Implementing seamless GST compliance is necessary to run a legitimate and successful business enterprise. As a business owner, it's crucial to anticipate potential pitfalls that could lead to penalties, errors, and non-compliance issues.

What is the penalty for GST non-compliance?

Failure to meet GST compliance requirements leads to penalties from ₹200 to ₹25,000 (and more), and even imprisonment in some cases.

To help you prevent that, let us look into five common problems business owners face, what they are, how they happen, and how to effectively avoid them with tested solutions (recommended by GST experts). Let's get started.

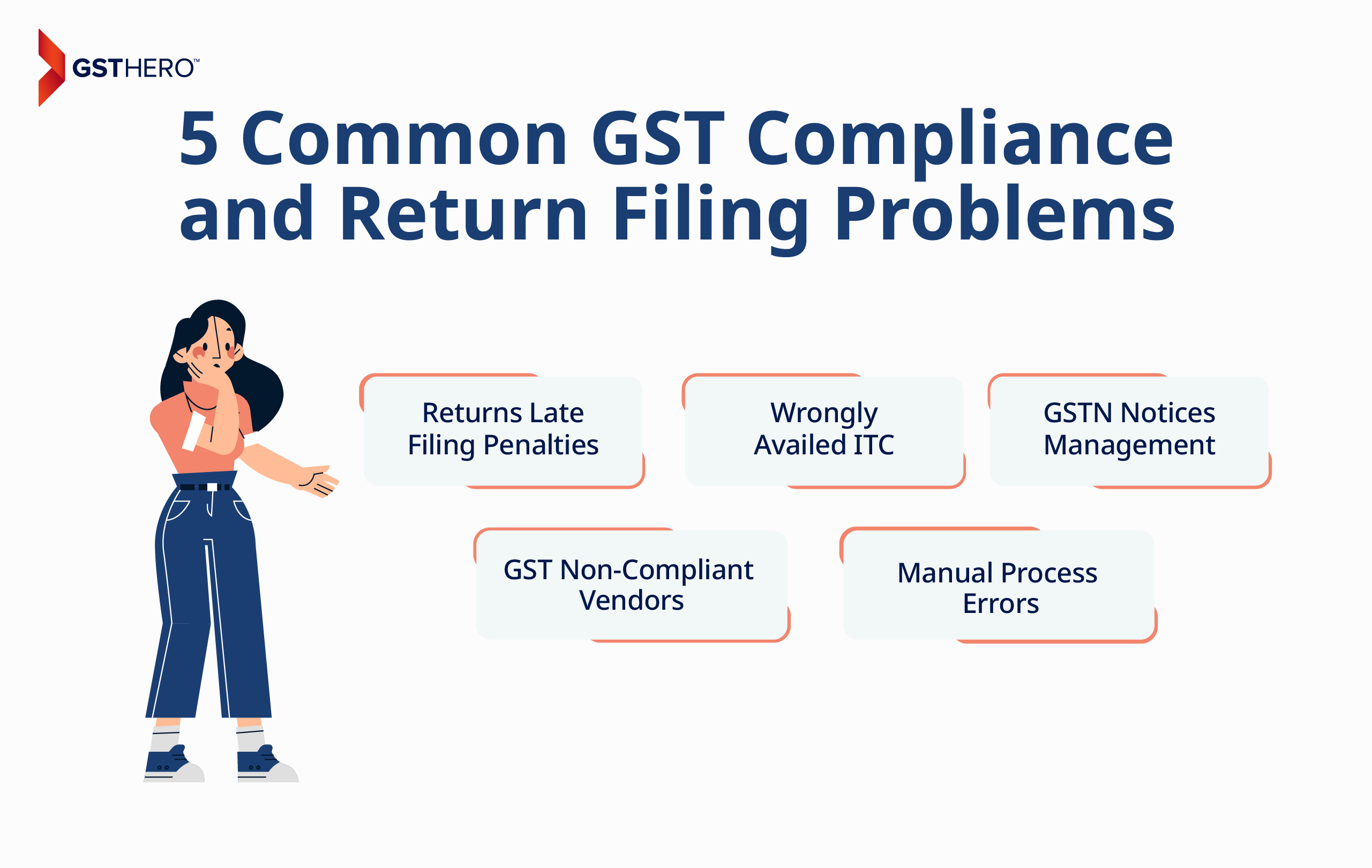

5 Common GST Compliance And Return Filing Problems

Filing late/ignorance by business owners is the primary cause of GST problems and penalties. For example, a Statista report found that 37% of business owners spent significantly less time on goods and services tax (GST) compliance.

Lack of invoices, false invoices, submission of incorrect information (GSTR-1 or GSTR-3B wrongly filed), GSTIN theft and usage, and submission of fake financial records often lead to expensive and legal problems, mainly GST non-compliance.

Returns Late Filing Penalties

Late filing of GST returns can result in substantial penalties and interest charges, whether it is a penalty for GSTR-1 or GSTR-3B late filing. It usually happens due to disorganized monitoring and tracking practices for filing due dates.

To avoid this, business owners need return filing reminders to ensure timely submission before deadlines. Additionally, you should outsource your GST return filing process to professionals specializing in automating compliance while ensuring accuracy.

Wrongly Availed ITC

Wrong claim of ITC (Input Tax Credit) is a significant concern, prone to cause GSTR-1 and GSTR-3B filing mistakes. It is one of the most common problems faced while filing GST returns.

Well-organized monitoring and reconciliation of ITC with the help of GST reconciliation sheets helps prevent such errors.

Manual Process Errors

According to GST compliance requirements, any minor or major errors in informational accuracy lead to errors and penalties.

Taking that into account, data entry errors are always prone to happen in a manual GST return filing process. Any such error creates a risk of penalty and non-compliance, causing financial consequences or operational disruptions.

Implementing automation using reliable cloud-based GST software significantly reduces such manual mistakes. It will help you use automation beyond data entry to the entire GST workflow.

GST Non-Compliant Vendors

A leading mistake in B2B GST compliance is caused by relying on vendors who are not GST-compliant, leading to disruptions in your business.

You need a systematic tracking and follow-up process with vendors and withhold any payments until they ensure GST compliance.

GSTIN Notices Management

Having a disorganized process for handling notices from the GSTIN is one of the major GST mistakes made by business owners

You must keep track of notices and maintain a consolidated data record for internal audit in GST to ensure timely responses and compliance.

