Job Work is an inevitable part of the Indian economy.

Many businesses outsource some of their tasks to other manufacturers. It’s a big industry and hence, the Input Tax Credit applicable to this sector becomes necessary to address.

We will also discuss in brief the ITC-04 form which is required to claim Input Tax Credit on ‘Job-Work’.

What does Job-Work mean? & How to claim Input Tax Credit ?

Get Free Bonus Report: Claim 100% ITC for your business

A furniture manufacturer ‘Jai Mata Di Furniture’ outsources some of its work to small scale manufacturers.

Suppose, they are preparing a table out of wood, they cut the wood and do the necessary processes and give it the shape and form of a table.

This trader then gives the table for painting to some other manufacturer named ‘Sai Traders’.

In this case, according to the definition in the CGST Act of 2017,

Jai Mata Di Furniture is the Principal &

Sai Traders is the Job Worker.

Here, ‘Jai Mata Di Furniture’ is a registered business.

‘Sai Traders’ has taken on the goods from this registered person to carry some further processes of painting and polishing.

This makes ‘Sai Traders’ a ‘Job Worker’ as it has taken a job from a GST registered business.

Understanding How to claim Input Tax Credit on this Job-Work

According to Section 19 of the CGST Act, the ‘Principal’ shall be eligible to take credit on the Input Tax paid on the inputs he has sent to the ‘Job-Worker’.

This provision also makes clear that the 'Principal' shall be eligible to take the credit even if the goods have been directly supplied to the ‘Job-Worker’ without bringing them to the 'Principal's place of business.

Is there a specific time duration during which the principal should receive the goods back?

How is the effective date calculated?

How to claim Input Tax Credit with Form ITC-04?

Get Free Bonus Report: Claim 100% ITC for your business

Form ITC-04 is necessary to claim Input Tax Credit on the Job-Work.

We will see some details about this form in this section.

Major highlights of form ITC-04

Must be submitted by the ‘Principal' quarterly. The Principal should furnish challan details of the following transactions:

- Goods sent to the job-worker

- Goods received from a job worker

- Goods transferred from one job worker to another.

We provided a complete guideline for form ITC 04 job work in article, it gives the information on what is job work, time limit to receive goods from job work and more.

Due Date details of form ITC-04

What details are required for ITC-04 & understand How claim Input tax credit?

When there’s a job-work involved there are two main things which are considered:

- Goods sent to the job worker

- Goods received from the job worker.

