to you.

Thank You.

Generate complete and ready-to-use

e-Invoices in just

1-click !

Generate e-Invoices directly from your ERP Hassle-free