Discount under GST is of the crushal part of GST system. It directly impact on the liability of GST and ITC.

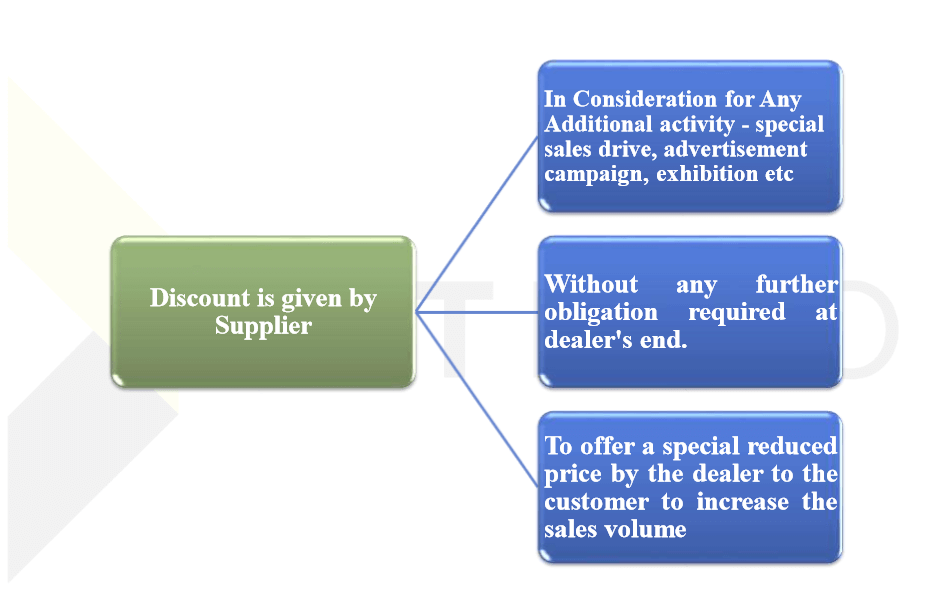

It is very usual and often that Supplier offers various kind of discounts to its Customer/dealer/retailer (referred as “dealer”), in order to incentives Sales, to offset for advertisement expense uncorrected, for reduction of sale price to ultimate customer etc.

Some of discount under GST are offers upfront in invoices whereas some are offered after Sale. In this article, we will be discussing on post sale discount, impact on GST liability and Input Tax Credit in the hands of supplier and dealer.

Watch video to claim 100% ITC for your business

Legal Provision of discount under GST

As per Sec 15(3) of CGST Act, amount of discount can be reduced, for charging GST

• Discount offer before or at the time of supply [ Discount mentioned on Invoice Itself ] - If such discount is recorded/mentioned in Invoice

• Discount offered after supply has been effected [ Discount through Credit Note ] – If such discount is established in terms of an agreement entered into, at or before the time of such supply, (In simple words, it means, terms of said discount were known at the time of supply) and ITC as is attributable to said discount amount is reduced by recipient of the supply/

However due to ambiguity in the provisions, decisions of Advance Ruling Authority, there was need for clarification, on Post Sale discount offered by supplier to dealer by way of Credit Note, with respect to:

- Whether supplier is required to reverse his GST liability to the extent of Discount Officer.

- Can Supplier issue financial Credit Note without any GST.

- Whether Customer / Dealer is required to reverse ITC, if financial credit note is issued by supplier, in terms of second proviso to Sec 16(2) of CGST Act 2017

