A high-performance GST return filing software enables efficient GST compliance tracking, invoice data management, GST Reconciliation, vendor compliance, and payment management solutions. These GST solutions prevent complicated and error-prone outcomes, usually resulting from a manual process.

Any slight inaccuracy or mistake in return filing may lead to penalties and legal issues for an enterprise, disrupting the stability of its operations.

How can small and large businesses cope with GST compliance requirements?

Well, you now have a wide range of the best software for GST return filing to analyze and compare.

For example, Web-GST by Webtel, Tally ERP 9, MARG GST, and Tally Connector. These solutions simplify GST filing, e-way billing, and e-invoicing processes using automation and user-friendly features.

To determine which suits your requirements the best, you must consider the challenges of filing GST manually and the various solutions that good GST software will offer for your enterprise.

Challenges of Filing GST Manually

The complexity of filing GST manually weighs greater, especially since an average business organization has to file 25 GST returns in a year. To prevent and deal with them, let us learn about a few of the common challenges.

Costly Manual Delays and Errors

Late fees/charges are applicable for any manual delays or errors you make in return filing. It costs additional money to manage, disrupts your business operations, causes inconvenience to your customers, gives you a poor GST compliance rating, and negatively impacts your brand image.

Intricate Calculations in GST Filing

GST return filing includes several intricate tax calculations for all the supplied goods and services. And you have to consider all the tax rates, exemptions, and a GST composition scheme if applicable.

For example, there are some exemptions for real estate and goods, while products/services such as healthcare, education, and (certain) essential goods are entirely exempt from GST.

Managing calculations manually for all these tax rates and exemptions is a complex and time-consuming GST filing process, prone to errors and further delays.

Repetitive E-way Billing and E-Invoicing Process

GST return filing is not a one-time task. It involves similar and repetitive steps for generating/managing E-way bills and E-invoices to carry out return filing with authentication and accuracy. Doing these tasks manually takes time, effort, and money that the GST automation software can save, making it hassle-free with automation.

Input Tax Credit (ITC) Management

ITC management involves a tedious process of invoice matching, purchase/expense record maintenance, and comparisons, whether you are figuring out how to file GSTR 9 or GSTR 1, all of which take a substantial amount of time when done manually. However, the process is essential for businesses to claim Input tax credit under GST.

GST Compliance Standards

According to GST Compliance standards, a business is required to file returns regularly, maintain accurate records, and comply with various GST guidelines. Meeting such compliance standards effectively can be tricky with a manual GST filing process.