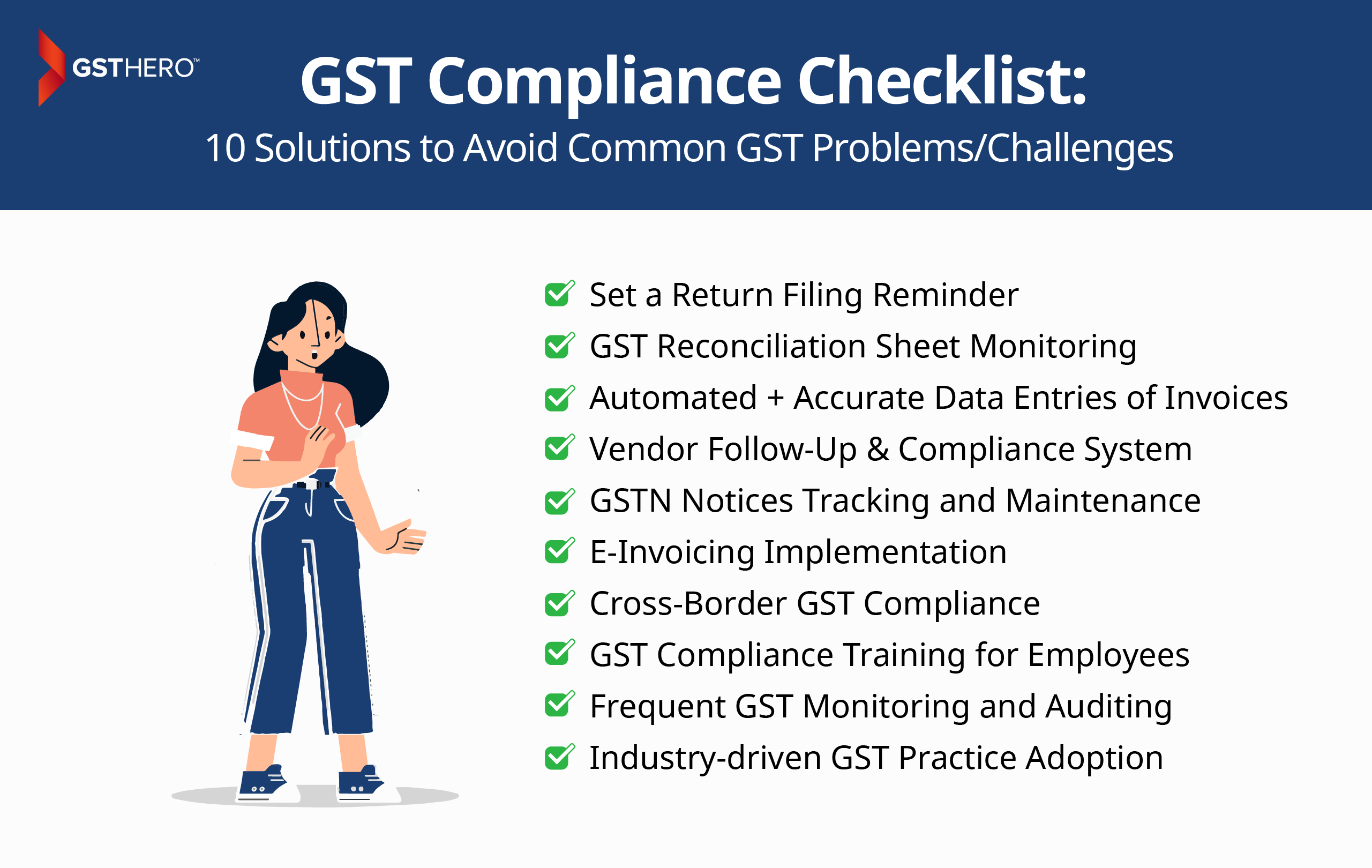

GST Compliance Checklist: 10 Solutions to Avoid Common GST Challenges

As mentioned before, following best GST practices and meeting compliance standards is the best way to prevent these issues. With time and consistency, you will find your business thriving better than before, primarily due to your real-time GST compliance practices.

For example, not so long ago, a similar Statista survey found that 45% of businesses were happy with GST laws after five years of compliance.

Set a Return Filing Reminder

By setting a return filing reminder, you will proactively manage your filing deadlines and even file returns ahead of schedule. Filing early helps avoid any chance of penalties and gives you time to deal with any unexpected issues that may arise during filing.

Use innovative solutions that automate the filing process, ensuring accuracy and efficiency while keeping your business ahead of GST compliance deadlines.

GST Reconciliation Sheet Monitoring

You should regularly monitor crucial reconciliations such as GSTR 1 vs. GSTR 3B, GSTR 2A vs. GSTR 3B, GSTR 1 vs. Books of Account, GSTR 1 vs. E-way Bill, and GSTR 2A vs. Books of Account. It helps you rapidly identify the mismatches, errors, and incorrect entries, which you can rectify right away.

Use advanced GST reconciliation software that helps identify discrepancies and provides actionable insights for improvement.

Automated + Accurate Data Entries of Invoices

Implement automation and reliable GST filing software to ensure accurate data entry, minimizing the risk of manual errors and enhancing overall efficiency. Incorporate solutions such as AI-driven data validation and real-time error alerts to streamline the e-invoicing process and meet GST compliance standards.