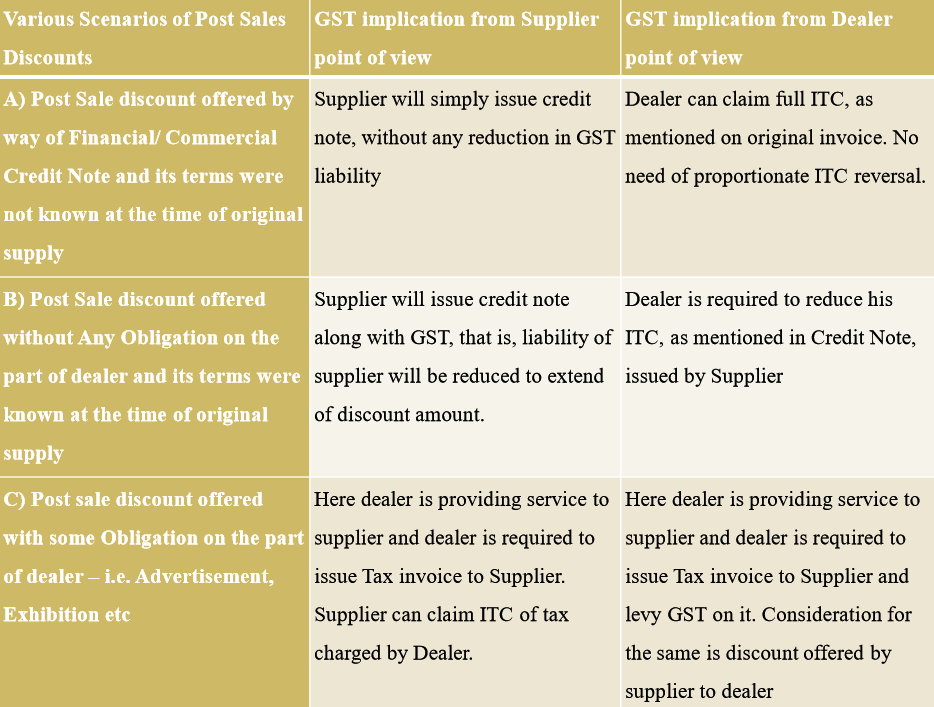

- Finally said issues has been examined by government and clarified vide Circular No 105/24/2019 GST dated 28th June 2019. Based on nature of discount, government has clarified GST implications, which is explained as under

A

Discount without Any Obligation On The Part Of Dealer:

If the post-sale discount is given by the supplier to the dealer, without any further obligation or action required at the dealer’s end and terms/conditions of discount are established in terms of agreement entered into at or before the time of original supply,

then the post sales discount given by the said supplier will be,

related to the original supply of goods and it’s would not be included in the value of supply, in the hands of supplier of goods. It means supplier in such can issue credit note with GST amount and dealer is required to reverse said Input tax credit.

B

Discount under GST with some Obligation On The Part Of Dealer:

If the additional discount given by the supplier to dealer, is in the nature of the post-sale incentive, requiring the dealer to do some act, like undertaking special sales drive, advertisement campaign, exhibition etc.,

then such transaction would be a treated as separate transaction as if, dealer has provided some service to supplier and the additional discount in GST from supplier will be the consideration for undertaking such activity by dealer.

Here the dealer, being supplier of services, would be required to charge applicable GST, on the value, equal to discount received amount and the supplier of goods, being recipient of services, will be eligible to claim input tax credit, of the GST so charged by the dealer.

C

Discount by Supplier, to offer price reduction by dealer to Customer:

If the additional discount is given by the supplier to the dealer, to offer a special reduced price by the dealer to the customer to increase the sales volume, then such additional discount under GST would represent the consideration flowing from the supplier of goods to the dealer, for the supply made by dealer to the customer.

Under GST, as per Sec 2(31) of CGST Act 2017, consideration can move from recipient or any other person.

Therefore, this additional discount from supplier to dealer, would be treated as consideration for supply by dealer to customer, for the purpose of arriving value of supply, in the hands of the dealer, under Sec 15 of the CGST Act 2017.

The customer, if registered, would be eligible to claim Input Tax Credit of the tax charged by the dealer only to the extent of the tax paid by the said customer to the dealer, as per second proviso to Sec 16(2) of CGST Act 2017.

D

Discount by way of Financial Credit Note:

There may be cases, where post-sales discount granted by the supplier of goods is not permitted, to be excluded from the value of supply, in the hands of the said supplier, not being in accordance with the provisions contained in Sec 15(3) of CGST Act 2017.

In such case, it is already been clarified vide Circular No. 92/11/2019-GST dated 7th March, 2019, that the supplier of goods can issue financial / commercial credit notes without reduction in original tax liability.

Now government has clarified that, dealer will be eligible to take ITC of the original amount of tax paid by him, to the supplier of goods and he will not be required to reverse proportionate ITC attributable on such post-sale discount received by him, through issuance of financial / commercial credit notes by the supplier of goods.

You May Be Also Interested in Reading This Post:

CONCLUSION:

GST impact of post sale discount and its ITC impact was matter of concern since GST implementation. Partially, said issue was clarified by government vide Circular No 92/11/2019 GST dated 7th Mar 2019. However still there were concern on ITC implication.

Vide Circular No 105/24/2019 GST dated 28th June 2019 government has clarified issue of ITC implication in the hands of dealer. Also government has given new angel to this issue, being, supply of service by dealer and additional consideration flowing to dealer from supplier for supply from dealer to customer.

However all such clarification seems to be putting an end to this issue.

All FMCG dealer / Mobile and Electronics Dealer is required to evaluate nature of discount which they are receiving from supplier, since there may be supply of service.

Claim upto 100% Input Tax Credit

Easiest GSTR 2B Reconciliation With Reverse ERP Integration