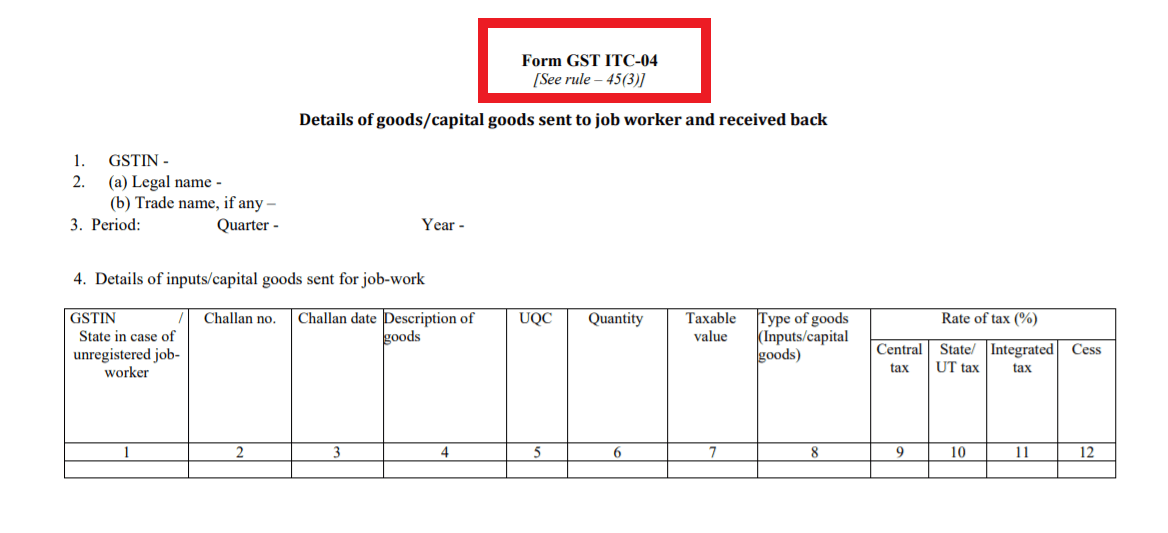

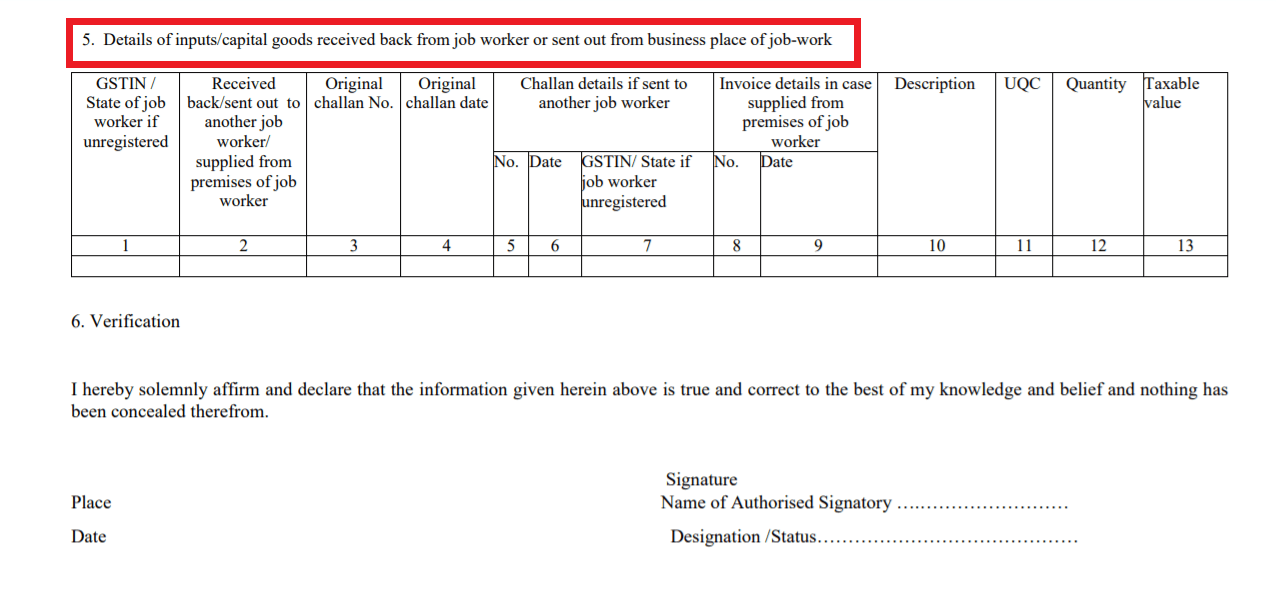

Following is a snapshot of the GST ITC-04 form:

1. Goods Sents for Job work:

You have to furnish the details of the goods sent to the job-worker. Some of the details include:

- GSTIN

- Challan number

- Description of goods

- Types of capital goods

- Rate of tax

2. Details of the goods received back from the job-worker

In this column, you will have to furnish the details of the goods received by the principal or sent them to another job-worker directly.

To Summarize

Input Tax Credit overall is a dearest subject for all the taxpayers. It is at the same time difficult as incorrect reconciliations may block your working capital.

You can try out GSTHero’s superfast ITC reconciliation tool!

Until the next time…

Claim upto 100% Input Tax Credit

Easiest GSTR 2B Reconciliation With Reverse ERP Integration