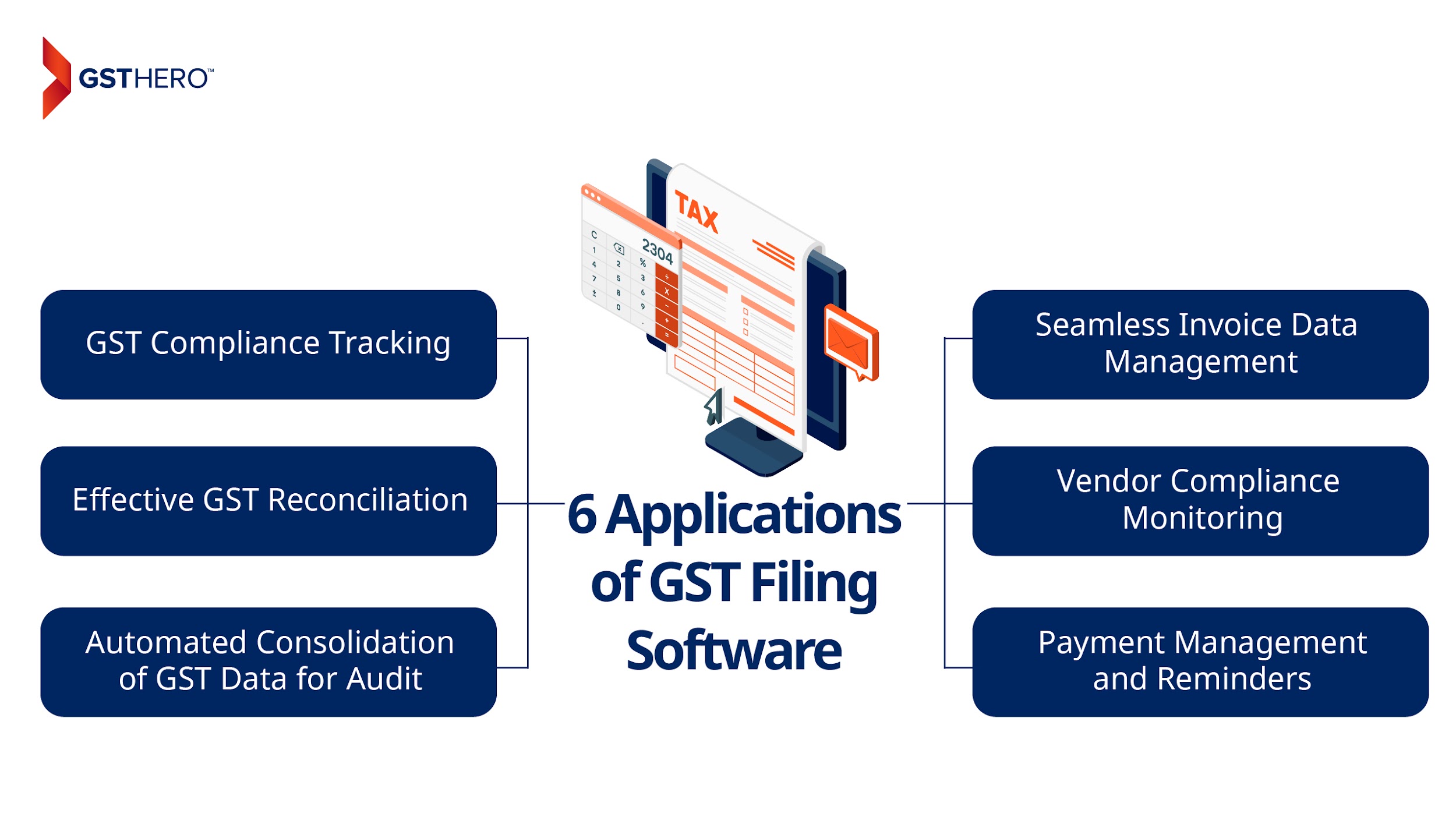

6 Applications of GST Filing Software

Simplifying GST return filing becomes a number-one priority for enterprises when GST compliance standards define regular filing practices as mandatory. As a result, the GST return filing had been the highest it had ever been during March 2023, and the gross GST revenue collected in June 2023 was ₹1,61,497 crore. Such changes and growth rates make it necessary to have an automated and error-free system for return filing.

GST Compliance Tracking

Evaluating the compliance level of an entire organization is a necessary step in ensuring 100% GST compliance. At the same time, it is also a complicated and time-consuming process when executed manually. The solution for this is Automation. It is the key advantage of GST software, powering all of its solutions for businesses and chartered accounts.

For example, a solution such as a GST MIS Report, utilizes automation to analyze the compliance level of an organization. It proves highly productive for an organization with multiple registrations under GST, requiring constant GST compliance tracking.

A well-developed return filing software substantially simplifies the complexities of GST compliance tracking with a proven automation solution. It also helps organizations optimize their ITC in GST availed and achieve accuracy in GST reconciliation.

Seamless Invoice Data Management

An invoice contains the detailed records of transactions between the buyer and seller, names/types of goods/services supplies, their prices, the quantity, and the GST rate applicable. In this invoice, the accuracy of information is of utmost importance, lack of which would lead to errors, filing delays, late fees/charges, and in some cases, penalties and legal consequences.

Using Automation and high-performance computing, GST software ensures the accuracy of data entered in such invoices to help organizations stay on schedule when filing and track their business growth more efficiently. The software also utilizes automation to auto-fill GST returns based on the generated data.

After e-invoice generation, GST software helps incorporate seamless integration with the authorized Invoice Registration Portal (IRP) to generate IRN for the invoice.

Effective GST Reconciliation

Another return filing task simplified by automated solutions is GST reconciliation. In general, the reconciliation of data like outward supplies, GST input tax credits, and payment of TDS on GST consumes a lot of time and energy. Return filing software accelerates and simplifies this by making data reconciliation a one-click + automated task.

Vendor Compliance Monitoring

Vendor compliance monitoring is a crucial solution in GST return filing software for better transparency and GST compliance. Especially since the availment of input tax credit depends on the timely compliance by the vendor.

Delayed or non-filing filing of GST returns by the vendor results in the non-availability of input tax credit, and consequently, blockage of working capital.

It is why monitoring vendor compliance under GST standards and practices is essential amidst and after the various amendments in GST law.