Use an Error-Free + Bulk-Generation-Compatible E-Invoicing System

Vendor Follow-Up & Compliance System

Create a well-organized system for following up with vendors to confirm/verify their GST compliance. If necessary, consider holding payments until vendors provide evidence of their GST compliance.

Also, build collaborative relationships with vendors by organizing joint training sessions on GST compliance. It helps you create a shared commitment to compliance adherence within your supply chain.

GSTIN Notices Tracking and Maintenance

Regularly monitor and maintain a record of GSTIN notices. Prepare consolidated data for internal audits and respond to notices promptly to prevent legal consequences.

Using advanced analytics tools like the GST Litigation Management System, you will easily track notices but get insights into the causes, enabling your business to address underlying issues and ensure overall GST compliance.

E-Invoicing Implementation

Implement an automation-driven e-invoicing solution that seamlessly integrates with your ERPs. Such a solution will help you generate bulk e-invoices rapidly, reduce manual efforts, and ensure real-time data accuracy, streamlining the entire invoicing process and enhancing GST compliance.

GST Compliance Training for Employees

Create training programs for your employees to increase their practical understanding of real-time GST compliance. It will help foster a culture of compliance within the organization, reducing the chances of errors and ensuring better GST workflows.

Frequent GST Monitoring and Auditing

Implement regular monitoring and auditing practices in your business beyond the standard filing periods. Also, frequently audit your GST processes to identify areas for improvement, ensuring ongoing compliance and reducing the risk of any issues.

Cross-Border GST Compliance

Incorporate a reliable system for handling cross-border GST compliance if your business involves international transactions.

Additionally, stay up-to-date on international GST regulations, regularly engage with global compliance experts, and use technology-driven solutions to streamline cross-border GST filings.

Industry-driven GST Practice Adoption

Keep yourself up to date on the latest developments in GST filing and compliance standards. Regularly engage with peers and industry experts offering valuable insights, which should help you adapt your business processes to evolving GST regulations.

And look up and research the best GST filing software that can provide your business with a one-stop solution for automation and accuracy in return filing and compliance.

Keep yourself up to date on the latest developments in GST filing and compliance standards. Regularly engage with peers and industry experts offering valuable insights, which should help you adapt your business processes to evolving GST regulations.

And look up and research the best GST filing software that can provide your business with a one-stop solution for automation and accuracy in return filing and compliance.

Conclusion

By staying informed, incorporating advanced technology, and implementing these proactive solutions, you can simplify the complexities of return filing and centralize GST compliance within your organizations.

Additionally, building strong partnerships with GST-compliant vendors improves your GST compliance adherence and the success of your business in the long run.

Why Choose Us as Your GST Return Filing Partner?

GSTHero is a Govt. Appointed GST Suvidha Provider, streamlining GST compliance and GST compliance and tax management for enterprises through automation.

Here’s what you can expect from us:

- Automated and Hassle-free GST Filing

- 100% GST Compliance

- 100% Accuracy in Automated Data Management

- Tested and Proven GST Solutions

- On-call Expert and Training Support

- Error-free ITC Reconciliation

GSTHero - GST Filing Solutions

GSTR Filing

Utilize automated and 1-click solutions to reduce hours of manual work in preparing e-invoice and e-way billing data for GSTR-1 to GSTR-9.

ITC Reconciliation

Automated and error-free Input Tax Credit Reconciliation with advanced features to auto-notify your vendors and suppliers.

E-Invoicing

Offering compatibility with numerous ERPs, our e-invoicing solutions help you generate and print 100% GST-compliant invoices with 1-click solutions.

E-Way billing

Using automation, you can save time and prevent errors while generating, printing, and managing multiple e-way bills.

GST Litigation

Our user-friendly and centralized Litigation Management System (LMS) simplifies Notices tracking and management to streamline GST Litigation and Compliance.

Third Eye

A smart MIS and pre-auditing solution to get Compliance Diagnosis, Risk Exposure Alerts, and strategic information to make informed decisions.

SafeSign

A digital signature solution to authorize your confidential documents faster and with better security.