Chartered accountants (CA) are the professionals who are experts in their field. Clients depend on their CA for their accounts. They handle client’s accounts and finances. For GST also, a taxpayer needs their service. The concept of e-Invoicing Under GST has been introduced and is very important for every size of business.

Chartered accountants play a vital role in any organisation as they understand company’s financial statements and financial position better than anyone else in the organisation.

In this article, we are going to see as to how important, is the role of a chartered accountant in e-invoicing to be understood by them to support their client.

Any new law or new concept introduced is not easy to implement. Normal taxpayer will find it very difficult and will require help of an expert.

In taxation matters, a chartered accountant is an expert and can easily help the client as this is his day-to-day work.

A chartered accountant knows the law and if any new law is inserted, he knows how to interpret it. E-invoice is a technical work.

A client will require a well-trained person to handle it. Who else can be better than a chartered accountant in this?

There are certain businesses where e-invoice is not applicable. Taxpayer may not be aware about whether e-invoicing is applicable to it or not. A chartered accountant can tell him about his applicability.

Get Free Bonus Report: Discover how to automate e-Invoicing

E-invoicing Under GST: Chartered Accountants Role

E-invoicing Under GST Applicability

Explanation:

E-invoice is not applicable to all the business, it is applicable to the business having turnover of more than 50 crores (from 1st April 2021).

Apart from this, following businesses are outside the ambit of E-invoicing:

- SEZ

- Insurance, Banking, Financial institution.

- Goods Transport Agency (GTA)

- Passenger transport service

- Admission to exhibition of cinematographic films in multiplex

The Role of CA

A chartered accountant can help his clients to understand the applicability of e-invoicing to his organisation.

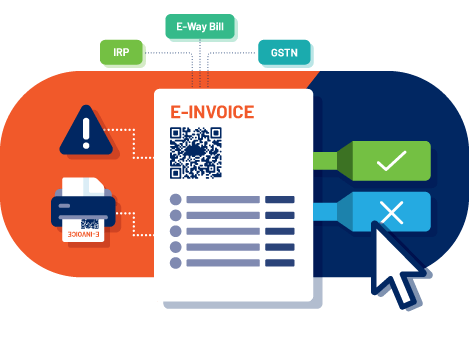

Also, he can explain to his client’s staff to work and check the e-invoicing on IRP portal.

A chartered accountant is a perfect person to handle the accounts of his client as he has adequate knowledge and understanding of accounting as well as taxation.

Suppose the turnover of client

is not above 50 crores, he is not required to generate e-invoice, but after crossing the turnover of crore, he will have to e-invoice generation process is for him.

A CA will help him understand as to what is applicable to him.

e-Way Bill

Explanation:

When there is movement of goods involved, E-way bill is required to be generated.

When e-invoice is generated and e-way bill is applicable, it will automatically get generated.

The Role of CA

Chartered Accountant can help generate e-way bill for his clients.

GSTR-1

Explanation:

E-invoice generated auto-populated in the GSTR-1.

If proper invoice is uploaded, proper details will be shown in the return.

The Role of CA

Having adequate knowledge, a chartered accountant can help his clients to upload appropriate returns.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

Determining Tax Payable in e-invoicing under GST

The Role of CA

Determining accuracy of tax liability is not a difficult task for a CA. A client will get to know the appropriate tax amount which is to be paid to the government.

Staff Training

Explanation:

Efficient staff are the back bone of every organisation. Staff need proper training before handling any task.

If the staff is properly trained, occurrence of mistake is minimised.

Thus, every organisation gives proper attention to staff training.

The Role of CA

Chartered accountants are capable of giving proper training to client’s staff.

Staff can clarify any doubt regarding any aspect of GST or e-invoicing.

Getting training from a chartered accountant will be very much beneficial for the staff as well as the organisation.

Avoidance of Mistake

Explanation:

As we know, GST is a complex law, it is quite apparent that there will be various mistake.

Especially, when a person having less knowledge about GST is bound to commit more mistake.

The Role of CA

Chartered Accountant is a person who is completely sunk in taxation. Emergence of GST was a turning point of CA’s life who was more into indirect taxation.

It became important for such CAs to gain complete understanding about GST.

So, the chartered accountants started gaining full knowledge of GST. And therefore, there will be less error when GST is handled by such knowledgeable person.

E-invoicing Under GST Assessment

Get Free Bonus Report: Discover how to automate e-Invoicing

Explanation:

Types of assessment under GST: -

- Self-assessment

- Provisional assessment

- Scrutiny assessment

- best judgement assessment

- Assessment of non-filers of return

- Assessment of unregistered persons

- Summary Assessment

The Role of CA

In all the assessment mentioned, a taxpayer needs the help of a CA.

Handling assessment and scrutiny is day to day task of a CA and he can easily resolve any GST matter of his client as they have good understanding of GST law and problem.

Reconciliation

Explanation:

E-invoice is the first step of any transaction where it is mandatory.

It becomes important to generate e-invoice correctly so that the series of transaction does not go wrong.

For this purpose, after entering all e-invoices, proper reconciliation is needed.

The Role of CA

Data entry part is never of a chartered accountant, he only checks the correctness of data entered.

As it is his day-to-day work, he will be able to trace the error in minimum time.

e-Invoice Reconciling and correcting the error is very easy for him and his client can easily rely on him for this.

Get E-Invoicing Ready

GSTHero e-invoicing software - Easiest and fastest way to generate e-invoice

e-Invoicing under GST Finalisation

Explanation:

As GST has become an integral part of accounts, it is required to be properly dealt with.

E-invoice is applicable on almost every transaction and therefore creates great impact on accounts.

While finalising, special care needs to be taken when it comes to GST.

The Role of CA

Chartered Accountants work to finalise the accounts is of utmost importance.

Accounts once finalised are difficult to amend.

Chartered Accountants work to finalise the accounts is of utmost importance. Accounts once finalised are difficult to amend.

They get uploaded at various places such as ROC, Income tax site, etc. So, if any error takes place, series of filing will get affected and resultingly work load will drastically increase.

Therefore, a chartered accountant’s role in this aspect is very important. He is the person of competence; data comes to him after checking by most knowledgeable person of the organisation.

Therefore, client trusts his work and depend on the finalised account checked by him.

E-invoicing under GST Final Words

E-invoicing is an important component of GST introduced by government and followed by people.

It required a very fine attention as all the transactions, accounts, filings etc will get affected by a very small mistake.

Thus, a CA is very dependable person in this regard.

This is it from my side. If there is any query or comment, please feel free to write in comment section

Generate complete and ready-to-use E-Invoices in just 1-click !

Generate e-Invoices directly from your ERP Hassle-free