To help with that, value-centric GST software enables the following basic tasks to keep an eye on the vendor’s compliance-

- Verify the GSTIN of the vendor.

- Match actual entries with the entries reflected in GSTR-2A/ GSTR-2B.

- Identify the errors (if any) and the missing entries by the vendors.

Automated Consolidation of GST Data for Audit

GST return filing software also simplifies the consolidation of GST data and compliance with audit under GST requirements (which is yet another complex and time-consuming task if conducted without using software).

It utilizes automation to organize, collect, evaluate, and reconcile a large amount of transactional data from different sources. In short, GST software enables the error-free and faster compilation of GST data.

Payment Management and Reminders

Regular management and tracking of received and pending payments is a standard process and a requirement for better GST compliance.

Accuracy of information and efficiency in payment management/reminders becomes a vital element in this process, especially with the rising number of GST taxpayers. For example, there were nearly 14 million registered GST taxpayers in January 2023.

It makes payment management and reminders a sensitive task to be carried out by an error-free and automated system like GST software. Such software improves and simplifies the process by offering solutions like payment management, pending payment tracking, and auto-reminders. These solutions help it keep track of the collection and payment process.

Acting as a collection manager, GST Software also sends auto-reminders to customers with pending payments.

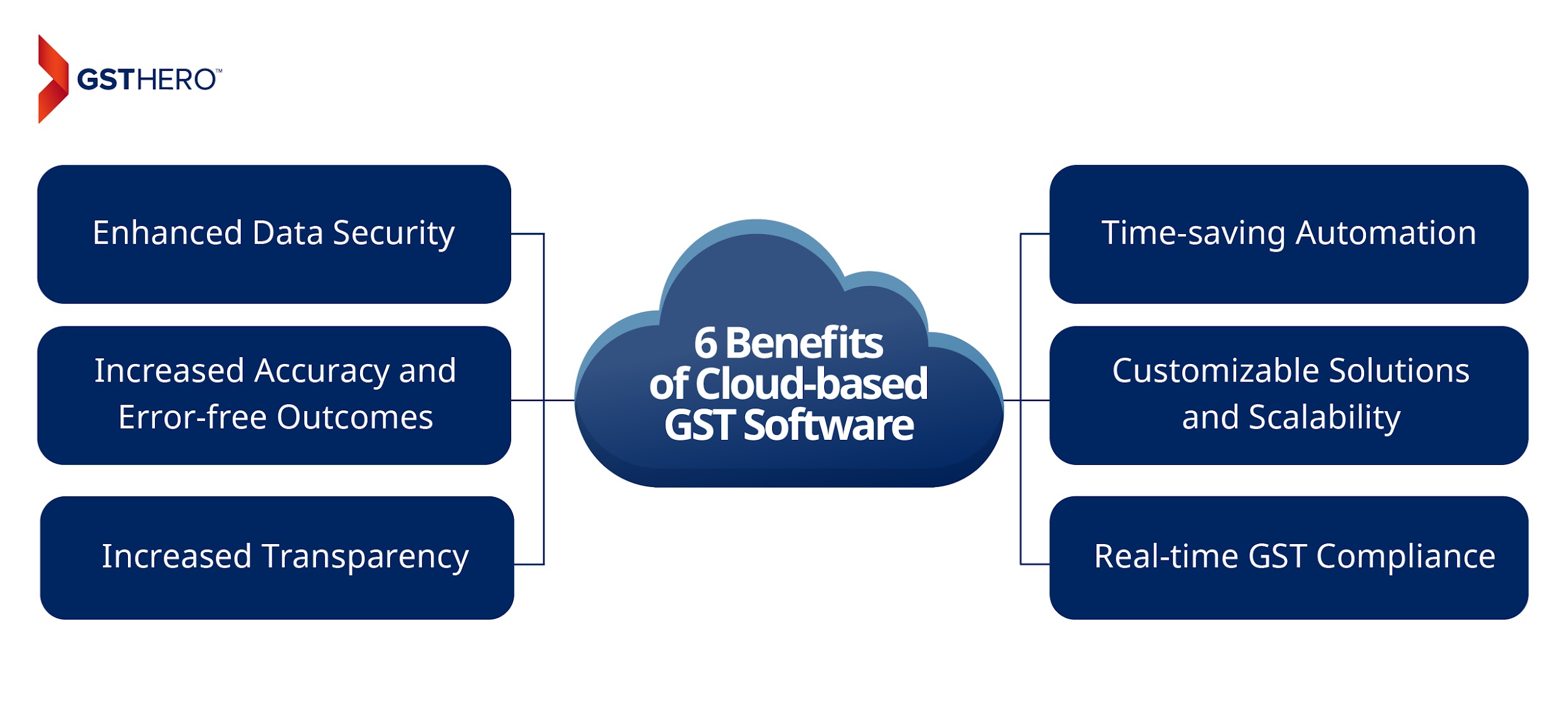

6 Benefits of Cloud-based GST Software

Let’s take a quick look at some of the highly contributory benefits of cloud-based + automated GST return filing software in India.

Enhanced Data Security

A cloud-based GST software has tested security protocols to protect your confidential information, anticipate and prevent cybersecurity threats, and includes data backup and storage features.

Time-saving Automation

GST software increases the efficiency and speed of return filing by automating document collection, mismatch prevention, record management, invoice data management, easy GST reconciliation, consolidation of GST data, and payment management.

94% of employees say they perform repetitive

and time-consuming tasks in their role.

Automate your GST Returns to Streamline Operations!

Increased Accuracy and Error-free Outcomes

As mentioned above, GST automation software and high-performance computing to scan and analyze multiple documents to ensure an error-free inclusion and management of every document required for GST-compliance-centric filing. It also has an automated TDS on GST calculation feature that minimizes manual effort, prevents numerous errors, and saves time.

Customizable Solutions and Scalability

A well-developed GST software offers customization with its solutions, allowing businesses to integrate various GST solutions with their existing tally systems.

Additionally, the software provides customizable scalability to meet the changing GST compliance needs of businesses.

Increased Transparency

It helps businesses simplify GST compliance and track their liabilities, invoice/record discrepancies, pending refunds, and payment status in real time, increasing the overall transparency of the business for return filing.

Real-time GST Compliance

It enables a business to stay up-to-date with the latest/changing GST requirements, helping it maintain real-time GST compliance.

Conclusion

GST return filing software, with its plethora of solutions, improves the efficiency of business operations by automating and simplifying GST filing and compliance. Without it, compliance takes a lot of effort and time due to complex tasks and paperwork. It also allows businesses to focus on their primary goals and project timelines by effectively dealing with tax compliance through automation.

Businesses can rapidly generate GST-compliance invoices, manage GST payments, conduct error-free and automated tax calculations, and file GST returns using GST-billing software. In short, GST software is a one-stop and automated solution a business can use to meet all GST compliance needs.

Why Choose Us as Your GST Return Filing Partner?

GSTHero is a Govt. Appointed GST Suvidha Provider, streamlining GST compliance and GST compliance and tax management for enterprises through automation.

Here’s what you can expect from us:

Automated and Hassle-free GST Filing

100% GST Compliance

100% Accuracy in Automated Data Management

Tested and Proven GST Solutions

On-call Expert and Training Support

Error-free ITC Reconciliation

Why Choose Us as Your GST Return Filing Partner?

GSTHero is a Govt. Appointed GST Suvidha Provider, streamlining GST compliance and GST compliance and tax management for enterprises through automation.

Here’s what you can expect from us:

- Automated and Hassle-free GST Filing

- 100% GST Compliance

- 100% Accuracy in Automated Data Management

- Tested and Proven GST Solutions

- On-call Expert and Training Support

- Error-free ITC Reconciliation

GSTHero - GST Filing Solutions

GSTR Filing

Utilize automated and 1-click solutions to reduce hours of manual work in preparing e-invoice and e-way billing data for GSTR-1 to GSTR-9.

ITC Reconciliation

Automated and error-free Income Tax Credit Reconciliation with advanced features to auto-notify your vendors and suppliers.

E-Invoicing

Offering compatibility with numerous ERPs, our e-invoicing solutions help you generate and print 100% GST-compliant invoices with 1-click solutions.

E-Way billing

Using automation, you can save time and prevent errors while generating, printing, and managing multiple e-way bills.

GST Litigation

Our user-friendly and centralized Litigation Management System (LMS) simplifies Notices tracking and management to streamline GST Litigation and Compliance.

Third Eye

A smart MIS and pre-auditing solution to get Compliance Diagnosis, Risk Exposure Alerts, and strategic information to make informed decisions.

SafeSign

A digital signature solution to authorize your confidential documents faster and with better security.